Doggydogworld

Active Member

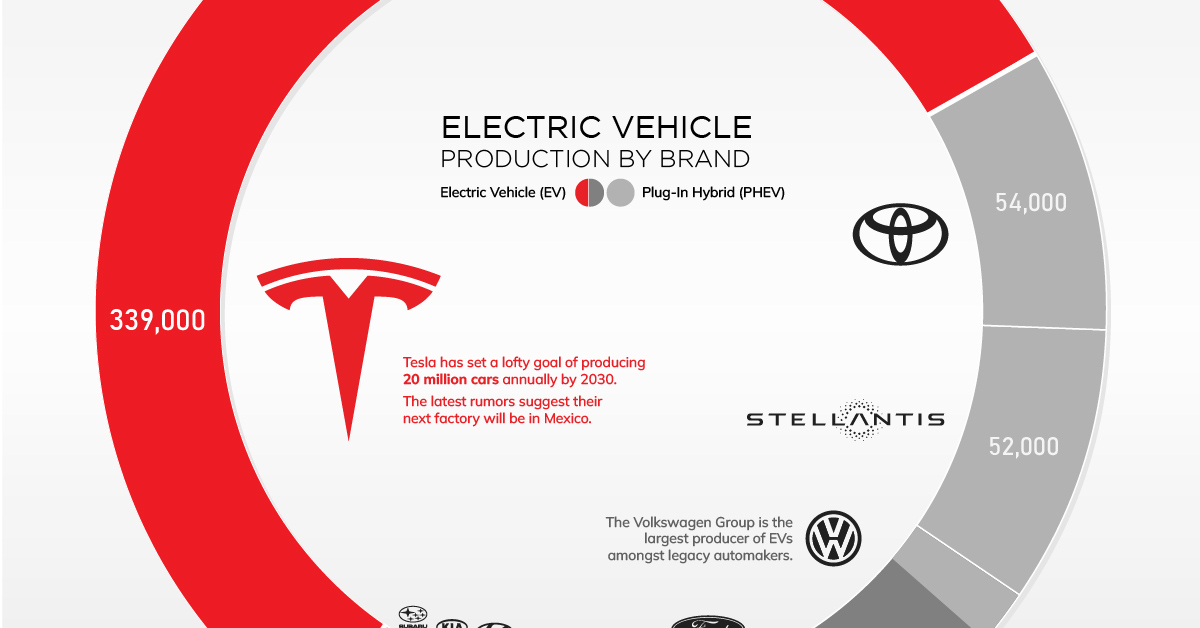

It'd help if you ordered your legend by 2021 sales. So Toyota on top then VW then Hyundai/Kia, GM and Stellantis. Otherwise it's hard to track down which blue-ish line matches which OEM. Your legend also needs to include Tesla a couple more times, ha.I have a noob question. Is there anyone keeping track of total global deliveries/sales per car manufacturer and comparing that to Tesla? This would be a very stunning graph to follow in the coming decade, seeing Tesla rise from zero to hero.

I looked around on the internet but I find fragmented data and it is also hard to account for mergers (Stellantis for example).

