In listening to the other analysts at that conference, its interesting that they've commented that Tesla just doesn't seem to be interested in doing ANY equity investments in mining. Hard rock, brine or DLE. Instead all they do is make occasional offtake agreements (ie. purchase contracts).

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

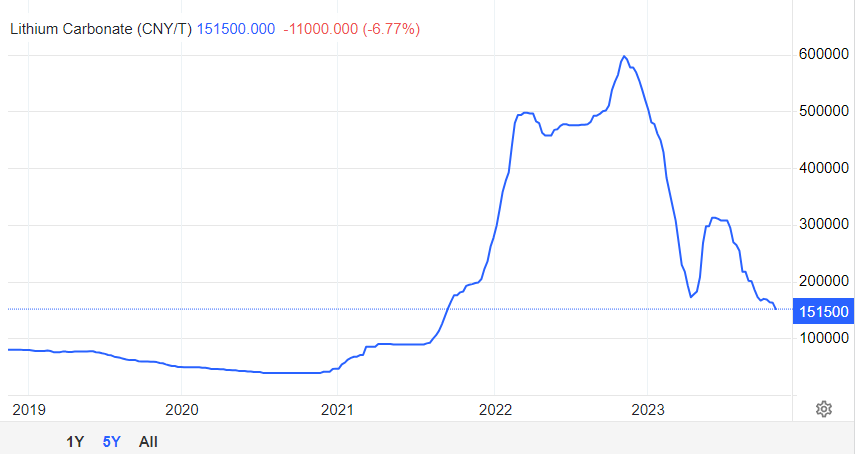

So here's the deal on Lithium after listening to that conference. Lithium spot prices soared last year (2022) and then "crashed" in 2023, but it is still elevated compared to before 2022. The analysts think the current price level is a floor since if it goes much lower, supply will get turned off until prices recover (yes, that's a thing in commodities, which makes trading them trickier).

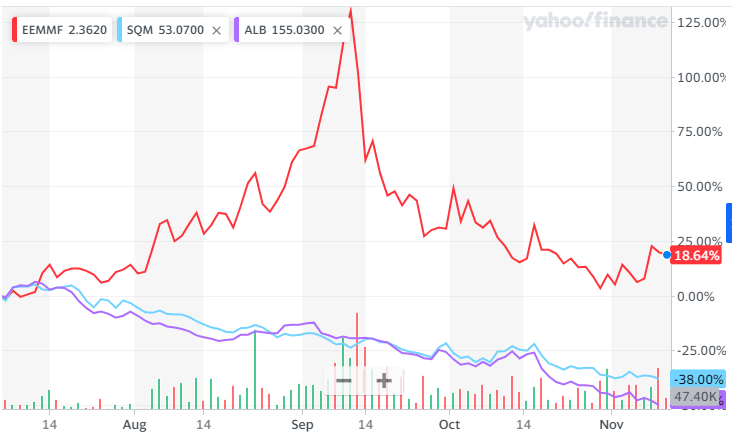

Commeasurably, Lithium mining majors, who supply all current Lithium to the world markets, crashed in 2023. Here's a chart comparing relative performance on my favorite junior development company, E3 vs the two big majors, SQM and ALB for the last year:

Right now, there is another factor that is impacting Lithium spot prices, and that's the drumbeat of negative news about EV sales. The Conventional Wisdom (which is never wrong) says that EV adoption has hit a wall. This is no doubt impacting Lithium spot pricing. Of course, if you think that is grade A horse manure, then there is a buying opportunity right now for anything Lithium related.

(which is never wrong) says that EV adoption has hit a wall. This is no doubt impacting Lithium spot pricing. Of course, if you think that is grade A horse manure, then there is a buying opportunity right now for anything Lithium related.

Also, if you listen to people like Jordan G. of the Limiting Factor Channel, he (and others who follow the EV space), think that Lithium supply is going to hit a wall in the 2025/2026 timeframe. This is because it takes a loooong time to bring up new hard rock lithium mines, or traditional brine/evaporation supplies, mostly due to regulatory issues. This will help Lithium mines long term. This will ALSO help all these startup DLE players who have projects that will come online in the 2025/2026 timeframe. DLE is expected to get fast tracked through the regulatory process since it doesn't impact the environment. It also is fast to ramp up from a plant construction point of view.

DLE though is fairly brand new technology for Lithium. It is actually very old technology for industry writ large since the same techniques are used for water filtration and various industrial chemical processes. I strongly suspect the traditional (hard rock and evaporation) Lithium industry in general is thinking that DLE is too risky to invest too much money into it. However, as some of the analysts pointed out, there are some strategic non-Lithium players that are looking very closely at DLE companies. And that is the giant Oil and Gas industry. First, they understand continuous processes like DLE very well. Second, their own depleted wells are often a source of high concentration lithium brine (it's what E3 is using). And third, it is an obvious way for them to diversify into the green tech area.

