It's fine. Just strengthens the squeeze. This stock does not trade freely or normally. When it truly pops, everyone and their grandma will knowClassic news nullification. Great, important positive news comes out. Instantly nullify it with a stupid negative story.

What boggles my mind is that Mr. Market thinks some OSHA investigation about a worker losing a finger is more fundamentally important to the company than the 5-star rating across the board.

This company is under such a microscope that the dumbest sh*t gets amplified into doom.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

humbaba

sleeping until $7000

$TSLA is down while *a different* index is up.

True, I was just identifying her 'spin' -- what she wanted the reader to take away from it. $TSLA *is* down compared to a year ago. That's a fact, though I don't think she wants to get into the weeds explaining *why* it is down so much...

middle index Finger?$TSLA is down while *a different* index is up.

Didn't some Tesla worker lose one of those recently?middle index Finger?

Todd Burch

14-Year Member

Shortsville Times Exclusive:

Sketch Artists have created a reproduction of their vision of Tesla's devastating finger loss at the factory:

Experts expect OSHA investigation to reveal that company executives ordered workers to work as dangerously as possible, and to place their hands at all factory pinch points when possible.

Sketch Artists have created a reproduction of their vision of Tesla's devastating finger loss at the factory:

Experts expect OSHA investigation to reveal that company executives ordered workers to work as dangerously as possible, and to place their hands at all factory pinch points when possible.

X Fan

Active Member

good buying opportunity.....bought again on the dip this morning....

tinm

2020 Model S LR+ Owner

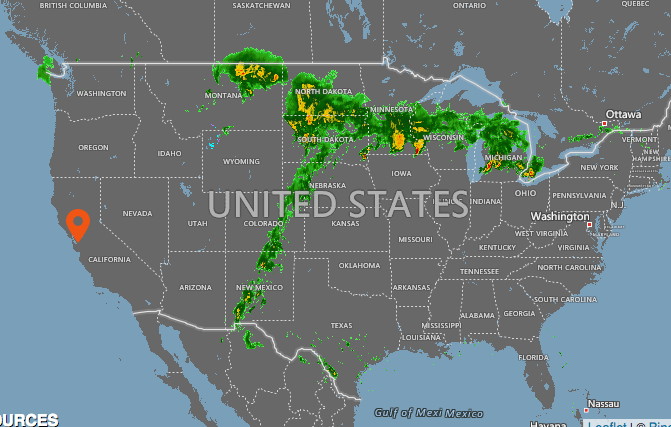

Ok this is impressive. Right at this moment there is currently a very large T stretching across America. It's showing up on radar even (source: Accuweather site). It kinda reminds me of a certain company logo!

It's funny, I've started to find this rather entertaining. What new story can they find to manipulate the market next?!

Anecdotally, I talked with my two colleagues yesterday, about smog, and how EVs can't get here fast enough. I said that I was looking forward to a nice but cheap EV - Teslas are waaaay out of my league here - but they immediately started in on Teslas, how awesome they are, how their kids kids really, really wanted one, the acceleration, their friend with a Tesla who deeply loved it etc. The kicker is that we're all women, aged 40 to 55, and mostly talk about baking, clothes, family etc. You can't get any further from the even-vaguely-interested-in-cars segment.

Anecdotally, I talked with my two colleagues yesterday, about smog, and how EVs can't get here fast enough. I said that I was looking forward to a nice but cheap EV - Teslas are waaaay out of my league here - but they immediately started in on Teslas, how awesome they are, how their kids kids really, really wanted one, the acceleration, their friend with a Tesla who deeply loved it etc. The kicker is that we're all women, aged 40 to 55, and mostly talk about baking, clothes, family etc. You can't get any further from the even-vaguely-interested-in-cars segment.

WTF is this. Has somebody else lost a foot? I do wonder why some people are so easy to manipulate. That I can see through this noise makes me feel all smug, superior and intellectual.

beachbum77

Banned

The better play is to forget the strike price and play the movement. A few days ago I told you all I bought Oct 5 $360 calls. The buy was at $.96 each. I only bought 10. I sold them this morning on an order I placed right after the buy at $1.90 when Tesla spiked to $305 earlier. If they drop back close to $1.00 (they are already back down to $1.06/$1.19) I will reload again since I expect an SP pop on the Q3 numbers no matter what they are since they will be higher than Q2.Weird. I mean, that's economically irrational. The call buyer should always, always, always execute the option if the strike price is below the aftermarket Friday price for which they can sell the stock, and collect the difference in price as an arbitrage gain. There is *never* any reason not to do this.

