Oh my. Sandy Munro just did a video about EnergyX, and invested in their stock (it’s a private company still). I still don’t like the company. Sigh, Sandy. Anyways, here’s his video:So GM is investing in private startup EnergyX that has DLE (Direct Lithium Extraction) technology, but no resources. They plan to source lithium brine from other brine producers and then use their DLE technology (which isn't rocket science, it would be a series of filtration and other standard industrial processes) to produce lithium.

Personally, I think this isn't going to work. Anyone who has brine resources under their control is simply going to build their own DLE tech. unique to their specific brine (each brine is going to be different and have their own challenges).

As an alternative, I invested in the public company E3 Lithium (EEMMF for the US ticker) which has rights to brine in Alberta and has their own DLE technology to bring lithium to market. E3 just announced that they've been given the go-ahead to build their first pilot plant. They will be giving an investor presentation this Thursday.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

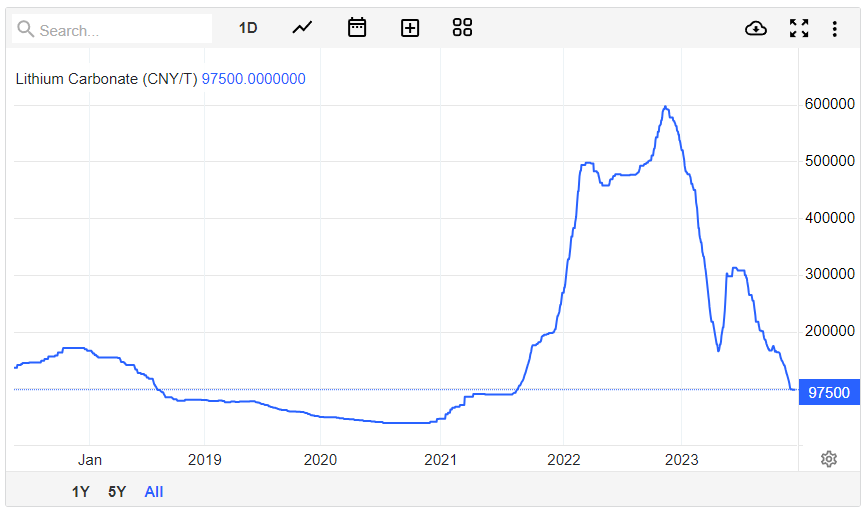

Lithium time. I have bought into some more lithium stocks. I now have a positions in EEMMF (which is currently underwater), and newly added SLI and PLL. Here's the 6 year chart now of China lithium carbonate prices:

For the past week or so, prices have stabilized at CNY 97,500 (US$13,692). That ... is pretty low. EEMMF was using a price around $14,000 to do their economic modelling, so, yeah, we are bumped up right at their limit (although they are still profitable below that number, just not as profitable).

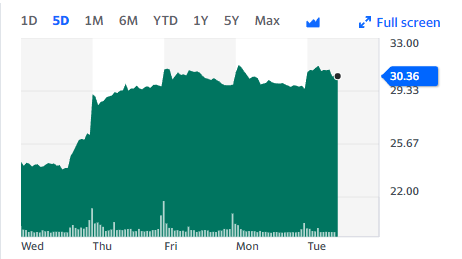

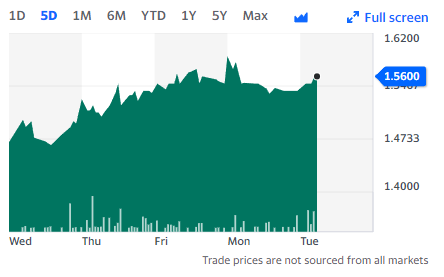

Recent stock market price action to the cessation of the lithium spot market price freefall has been dramatic. Both majors and junior lithium stocks basically act as leveraged options against lithium prices.

