They'll make a couple thousand of them and have them sit on dealership lots while the salespeople ignore them. Go on deep discount on 2021 when inventory is eating into the books.I can see why they're having a "quiet debut". Fairly "meh" car specs. Low range, low performance... and it has a GRILL!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Tesla's branding is much stronger than an Audi/Merc/ICE manufacture when it comes to electrification of transportation.

I think there is some overconfidence here that can be dangerous.

Sure Tesla is the big fish in the EV pond, but that is a small pond. Tesla needs to be successful in the ocean taking car sales away from competitors not just EV sales and brand loyalty creates meaningful headwinds. While we might pooh-pooh the EV specs of the EQC, for some set of current MB owners, it's going to be "good enough" to allow them to stay in the MB fold and still drive an EV. In many ways, the real impact of the negative spin in the media is that is weakens trust in the brand--sure this Tesla might be a better EV but MB, BMW, etc are safer choices.

Now, the Model 3 can quite happily be cross-shopped against the BMW Model 3, Audi A4, etc. and hold its own. From Elon's comments on the last EC, we see that Tesla is making progress prying lose BMW 3 Series owners but I would also expect a massive messaging counter attack from the incumbent vendors so they don't see a repeat of that happened with the Model S in the luxury/performance sedan segment.

Fact Checking

Well-Known Member

I have a question - Mechanic Liens - it's something that the bears/shorts on Twitter go on and on about, claiming Tesla have many outstanding, but I find little or no information and I neither understand the potential consequences.

Can anyone say a few words about that?

This is basically a variant of the "negative working capital" FUD. A quick summary:

- "Working capital" is assets minus liabilities and various definitions exist to calculate it.

- The GAAP definition is pretty strict that requires Tesla to count many 'possible' probabilistic liabilities that normally don't turn into real liabilities, and also don't allow them to recognize Tesla's most valuable assets:

- For example AutoPilot, probably worth well over 10 billion dollars, is worth zero according to the GAAP working capital definition. Same for brand recognition, or the network value of the Supercharger network: it's only accounted as the sum of real estate, not the infrastructure and franchise value, etc.

- On the liabilities side, reserves/warranties Tesla has set aside with conservative over-allocation, repurchase obligations it has on older Model S's are all accounted as 100% liabilities, while in reality a lot of these liabilities just 'go away' once the time span they are valid for pass and they are de-recognized.

- Furthermore, during the Model 3 expansion Tesla has a rapidly increasing inventory: started the year with $2.2b, in Q1 it was $2.5 billion in Q2 $3.3 billion. This is representative of a higher number of cars 'in transit' across quarter boundaries: ~3.3k at year's begin, ~6.1k at the end of Q1, ~15k at the end of Q2. This artificially decreases working capital: inventory is recognized as an asset only on a cost basis, even if it's Model S/3/X's a day away from delivery. Liabilities to suppliers and customer deposits are 100% recognized on the other hand. So by increasing their inventory Tesla is artificially decreasing 'working capital' - but that's both temporary and largely an accounting fiction.

- As a fourth factor, Tesla has invested over 3 billion dollars into the Model 3 expansion, which required heavy frontal payments: tooling and equipment suppliers want to be paid regardless of where Tesla is in the Model 3 ramp-up. This debases working capital by another 3+ billion dollars: those payments are going to be a drain on Tesla's cash until the end of 2018, while the actual income from the greatly expanded manufacturing capacity only began last quarter.

- By the GAAP definition Tesla has negative working capital of somewhere around -$2b right now. For a regular business like a bog standard department store that would normally spell trouble: more debt than assets, trouble rolling forward short-term debt, etc.

- For high-tech companies and for manufacturing companies that are at the apex of their capex spending these rigid definitions of 'working capital' are accounting fictions to the level of ridiculousness:

- For example Apple has a current working capital of around 30 billion dollars only, while it's a trillion dollar company. (!)

- Amazon, another company that has crossed 1 trillion dollars in market capitalization, has a current working capital of only 1.8 billion dollars by some estimates. (!!)

- For example Apple has a current working capital of around 30 billion dollars only, while it's a trillion dollar company. (!)

- Does anyone with a functioning brain truly believe that Apple, if they raised 30 billion dollars of debt, would get into trouble due to slipping into negative working capital territory? Or that Amazon would get into trouble by raising just 3 billion dollars of debt?

- So the whole 'Negative Working Capital' thesis of the shorts is just another proof that they don't know high-tech, don't know valuations and don't know accounting - in short: shorts on Twitter know absolutely nothing.

