Wait for the Cybertruck, then judge.Those are honestly pretty lackluster and mundane wrap colors for those prices. I've seen a lot of custom wraps in fantastic wild colors (sky blue, orange, Ford yellow, silver stardust, etc), they stood out in parking lots easily, and the few owners I talked to about them paid much less than $7500 to have it done. And why offer white, gray, and black again? Seems very redundant and poorly thought out to me?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Wait for the Cybertruck, then judge.

Well wraps for the CT make sense because it only comes in one color: unpainted!!!

I think the CT wrapping business is going to be massive and I can't wait to see custom wrapped CT's driving everywhere!

Cult Member

Born on the 4th of July

Very informative article about the negotiation process for FSD in UNECE member states. Long, but worth reading if you are interested in. No matter as an investor or Tesla owner. Written in Dutch, but I'm sure the translator of your browser will help.

www.mistergreen.nl

www.mistergreen.nl

Besprekingen UNECE en GRVA: toekomst van zelfrijdende auto’s | MisterGreen

In dit artikel lees je alles over de bestuursorganen en actoren die verantwoordelijk zijn binnen de VN voor voertuigregulering, de geschiedenis van reguleringen

@jerry33Agreed, but Microsoft did all those things (and worse) and they don't seemed to have been harmed any.

I'm unsure what long established, like 100 year and more industries, did Microsoft go up against?

Last edited:

UkNorthampton

TSLA - 12+ startups in 1

Luton Airport (UK) is closed due to a fire that burned 1200-1500 cars. FUD incoming, but one claim that it was an Evoque (not EV), fire chief states that it was a diesel.

I can't verify, but Evoques been involved in other fires eg https://www.scotsman.com/news/trans...aze-latest-to-hit-range-rovers-evoque-1481410

That second car in the Scotsman was recalled due to a fire risk, checked and then sent back to its secondhand owner.

Fire chief has stated that Luton fire started in a diesel, not an Ev.

Video/article of Evoque burning, allegedly at Luton: (warning: SUN, first time I'm aware I've ever linked to the Sun - 'Cause' of Luton Airport fire revealed after 1,500 holidaymakers' cars destroyed )

I can't verify, but Evoques been involved in other fires eg https://www.scotsman.com/news/trans...aze-latest-to-hit-range-rovers-evoque-1481410

That second car in the Scotsman was recalled due to a fire risk, checked and then sent back to its secondhand owner.

Fire chief has stated that Luton fire started in a diesel, not an Ev.

Video/article of Evoque burning, allegedly at Luton: (warning: SUN, first time I'm aware I've ever linked to the Sun - 'Cause' of Luton Airport fire revealed after 1,500 holidaymakers' cars destroyed )

As many as 1,500 vehicles parked in the car park, which is a five-minute walk from the terminal entrance, could have been damaged.

In a statement on Wednesday morning, the airport said emergency services remain at the scene and flights would be suspended until 3pm, having initially been paused until noon.

Four firefighters and a member of airport staff were taken to hospital suffering from smoke inhalation and another firefighter was treated at the scene.

Now Andrew Hopkinson, chief fire officer for Bedfordshire Fire and Rescue Service, has explained how the fire started.

He said: "We have no intelligence at this stage to suggest that this was anything other than an accidental fire that started in one of the vehicles that had not long arrived at the airport.

"It was not an EV. This was a diesel powered vehicle."

We have not seen the EU and UK resolutions thus far, and several concessions were extracted in the 1990 US case.Agreed, but Microsoft did all those things (and worse) and they don't seemed to have been harmed any.

of course breakups similar to those of AT&T, Standard Oil, etc are unlikely in today’s world. Now trade restrictions, fines and regulatory impediments are far more common. Tesla is facing regular challenges in those respects, just as is Microsoft, Alphabet, Apple and Amazon. In all these historical cases breakups were typical. Today, as then, new technological advances result in dominance by the most innovative companies. These are unimpeded when they are small, and. challenged when they implicitly threaten the ‘established order’.

i am not suggesting that Tesla will suffer major harm, maybe not even TSLA, but the defenses against these attacks which persist in the financial markets, regulatory procedures at every level, regulatory agencies all are stout defenders of the status quo. TSLA, like it or not, is being forced into less aggressive positions. As with Gwynne Shotwell presenting a harmonious front to the SpaceX community of regulators so Tesla now needs a similar face.

However difficult, the Elon Musk roles must be less CEO and more CTO. That, without question, is not easy. However, frontal attack on crucial constituents, especially regulatory ones, simply cannot survive in market-dominant maturing conditions.

Edison lost General Electric, JD Rockefeller lost The Standard Oil Trust, JP Morgan lost US Steel and many more,

Huawei might be seen in nationalistic terms, but now Apple is attacked for app control and Tesla with SEC, union, auto dealer, regional special interest and more. Just as Apple is attacked for ‘right to repair’ so Tesla is facing multiple attack points. The modern approach is rarely the forced breakups of the past. Now it is simply impeding eventual dominance of a newly major market by the very people who invented the market itself.

In that respect I hope it becomes clearer that the ‘letter of the law’ is not really the issue. The issue is essentially what used to be called ‘populist’ forces. Any entity that becomes a threat to the established order and the established opposition faces opprobrium which then foments constraints. That is how societies function. Obviously much of the world is now in the midst of huge political upheaval. That irrefutable fact points towards less stability for regulatory outlook.

