WolfHero

Member

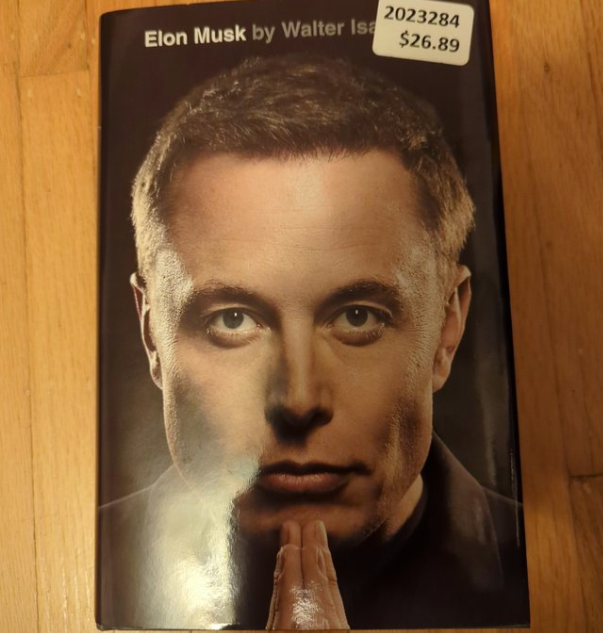

For those holding out for a discount (like me), Walter Isaacson's Elon biography is now available with significant savings at Costco. Found this at it's BC Canada location for CAD $26.89

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

It doesn't feel like there is much distance between the simplest processes in clipping the vehicle together and moving around the blocks."...so the operator, even if it's first day of job [sic], they cannot mix it up."

Everyone who saw Optimus' latest performance, draw your own conclusions.

I'd be very surprised if Tesla gets to double digit % market share for L2 chargers. The L2 charger is basically a commoditised product at this stage because it is trivial for any company that already manufacturers electrical products to move into this adjacent product and they all know how many are needed in the long run. There's also no limit to scaling like we have with batteries in vehicles. Tesla's offering isn't the cheapest. When building management is deciding to purchase hundreds of L2 chargers there are cheaper offerings.And this revenue stream could become quite massive. I've been thinking about this a lot lately. With NACS as the standard, Tesla has a significant brand advantage when it comes to selling its L2 charging network. Tesla's L2 network should quickly dwarf companies like ChargePoint.

Just think of all the apartment complexes that are ready to install chargers. The complex gets paid. Tesla gets paid. Residents save money over buying gasoline. Everybody wins except the oil companies.

Analysts have talked about how putting everyone onto the Supercharger network won't bring in a lot of revenue for Tesla. But Supercharging is not where the money is. The big money for Tesla will be in apartments, condos, and businesses offering L2 charging. This is where millions of EVs will charge every day. And Tesla will get a nice cut.

Let's throw out some napkin math.

From what I gather, about 25% of US drivers don't live in a place where they could install a private charger. So they would rely on an L2 network like Tesla's. Let's say we are at a point where 25% of the US fleet is electrified. The fleet is currently about 290 million cars. So that's about 18 million who need to charge on L2. And let's say it averages about $5 per day of revenue per car and Tesla has a 50% share of the L2 charging market. Tesla's revenue is split 50/50 with the owner of the property. (Note that I'm assuming the $5 is after paying the utility for the electricity)

So we have:

18,000,000 x 50% x $5 = $22.5 million per day split evenly with the property owners.

We are talking about roughly $8 billion in revenue per year going to Tesla. And it's mostly profit.

What do we score the Highland transition at? 9/10? Has there been any recognition in the media given the sheer number of logistical changes?

And this is the real long term advantage of everyone going with NACS. It gives a natural advantage to Tesla for its L2 network.

Ah, remember the good old days, June to September 2019? TSLA lower than it had been for years, around $10 pre-pre-split? Buying mispriced Jan 2021 +c650 call options for $1 and selling them in February 2021 for $220I feel like Tesla is due for another step change in valuation. It's been dead money for two years, and I've seen this pattern before.

I think your $5.00/day is a bit over optomistic (~$150/month or even $100/month (20 work days))From what I gather, about 25% of US drivers don't live in a place where they could install a private charger. So they would rely on an L2 network like Tesla's. Let's say we are at a point where 25% of the US fleet is electrified. The fleet is currently about 290 million cars. So that's about 18 million who need to charge on L2. And let's say it averages about $5 per day of revenue per car and Tesla has a 50% share of the L2 charging market. Tesla's revenue is split 50/50 with the owner of the property. (Note that I'm assuming the $5 is after paying the utility for the electricity)

So we have:

18,000,000 x 50% x $5 = $22.5 million per day split evenly with the property owners.