- A Mechanic Lien is basically just a technical accounting expression, a guarantee used by lenders to secure short term loans - to make sure they get priority before more speculative long term loans. A department store can use it against their valuable building on Main Street to secure a loan to renovate their building. Tesla has used similar loan constructs to temporarily raise cash, secured by their factory buildings. This expression is used by shorts to sound as if they knew what they were talking about, and to unify the 'negative working capital' FUD with the 'bankwuptcy' FUD: they are passive-aggressively insinuating that Tesla is on the verge of bankwuptcy even in the tweets where they are not saying that explicitly.

- Tesla has no trouble raising cash, and recently extended their short term lines of credit to 2020, because banks actually know all of what I've written above. What matters isn't the absolute level of working capital which is highly sensitive to high-tech valuation, but the expected balance of cash payments for the next 1-2 years - and those are excellent for Tesla.

- Ask them whether they think that Amazon, a trillion dollars company, with just 1.8 billion dollars of 'working capital', is in danger of bankwuptcy? Here's a link to an estimate of Amazon's working capital. Note, I actually think it's a bogus estimate - but it's out there.

- Confront them how ridiculous it is for their definition of 'working capital' to assign zero asset value to the SuperCharger network, to Tesla's brand value and customer base, to AutoPilot and Tesla's new AI Chip that is 10 times faster than the Nvidia solution and to the Gigafactory technologies overall. (Not to mention a ton of other Tesla intangible assets, worth billions.) I.e. Tesla's 'high-tech enterprise value' is largely off the balance sheet for Tesla and is not recognized as a basis for 'working capital' on a GAAP basis.

- Point out that Tesla is right now paying more than $600m of cash per quarter for the Model 3 equipment. Those payments will continue for Q3 and Q4 2018, but in 2019 they will decrease significantly, while cash flow will literally explode with that additional contribution. Working capital will be strongly positive in 2019 even by GAAP standards which values most of Tesla's real assets as zero.

- Point out the fact that Tesla working capital has already improved by about 300 million dollars in Q2 and is expected to improve by another billion dollars in Q3 alone.

Summary: the 'Tesla negative working capital' short thesis is basically a confidence trick: the sophisticated, neutral sounding argument is in reality based on an accounting fiction that is seriously detached from reality not just for Tesla but for absolutely every other high-tech company on the west coast.

Last edited:

So I've never invested in the stock market before. I started a bit back around 350. Added a couple more at just under 330.I truly hate Elon Musk for smashing down TSLA stock with a hammer full of idiotism. Now I am sitting on a 10K loss and I just feel horrible... He doesnt even apologize for his behaviour and investors suffering because of him. Great

It got below 320 a few weeks ago and scooped up another few shares. It hit $300 last week and I bought my biggest chunk yet.

I'm a small fry... only about $27K total. And I'm down so far on all of it.

My view? I'm thrilled I was able to buy over half of it at 300. As far as I can tell, the rest of the market/public just haven't figured out the goldmine this is, and I've been able to capitalize on it. In 5 or 10 years from now, I'm not going to remember or care about a few weeks/months under water while I watch the stock price break 4 digits and Tesla's valuation break 10 digits on it's way to 11(!) or 12...

My first time saying: cheers to the longs! (And a sincere thanks to all those who have taken the time to spell out the fundamentals and debunk the bear thesis'. I've learned a lot...)

Last edited:

Tslynk67

Well-Known Member

This is basically a variant of the "negative working capital" FUD. A quick summary:

Nevertheless shorts are going to use that kind of FUD, and to counter them when they are using it on Twitter just point out the sheer ridiculousness of it:

- "Working capital" is assets minus liabilities and various definitions exist to calculate it.

- The GAAP definition is pretty strict that requires Tesla to count many 'possible' probabilistic liabilities that normally don't turn into a real liabilities, and also don't allow to recognize Tesla's most valuable assets:

- For example AutoPilot, probably worth well over 10 billion dollars, is worth zero according to the GAAP working capital definition. Same for brand recognition, or the network value of the Supercharger network: it's only accounted as the sum of real estate, not the infrastructure value, etc.

- On the liabilities side, reserves/warranties Tesla has set aside with conservative over-allocation, repurchase obligations it has on older Model S's are all accounted as 100% liabilities, while in reality a lot of these liabilities just 'go away' once the time span they are valid for pass and they are de-recognized.

