Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Artful Dodger

"Neko no me"

What we need is a few more of the “smart money” people to announce that the stock is going nowhere for 2 years.

Shirley, you're not implying 'cattle roundup' time?

How long was a typical cattle drive?

"Most drives lasted 3-5 months depending on the distance they needed to travel and delays they experienced along the way. A typical drive could cover 15-25 miles per day. Although it was important to arrive at their destination on time, the cattle needed time to rest and graze."

Cheers to the Long(horn)s!

EDIT: Seems that 1-hr run was to get the $195 Calls in the money (58K at that strike). Now they can 'sell-to-close' and the Options Market Makers sell shares to remain delta-neutral... and so goes another day on the ranch...

Note that there's a small balance of Puts to Calls at the $190 Strike, might be some support from MMs at that level, but it's not a big difference. Let's watch the $195 Strike Call volume today and see how this likely played out.

Cheers!

Last edited:

Given this time horizon the next few years will be a period of accumulating, where every $100 spend on TSLA will be worth potentially $1000 in a decade (in my opinion).

Yep, I agree with that. Once Robotaxis are on the roads and Optimus is being sold to millions of customers Tesla will be a VERY different company with a massive valuation. It's coming, it's just pretty far down the road yet, but I feel $1000/share by 2035 is an easy lock. Honestly it will probably get there much sooner than I think it will.

That said, I do think we'll trade "flat" more or less for the next couple of years. Patience will most likely be greatly rewarded though!

Rally in the face of doom and gloom, what’s going on

There is an expression Climbing the Wall of Worry. It has been used about Tesla before:

- Climbing the wall of worry is a reference to investor behavior during bull markets, at the end of major bear periods, or general periods of market gains.

- The phrase refers to the market's ability to show resilience in the face of economic or corporate news that might otherwise spark a selloff, and instead keep pushing securities higher.

- The wall of worry is sometimes one event the market must keep climbing in spite of but is more often a confluence of events the market must look beyond.

I don’t even believe my own forecast.I am not bearish or bullish on the stock over the next one to two years, I think it will bounce between $170-$320, but that could change if they have a unexpected quarter that exceeds estimates. For selfish reasons I am happy about this, like you I only buy unleveraged stocks and plan to hold forever.

Given this time horizon the next few years will be a period of accumulating, where every $100 spend on TSLA will be worth potentially $1000 in a decade (in my opinion).

Yep, I agree with that. Once Robotaxis are on the roads and Optimus is being sold to millions of customers Tesla will be a VERY different company with a massive valuation. It's coming, it's just pretty far down the road yet, but I feel $1000/share by 2035 is an easy lock. Honestly it will probably get there much sooner than I think it will.

That said, I do think we'll trade "flat" more or less for the next couple of years. Patience will most likely be greatly rewarded though!

Yes that would make Tesla's market capital around $3T, I think it could be more by 2035 but who knows what can happen.

Flat is kinda relative to the timeframe but yeah could be a tightish range for a while.

I am aware of the wall of worry, however Tesla has not been climbing anything .There is an expression Climbing the Wall of Worry. It has been used about Tesla before:

From: Wall Of Worry: What it is and How it Works

- Climbing the wall of worry is a reference to investor behavior during bull markets, at the end of major bear periods, or general periods of market gains.

- The phrase refers to the market's ability to show resilience in the face of economic or corporate news that might otherwise spark a selloff, and instead keep pushing securities higher.

- The wall of worry is sometimes one event the market must keep climbing in spite of but is more often a confluence of events the market must look beyond.

Tesla has been descending, maybe a reverse wall of worry .

I don’t even believe my own forecast.

Tbh, I felt like this in 2017 when I built a spreadsheet based on what Elon was saying about the production numbers once GigaNevada and GigaShanghai were built out. That forecast was $4700 / share pre-pre-split (just running the numbers) and I got irrationally exuberant at the time, while understanding that no one would believe this spreadsheet or forecast. Turned out way earlier than I thought it would happen in 2021.

I kept the spreadsheet and never updated it.

I think its fine to be irrationally exuberant about this R&D company and the product line-up is pretty remarkable across the board compared to any other company - whether its for the short-term or long-term.

Artful Dodger

"Neko no me"

Yes that would make Tesla's market capital around $3T, I think it could be more by 2035 but who knows what can happen.

Indeed, Elon said he sees a path to a TSLA Mkt Cap greater than AAPL+Saudi ARAMCO combined, so approx. $4.4T / 3.2B shares, or TSLA around $1,375/share.

As for the time frame, I don't know of any Tesla financial projection Elon's ever done which goes beyond 2030, so maybe 7x in 6 yrs, or about ~39% CAGR from here.

Last edited:

I don’t even believe my own forecast.

I don't' believe mine either, it's why I use super pessimistic PE Ratios in my stock price model for future years, because the numbers just get stupid high if I don't model conservatively. I want to believe, but I can't believe I'll be that rich five years from now!

Did ya'll hear about Disney's new movie?

Fear

Uncertainty

Doubt

Fear

Uncertainty

Doubt

Artful Dodger

"Neko no me"

I am aware of the wall of worry, however Tesla has not been climbing anything .

Tesla has been descending, maybe a reverse wall of worry .