E3 snagged a small $5M investment from Imperial Oil, while Standard Lithium got $100M from Koch industries. I suspect we will see many more strategic investments from the Oil & Gas sector into the Lithium sector in the coming years.

That's all I got. Now is a great time to buying anything Lithium IF you believe that EV growth will continue at its current rapid pace for the next several years.

Commeasurably, Lithium mining majors, who supply all current Lithium to the world markets, crashed in 2023. Here's a chart comparing relative performance on my favorite junior development company, E3 vs the two big majors, SQM and ALB for the last year:

Right now, there is another factor that is impacting Lithium spot prices, and that's the drumbeat of negative news about EV sales. The Conventional Wisdom

Also, if you listen to people like Jordan G. of the Limiting Factor Channel, he (and others who follow the EV space), think that Lithium supply is going to hit a wall in the 2025/2026 timeframe. This is because it takes a loooong time to bring up new hard rock lithium mines, or traditional brine/evaporation supplies, mostly due to regulatory issues. This will help Lithium mines long term. This will ALSO help all these startup DLE players who have projects that will come online in the 2025/2026 timeframe. DLE is expected to get fast tracked through the regulatory process since it doesn't impact the environment. It also is fast to ramp up from a plant construction point of view.

DLE though is fairly brand new technology for Lithium. It is actually very old technology for industry writ large since the same techniques are used for water filtration and various industrial chemical processes. I strongly suspect the traditional (hard rock and evaporation) Lithium industry in general is thinking that DLE is too risky to invest too much money into it. However, as some of the analysts pointed out, there are some strategic non-Lithium players that are looking very closely at DLE companies. And that is the giant Oil and Gas industry. First, they understand continuous processes like DLE very well. Second, their own depleted wells are often a source of high concentration lithium brine (it's what E3 is using). And third, it is an obvious way for them to diversify into the green tech area.

E3 snagged a small $5M investment from Imperial Oil, while Standard Lithium got $100M from Koch industries. I suspect we will see many more strategic investments from the Oil & Gas sector into the Lithium sector in the coming years.

That's all I got. Now is a great time to buying anything Lithium IF you believe that EV growth will continue at its current rapid pace for the next several years.

So I just did a bit of a deep dive into Piedmont Lithium. Another junior, another lowish market cap ($492M currently). Piedmont is a lot less risky than E3 since it produces tried and true spodumene concentrate. It has an equity investment into a Quebec mine/project from which it generated its first revenue this quarter ($47M) from which it made 50% margins on while selling at very challenged Lithium spot pricing. They have investments in a handful of other rather interesting projects, so investing in Piedmont is a bit like owning a small basket of Lithium stocks. They are going to be building a refining plant in N. Carolina, have a project in Guyana and another project in Tennessee. Stock is trading at $25, hit an ATH of $75 last year.

Personally, looks like a buy whenever the stock market stops being an idiot and the stock price starts to move upwards again. BTW, Tesla has an offtake agreement with Piedmont to supply Tesla's hard rock refining plant they are building in Texas.

Some history:

8/3/2020, PLL: $6.50

9/28/2020: Announces Tesla offtake agreement to purchase 50,000 tons of 6% grade spodumene concentrate (SC6) over five years, to start between July 2022 and July 2023, which would be about 10-20% of Piedmont total revenues. (My maybe faulty math puts this deal at about $150M total revenue).

PLL hits $39 on news, falls back to around $25.

10/22/2022: Receives $57M in proceeds on oversubscribed stock sale at $25.

12/9/2020: Announces intent to become a US corporation, moving from Australia.

1/11/21: Announces $12M investment into a Quebec spodumene producer.

PLL hits $50 by 2/1/2021 on back of this news.

PLL hits ATH of $79 by 3/15/2021.

PLL bounces around $55 for rest of 2021.

3/22/2022: Raises $133M in oversubscribed stock offering at $65/share. Lithium spot prices are going parabolic in 2022.

1/3/2023: Tesla agreement is modified. The new one is a 3 year agreement (as opposed to 5) with a Tesla option to renew for another 3 years. The offtake is upsized to 125,000 tons of SC6 from 23H2 through end of 2025. No pricing was disclosed, of course, so that certainly was (re)negotiated as well.

PLL rises to hit $68 by 1/30/2023.

2/16/2023: LG Chem announces $75M equity investment into PLL at $68/share as well as an offtake agreement for 200,000 tons of SC6 over four years (50,000 tons per year).

3/6/2023 PLL hits $55/share following a short report hit piece.