We are talking about roughly $8 billion in revenue per year going to Tesla. And it's mostly profit.

I suspect Tesla's advantage will be the "known good brand" advantage. "No one ever got fired for buying IBM."I'd be very surprised if Tesla gets to double digit % market share for L2 chargers. The L2 charger is basically a commoditised product at this stage because it is trivial for any company that already manufacturers electrical products to move into this adjacent product and they all know how many are needed in the long run. There's also no limit to scaling like we have with batteries in vehicles. Tesla's offering isn't the cheapest. When building management is deciding to purchase hundreds of L2 chargers there are cheaper offerings.

a few years back (around 2010 or so) folks were talking about charging $ for charging at work and rough/vague consensus was around $20/month was a fair price for paid charging at work so $1.00 roughly a day for commuters based on avg of 40 mile commute 5 days a week, 12,000 miles a year.

How much Media are you consuming? You might benefit from cutting back on the steady diet of spam, fud, and b.s.

I do concede while I am bullish long term, I'm not as bullish in the short term as most people on this forum.

It's napkin math. And it's a few years in the future. Gas is probably more expensive. You can also play with the electrification rate. I suggested using a point in time where the fleet is at 25% EVs. It will eventually go much higher than that.

So you can play with the numbers. My main point is that Tesla's L2 charging network is potentially worth billions per year in profit. And this is the real long term advantage of everyone going with NACS. It gives a natural advantage to Tesla for its L2 network.

I am also bullish long term.…

I do concede while I am bullish long term, I'm not as bullish in the short term as most people on this forum.

No monthly fees (fee regardless of usage) doesn't mean no per-session fees.Except, as we talked about yesterday, the announcement specifically discusses Tesla handling payment, but makes an explicit point about the Property Manager setting the price, and no monthly fees. I can't imagine Tesla is going to take a cut of the charging price without bothering to mention that...

View attachment 978682

I asked ChatGPT to rewrite:IOW, Tesla must charge to handle charging for charging otherwise the charge for using a charge to charge will be large.

That also applies to the many OEM’s that still supply L2 chargers with EV sales, but surely those are diminishing as adoption rates rise. Otherwise there are almost countless L2 suppliers around the world, including many that supply multi-unit installations for shopping centers, commercial buildings and multi-family housing. I think even a 5% share is unlikely because of that context.I'd be very surprised if Tesla gets to double digit % market share for L2 chargers. The L2 charger is basically a commoditised product at this stage because it is trivial for any company that already manufacturers electrical products to move into this adjacent product and they all know how many are needed in the long run. There's also no limit to scaling like we have with batteries in vehicles. Tesla's offering isn't the cheapest. When building management is deciding to purchase hundreds of L2 chargers there are cheaper offerings.

The news of the minor updates to the Shanghai built Model Y this morning would seem to further feed my supposition above. Of course a new "LED strip" isn't likely to require crash testing, so I suspect even larger changes coming from the GigaTexas shutdown (it is TEXAS after all). It does open the door to yet another question: "What about Fremont and Berlin built Model Ys?". If we think about what differentiates GigaTexas from the other plants it would seem to come down to either 4680s and/or structural packs and giga castings of some sort. Then again, what the heck do I know!?I know the focus this weekend is on PD numbers and most of us are a bit disappointed at the length of time GigaTexas was shut down. Indeed, even though folks are back at work there, it appears they are building mostly "test" cars. All of that has me intrigued though. I mean, "what exactly are they doing with the Model Y there?". I think the initial assumption is the Y line was getting some efficiency improvements, but the changes seem to be more material given:

a.) the need for crash testing

b.) the number of cars in the "test" lot

c.) what appear to be cars in different colors (or man, that paint booth needs calibration!)

Crash testing implies more than just a "we sped up how we do X" - it would seem to imply a change (or changes) to the car itself. It may not be huge, but something.

I almost wonder if they are taking this opportunity to move "part of the way" toward Juniper - not out of character for Tesla to make incremental changes, but this one must be decently sized. This could help spur sales or perhaps just shave costs out of the car (i.e. a reduction of parts could require crash testing).

On the downside, it isn't clear to me that "come Monday" (aka start of Q4) they will be back at full production. They could still be testing, etc. and thus we start Q4 a little more behind the 8-ball in terms of PD than I had hoped.

Unfortunately, we may not know any specifics until earnings even if the start delivering cars sooner.

Never a dull moment on the Tesla train!