Maybe invest in those not-a-tents?Storage issues. Where do you put an extra 30K non delivered cars in transit? Rent and transport expense to spread all this inventory out over the state plus the headache of inventory management at all these pop up holding lots. Also extra insurance for abnormally large off site inventory. You also don't want your supplier A/P coming due too far ahead of the sales revenue.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

rameshbende

Member

Giga factory producing at 5k per week, Article on Electrek. My guess is GA3 and GA4 are also good for 5k. End of line and body shop should be also ok. I think only problem we need confirmation is paint shop.

Skryll

Active Member

Giga factory producing at 5k per week, Article on Electrek. My guess is GA3 and GA4 are also good for 5k. End of line and body shop should be also ok. I think only problem we need confirmation is paint shop.

And shipping / delivery.

Well, I have something negative to say about Sacconaghi's number skills.

Sacconaghi's looks at Tesla's service margins in two consecutive years, 2016 and 2017, where they are 66M$ and 266M$ (or something like that, the actual values are irrelevant).

Sacconaghi describes this as growing "exponentially'.

The problem is that any two non-zero and non-equal data points can be fitted to an exponential function.

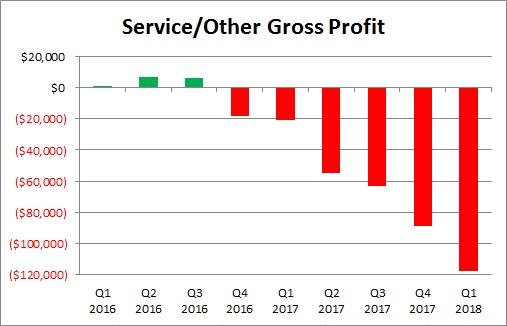

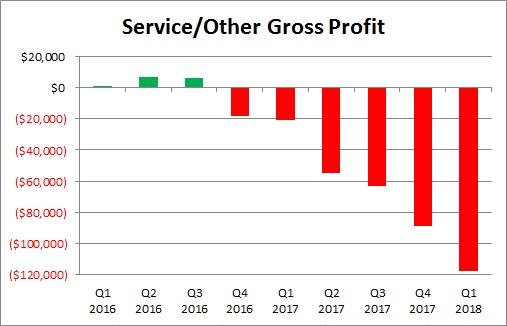

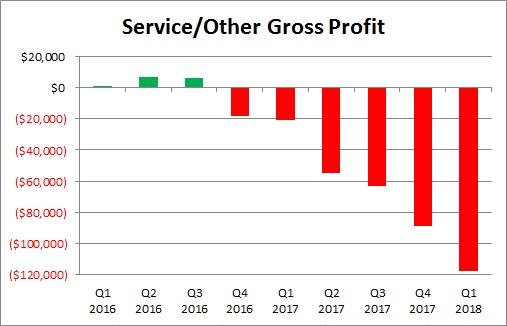

That Sacconaghi guy may be looking at the quarterly data and use more than 2 datapoints. Since i don't have access to the full report i can't verify that, someone else may want to do that. The chart is taken from the SA article i linked below. While you don't have to agree with the authors conclusions, i'd assume he is able to represent the numbers from the quarterly reports accuratly.

Is Tesla Overstating Margins? - Tesla, Inc. (NASDAQ:TSLA) | Seeking Alpha

Could we somehow arrange that he is the one that gets squeezed in a vicious way and leave me alone please?

I'm mostly harmless.

Thank you!

Bears are no where near as united as the bulls

Esme Es Mejor

Member

That Sacconaghi guy may be looking at the quarterly data and use more than 2 datapoints. Since i don't have access to the full report i can't verify that, someone else may want to do that. The chart is taken from the SA article i linked below. While you don't have to agree with the authors conclusions, i'd assume he is able to represent the numbers from the quarterly reports accuratly.