And the kicker -- the brokerages will actually *do it for you automatically* if you don't issue special instructions. On Saturday, they will execute options which were in-the-money on Friday close if you don't give specific instructions to the contrary. It's actually an options exchange *requirement* that they do so.

This implies to me that a lot of call buyers are even stupider than I thought they were. Making specific phone calls in order to avoid execution of options so that they can unnecessarily lose money?!?

Perhaps they're all wildly leveraged and can't actually afford to buy the stock (and sell it in the aftermarket)? But that would also imply wild stupidity on the part of the call buyers.

Hoping to exercise ties up too much cash. Quick ins and outs win the day in options trading. All of those worthless puts you have been talking about are usually purchased as catastrophic insurance policies against large long positions. They are just a cost of doing business for large positions.

tivoboy

Active Member

thats probably a nice level to target esp if below 1$ prior to ER. I'm going to try and reload in some stock though, want to actually be able to trade the stock for AH on ER day.The better play is to forget the strike price and play the movement. A few days ago I told you all I bought Oct 5 $360 calls. The buy was at $.96 each. I only bought 10. I sold them this morning on an order I placed right after the buy at $1.90 when Tesla spiked to $305 earlier. If they drop back close to $1.00 (they are already back down to $1.06/$1.19) I will reload again since I expect an SP pop on the Q3 numbers no matter what they are since they will be higher than Q2.

Hoping to exercise ties up too much cash. Quick ins and outs win the day in options trading. All of those worthless puts you have been talking about are usually purchased as catastrophic insurance policies against large long positions. They are just a cost of doing business for large positions.

Will probably buy back the sept 292.5 if/when they are below 4.5$.

Todays' price action was encouraging.

Ok this is impressive. Right at this moment there is currently a very large T stretching across America. It's showing up on radar even (source: Accuweather site). It kinda reminds me of a certain company logo!

View attachment 336622

So much for the "Tesla doesn't have to advertise" myth. Another bullish talking point gone.

bdy0627

Active Member

That was a pretty impressive MMD. I didn't expect TSLA to be that vulnerable today.

copyhacker

Member

If the shorts have this much ammo in the hopper for whenever we break $300, makes me wonder what kind of FUD they're sitting on to release after the earnings report. They've got to have something planned.

Tslynk67

Well-Known Member

OK, I don't want to denigrate the poor guy/girl that lost a finger, that must be utterly awful - I hope they stitched it back on, but this is ridiculous.

I'm sticking my neck out and saying we should close above $320

And while I'm here, WTF?

I'm sticking my neck out and saying we should close above $320

And while I'm here, WTF?

If the shorts have this much ammo in the hopper for whenever we break $300, makes me wonder what kind of FUD they're sitting on to release after the earnings report. They've got to have something planned.

Ahh don't worry :

" Once reservation backlog empties Tesla will crash "

" Profitable this quarter but not next "

" The 35k M3 will never be profitable"

....

MikeQ

Member

Clearly Tesla has a safety problem. This guy has already lost his other hand and both feet as well!

Unidentified edit-er: and his ears

Fact Checking

Well-Known Member

The NHTSA 2018 Model 3 crash-test videos are showing impressive levels of Model 3 safety:

In the side pole crash test it was impressive to see how the very rigid battery pack at the bottom of the car acted as an effective barrier against the pole intruding into the passenger compartment.

Even a Volvo XC60 (2017), famous for the integrity of the passenger compartment in crashes, is softer in side crashes:

Or an Audi Q7 (2018):

EVs with rigid battery packs at the bottom of the car have not only very safe low center of mass, but also have clear side crash protection advantages here: ICE cars put a lot of mass into the powertrain, which doesn't increase crash protection, probably the opposite is the case: that engine mass uses up crunch zone volume in the front of the car.

In the side pole crash test it was impressive to see how the very rigid battery pack at the bottom of the car acted as an effective barrier against the pole intruding into the passenger compartment.

Even a Volvo XC60 (2017), famous for the integrity of the passenger compartment in crashes, is softer in side crashes:

Or an Audi Q7 (2018):

EVs with rigid battery packs at the bottom of the car have not only very safe low center of mass, but also have clear side crash protection advantages here: ICE cars put a lot of mass into the powertrain, which doesn't increase crash protection, probably the opposite is the case: that engine mass uses up crunch zone volume in the front of the car.

Last edited:

Those are not clouds but drones delivering Model 3s. Extra points for flying in formation!Ok this is impressive. Right at this moment there is currently a very large T stretching across America. It's showing up on radar even (source: Accuweather site). It kinda reminds me of a certain company logo!

View attachment 336622

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K