For those unfamiliar with the term "Wall of Worry"::

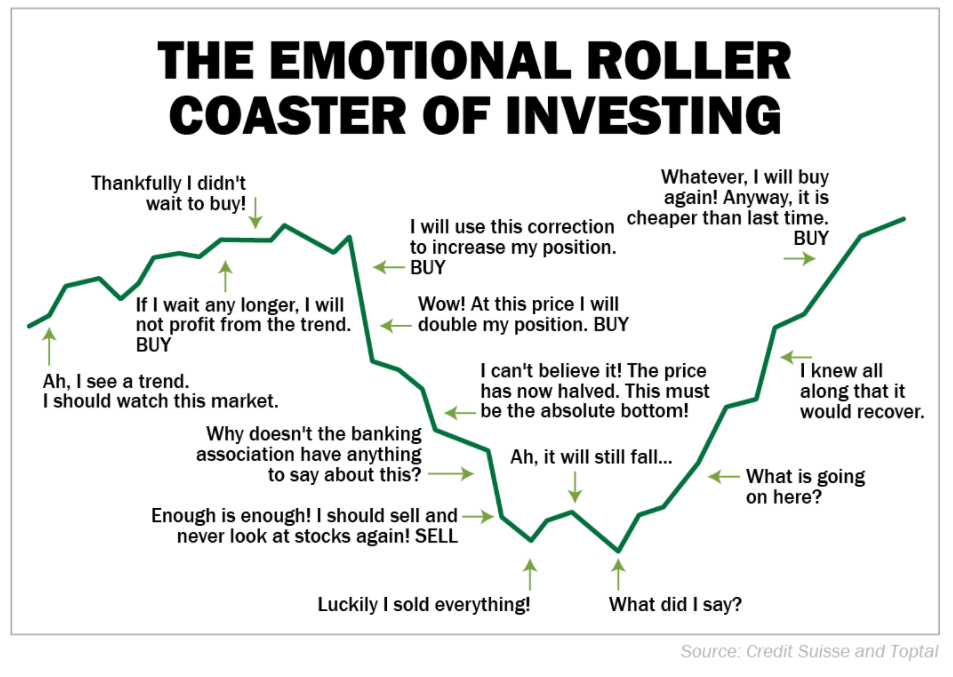

And NO! The Tesla Economist DID NOT create this chart, he just acts it out!

More here:

Wall Of Mengy: What it is and How it Works | Investopedia

Cheers to the Worriers!

Last edited:

Likely if FSD accomplished and more, and recent version is encouraging.Indeed, Elon said he sees a path to a TSLA Mkt Cap greater than AAPL+Saudi ARAMCO combined, so approx. $4.4T / 3.2B shares, or TSLA around $1,375/share.

As for the time frame, I don't know of any Tesla financial projection Elon's ever done which goes beyond 2030, so maybe 7x in 6 yrs, or about ~39% CAGR.

Partial FSD looks like a great driving assistant, certainly requiring less

Mind share when driving .

Last edited:

For those unfamiliar with the term "Wall of Worry"::

And NO! The Tesla Economist DID NOT creat this chart! *he just acts it out*

More here:

Wall Of Mengy: What it is and How it Works | Investopedia

Cheers to the Worriers!

I've always preferred this characterization:

That's not how I remember it. If I recall correctly, the partnership broke up because Tesla wanted access to the raw data from the Mobileye chipset, and Mobileye refused.Mobileye for example is used in a lot of different brands for advanced cruise control and specifically cut its partnership with Tesla back in the early AP1 days because Tesla was taking too much risk with how it was deploying the tech.

Bot will be an insane money printing machine. And it can happen fast. The stars are aligning. Energy, FSD and Semi, maybe even robotaxi will follow, but they will be peanuts compared to Teslas fleet of bots.

Captkerosene

Member

Better to look at the company and make your own appraisal of its value. I don't know if it's still true but the average stock goes up and down 50% in any given year; probably much more in speculative companies ... which Tesla surely is. The point being that price swings wildly even though value moves like a glacier. Think about price and value ... not what other people are saying. We just had a move from 300 to 200. I think it's much more likely that we see 300 before we see 100 given that the value of TSLA is 500.But none of that will happen anytime soon, if ever. Dividends is the only one even remotely plausible IMHO. I'd love it if Tesla issued a few pennies per share dividend, just enough to screw the shorts up, but I don't think they will do that.

This is why I'm bearish on TSLA over the next few years (trading mostly flat and below $300), I just don't see anything to prevent Wall Street from continuing to hold the stock down. Massive buying pressure could overwhelm them, but I don't think we'll see that kind of pressure until Gen3 is well into production and contributing to the balance sheet, which won't be until EoY 2025 at the earliest. Or until Optimus is being sold to customers, or until FSD is solved, but I don't think either of them is likely within the next few years either. Megapack is ramping nicely but it's still early in its S curve and I don't think it's going to move the needle measurably for awhile yet.

It's disheartening to think about. While I'm going to simply hold through this slump, I can see why some investors might not be willing to do that.

Last edited:

DarkandStormy

Active Member

Trying to track various Musk companies... movement.

- Tesla Texas (?) (Delaware)

- The Boring Company: Nevada. (Mar2023). (Delaware)

- Neuralink Nevada. (Feb 2024) (Delaware)

- SpaceX Texas. (Today?) (Delaware)

- X.com (Twitter) Nevada (2023). (Delaware) Subsidiary of X Holdings

- X.AI Nevada. (Mar2023)

Musk

Tesla is not "Elon's company" despite his phrasing on X. As we know from last night, he owns ~20% of the company. Completely disingenuous of him to say "my companies," but it does give you insight as to how he views the other ~80% of shareholders.

Don't know the ownership structure of the other companies.

Your lectures irritate me more and more. Although I only own 10% of my employer company, I say "my company". And although I only own roughly 0.0000000003% of Tesla, I say "my company" here too. Please try to get used to the fact that it can also be an expression of emotional and mental closeness rather than just a possessive pronoun. I would be grateful for more thoughtful contributions. Thank you in advance.Tesla is not "Elon's company" despite his phrasing on X. As we know from last night, he owns ~20% of the company. Completely disingenuous of him to say "my companies," but it does give you insight as to how he views the other ~80% of shareholders.

Don't know the ownership structure of the other companies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M