Through 23Q2 The street starts to expect Peidmont to have their first deliveries from Quebec in Q3 and are attaching some unrealistic pricing to the revenue. Lithium spot pricing tumbles through 2023.

PLL share prices starts falling off a cliff in July to hit around $25 now under no real change other than lithium spot pricing tumbling. Seems the street expected better Q3 results than was released a few days ago. On their own, the Q3 results look pretty good in that Piedmont had $47M in revenues for the quarter and net income of $23M with a gross margin of 50% in a very challenging spot market pricing environment. Q3 and Q4 revenues are going to be sold at spot prices and it won’t be until 1Q24 before long term contracted pricing kicks in.

10/11/23 Piedmont announces 20% equity investment into an early stage Newfoundland lithium project for C$2M.

Personally, looks like a buy whenever the stock market stops being an idiot and the stock price starts to move upwards again. BTW, Tesla has an offtake agreement with Piedmont to supply Tesla's hard rock refining plant they are building in Texas.

Some history:

8/3/2020, PLL: $6.50

9/28/2020: Announces Tesla offtake agreement to purchase 50,000 tons of 6% grade spodumene concentrate (SC6) over five years, to start between July 2022 and July 2023, which would be about 10-20% of Piedmont total revenues. (My maybe faulty math puts this deal at about $150M total revenue).

PLL hits $39 on news, falls back to around $25.

10/22/2022: Receives $57M in proceeds on oversubscribed stock sale at $25.

12/9/2020: Announces intent to become a US corporation, moving from Australia.

1/11/21: Announces $12M investment into a Quebec spodumene producer.

PLL hits $50 by 2/1/2021 on back of this news.

PLL hits ATH of $79 by 3/15/2021.

PLL bounces around $55 for rest of 2021.

3/22/2022: Raises $133M in oversubscribed stock offering at $65/share. Lithium spot prices are going parabolic in 2022.

1/3/2023: Tesla agreement is modified. The new one is a 3 year agreement (as opposed to 5) with a Tesla option to renew for another 3 years. The offtake is upsized to 125,000 tons of SC6 from 23H2 through end of 2025. No pricing was disclosed, of course, so that certainly was (re)negotiated as well.

PLL rises to hit $68 by 1/30/2023.

2/16/2023: LG Chem announces $75M equity investment into PLL at $68/share as well as an offtake agreement for 200,000 tons of SC6 over four years (50,000 tons per year).

3/6/2023 PLL hits $55/share following a short report hit piece.

Through 23Q2 The street starts to expect Peidmont to have their first deliveries from Quebec in Q3 and are attaching some unrealistic pricing to the revenue. Lithium spot pricing tumbles through 2023.

PLL share prices starts falling off a cliff in July to hit around $25 now under no real change other than lithium spot pricing tumbling. Seems the street expected better Q3 results than was released a few days ago. On their own, the Q3 results look pretty good in that Piedmont had $47M in revenues for the quarter and net income of $23M with a gross margin of 50% in a very challenging spot market pricing environment. Q3 and Q4 revenues are going to be sold at spot prices and it won’t be until 1Q24 before long term contracted pricing kicks in.

10/11/23 Piedmont announces 20% equity investment into an early stage Newfoundland lithium project for C$2M.

Last edited:

Knightshade

Well-Known Member

They are going to be building a refining plant in N. Carolina

FWIW, and I think I've discussed it here before (and have in the main investor thread) they've been "going to" do that a bit like Toyota has been "going to" release a solid state battery... lots of press releases, not so much on the action.

I made a few bucks on them on that $39 pop you mention then GTFO since I knew they'd never be able to actually supply the stuff and as you note they've since had to modify the deal due to the utter lack of progress on the NC project- all of which appears to be due to piedmonts incompetence.

They'd missed a ton of filing deadlines, ignored meeting with various regulators involved, made no appearance of actually intending to do the project in a legal/permit sense...for years.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VXJG5I2W65K4ZDJILK3JMVGNN4.jpg)

Focus: In push to supply Tesla, Piedmont Lithium irks North Carolina neighbors

In its quest to build one of the largest lithium mines in the United States, Piedmont Lithium Inc (PLL.O) has overlooked one crucial constituency: its North Carolina neighbors.

That's from mid-2021 mentioning they'd been "planning" this since 2018 but 3 years later still hadn't actualy applied for a state mining permit or a necessary zoning variance. Mind you Piedmont had told investors it expected to have the permits in 2019. But again, hadn't even filed for em 2 years later.

Then they cancelled several meetings with the county... then finally showed up to this mid-2021 meeting for the first time in the entire process to present their plan. At the meeting the CEO said they'd apply for the permit THAT summer, construction by April 2022, and production by 2H 2023.

How's that going?