- Furthermore, during the Model 3 expansion Tesla has a rapidly increasing inventory: started the year with $2.2b, in Q1 it was $2.5 billion in Q2 $3.3 billion. This is representative of a higher number of cars 'in transit' across quarter boundaries: ~3.3k at year's begin, ~6.1k at the end of Q1, ~15k at the end of Q2. This artificially decreases working capital: inventory is recognized as an asset only on a cost basis, even if it's Model S/3/X's a day away from delivery. Liabilities to suppliers and customer deposits are 100% recognized on the other hand. So by increasing their inventory Tesla is artificially decreasing 'working capital' - but that's both temporary and an accounting fiction.

- As a fourth factor, Tesla has invested over 3 billion into the Model 3 expansion, which require front payments: tooling and equipment suppliers want to be paid regardless of where Tesla is in the ramp-up. This debases working capital by another 3 billion dollars: those payments are going to be a drain on Tesla's cash until the end of 2018, while the actual income from the greatly expanded manufacturing capacity only began last quarter.

- By the GAAP definition Tesla has negative working capital right now. For a regular business like a bog standard department store that would normally spell trouble: more debt than assets, trouble to raise more debt, etc.

- For high-tech companies and for manufacturing companies that are at the apex of their capex spending these rigid definitions of 'working capital' are accounting fictions to the level of ridiculousness:

- For example Apple has a current working capital of around 30 billion dollars only, while it's a trillion dollar company. (!)

- Amazon, another company that has crossed 1 trillion dollars in market capitalization, has a current working capital of only 1.8 billion dollars. (!!)

- Does anyone truly that Apple, if they raised 30 billion dollars of debt, would get into trouble? Or that Amazon would get into trouble by raising just 3 billion dollars of debt?

- So the whole 'Negative Working Capital' thesis of the shorts is just another proof that they don't know high-tech, don't know valuations and don't know accounting - in short: shorts on Twitter know absolutely nothing.

- A Mechanic Lien is basically just a technical accounting expression, a guarantee used by lenders to secure short term loans - to make sure they get priority before more speculative long term loans. A department store can use it against their valuable building on Main Street to secure a loan to renovate their building. Tesla has used similar loan constructs to temporarily raise cash, secured by their factory buildings. This expression is used by shorts to sound as if they knew what they were talking about, and to unify the 'negative working capital' FUD with the 'bankwuptcy' FUD: they are passive-aggressively insinuating that Tesla is on the verge of bankwuptcy even in the tweets where they are not telling that explicitly.

- Tesla has no trouble raising cash, and recently extended their short term lines of credits to 2020, because banks actually know all of what I've written above. What matters isn't the absolute level of working capital, but the expected balance of cash payments for the next 1-2 years - and those are excellent for Tesla.

Summary: the 'Tesla negative working capital' short thesis is basically a confidence trick: the sophisticated, neutral sounding argument is in reality based on an accounting fiction that is seriously detached from reality not just for Tesla but for absolutely every other high-tech company on the west coast.

- Ask them whether they think that Amazon, a trillion dollars company, with just 1.8 billion dollars of GAAP 'working capital', is in danger of bankwuptcy? Here's a link to Amazon's working capital estimate.

- Confront them how ridiculous it is for their definition of 'working capital' to assign zero asset value to the SuperCharger network, to Tesla's brand value and customer base, to AutoPilot and Tesla's new AI Chip that is 10 times faster than the Nvidia solution and the Gigafactory technologies overall.

- Point out that Tesla is right now paying more than $600m of cash per quarter for the Model 3 equipment. Those payments will continue for Q3 and Q4 2018, but in 2019 they will decrease significantly, while cash flow will literally explode with that additional contribution. Working capital will be strongly positive in 2019 even by GAAP standards which values most of Tesla's real assets as zero.

- Point out the fact that Tesla working capital has already improved by about 300 million dollars in Q2 and is expected to improve by another billion dollars in Q3 alone.

Where's the button for helpful-informative-like-love all in one?

sub

Active Member

They got the competition part right, they are no competition to Tesla.

Did I miss it, or do they keep the car's weight secret?

Trunk space seems limited. What about a frunk??

The weight is 2,5 tons. That info came out of a German video from yesterday and was a statement from the Mercedes employee driving.

Frunk space is small if existent at all. They literally used the space where the ICE is and put the electric motor in. Opening the frunk the motor is just in front of you.

They did that to optimize the production and enable it to be produced on one line. I heard them to be quite proud about it.

This has many disadvantages in my view. Just think about the crunch zone at front....

mershaw2001

I'm short the short sellers

Am I late to the show? I haven't seen any discussion of this all day.