SLI 5 day price action:

PLL 5 day:

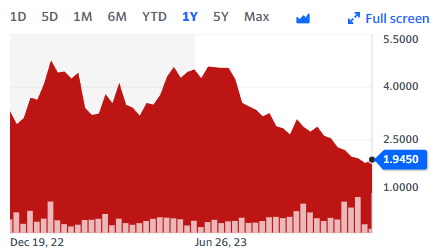

EEMMF:

However if you zoom out and look at the 1 year chart, they all kinda look like this (SLI):

So, these three stocks are my picks. PLL is furthest along in that they have revenue and 3 other projects in the hopper. SLI is close to inking an offtake or project financing agreement, I expect it'll be in 1Q24. I expect EEMMF to ink the same in 2H24.

BTW, if you want more stable returns, ALB and SQM which both sport dividends, also jumped in the last week, both are also way down from previous highs and both will do well in the transition to EVs.

Basically, in buying these lithium stocks, you are betting that a robust EV transition will occur going forward. THESE ARE RISKY. Risk factors include:

1. the lithium mining industry manages to rise to the occasion and delivers more output than predicted, thus lowering lithium pricing

2. the EV transition doesn't occur as fast as predicted, and thus we get an oversupply due to point 1.

While the market in general is still cautious about the EV transition due to the legacy OEMs suddenly getting cold feet, I am still bullish. I think Tesla will rise to the occasion and fill the void left by the auto majors. 2024 will be a very interesting year for Tesla announcements WRT how big Tesla will grow IMHO.

For the past week or so, prices have stabilized at CNY 97,500 (US$13,692). That ... is pretty low. EEMMF was using a price around $14,000 to do their economic modelling, so, yeah, we are bumped up right at their limit (although they are still profitable below that number, just not as profitable).

Recent stock market price action to the cessation of the lithium spot market price freefall has been dramatic. Both majors and junior lithium stocks basically act as leveraged options against lithium prices.

SLI 5 day price action:

PLL 5 day:

EEMMF:

However if you zoom out and look at the 1 year chart, they all kinda look like this (SLI):

So, these three stocks are my picks. PLL is furthest along in that they have revenue and 3 other projects in the hopper. SLI is close to inking an offtake or project financing agreement, I expect it'll be in 1Q24. I expect EEMMF to ink the same in 2H24.

BTW, if you want more stable returns, ALB and SQM which both sport dividends, also jumped in the last week, both are also way down from previous highs and both will do well in the transition to EVs.

Basically, in buying these lithium stocks, you are betting that a robust EV transition will occur going forward. THESE ARE RISKY. Risk factors include:

1. the lithium mining industry manages to rise to the occasion and delivers more output than predicted, thus lowering lithium pricing

2. the EV transition doesn't occur as fast as predicted, and thus we get an oversupply due to point 1.

While the market in general is still cautious about the EV transition due to the legacy OEMs suddenly getting cold feet, I am still bullish. I think Tesla will rise to the occasion and fill the void left by the auto majors. 2024 will be a very interesting year for Tesla announcements WRT how big Tesla will grow IMHO.

Last edited:

It doesn't seem like it has been mentioned here, however Panasonic NA signed a contract with Sila a couple of weeks ago for silicon anodes in North America - Almost certainly feeding into the Tesla supply chain.

It doesn't appear to show any significant energy density increase assumptions (25% over 8 years), however volume is presumably going to be healthy to feed Panasonic's factories.

PDF Below

https://news.panasonic.com/uploads/tmg_block_page_image/file/20900/en231212-3-1.pdf

It doesn't appear to show any significant energy density increase assumptions (25% over 8 years), however volume is presumably going to be healthy to feed Panasonic's factories.

