Feels like some people must've taken profits on their options, hence $940 -> $910? Can't imagine too many sellers of shares are materializing all of a sudden. I really think this might be driven for a large part by the options market and delta hedging.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

trading

- Thread starter Boomer19

- Start date

jeewee3000

Active Member

I've pulled the plug on my most ITM LEAP (JAN2022 640c): bought at $15 and sold at $375. Converted 25k of that to shares, holding the other 12k in cash in case of a drop, to invest in LEAPS.

Now I'm back to 75% shares, 25% LEAPS. Breathe...

Now I'm back to 75% shares, 25% LEAPS. Breathe...

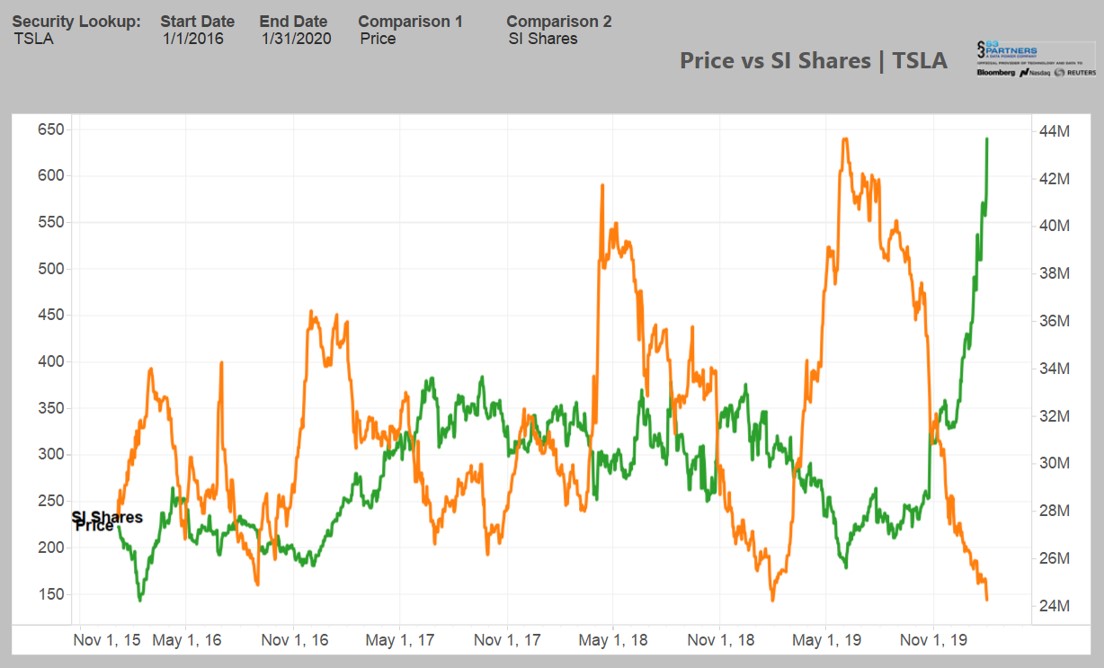

Sorry, for not seeing the obvious that you're pointing out.At this point I think the best source of information for discovering this top for TSLA is to look for a bottom in the short interest graph.

I de-leveraged a bit today as my account was 66% options / 33% shares. Back to a more conservative 50/50 now.  Holding cash for any sort of pullback and I still have plenty of room on the upside with uncapped LEAPS and some bull call spreads.

Holding cash for any sort of pullback and I still have plenty of room on the upside with uncapped LEAPS and some bull call spreads.

Sorry, for not seeing the obvious that you're pointing out.What is the bottom in the short interest graph? I missed the rise at $440, but I still want to get in but its kinda high now. Trying to determine if it will drop again soon in the next couple of quarters or perhaps I have completely missed the boat on this meteoric stock.