Is Tesla Overstating Margins? - Tesla, Inc. (NASDAQ:TSLA) | Seeking Alpha

It’s almost like service losses started expanding at the same time Tesla started massively expanding their service infrastructure in anticipation of the Model 3.

It’s almost like service losses started expanding at the same time Tesla started massively expanding their service infrastructure in anticipation of the Model 3.

That may very well be one part of the puzzle.

Cal1

Member

Giga factory producing at 5k per week, Article on Electrek. My guess is GA3 and GA4 are also good for 5k. End of line and body shop should be also ok. I think only problem we need confirmation is paint shop.

Is the 5k still accurate after the sabotage stuff? No one has indicated just what was affected and how easy it would be to fix.

Is the 5k still accurate after the sabotage stuff? No one has indicated just what was affected and how easy it would be to fix.

That info from John about the 5K/W came in tonight so its after the sabotage message. Its not likely that Tripps action did cause delays. We do not have certainty on it though.

Sudre

Active Member

It is my belief that there is no recent effect at all. They just finally got enough evidence to prove something so they announced it. It was not possible to say anything until they had proof or it would have led to a lawsuit against Tesla. All the sabotage was probably months ago. They probably set a trap to catch him on video updating one of his bots.Is the 5k still accurate after the sabotage stuff? No one has indicated just what was affected and how easy it would be to fix.

dc_h

Active Member

I would expect, if they knew, they would be logging his access and maybe even watching his cell phone. Tracking who the stuff was sent to is the interesting part of this. I’m sure the lawyer was hired to tie the clues together and not stop at Tripp.It is my belief that there is no recent effect at all. They just finally got enough evidence to prove something so they announced it. It was not possible to say anything until they had proof or it would have led to a lawsuit against Tesla. All the sabotage was probably months ago. They probably set a trap to catch him on video updating one of his bots.

hey guys, you probably shouldnt consider electrek as a reliable source of information, like keep an open eye on all news sources, but electrek is quite literally pushing tesla referrals and clearly has a relationship with tesla that prevents it from producing unbiased articles

Like do what you want, this is just a friendly piece of advice

Like do what you want, this is just a friendly piece of advice

It’s almost like service losses started expanding at the same time Tesla started massively expanding their service infrastructure in anticipation of the Model 3.

That may very well be one part of the puzzle.

Tesla explained that service revenue would be almost entirely due to out-of-warranty work, which is currently minimal and is not yet covering the cost of creating new service centers. This is not an issue for long-established automakers who rely on their long-established franchised dealerships to provide service.

Bernstein analyst Sacconaghi apparently does not fully understand this situation with a relatively new car company in the process of ramping up production, having few out-of-warranty cars, yet with no franchised dealerships. Nevertheless much of the media keep repeating his puzzlement and tops it with headlines with negative implications, while failing to seek deeper explanations from Tesla.

Last edited:

sundaymorning

Active Member

Nice to hear some confirmation that things are picking up.

Found a LOT of Model 3's in a Tesla lot - Pictures inside

Found a LOT of Model 3's in a Tesla lot - Pictures inside

while failing to seek deeper explanations from Tesla.

Things Tesla is definitely reliable for, lots of color and a deep explanation of all its numbers and metrics

That Sacconaghi guy may be looking at the quarterly data and use more than 2 datapoints. Since i don't have access to the full report i can't verify that, someone else may want to do that. The chart is taken from the SA article i linked below. While you don't have to agree with the authors conclusions, i'd assume he is able to represent the numbers from the quarterly reports accuratly.

Is Tesla Overstating Margins? - Tesla, Inc. (NASDAQ:TSLA) | Seeking Alpha

Q1 2018, first revenue then costs

services and other 263,412

services and other 380,969

Q4 2017

services and other 288,017

services and other 376,576

Q3 2017

services and other 304,281

services and other 367,401

Q2 2017

services and other 216,161

services and other 271,169

Q1 2017

Services and other 192,726

Services and other 213,876

OK so first of all, you don't look at margins in dollars, you look at %.