PDF Below

https://news.panasonic.com/uploads/tmg_block_page_image/file/20900/en231212-3-1.pdf

DanCar

Active Member

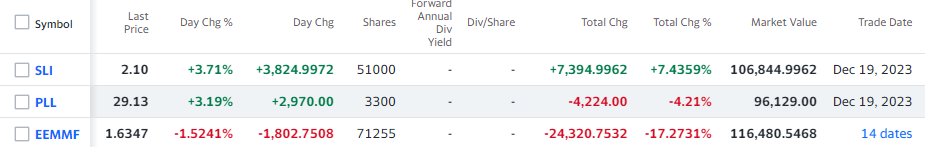

Happy New Year everyone! Continuing my impromptu blog of my lithium mining stock investment. So I now have a basket of three lithium mining juniors and one major (which was bought as a basket of five battery/industrial mining companies). The same $ allocation into each of these 8 companies (well, looks like I overbought a bit into EEMMF). First the juniors.

I accumulated EEMMF through late 2022 and throughout 2023. I obviously bought way too early in that stock. Lithium carbonate pricing was in freefall for all of 2023, and seems to have stabilized at 96,500 CNY/T since early December. Either that or the traders all went on vacation and the price will drop again once everyone recovers from their hangovers, I don't know.

Q1, of course, is historically a bad quarter for auto sales, so that is worrisome, but is that already priced into the lithium spot price since purchases for Q1 production happened a while ago? I guess we'll find out.

Anyways, so far, I'm just a little bit negative on the junior lithium mining stocks, all due to my too early foray into EEMMF, which in hindsight, was way too early to invest (I was still learning how long it takes for juniors to move from milestone to milestone, and I did not anticipate the 2023 lithium freefall, which, again in hindsight, wouldn't have been hard to forecast!).

Now the mining majors. Here I chose majors that had juicy dividends (which is why I didn't buy ALB) and mined other battery or electrification minerals (like copper). Can you guess which stock is the lithium pure play?

So either by luck or timing, this portfolio has done great, even with SQM. And remember to knock 8% off the SQM capital loss due to the dividend.

So risk/reward. Think 2024 will be a banner year for EVs as a whole? Dipping toes into these stocks might allow you to ride an interesting wave. At the very least, it'll be exciting!

I accumulated EEMMF through late 2022 and throughout 2023. I obviously bought way too early in that stock. Lithium carbonate pricing was in freefall for all of 2023, and seems to have stabilized at 96,500 CNY/T since early December. Either that or the traders all went on vacation and the price will drop again once everyone recovers from their hangovers, I don't know.

Q1, of course, is historically a bad quarter for auto sales, so that is worrisome, but is that already priced into the lithium spot price since purchases for Q1 production happened a while ago? I guess we'll find out.

Anyways, so far, I'm just a little bit negative on the junior lithium mining stocks, all due to my too early foray into EEMMF, which in hindsight, was way too early to invest (I was still learning how long it takes for juniors to move from milestone to milestone, and I did not anticipate the 2023 lithium freefall, which, again in hindsight, wouldn't have been hard to forecast!).

Now the mining majors. Here I chose majors that had juicy dividends (which is why I didn't buy ALB) and mined other battery or electrification minerals (like copper). Can you guess which stock is the lithium pure play?

So either by luck or timing, this portfolio has done great, even with SQM. And remember to knock 8% off the SQM capital loss due to the dividend.

So risk/reward. Think 2024 will be a banner year for EVs as a whole? Dipping toes into these stocks might allow you to ride an interesting wave. At the very least, it'll be exciting!

Happy New Year everyone! Continuing my impromptu blog of my lithium mining stock investment. So I now have a basket of three lithium mining juniors and one major (which was bought as a basket of five battery/industrial mining companies). The same $ allocation into each of these 8 companies (well, looks like I overbought a bit into EEMMF). First the juniors.

View attachment 1005002

I accumulated EEMMF through late 2022 and throughout 2023. I obviously bought way too early in that stock. Lithium carbonate pricing was in freefall for all of 2023, and seems to have stabilized at 96,500 CNY/T since early December. Either that or the traders all went on vacation and the price will drop again once everyone recovers from their hangovers, I don't know.

Q1, of course, is historically a bad quarter for auto sales, so that is worrisome, but is that already priced into the lithium spot price since purchases for Q1 production happened a while ago? I guess we'll find out.