It appears that Elon is doubling down on his claim of the guy being "a child rapist".

https://www.buzzfeednews.com/article/ryanmac/elon-musk-thai-cave-rescuer-accusations-buzzfeed-email

It appears that Elon is doubling down on his claim of the guy being "a child rapist".

https://www.buzzfeednews.com/article/ryanmac/elon-musk-thai-cave-rescuer-accusations-buzzfeed-email

bdy0627

Active Member

The points Neroden mentions are things we are expecting here at TMC, definitely not the general market. I don't think the market is expecting a profitable Q3. Several analysts covering TSLA are predicting losses for Q3 along with a need for capital raise soon. If Tesla achieves guidance for Q3, that will be a surprise for much of the market. The drop right now is primarily sentiment-based. The market has placed Tesla in the penalty box, so to speak.I didn't say "substantially".

The points you mention are the points EVERYONE is expecting. If they meet it, that's all they get. It would have to be something significantly BETTER to really push us up higher in the near term.

I don't make the news, I just interpret it, create my thesis and act on it. Question? Have I been wrong-once?

pnungesser

BarNun

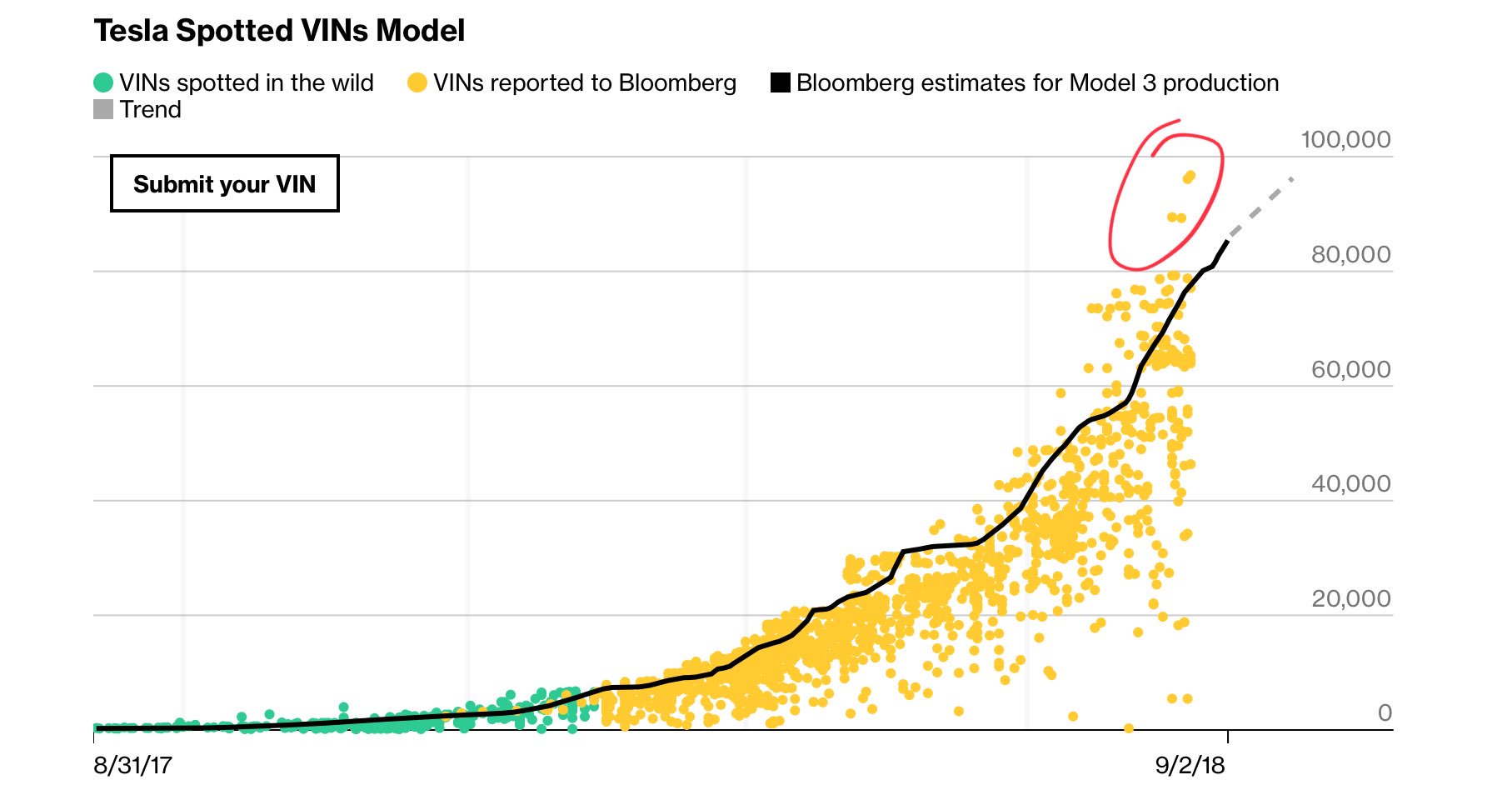

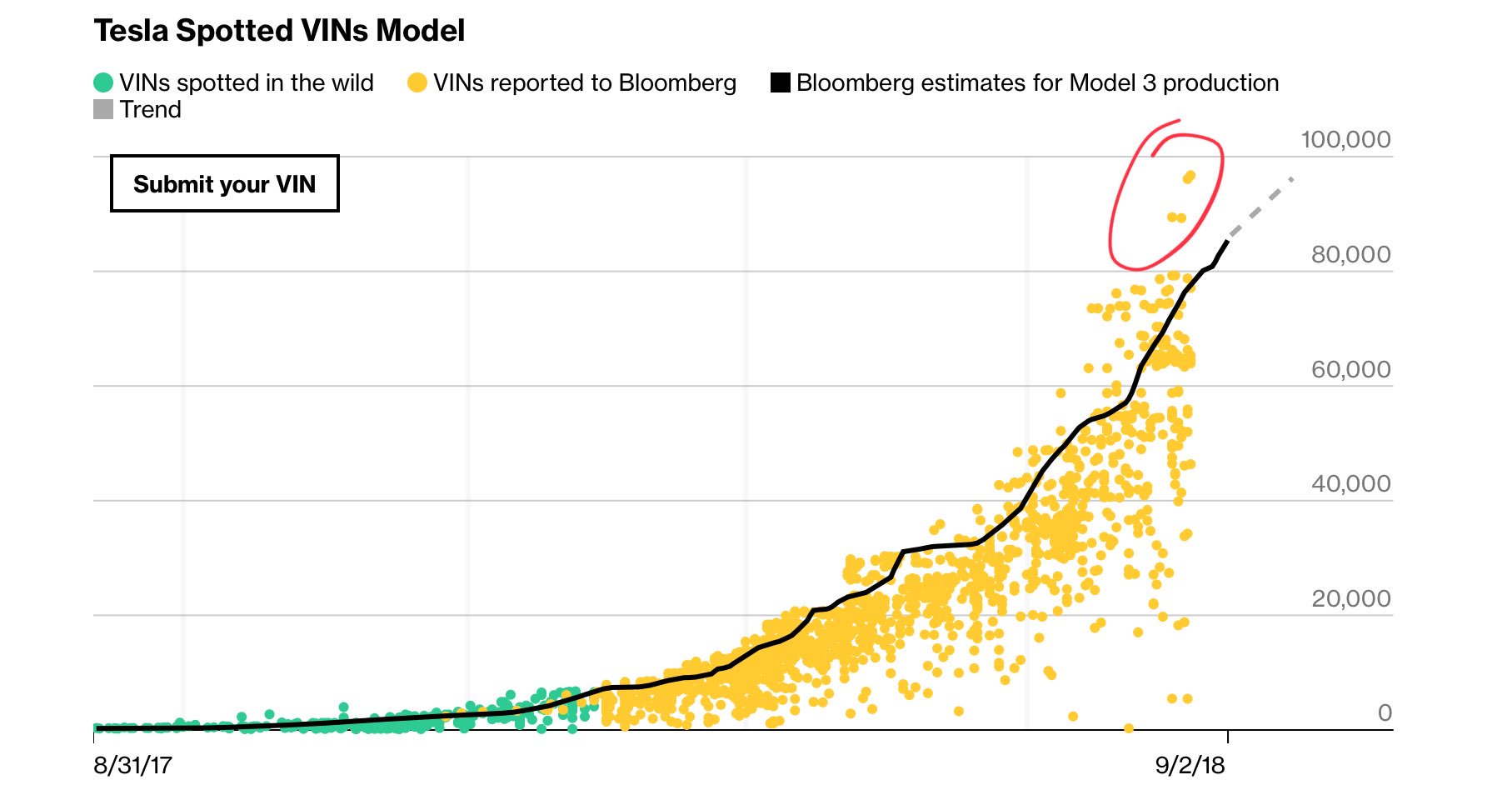

QUOTE="FirebirdAlpha, post: 3007582, member: 80280"]I don't believe Bloomberg's estimation model, because the calculations that go into that model are public and can be manipulated.