Recent update here:

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VXJG5I2W65K4ZDJILK3JMVGNN4.jpg)

Piedmont Lithium's plans to supply Tesla face skeptical North Carolina officials

Piedmont Lithium on Tuesday drew skepticism and anger at a meeting with local North Carolina officials about its plans for a lithium mine that could supply the electric vehicle battery metal to Tesla .

That last link mentions ANOTHER interesting bit-

The Quebec supply they're using for Tesla instead of the NC one? They lose access to it in 2026.

And based on how the NC thing has been going seems highly unlikely it'll be up and running by then to fill in.

FWIW, and I think I've discussed it here before (and have in the main investor thread) they've been "going to" do that a bit like Toyota has been "going to" release a solid state battery... lots of press releases, not so much on the action.

Thanks for the info.

I made a few bucks on them on that $39 pop you mention then GTFO since I knew they'd never be able to actually supply the stuff and as you note they've since had to modify the deal due to the utter lack of progress on the NC project- all of which appears to be due to piedmonts incompetence.

So the Tesla deal was modified, but Tesla has been in no position to buy SC6 from Peidmont since Tesla's own refining plant won't be in operation until mid 2024 last I heard. Have you heard something different? I don't think blaming the deal renegotiation on Peidmont is fair in this case.

They'd missed a ton of filing deadlines, ignored meeting with various regulators involved, made no appearance of actually intending to do the project in a legal/permit sense...for years.

They needed to raise about $900M to build the plant and start mining operations there. That's a tall order for a startup. So, yes, they thought they could parlay the Tesla offtake deal into project financing. That didn't happen. They did parlay it into raising $100M or so of equity which they've spent on engineering, getting the project to "shovel ready". They also acquired a $150M grant from the feds for the project but even that wasn't enough to entice a strategic investor to fund the rest. So, plan C, which is to give up on the grant, and instead get a $600M federal govt loan for the project, and then they think they can get a strategic investor to pony up the rest.

So, yes, delays. Financing is a bitch, but I don't think I would characterize it as incompetence.

Meanwhile, their other projects continue. Seems like they have all permits needed for Tennessee which is a refining plant. From the 10Q: "In July 2023, we received our Conditional Major Non-Title V Construction and Operating Air Permit for Tennessee Lithium from TDEC. With the receipt of the Air Permit for the planned 30,000 metric ton per year lithium hydroxide manufacturing plant, we now hold all the material permits required to begin construction at Tennessee Lithium."

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VXJG5I2W65K4ZDJILK3JMVGNN4.jpg)

Focus: In push to supply Tesla, Piedmont Lithium irks North Carolina neighbors

In its quest to build one of the largest lithium mines in the United States, Piedmont Lithium Inc (PLL.O) has overlooked one crucial constituency: its North Carolina neighbors.www.reuters.com

That's from mid-2021 mentioning they'd been "planning" this since 2018 but 3 years later still hadn't actualy applied for a state mining permit or a necessary zoning variance. Mind you Piedmont had told investors it expected to have the permits in 2019. But again, hadn't even filed for em 2 years later.

Then they cancelled several meetings with the county... then finally showed up to this mid-2021 meeting for the first time in the entire process to present their plan. At the meeting the CEO said they'd apply for the permit THAT summer, construction by April 2022, and production by 2H 2023.

How's that going?

Recent update here:

Discusses yet ANOTHER meeting with government folks their CEO didn't bother to show up for./cloudfront-us-east-2.images.arcpublishing.com/reuters/VXJG5I2W65K4ZDJILK3JMVGNN4.jpg)

Piedmont Lithium's plans to supply Tesla face skeptical North Carolina officials

Piedmont Lithium on Tuesday drew skepticism and anger at a meeting with local North Carolina officials about its plans for a lithium mine that could supply the electric vehicle battery metal to Tesla .www.reuters.com

Negative spin from Reuters. Company experts were there. There are obviously nimbys on the county commission which don't want a mine, and they'll say anything and everything negative about Piedmont and Reuters will report the negative comments and only the negative comments. However, this slipped by: "The project, which has divided the county of roughly 230,000 just west of Charlotte". Divided you say? By definition that means there are proponents.

Where it mentions they STILL don't have the state mining permit they originally promised to have in 2019...then 2020...then 2021... then 2022... then 2023... still no permit. The board basically told Piedmont how bout you get back to us when you ACTUALLY have a permit and we can talk zoning?

That last link mentions ANOTHER interesting bit-

The Quebec supply they're using for Tesla instead of the NC one? They lose access to it in 2026.