Anyways, so far, I'm just a little bit negative on the junior lithium mining stocks, all due to my too early foray into EEMMF, which in hindsight, was way too early to invest (I was still learning how long it takes for juniors to move from milestone to milestone, and I did not anticipate the 2023 lithium freefall, which, again in hindsight, wouldn't have been hard to forecast!).

Now the mining majors. Here I chose majors that had juicy dividends (which is why I didn't buy ALB) and mined other battery or electrification minerals (like copper). Can you guess which stock is the lithium pure play?

View attachment 1005012

View attachment 1005006

So either by luck or timing, this portfolio has done great, even with SQM. And remember to knock 8% off the SQM capital loss due to the dividend.

So risk/reward. Think 2024 will be a banner year for EVs as a whole? Dipping toes into these stocks might allow you to ride an interesting wave. At the very least, it'll be exciting!

Those majors will probably do well in 2024 because of the US infrastructure spending if nothing else. The US government is pouring billions into repairing physical infrastructure which is going to require metals, especially iron. The infrastructure spending is also expanding things like rural broadband which will increase demand for copper.

I think EVs are going to be mixed this year. Tesla will be expanding production and some other EV makers will do well like BYD, but I think the legacy car makers in North America are going to see sales fairly flat because customers are going to hold off buying their EVs in 2023 waiting until they come out with their NACS cars starting at the end of the year and into 2026.

The infrastructure spending might boost stationary battery storage spending. There is a lot of money going into green energy in those packages and expanding stationary battery storage is the one missing piece of the renewable puzzle that just hasn't been done because there aren't enough batteries. Though non-li-ion cells may end up dominating the stationary storage world in the long run. When space isn't an issue, more batteries that are cheaper with lower energy densities will be the answer.

So .... hope no one followed me into the lithium mining pit.

My basket of three lithium mining juniors is down 45% from when I bought them last fall. They are following spot lithium mining prices which have bottomed out, but with no catalysts to raise prices in the near term. Basically, China EV manufacturers went on a credit fueled binge and made tons of surplus EVs, which they dumped wherever they could (China, Europe, not the US due to tariffs). As Trading Economics put it:

"Lithium carbonate prices eased to CNY 95,500, matching the over-two-year low from mid January and holding the 80% plunge in 2023 as the market continued to struggle with a considerable surplus. New estimates showed that NEV sales in China plunged by nearly 40% from the previous month in January, stretching the pessimism following the slowdown from the previous year. The slowdown in electric vehicle sales in China limited lithium demand for battery manufacturers, driving factories to skip their typical restocking season. Instead, firms took advantage of high inventories following the supply glut caused by extensive subsidies from Beijing throughout 2022. The developments drove key market players to forecast the next lithium deficit to return only in 2028, an aggressive twist from speculations of persistent shortfalls that lifted lithium prices to CNY 600,000 in November 2022."

No wonder, by the way, why legacy auto is reeling with their EVs. Chinese and Europe markets have been a disaster due to this. Tesla is hanging on, but until the overhang is cleared out by China, it'll be pressuring Tesla too.

My basket of three lithium mining juniors is down 45% from when I bought them last fall. They are following spot lithium mining prices which have bottomed out, but with no catalysts to raise prices in the near term. Basically, China EV manufacturers went on a credit fueled binge and made tons of surplus EVs, which they dumped wherever they could (China, Europe, not the US due to tariffs). As Trading Economics put it:

"Lithium carbonate prices eased to CNY 95,500, matching the over-two-year low from mid January and holding the 80% plunge in 2023 as the market continued to struggle with a considerable surplus. New estimates showed that NEV sales in China plunged by nearly 40% from the previous month in January, stretching the pessimism following the slowdown from the previous year. The slowdown in electric vehicle sales in China limited lithium demand for battery manufacturers, driving factories to skip their typical restocking season. Instead, firms took advantage of high inventories following the supply glut caused by extensive subsidies from Beijing throughout 2022. The developments drove key market players to forecast the next lithium deficit to return only in 2028, an aggressive twist from speculations of persistent shortfalls that lifted lithium prices to CNY 600,000 in November 2022."

