I read some comments from friends recently casting doubt on the popularity of the cybertruck because they had not seen one in the wild yet. The state of 'research' of the average retail investor is staggeringly bad.

This is why cynical companies pre-seed New York with their products early, hoping wall st types 'see the product everywhere'. Fortunately Tesla is not run this way...

I definitely know people who thought my model S was some weird foreign thing, and experimental, and not something anyone but me would ever risk buying. Those same people recently chatted to me over coffee when my model Y was one of 4 Tesla's just in the cafe car park. They think differently about them now...

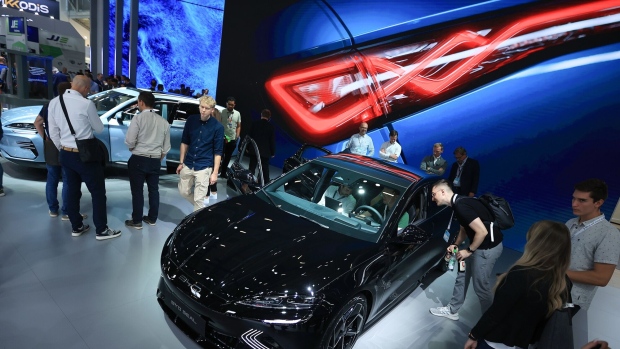

In other words, we may look at the stock price and go 'wtf? but CT ramp is going well, FSD12 looks awesome, semi soon, juniper soon...' but the average wall st analyst doesn't look at any of this. They haven't see a real CT yet. They think FSD is never going to improve. Juniper is a bush right? I hear BYD is bigger than Tesla right?

Patience! The slow-horses at wall st will eventually notice CTs on the roads, will talk to someone who has FSD, will see the jump in model Y interest after a refresh. Eventually there will be signs of construction in Mexico, there will be bot updates, dojo updates and some production-line-built semis. I doubt we see a big jump this quarter, but like I keep repeating, the CT ramp looks pretty good. Would love CT Q1 numbers, but will HODL regardless.