Where did Reuters get that from??? Here's the 10Q filed last week:

"We own an equity interest of 25% in Sayona Quebec for the purpose of furthering our investment and strategic partnership in Quebec, Canada. The remaining 75% equity interest is held by Sayona Mining. Sayona Quebec holds a 100% interest in NAL, which consists of a surface mine and a concentrator plant, as well as the Authier Lithium Project and the Tansim Lithium Project.

We hold a life-of-mine offtake agreement with Sayona Quebec for the greater of 113,000 metric tons or 50% of spodumene concentrate production per year. Our purchases of spodumene concentrate from Sayona Quebec are subject to market pricing with a price floor of $500 per metric ton and a price ceiling of $900 per metric ton for 6.0% spodumene concentrate on an FOB North Carolina basis."

Life-of-mine is expected to be at least 20 years. So either Reuters just printed some wild assed, unsourced rumor it heard, or Piedmont just lied in a 10Q.

BUT having said all that, here's a local newspaper report which has more details on that recent commissioner hearing:

Piedmont Lithium faces questions, criticism at latest meeting with county

Piedmont Lithium representatives faced a hostile crowd and critical political leaders at a meeting with the Gaston County Board of Commissioners Tuesday evening.

www.gastongazette.com

It does sound as it getting a permit for the mine is going to be hard. And THAT is probably what is holding up getting project financing. Basically, the US is once again showing why minerals are mined elsewhere - you simply can't get permits for US mines these days.

So, thanks for making me look more critically into Piedmont. They do have other projects, and plan D for North Carolina might be to just build a refining plant. Indeed, I'm not sure why they don't just do that since the locals seem to be OK with that. Its the mine they don't want.

Meanwhile, they are making 50% gross margin from the Quebec investment. Tennessee seems to be on the right track. Guyana also seems to be on the right track. Piedmont is more than just a mine in N. Carolina.

So I went and visited Alex's company site - Magrathea Metals and was searching around and clicked on this link under the News section:Great Alex Grant interview. If you don't know who he is, he has a deep background in chem.

Magrathea Raises $10M For New Generation Electrolytic Technology to Make Magnesium Metal - Light Metal Age Magazine

Magrathea raised $10M for its new generation technology to make magnesium metal.

www.lightmetalage.com

www.lightmetalage.com

Alex says at the end of the interview that they do have an R&D project with one "of the world's largest automakers", so my only rational thought would be Tesla. Who else would go this deep on stuff like this?

Now, not sure if that is the right connection, but from the article:

The seed round was co-led by VoLo Earth and Capricorn Investment Group. The syndicate includes Valor Equity Partners, Exor Ventures, Counteract, Hyperguap, Necessary Ventures, Untitled, EQT Foundation, and other recognized technology investing leaders with global industrial connectivity. Capricorn and Valor are both early investors in Tesla and SpaceX, with Valor currently having a seat on SpaceX’s board.

So maybe through their funding round, they were connected to Tesla....?

Alex says Mag is great for die casting, so maybe Tesla will use it for the one-piece casting we've been hearing about for a few years now....just thinking out loud...

Last edited:

So I went and visited Alex's company site - Magrathea Metals and was searching around and clicked on this link under the News section:

Magrathea Raises $10M For New Generation Electrolytic Technology to Make Magnesium Metal - Light Metal Age Magazine

Magrathea raised $10M for its new generation technology to make magnesium metal.www.lightmetalage.com

Alex says at the end of the interview that they do have an R&D project with one "of the world's largest automakers", so my only rational thought would be Tesla. Who else would go this deep on stuff like this?

Now, not sure if that is the right connection, but from the article:

So maybe through their funding round, they were connected to Tesla....?

Alex says Mag is great for die casting, so maybe Tesla will use it for the one-piece casting we've been hearing about for a few years now....just thinking out loud...

I hope they don't cast parts out of magnesium. Magnesium burns and once it gets going it's virtually impossible to put out. When I was a kid I saw the aftermath of an engine fire on our next door neighbors Volkswagen Squareback. The magnesium engine block caught fire and there was liquid magnesium that flowed down the gutter. The fire department could only prevent it from spreading. She barely made it out of the car.

There is no fuel tank to feed a magnesium fire, but a fire from another source could set the casting on fire.

Magnesium also suffers from all types of corrosion and is particularly bad at galvanic corrosion when it comes in contact with other metals and something to encourage corrosion like salt. The cast part could just corrode to a point it falls apart. Especially in parts of the world that salt their roads in the winter.

Aluminum is a much better metal for these castings. It's not quite as light as magnesium but it's a much better metal for this purpose.

hmm....alrighty then...don't want that then. haha. But Alex says around the 4 minute mark large chunks will not catch fire...maybe I'm missing something....I hope they don't cast parts out of magnesium. Magnesium burns and once it gets going it's virtually impossible to put out. When I was a kid I saw the aftermath of an engine fire on our next door neighbors Volkswagen Squareback. The magnesium engine block caught fire and there was liquid magnesium that flowed down the gutter. The fire department could only prevent it from spreading. She barely made it out of the car.