Then you add context, what do you have here, should be mostly the service centers and used car sales.

Used cars sales tend to be break even but vols went up recently as leases expire.

And then they got the scaling ahead of Model 3 and margins are gonna be low because of underutilization.

Not sure if the Superchargers are reported here but likely and again that's an underutilization issue - do remember that almost all the current fleet has it for free but the balance will shift soon.

This is people looking for a negative and pushing a narrative at any cost.

Edit: The argument that can be made is that by delivering cars with issues that need to be serviced right away, Tesla is shifting margins from Auto to this segment. That would mean a large spike in costs and no increase in revenue and we aren't seeing much of that at all. There is some but that can be put on them scaling this ahead of the increase in fleet size with M3. Notable here that M3 deliveries have been low in the reported quarters so any margin shifting would have to be mostly for S&X and that's a bit extravagant.

Last edited:

RichardL

Member

I think only problem we need confirmation is paint shop.

I recall the paint shop being updated quite some time ago, and it was quoted as being ready for 10K/wk throughput. I am surprised if that is the bottleneck.

As I recall that was prior to MX production even, and was the holdup on expanded MS production at one point. They spent a lot of time and money and said it would not be a bottleneck for many years. (of course my memory might be flawed!)

I have a question for "our" bears/shorts. (MODS please move to the appropriate section if needed)

The basic premise: The reason people/institutions participate in the Stock Market is for the purpose of amassing wealth (as horrific as that thought is in some circles).

Hypothetical: Using whatever source/metric you are comfortable with that shows Tesla becoming profitable; for example Seeking Alpha verifies 6K per week of sustained M3 production with 7k of burst rate easily attained or (insert bank) confirms that Tesla has $100B in cash reserves, etc.

The basic premise: The reason people/institutions participate in the Stock Market is for the purpose of amassing wealth (as horrific as that thought is in some circles).

Hypothetical: Using whatever source/metric you are comfortable with that shows Tesla becoming profitable; for example Seeking Alpha verifies 6K per week of sustained M3 production with 7k of burst rate easily attained or (insert bank) confirms that Tesla has $100B in cash reserves, etc.

- Would you still short Tesla?

- If so, is it based on your dislike of Musk?

- Is your personal circumstance so tied to non-renewable energy that Tesla is a threat economically?

- If so, is it based on your dislike of Musk?

It may be surprising, but i'm vaguely aware what a margin is. I responded to a post argueing that it's stupid to talk about exponential curves when you only have 2 points of data, by posting a chart showing there is more data. I realize that it wasn't very clever to link to a chart showing gross profit instead of margins. It simply was the first chart i came across, since i was reading that SA article anyway.

The reason i hesitated to give my own interpretation of the data is, that i haven't yet made up my mind about that topic. You guys made some valid points about front running costs for the service expansion and Model 3. I really wish, we were able to quantify that a little better. Although i'd assume early quarters up to Q1/2017 may still reflect some of the problems the Model X had. Having to do more warranty work in relation to other service stuff is something, they'll have to cope with for a lot more years, since the fleet will continue to grow fast. So that won't go away anytime soon. Until we can see how service numbers change with increasing Model 3 deliveries, it's probably just another point on the list of things to watch developing.

Sorry pal, but being squeezed in a vicious way doesn't sound like a lot of fun. I'll just hide and pray for you.

Good luck! :-/

1. No.

There are a lot of things to like about Musk, especially when it comes to his nerdy side. I'm a software guy myself, having read a lot the Banks, Asimov and Clarke stuff. I'm enjoying a solar array (and the income it is generating). But all this doesn't mean, that i think Tesla is a healthy business in the current situation. Imho, the valuation has been running way to much ahead. With overheated global markets a short position in Tesla (and some other companies / indices) looks like a good hedge for a mostly long portfolio. Of course, should i be wrong about Tesla, that wouldn't mean i would run over and join the bull camp. I'd probably just stay away. And do you really think you will get an honest answer asking this kind of question in such a way?