See this thread: TeslaCharts on Twitter

Specifically, this:

[/QUOTE]

[/QUOTE]

I assume your point is that their are some very high outliers. Even if true (which I doubt since I saw a photo of a VIN in the upper 90k's) just a visual examination supports a total production in the 80k range that Bloomberg is reporting. What bothers me, and seemingly no one else, is that the latest reported VIN in the chart is more than ten days old. Look at the line at the bottom for 9/2. Today's chart is exactly the same except it shows 9/4. The most recently added point was about 8/20. What good is this chart if you're not going to keep it current?

See this thread: TeslaCharts on Twitter

Specifically, this:

I assume your point is that their are some very high outliers. Even if true (which I doubt since I saw a photo of a VIN in the upper 90k's) just a visual examination supports a total production in the 80k range that Bloomberg is reporting. What bothers me, and seemingly no one else, is that the latest reported VIN in the chart is more than ten days old. Look at the line at the bottom for 9/2. Today's chart is exactly the same except it shows 9/4. The most recently added point was about 8/20. What good is this chart if you're not going to keep it current?

Thekiwi

Active Member

This is basically a variant of the "negative working capital" FUD. A quick summary:

Nevertheless shorts are going to use that kind of FUD, and to counter them when they are using it on Twitter just point out the sheer ridiculousness of it:

- "Working capital" is assets minus liabilities and various definitions exist to calculate it.

- The GAAP definition is pretty strict that requires Tesla to count many 'possible' probabilistic liabilities that normally don't turn into real liabilities, and also don't allow them to recognize Tesla's most valuable assets:

- For example AutoPilot, probably worth well over 10 billion dollars, is worth zero according to the GAAP working capital definition. Same for brand recognition, or the network value of the Supercharger network: it's only accounted as the sum of real estate, not the infrastructure and franchise value, etc.

- On the liabilities side, reserves/warranties Tesla has set aside with conservative over-allocation, repurchase obligations it has on older Model S's are all accounted as 100% liabilities, while in reality a lot of these liabilities just 'go away' once the time span they are valid for pass and they are de-recognized.

- Furthermore, during the Model 3 expansion Tesla has a rapidly increasing inventory: started the year with $2.2b, in Q1 it was $2.5 billion in Q2 $3.3 billion. This is representative of a higher number of cars 'in transit' across quarter boundaries: ~3.3k at year's begin, ~6.1k at the end of Q1, ~15k at the end of Q2. This artificially decreases working capital: inventory is recognized as an asset only on a cost basis, even if it's Model S/3/X's a day away from delivery. Liabilities to suppliers and customer deposits are 100% recognized on the other hand. So by increasing their inventory Tesla is artificially decreasing 'working capital' - but that's both temporary and largely an accounting fiction.

- As a fourth factor, Tesla has invested over 3 billion dollars into the Model 3 expansion, which required heavy frontal payments: tooling and equipment suppliers want to be paid regardless of where Tesla is in the Model 3 ramp-up. This debases working capital by another 3+ billion dollars: those payments are going to be a drain on Tesla's cash until the end of 2018, while the actual income from the greatly expanded manufacturing capacity only began last quarter.

- By the GAAP definition Tesla has negative working capital of somewhere around -$2b right now. For a regular business like a bog standard department store that would normally spell trouble: more debt than assets, trouble rolling forward short-term debt, etc.

- For high-tech companies and for manufacturing companies that are at the apex of their capex spending these rigid definitions of 'working capital' are accounting fictions to the level of ridiculousness:

- For example Apple has a current working capital of around 30 billion dollars only, while it's a trillion dollar company. (!)

- Amazon, another company that has crossed 1 trillion dollars in market capitalization, has a current working capital of only 1.8 billion dollars. (!!)

- Does anyone with a functioning brain truly believe that Apple, if they raised 30 billion dollars of debt, would get into trouble due to slipping into negative working capital territory? Or that Amazon would get into trouble by raising just 3 billion dollars of debt?

- So the whole 'Negative Working Capital' thesis of the shorts is just another proof that they don't know high-tech, don't know valuations and don't know accounting - in short: shorts on Twitter know absolutely nothing.

- A Mechanic Lien is basically just a technical accounting expression, a guarantee used by lenders to secure short term loans - to make sure they get priority before more speculative long term loans. A department store can use it against their valuable building on Main Street to secure a loan to renovate their building. Tesla has used similar loan constructs to temporarily raise cash, secured by their factory buildings. This expression is used by shorts to sound as if they knew what they were talking about, and to unify the 'negative working capital' FUD with the 'bankwuptcy' FUD: they are passive-aggressively insinuating that Tesla is on the verge of bankwuptcy even in the tweets where they are not saying that explicitly.