There is no fuel tank to feed a magnesium fire, but a fire from another source could set the casting on fire.

Magnesium also suffers from all types of corrosion and is particularly bad at galvanic corrosion when it comes in contact with other metals and something to encourage corrosion like salt. The cast part could just corrode to a point it falls apart. Especially in parts of the world that salt their roads in the winter.

Aluminum is a much better metal for these castings. It's not quite as light as magnesium but it's a much better metal for this purpose.

I swear somebody posted a video, or article, not too long ago talking about all those "FUD" points, as it applies to straight Magnesium or old alloys, and not modern/current Magnesium alloys, where they have mostly, or completely, resolved those issues.I hope they don't cast parts out of magnesium. Magnesium burns and once it gets going it's virtually impossible to put out. When I was a kid I saw the aftermath of an engine fire on our next door neighbors Volkswagen Squareback. The magnesium engine block caught fire and there was liquid magnesium that flowed down the gutter. The fire department could only prevent it from spreading. She barely made it out of the car.

There is no fuel tank to feed a magnesium fire, but a fire from another source could set the casting on fire.

Magnesium also suffers from all types of corrosion and is particularly bad at galvanic corrosion when it comes in contact with other metals and something to encourage corrosion like salt. The cast part could just corrode to a point it falls apart. Especially in parts of the world that salt their roads in the winter.

Aluminum is a much better metal for these castings. It's not quite as light as magnesium but it's a much better metal for this purpose.

I swear somebody posted a video, or article, not too long ago talking about all those "FUD" points, as it applies to straight Magnesium or old alloys, and not modern/current Magnesium alloys, where they have mostly, or completely, resolved those issues.

I'm not trying to pass on FUD. Maybe there are new alloys that solve the problems. But at least in the past magnesium was a metal to be cautious to use.

And here we go!! That sound you heard was the starting gun for a US lithium "gold rush". Exxon today announced they are have bought the rights to 120,000 gross acres in the Arkansas Smackover formation. Exxon will drill 10,000 feet to reach lithium rich brine and use DLE technology to extract it. Their press release also said they would refine it onsite. Production target is 2027 and they are exploring other options globally.

Standard Lithium is a development phase mining junior that has rights to 30,000 net acres in the same formation. Latest press release with 3Q results here. Arkansas is their later stage project with target production in 2027, but they have a brownfield asset in Texas with production target in 2026. Here is a link to a three day old video presentation with their CEO (queued up at Standard Lithium). They too will use DLE (Direct Lithium Extraction) processes.

CEO quote: "When I'm in Arkansas, I spend most of my time touring and hosting site visits with offtake partners interested in domestic lithium hydroxide supply". Interest is both for IRA and permitting reasons (Arkansas is seen as much more friendly for permitting, and DLE in general is much, much easier to permit since it has almost no environmental footprint).

SLI stock price is, like all lithium stocks, currently depressed.

Standard Lithium is a development phase mining junior that has rights to 30,000 net acres in the same formation. Latest press release with 3Q results here. Arkansas is their later stage project with target production in 2027, but they have a brownfield asset in Texas with production target in 2026. Here is a link to a three day old video presentation with their CEO (queued up at Standard Lithium). They too will use DLE (Direct Lithium Extraction) processes.

CEO quote: "When I'm in Arkansas, I spend most of my time touring and hosting site visits with offtake partners interested in domestic lithium hydroxide supply". Interest is both for IRA and permitting reasons (Arkansas is seen as much more friendly for permitting, and DLE in general is much, much easier to permit since it has almost no environmental footprint).

SLI stock price is, like all lithium stocks, currently depressed.

jhm

Well-Known Member

Looks like Exxon can keep poking holes in the earth, but now without extracting carbon.

Is the CEO's name Slartibartfast?So I went and visited Alex's company site - Magrathea Metals and was searching around and clicked on this link under the News section:

Magrathea Raises $10M For New Generation Electrolytic Technology to Make Magnesium Metal - Light Metal Age Magazine

Magrathea raised $10M for its new generation technology to make magnesium metal.www.lightmetalage.com

Alex says at the end of the interview that they do have an R&D project with one "of the world's largest automakers", so my only rational thought would be Tesla. Who else would go this deep on stuff like this?

Now, not sure if that is the right connection, but from the article:

So maybe through their funding round, they were connected to Tesla....?

Alex says Mag is great for die casting, so maybe Tesla will use it for the one-piece casting we've been hearing about for a few years now....just thinking out loud...