Anyway, bedtime for me.

Harass you soon.

The reason i hesitated to give my own interpretation of the data is, that i haven't yet made up my mind about that topic. You guys made some valid points about front running costs for the service expansion and Model 3. I really wish, we were able to quantify that a little better. Although i'd assume early quarters up to Q1/2017 may still reflect some of the problems the Model X had. Having to do more warranty work in relation to other service stuff is something, they'll have to cope with for a lot more years, since the fleet will continue to grow fast. So that won't go away anytime soon. Until we can see how service numbers change with increasing Model 3 deliveries, it's probably just another point on the list of things to watch developing.

Bears are no where near as united as the bulls

Sorry pal, but being squeezed in a vicious way doesn't sound like a lot of fun. I'll just hide and pray for you.

Good luck! :-/

Hypothetical: Using whatever source/metric you are comfortable with that shows Tesla becoming profitable; for example Seeking Alpha verifies 6K per week of sustained M3 production with 7k of burst rate easily attained or (insert bank) confirms that Tesla has $100B in cash reserves, etc.

I’m genuinely curious about the percentage of the bears that post on TMC that would continue to short Tesla vs those that would switch over.

- Would you still short Tesla?

- If so, is it based on your dislike of Musk?

- Is your personal circumstance so tied to non-renewable energy that Tesla is a threat economically?

1. No.

There are a lot of things to like about Musk, especially when it comes to his nerdy side. I'm a software guy myself, having read a lot the Banks, Asimov and Clarke stuff. I'm enjoying a solar array (and the income it is generating). But all this doesn't mean, that i think Tesla is a healthy business in the current situation. Imho, the valuation has been running way to much ahead. With overheated global markets a short position in Tesla (and some other companies / indices) looks like a good hedge for a mostly long portfolio. Of course, should i be wrong about Tesla, that wouldn't mean i would run over and join the bull camp. I'd probably just stay away. And do you really think you will get an honest answer asking this kind of question in such a way?

Anyway, bedtime for me.

Harass you soon.

1. No.

There are a lot of things to like about Musk, especially when it comes to his nerdy side. I'm a software guy myself, having read a lot the Banks, Asimov and Clarke stuff. I'm enjoying a solar array (and the income it is generating). But all this doesn't mean, that i think Tesla is a healthy business in the current situation. Imho, the valuation has been running way to much ahead. With overheated global markets a short position in Tesla (and some other companies / indices) looks like a good hedge for a mostly long portfolio. Of course, should i be wrong about Tesla, that wouldn't mean i would run over and join the bull camp. I'd probably just stay away. And do you really think you will get an honest answer asking this kind of question in such a way?

Anyway, bedtime for me.

Harass you soon. [/QUOTE]

[/QUOTE]

I don't know how to provide confidentiality to a member's response (that pixilated blur over the username/avatar would be cool) so there is a leap of faith in asking. However, I do believe you answered the question.

There are a lot of things to like about Musk, especially when it comes to his nerdy side. I'm a software guy myself, having read a lot the Banks, Asimov and Clarke stuff. I'm enjoying a solar array (and the income it is generating). But all this doesn't mean, that i think Tesla is a healthy business in the current situation. Imho, the valuation has been running way to much ahead. With overheated global markets a short position in Tesla (and some other companies / indices) looks like a good hedge for a mostly long portfolio. Of course, should i be wrong about Tesla, that wouldn't mean i would run over and join the bull camp. I'd probably just stay away. And do you really think you will get an honest answer asking this kind of question in such a way?

Anyway, bedtime for me.

Harass you soon.

I don't know how to provide confidentiality to a member's response (that pixilated blur over the username/avatar would be cool) so there is a leap of faith in asking. However, I do believe you answered the question.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K