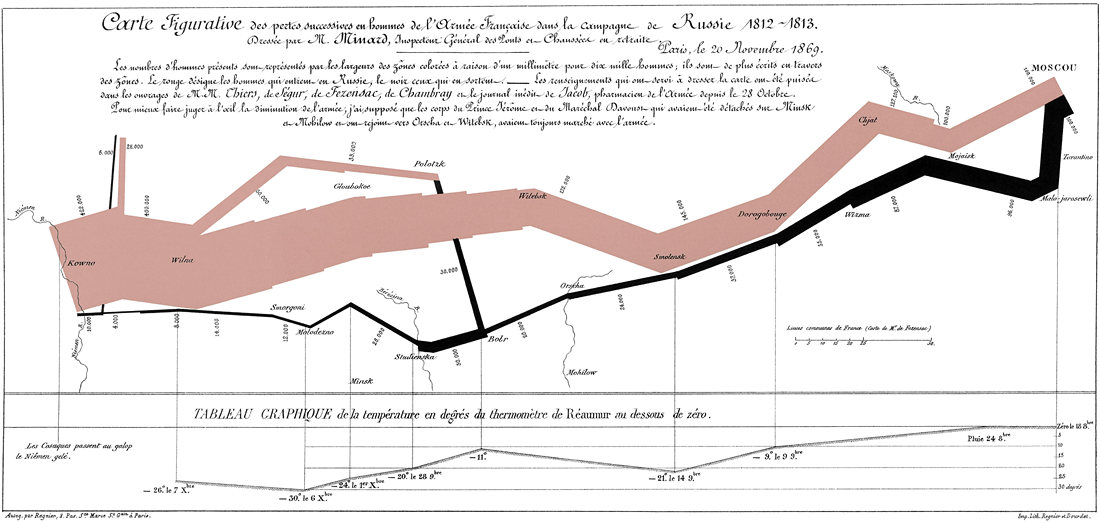

I went back as far as 2017 and this is what I currently came up with:

View attachment 850227

The data behind this:

Company/Year 2017 2018 2019 2020 2021 BMW 2.030.331,00 2.494.276,00 2.520.146,00 2.324.778,00 2.521.596,00 Changan 1.759.971,00 2.003.663,00 2.314.547,00 Ford 5.953.122,00 5.734.217,00 5.385.972,00 4.231.549,00 3.942.755,00 Geely 1.245.055,00 1.500.458,00 1.361.556,00 1.320.471,00 1.328.029,00 General Motors 8.787.233,00 7.724.163,00 6.833.592,00 6.294.385,00 Honda 4.967.689,00 5.265.892,00 5.323.319,00 4.790.438,00 4.456.728,00 Hyundai Kia 3.951.176,00 7.437.209,00 7.189.893,00 6.353.514,00 6.668.037,00 Maruti Suzuki 2.891.415,00 3.212.984,00 1.563.297,00 1.457.861,00 1.652.653,00 Mazda 1.495.557,00 1.631.142,00 1.454.121,00 1.243.039,00 1.074.987,00 Mercedes 2.093.476,00 2.310.185,00 2.339.024,00 2.164.275,00 2.093.476,00 Nissan 4.834.694,00 5.653.743,00 5.176.211,00 4.029.174,00 4.064.999,00 Renault 2.275.227,00 3.883.987,00 3.749.815,00 2.949.871,00 2.689.454,00 Stellantis 8.091.825,00 6.205.996,00 6.142.200,00 Tesla 103.100,00 245.200,00 367.500,00 499.550,00 936.172,00 Toyota 7.843.423,00 10.521.134,00 10.741.556,00 9.528.753,00 9.562.783,00 Volkswagen 9.667.535,00 10.831.232,00 10.975.352,00 9.305.427,00 8.882.346,00

Before I delve deeper to go back to 2012 or I merge previous companies' delivery data (Stellantis for example) I'd like to ask if this is being recorded by anyone or if there is an internet resource for this. I had to combine this from very fragmented data. (It's a first quick draft using numbers from third party websites. If I were to double down I should go to the Investor Relations pages of each company but I don't need that amount of detail IMO).

Either way, if nothing is out there, I'm planning on adding future values to my existing data since the future data will be way more interesting for us TSLA investors then past data (= Tesla hugging the x-axis whilst the rest does whatever above it).

Thanks in advance for insight/links and/or data!

These guys list the top 15 OEMs each year. I don't know how they handle China's JV manufacturers. Like you, they keep Nissan/Renault/Mitsubishi separate. Those who combine the three show them in 3rd place, ahead of Hyundai/Kia.

You mentioned BYD -- they were below Tesla last year at ~600k but will beat them this year. They plan to sell 4m cars (all EV) in 2023 which could vault them as high as 6th place. Get them on your chart now and beat the Christmas rush