The regulatory, lobbying and legal power exxon can bring to the approval process should be a step change in scale. They're also not beholden to difficult project financing as they could fund the development with retained earnings or issues corporate bonds at a reasonable price. Exciting to see what they can achieve.And here we go!! That sound you heard was the starting gun for a US lithium "gold rush". Exxon today announced they are have bought the rights to 120,000 gross acres in the Arkansas Smackover formation. Exxon will drill 10,000 feet to reach lithium rich brine and use DLE technology to extract it. Their press release also said they would refine it onsite. Production target is 2027 and they are exploring other options globally.

Standard Lithium is a development phase mining junior that has rights to 30,000 net acres in the same formation. Latest press release with 3Q results here. Arkansas is their later stage project with target production in 2027, but they have a brownfield asset in Texas with production target in 2026. Here is a link to a three day old video presentation with their CEO (queued up at Standard Lithium). They too will use DLE (Direct Lithium Extraction) processes.

CEO quote: "When I'm in Arkansas, I spend most of my time touring and hosting site visits with offtake partners interested in domestic lithium hydroxide supply". Interest is both for IRA and permitting reasons (Arkansas is seen as much more friendly for permitting, and DLE in general is much, much easier to permit since it has almost no environmental footprint).

SLI stock price is, like all lithium stocks, currently depressed.

Window dressing or Plan B? (Eventually Plan A, lol)

I don't trust oil money to not screw it up for everyone else at congressional levels. Hoping for the best but cautious.

I don't trust oil money to not screw it up for everyone else at congressional levels. Hoping for the best but cautious.

Hokay, the Lithium sector is still in purgatory. Indeed, producers are even talking about stockpiling until prices go back up. A China "recession", or at least slower growth, plus pull backs from the stupid US legacy car manufacturers that couldn't build their way out of a paper bag, is causing lithium prices to continue to slide. In this environment, any and all juniors are looking at tough times to get financing for their projects. I'm stalking PLL, EEMMF and SLI. I am expecting SLI to do some joint development/financing in early 2024, so I'll want to invest before that happens I think.

Meanwhile analysts says things like this about lithium:

The good news is that this will help Tesla, of course.

Meanwhile analysts says things like this about lithium:

Lithium carbonate prices extended their decline to CNY 130,000 per tonne in November, the lowest since August 2021, on lower demand and steady supply. EV sales pessimism in China limited lithium demand for battery manufacturers in their typical restocking season. Instead, firms took advantage of high inventories following the supply glut caused by extensive subsidies from the Chinese government throughout 2021 and 2022. The developments drove key market players to forecast the next lithium deficit to return only in 2028, an aggressive twist from speculations of persistent shortfalls that took lithium prices to CNY 600,000 in November 2022. Elsewhere, the EV sales in the US have missed expectations as higher credit costs hampered consumers’ willingness to make large purchases. Meanwhile, output is set to remain robust. Mineral Resources, the world’s second-largest producer of lithium raw material spodumene, plans to double its lithium production in Western Australia next fiscal year.

The good news is that this will help Tesla, of course.

jhm

Well-Known Member

I wonder if Tesla might be in a position to stock up. Will the lithium refinery have much storage capacity?Hokay, the Lithium sector is still in purgatory. Indeed, producers are even talking about stockpiling until prices go back up. A China "recession", or at least slower growth, plus pull backs from the stupid US legacy car manufacturers that couldn't build their way out of a paper bag, is causing lithium prices to continue to slide. In this environment, any and all juniors are looking at tough times to get financing for their projects. I'm stalking PLL, EEMMF and SLI. I am expecting SLI to do some joint development/financing in early 2024, so I'll want to invest before that happens I think.

Meanwhile analysts says things like this about lithium:

The good news is that this will help Tesla, of course.

Not only might this be a good trade for Tesla (hedging future spikes in lithium), but it can give lithium miners a little more confidence developing resources. That is, it helps avoid stalling in future supply development.

Every processing plant has to have storage capacity both on the input and output side. But I don't think it'll factor into any mining financing decision. Remember, it isn't the miners that decide to finance, it is the finance markets that decide to finance the miners.I wonder if Tesla might be in a position to stock up. Will the lithium refinery have much storage capacity?

Not only might this be a good trade for Tesla (hedging future spikes in lithium), but it can give lithium miners a little more confidence developing resources. That is, it helps avoid stalling in future supply development.

So here's the deal on Lithium after listening to that conference. Lithium spot prices soared last year (2022) and then "crashed" in 2023, but it is still elevated compared to before 2022. The analysts think the current price level is a floor since if it goes much lower, supply will get turned off until prices recover (yes, that's a thing in commodities, which makes trading them trickier).