These are major risks. Just as with most shareholders of those ancient examples TSLA long term HODL will do just fine, and better than that.

After all AT&T, General Electric and the Seven Sisters all did well even in the Great Depression. So too will TSLA face huge challenges which will not prevent great success.

I'll reserve judgement until I see it. Frontline usually does a decent job.Without a doubt this will be yet another hit piece on Musk and Twitter.

Artful Dodger

"Neko no me"

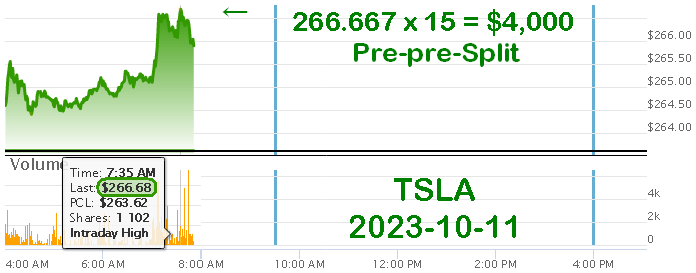

Do you find yourself wondering this morning why the 'hard-cap' resistance at such an odd number? $266.68 Well, then you need to know three (3) things:

Never discount shortzes ability to suffer over the long-term: it's their milieux.

Cheers to the Longs!

- TSLA shares have split 5x and then 3x for a total of 15x,

- $4,000 / 15 = $266.667 Pre-pre-split, and

- Shortzes have long-long memories.

Never discount shortzes ability to suffer over the long-term: it's their milieux.

Cheers to the Longs!

Typewriters.@jerry33

I'm unsure what long established, like 100 year and more industries, did Microsoft go up against?

I don’t get the “same price as a Corolla” thing though. The Corolla is way cheaper. What am I missing?

The quoted cost of the cheapest Corolla LE model with no options on the Toyota website is $21,900 but you will be very hard pressed to find one at that price at your local dealer. $24,500 was the lowest optioned price I saw online and even then you still have the fight with the dealer regarding all the extras they try to force on you. Once you consider the $7,500 tax rebate and the gas savings over 5 years, I think they are very comparable in overall cost.

Should we expect a jump in stationary storage for earnings given the auto factory revamps? That is, where did the batteries go, if not into cars at the usual rate given the factory shutdown/slowdown in Q3?

Different chemistries, vehicle cells/ packs would be buffered for Q4 production.Should we expect a jump in stationary storage for earnings given the auto factory revamps? That is, where did the batteries go, if not into cars at the usual rate given the factory shutdown/slowdown in Q3?

Storage revenue is logged after commissioning, so any shift would be delayed.

apparently we are going to need a lot of both stationary & mobile storage (like my CT that will be both!)Should we expect a jump in stationary storage for earnings given the auto factory revamps? That is, where did the batteries go, if not into cars at the usual rate given the factory shutdown/slowdown in Q3?

This _should_ help TE as general populace realizes it (?? 3 years to add a Terawatt ! of PV ??)

------snip-------

.......solar entrepreneur Danny Kennedy at Climate Week in New York City, who told him,(McKibben) “The planet is now adding a gigawatt a day of solar power. A nuclear plant’s worth every day of solar power.” About half of that total is being added in China and far outdistancing the increase in its fossil fuel plants. The U.S. is second, followed by Brazil and India......

------snip------

Bill McKibben, Pope Francis, & The Warmest September - CleanTechnica

Bill McKibben is spreading the word that September, 2023 was crazy hot and that the time to save our planet is critically short.

cleantechnica.com

cleantechnica.com

Are you sure? Don’t the cars run several chemistries, e.g. some cars are LFP, no? Tesla did a great job of shifting chips during the pandemic induced shortage. Why not batteries? Not being argumentative, just been wondering.Different chemistries, vehicle cells/ packs would be buffered for Q4 production.

Storage revenue is logged after commissioning, so any shift would be delayed.

Etna

Member

It is not. I have just read a LinkedIn post from someone at Tesla saying that it was developed internally.From 2016... https://teslamotorsclub.com/tmc/posts/1815971/

I wonder if this is an Xpel product...

You are correct that storage and cars overlap with LFP, but I think form factor is different. Still, that might lend itself to faster switchover if the cell lines were raw material constrained.Are you sure? Don’t the cars run several chemistries, e.g. some cars are LFP, no? Tesla did a great job of shifting chips during the pandemic induced shortage. Why not batteries? Not being argumentative, just been wondering.

Sorry @Artful Dodger , not seeing what’s funny here. It’s a genuine question.Should we expect a jump in stationary storage for earnings given the auto factory revamps? That is, where did the batteries go, if not into cars at the usual rate given the factory shutdown/slowdown in Q3?

And, maybe if one walks back the processes far enough, not actually off the mark. Think about it before you mock perhaps?

GhostSkater

Member

Great comparison of BYD profit per vehicle versus Tesla. Only nit I have with it is that BYD EVs are much smaller and cheaper on average, so “profit per vehicle” isn’t the best metric. Profit per vehicle GWh sold would be a better metric, but that would still show Tesla way ahead.

Wonder if they'll be required to have ICE parking? Looks like a cool hangout.Want ASAP, please.

Construction underway for Tesla diner at 7001 W Santa Monica Boulevard in Hollywood

A unique project from Tesla is set to combine Los Angeles staples of yesteryear and today on a single site: roadside diners, drive-in theaters, and electric vehicles.la.urbanize.city

View attachment 981347

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M