No wonder, by the way, why legacy auto is reeling with their EVs. Chinese and Europe markets have been a disaster due to this. Tesla is hanging on, but until the overhang is cleared out by China, it'll be pressuring Tesla too.

There is increased activity noise regarding the presence of Cobalt and Nickel in my backyard. I have exactly zero financial interest in any of the companies involved - I haven't even sold them short. I do admit the last time there was an exploration company making a big splash here, I vocally called them Miners of Wall St*, and urged all denizens of the region not to invest. Most didn't; some did and lost their entire amount. That company no longer is around.

At any rate, here is some material regarding what's happening out our window. I have a small amount more information, if anyone has specific questions.

On edit: That may have been confusing. Paraphrasing, what I told my neighbors was that they were not about to mine our tundra; all they cared about was mining Wall St(....'s gullible contingent).

At any rate, here is some material regarding what's happening out our window. I have a small amount more information, if anyone has specific questions.

Alaska Energy Metals' momentum builds

Alaska Energy Metals Corp. Jan. 30 provided a recap of a busy first year of business and an outlook for its 2024 plans at the Nikolai nickel-cobalt-copper-platinum group metals project in Alaska. Drawing on CEO Greg Beischer's nickel exploration background, the management of Millrock Resources...

www.miningnewsnorth.com

KoBold buys Alaska Energy Metals data

Alaska Energy Metals Corp. Nov. 28 announced that it has sold nickel exploration data to KoBold Metals, a high-tech mineral exploration company backed by funding from Bill Gates, Jeff Bezos, and others that leverages the power of AI and machine learning to accelerate the exploration of metals...

www.miningnewsnorth.com

On edit: That may have been confusing. Paraphrasing, what I told my neighbors was that they were not about to mine our tundra; all they cared about was mining Wall St(....'s gullible contingent).

Maybe this has been talked about already, but has anyone invested in a sand storage company? I keep thinking how we need to get off plastics and the best thing to do would be to go back to glass. You could "recycle" the old glass by melting it and then use it to store energy.

I just watched this video, which is why I'm posting in here. I understand, as the video points out, that it's hard to have smaller sand storage devices for homes vs. commercial industries, but it seems like we could make it work over time.

Thoughts?

I just watched this video, which is why I'm posting in here. I understand, as the video points out, that it's hard to have smaller sand storage devices for homes vs. commercial industries, but it seems like we could make it work over time.

Thoughts?

So it seems you just need to crush the glass to put it back into sand form...I've done some research and it seems there is no chemical change from sand to glass or glass to sand, it's just physical form, so I'm assuming that using the recycled sand from glass would/could hold the same amount of heat as using regular sand.Maybe this has been talked about already, but has anyone invested in a sand storage company? I keep thinking how we need to get off plastics and the best thing to do would be to go back to glass. You could "recycle" the old glass by melting it and then use it to store energy.

I just watched this video, which is why I'm posting in here. I understand, as the video points out, that it's hard to have smaller sand storage devices for homes vs. commercial industries, but it seems like we could make it work over time.

Thoughts?

Here is a company already doing this for four years now. Scale this up, give it to companies like batsand, and let's get off of plastics!

Glass Half Full | Glass Recycling, Coastal Restoration

Glass Half Full is a New Orleans based glass recycling company servicing Louisiana, Mississippi and across the Gulf South. Glass Half Full recycles post-consumer glass waste into sand and gravel for coastal restoration and erosion protection, disaster relief, new glass products, and more. Glass Half

Similar threads

- Article

- Replies

- 63

- Views

- 6K

- Replies

- 16

- Views

- 1K

- Replies

- 27

- Views

- 3K

- Replies

- 25

- Views

- 2K