View attachment 989707

Commeasurably, Lithium mining majors, who supply all current Lithium to the world markets, crashed in 2023. Here's a chart comparing relative performance on my favorite junior development company, E3 vs the two big majors, SQM and ALB for the last year:

View attachment 989708

Right now, there is another factor that is impacting Lithium spot prices, and that's the drumbeat of negative news about EV sales. The Conventional Wisdom(which is never wrong) says that EV adoption has hit a wall. This is no doubt impacting Lithium spot pricing. Of course, if you think that is grade A horse manure, then there is a buying opportunity right now for anything Lithium related.

Also, if you listen to people like Jordan G. of the Limiting Factor Channel, he (and others who follow the EV space), think that Lithium supply is going to hit a wall in the 2025/2026 timeframe. This is because it takes a loooong time to bring up new hard rock lithium mines, or traditional brine/evaporation supplies, mostly due to regulatory issues. This will help Lithium mines long term. This will ALSO help all these startup DLE players who have projects that will come online in the 2025/2026 timeframe. DLE is expected to get fast tracked through the regulatory process since it doesn't impact the environment. It also is fast to ramp up from a plant construction point of view.

DLE though is fairly brand new technology for Lithium. It is actually very old technology for industry writ large since the same techniques are used for water filtration and various industrial chemical processes. I strongly suspect the traditional (hard rock and evaporation) Lithium industry in general is thinking that DLE is too risky to invest too much money into it. However, as some of the analysts pointed out, there are some strategic non-Lithium players that are looking very closely at DLE companies. And that is the giant Oil and Gas industry. First, they understand continuous processes like DLE very well. Second, their own depleted wells are often a source of high concentration lithium brine (it's what E3 is using). And third, it is an obvious way for them to diversify into the green tech area.

E3 snagged a small $5M investment from Imperial Oil, while Standard Lithium got $100M from Koch industries. I suspect we will see many more strategic investments from the Oil & Gas sector into the Lithium sector in the coming years.

That's all I got. Now is a great time to buying anything Lithium IF you believe that EV growth will continue at its current rapid pace for the next several years.

How low can lithium go? Here's an updated 5 year graph of lithium carbonate pricing:

It has dropped 28% in less than a month! As you can imagine, the three mining juniors I'm following, EEMMF, SLI and PLL are also down considerably. Both EEMMF and SLI recently sent out press releases saying they are really close now to locking down financing for their projects. That might be true, but if I was a financier, I'd be waiting for the price to bottom out and start rising. Which is what I'm doing watching these stocks!

Resident lithium troll here. Lithium prices in China finally have stopped falling every single damn day. Are we at a bottom? Who knows. This is the one year chart:

These charts from: Lithium - Price - Chart - Historical Data - News Read the last sentence of the analysis at the top. Hmmm, what does it mean?

Meanwhile, Chinese EV sales are showing signs of life, or at least channel stuffing: Chinese EV makers speed towards 2023 sales record

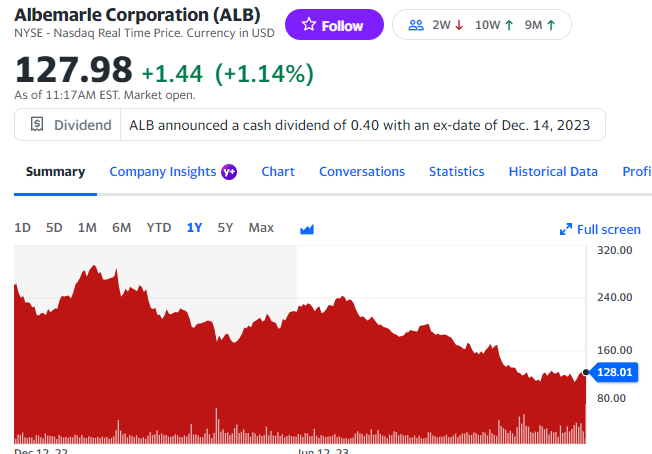

Meanwhile, lithium stocks continue their decline:

Pre-revenue junior:

Just started revenues junior:

Major:

Major:

The time to pounce into lithium stocks may be coming soonish...

These charts from: Lithium - Price - Chart - Historical Data - News Read the last sentence of the analysis at the top. Hmmm, what does it mean?

Meanwhile, Chinese EV sales are showing signs of life, or at least channel stuffing: Chinese EV makers speed towards 2023 sales record

Meanwhile, lithium stocks continue their decline:

Pre-revenue junior:

Just started revenues junior:

Major:

Major:

The time to pounce into lithium stocks may be coming soonish...

Similar threads

- Article

- Replies

- 64

- Views

- 6K

- Replies

- 16

- Views

- 1K

- Replies

- 27

- Views

- 3K

- Replies

- 25

- Views

- 2K