I don't know

There have been a lot more longs buying this time around compared to the last time we had a large decrease in short interest.

need some advice....

have 116 TSLA shares I've accumulated over last 3 years that I intend to hold for 5+ years and also 20 2/28 1000 calls now up $180k and 13 3/20 1000c up ~140k that I bought a couple weeks for $8k total about pre-earnings to play a possible squeeze.

trying to figure out my strategy from here, if it matters i'm young and jobless, tryna figure out my next path here in terms of long term gains and minimizing the tax hit and setting up my future

have 116 TSLA shares I've accumulated over last 3 years that I intend to hold for 5+ years and also 20 2/28 1000 calls now up $180k and 13 3/20 1000c up ~140k that I bought a couple weeks for $8k total about pre-earnings to play a possible squeeze.

trying to figure out my strategy from here, if it matters i'm young and jobless, tryna figure out my next path here in terms of long term gains and minimizing the tax hit and setting up my future

If the market opens around this price ($850-$870), I'll probably buy a small amount of calls expiring next Friday.

I don't trade much short term, but this morning was too obviously a manipulation imo, so I went ahead and bought a tiny amount of:

-$950s expiring this week @ $6,50

-$1000s expiring next week @ $16.33

So far so good.

Last edited:

jeewee3000

Active Member

Ballsy move.I don't trade much short term, but this morning was too obviously a manipulation imo, so I went ahead and bought a tiny amount of:

-$950s expiring this week @ $6,50

-$1000s expiring next week @ $16.33

So far so good.

I've told myself not to trade today as to avoid catching a falling knife. Mid $600's is where I see a secure foothold since that was the post ER point without margin calls.

So if it goes to $650 I'm adding calls.

Ballsy move.

I've told myself not to trade today as to avoid catching a falling knife. Mid $600's is where I see a secure foothold since that was the post ER point without margin calls.

So if it goes to $650 I'm adding calls.

I wouldn't have done so if it seemed like a natural pullback/halt of the rise, but it seemed too similar to the "unintended acceleration" day, and orchestrated by somebody.

Macros aren't helping so far, but it's only a very tiny bet, so it doesn't really matter if it doesn't work out. If it's still in $750-800 region, I might buy another very small amount of $950 or $1000 strike calls expiring next week.

Also funny how little I'm down so far, even though SP dropped by $50 since I bought them. Implied Volatility really is absurd right now. I'm basically even still on the $1000s expiring next week.

ev-enthusiast

Active Member

lowtek

Active Member

I put a S/L in at 900 and did pretty well. I picked it up again on the dip. My Model X and wifey's Y are being heavily subsidized by the market, thanks guys

Ballsy move.

I've told myself not to trade today as to avoid catching a falling knife. Mid $600's is where I see a secure foothold since that was the post ER point without margin calls.

So if it goes to $650 I'm adding calls.

$640-$650 or so would fill one now pretty obvious candle anyway. I don’t feel so bad now for missing out on a lot of gains yesterday and taking only a meager profit.

I bought NIO yesterday after that and sitting on a small loss there but the medium term graph appears promising.

Medium term TSLA is anyone’s guess. Q1 deliveries+financials worry me, whereas battery day excites me.

The weekly candle looks crazy! Such a long upper shadow. Would love to see some consolidation in the $700s or even $600s. This thing needs to cool off.

ev-enthusiast

Active Member

Today's volume almost 40 Mio shares. This is not back to normal. End of week and beginning of next week will be interesting.

ev-enthusiast

Active Member

48 Mio shares at close.Today's volume almost 40 Mio shares. This is not back to normal. End of week and beginning of next week will be interesting.

ev-enthusiast

Active Member

Note to self:

On the daily chart, be careful if SP is above upper BB, normally SP will not keep going more than three days outside upper BB.

On the daily chart, be careful if SP is above upper BB, normally SP will not keep going more than three days outside upper BB.

jeewee3000

Active Member

True, barring news or macros.Note to self:

On the daily chart, be careful if SP is above upper BB, normally SP will not keep going more than three days outside upper BB.

With Tesla, news is always round the corner.

Similar threads

- Marketplace listing

- Replies

- 0

- Views

- 98

- Locked

- Marketplace listing

- Replies

- 2

- Views

- 303

- Marketplace listing

- Replies

- 0

- Views

- 145

- Locked

- Marketplace listing

- Replies

- 5

- Views

- 414

- Marketplace listing

- Replies

- 0

- Views

- 333