- Tesla has no trouble raising cash, and recently extended their short term lines of credits to 2020, because banks actually know all of what I've written above. What matters isn't the absolute level of working capital which is highly sensitive to high-tech valuation, but the expected balance of cash payments for the next 1-2 years - and those are excellent for Tesla.

Summary: the 'Tesla negative working capital' short thesis is basically a confidence trick: the sophisticated, neutral sounding argument is in reality based on an accounting fiction that is seriously detached from reality not just for Tesla but for absolutely every other high-tech company on the west coast.

- Ask them whether they think that Amazon, a trillion dollars company, with just 1.8 billion dollars of GAAP 'working capital', is in danger of bankwuptcy? Here's a link to Amazon's working capital estimate.

- Confront them how ridiculous it is for their definition of 'working capital' to assign zero asset value to the SuperCharger network, to Tesla's brand value and customer base, to AutoPilot and Tesla's new AI Chip that is 10 times faster than the Nvidia solution and to the Gigafactory technologies overall.

- Point out that Tesla is right now paying more than $600m of cash per quarter for the Model 3 equipment. Those payments will continue for Q3 and Q4 2018, but in 2019 they will decrease significantly, while cash flow will literally explode with that additional contribution. Working capital will be strongly positive in 2019 even by GAAP standards which values most of Tesla's real assets as zero.

- Point out the fact that Tesla working capital has already improved by about 300 million dollars in Q2 and is expected to improve by another billion dollars in Q3 alone.

Nice summary!

You mention the model capex will subside after Q4 - has Tesla said this explicitly? I presume there will still be capex spend associated with model 3 production in 2019 as it continues to ramp higher - but is the thinking here that it will be considerably less each quarter? What sort of level do you think?

Motor Mouth

Member

I think this is exactly right in the sense that there is probably a strong market (especially in up market SUV) within the German makers that will only buy one of the 3 brands. For that market, Tesla is risky and, in that sense, not a status symbol. The safe buy is another EV with the same ornament on it, regardless of objective performance. And this is entirely ok by me. These are people who otherwise wouldn't buy an EV that are going to buy one because its a MB (or Audi or BMW). I say awesome. More EVs on the road and almost exclusively cannibalizing a legacy brand. It may be neutral to the Tesla SP, but supportive of the mission.I think there is some overconfidence here that can be dangerous.

Sure Tesla is the big fish in the EV pond, but that is a small pond. Tesla needs to be successful in the ocean taking car sales away from competitors not just EV sales and brand loyalty creates meaningful headwinds. While we might pooh-pooh the EV specs of the EQC, for some set of current MB owners, it's going to be "good enough" to allow them to stay in the MB fold and still drive an EV. In many ways, the real impact of the negative spin in the media is that is weakens trust in the brand--sure this Tesla might be a better EV but MB, BMW, etc are safer choices.

Now, the Model 3 can quite happily be cross-shopped against the BMW Model 3, Audi A4, etc. and hold its own. From Elon's comments on the last EC, we see that Tesla is making progress prying lose BMW 3 Series owners but I would also expect a massive messaging counter attack from the incumbent vendors so they don't see a repeat of that happened with the Model S in the luxury/performance sedan segment.

neroden

Model S Owner and Frustrated Tesla Fan

It's clear Musk believed what he said.Am I late to the show? I haven't seen any discussion of this all day.

It appears that Elon is doubling down on his claim of the guy being "a child rapist".

https://www.buzzfeednews.com/article/ryanmac/elon-musk-thai-cave-rescuer-accusations-buzzfeed-email

Libel law in the US requires proof that the person accused of libel *knew* they were making a false statement and made the statement with malice. So Unsworth is out of luck in the US; no libel case here.

Unsworth would probably win a libel case in the *UK*, which can't be enforced in the US. UK libel law allows people to win if they can prove that the statement will harm their reputation, even if the person making the statement really believed it was 100% true and had evidence.

Thai defamation law is yet another matter, and I'm not at all sure I understand it.

Buzzfeed's behavior, basically deliberately exposing a private conversation for the purpose of getting Musk in trouble, is not professional. I'm quite sure they didn't send an investigative reporter to Thailand.

Unfortunately, Musk should simply shut up. There are lots of pedophiles who moved to Thailand (Thailand is pretty much the world center for the worst sort of sex tourism) and it's not worth his time to stop any of them.

Don TLR

Active Member

Top speed 112mph??? WTF!!! Nobody in Germany's going to buy that, won't survive on the autobahn!

It's CRAP! Absolute CRAP!

Is it ironic that the website called TopSpeed never mentioned its lack of a top speed...

humbaba

sleeping until $7000

Am I late to the show? I haven't seen any discussion of this all day.

It appears that Elon is doubling down on his claim of the guy being "a child rapist".

https://www.buzzfeednews.com/article/ryanmac/elon-musk-thai-cave-rescuer-accusations-buzzfeed-email

You'd think Musk would learn to not trust anyone who says they are a "journalist". They all but laugh about his saying something "off the record". And buzzfeed? I'd expect more integrity from NYT than them (which, at least when it comes to Tesla/Musk, isn't setting the standard high at all). In any case, this is more fodder for the anti-Tesla/Musk crowd and I'm sure will be spread all over social media. After all, it plays nicely with the "Musk is unhinged" narrative that is currently being tendered.

bdy0627

Active Member

Nah, GS has been saying this for years, with a price target range of something like $190 - $210. I think it has to do with valuing Tesla strictly as a mature auto manufacturer.So Goldman Sachs says sell Tesla, likely to drop 30 per cent in 6 months...

So this is pretty much playing with inside information acquired by being employed by Tesla to go private...

How is this legal?

Excuse me but WTF. What does GS provide as proof for this prediction? Information gained from Musk’s go private BS?

Someone buying three M3s is not going to help the SP when Tesla and Musk can’t do a better job of protecting the company in the media, on Wall Street and on (preferably off) Twitter.

JRP3

Hyperactive Member

Yes he seems to think he has real information but unfortunately as of yet there is nothing which supports it.It's clear Musk believed what he said.

Off Shore

Off Topic Member

Answer: "I couldn't get one!" This is the manifestation of the thesis that all "Tesla killers" are all really ICE killers, until the ICE is gone.You'll have to explain it to people..and the next question people will ask is "...okay so why didn't you just buy a Tesla?".

So I've never invested in the stock market before. I started a bit back around 350. Added a couple more at just under 350.

It got below 320 a few weeks ago and scooped up another few shares. It hit $300 last week and I bought my biggest chunk yet.

I'm a small fry... only about $27K total. And I'm down so far on all of it.

My view? I'm thrilled I was able to buy over half of it at 300. As far as I can tell, the rest of the market/public just haven't figured out the goldmine this is, and I've been able to capitalize on it. In 5 or 10 years from now, I'm not going to remember or care about a few weeks/months under water while I watch the stock price break 4 digits and Tesla's valuation break 10 digits on it's way to 11(!) or 12...

My first time saying: cheers to the longs! (And a sincere thanks to all those who have taken the time to spell out the fundamentals and debunk the bear thesis'. I've learned a lot...)

I second this and it's why I am pretty bull on Tsla despite all the noise.

I was very much into AMD when the whole Ryzen was launched. Sales were I guess worst than analysts expected so the stock took a dump from 15s down to the 9s. I averaged down after buying from 15, 14, 13, 12,11, and 9s. I was down -43k and still buying. I put way more money into AMD than I have ever did on any one particular stock(enough to buy a house cash). I knew what they had coming and how it was going to be disruptive to Intel. I stuck to my guns and eventually the stock popped like crazy. I eventually thought to diversify so I sold a portion (big mistake) but still..didn't lose any money and I'm up over 100k. Analysts I swear are 6 months behind and they are a bunch of conservatives. Now I'm in Tesla because I love high drama stocks..and I'm bag holding again like I was with AMD..and keep averaging down..lol.

Musk has to provide some evidence here or he really is just starting to look like he's losing it.

there's a lot of evidence that Unsworth was crucial to the mission, so that part its clear Musk is misled or lying about him being banned. additionally considering Elon is wrong about Unsworth's role in the rescue (buzzfeed had substantial evidence refuting Elon's characterization) Elon is also probably wrong about Unsworth having a child bride.

This whole escapade is so meaningless and Musk's inability to just keep his mouth shut should get him reprimanded by the board a little bit.

I don't think that Musk realizes the the broader public very clearly sees this as a billionaire asshole bring mad that he didn't get credit for the rescue and starts attacking the "little guy" diver who was on the mission from the start.

there's a lot of evidence that Unsworth was crucial to the mission, so that part its clear Musk is misled or lying about him being banned. additionally considering Elon is wrong about Unsworth's role in the rescue (buzzfeed had substantial evidence refuting Elon's characterization) Elon is also probably wrong about Unsworth having a child bride.

This whole escapade is so meaningless and Musk's inability to just keep his mouth shut should get him reprimanded by the board a little bit.

I don't think that Musk realizes the the broader public very clearly sees this as a billionaire asshole bring mad that he didn't get credit for the rescue and starts attacking the "little guy" diver who was on the mission from the start.

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 107

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K