Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What other tech stock to consider?

- Thread starter Sanny

- Start date

serendipitous

Member

I doubt it was news - today was an option expiration day and the climb started at 3:00 which is when options brokers tend to start making trades to cover naked sales. People who bet on the stock being below $3 had to buy at any price to cover their positions.Looks like SENS is moving on some Patent news...

YouTube popped this video into my feed and I decided to listen to it. Private company, looking to raise a series B round (or frankly, would be a good SPAC candidate these days), making a small business class jet competitor for 1/5 operating costs by using highly efficient fuselage design and an efficient piston engine.

IF the specs are even close to true, this is a game changer. Read the second link though to get some skeptical thoughts on that.

www.forbes.com

www.forbes.com

IF the specs are even close to true, this is a game changer. Read the second link though to get some skeptical thoughts on that.

Otto Aviation Hopes To Torpedo The Business Jet Market With Its Curious New Design. Will It Sink Or Swim?

Otto Aviation's Celera 500L is an unconventional business aircraft with unconventional claims. It will have to convince investors and skeptical observers that it can deliver.

www.forbes.com

www.forbes.com

JRP3

Hyperactive Member

An overview of electric bus companies including Proterra A Look At The Listed Electric Bus Sector As Biden Moves To Electrify America

JRP3

Hyperactive Member

Another Matt Bohlsen piece, this one looking at Origin Materials

seekingalpha.com

seekingalpha.com

A Look At The Origin Materials - Artius Acquisition Potential Merger (NASDAQ:AACQ)

Origin Materials proposes to merge with SPAC Artius Acquisition in a pro-forma deal of ~US$1.8b, with net cash to Origin of ~US$863m, set to complete Q2 2021.

- Origin Materials is a disruptive materials/chemical company that uses wood residue (timber feedstocks) to create carbon negative materials cost effective with oil-based products. Funds are to scale production.

- Origin's materials are used for clothing, textiles, plastics, packaging, car parts etc. Origin's decarbonizing technology addresses a ~$1T market opportunity, already with ~$1 billion in product reservations.

An overview of electric bus companies including Proterra A Look At The Listed Electric Bus Sector As Biden Moves To Electrify America

And including my fav, Green Power. Great article!

OK, this post is for all you non-US investors out there. Just came across an interesting US based company, that has recently listed on the London AIM market. TinyBuild (tinyBuild GAMES - Indie Game Developer And Publisher) is an indie game publishing company. From what I've been able to learn from public articles about them, I like their philosophy and plucky startup vibe.

They raised £154 with a market cap of £340. IF this company succeeds (and with their new war chest and management, sounds like they can), then this seems like a bargain, if risky.

Unfortunately, since they haven't done any US SEC filings, US investors are barred from investing, and indeed, cannot even see or download any listing documents. If a US person tries to click on the Investors tab on their website, they get a blocked message. While I cannot invest in them, I wouldn't mind reading their Admissions Document just to keep tabs on them since they will eventually list on the NASDAQ when they get big enough and/or get their financial act together. So if such an Admissions Document ended up in my TMC inbox, I will erase it immediately. So don't PM me a copy

Anyways, I would also be curious to know how easy it is for even UK investors to purchase shares in it, since it seems liquidity is still tiny. More info on the listing:

www.cityam.com

www.cityam.com

www.geekwire.com

www.geekwire.com

They raised £154 with a market cap of £340. IF this company succeeds (and with their new war chest and management, sounds like they can), then this seems like a bargain, if risky.

Unfortunately, since they haven't done any US SEC filings, US investors are barred from investing, and indeed, cannot even see or download any listing documents. If a US person tries to click on the Investors tab on their website, they get a blocked message. While I cannot invest in them, I wouldn't mind reading their Admissions Document just to keep tabs on them since they will eventually list on the NASDAQ when they get big enough and/or get their financial act together. So if such an Admissions Document ended up in my TMC inbox, I will erase it immediately. So don't PM me a copy

Anyways, I would also be curious to know how easy it is for even UK investors to purchase shares in it, since it seems liquidity is still tiny. More info on the listing:

Video game maker Tinybuild debuts in record £340m Aim listing - CityAM

Video game maker Tiny Build has become the largest ever US company to list on Aim after its shares debuted on London’s junior index this morning.

Seattle-area game publisher tinyBuild valued at $474M after IPO on London Stock Exchange

Bellevue, Wash.-based indie video game publisher tinyBuild today completed an initial public offering on the London Stock Exchange’s AIM market, at a market capitalization of £340.6 million ($474 million). The… Read More

Buckminster

Well-Known Member

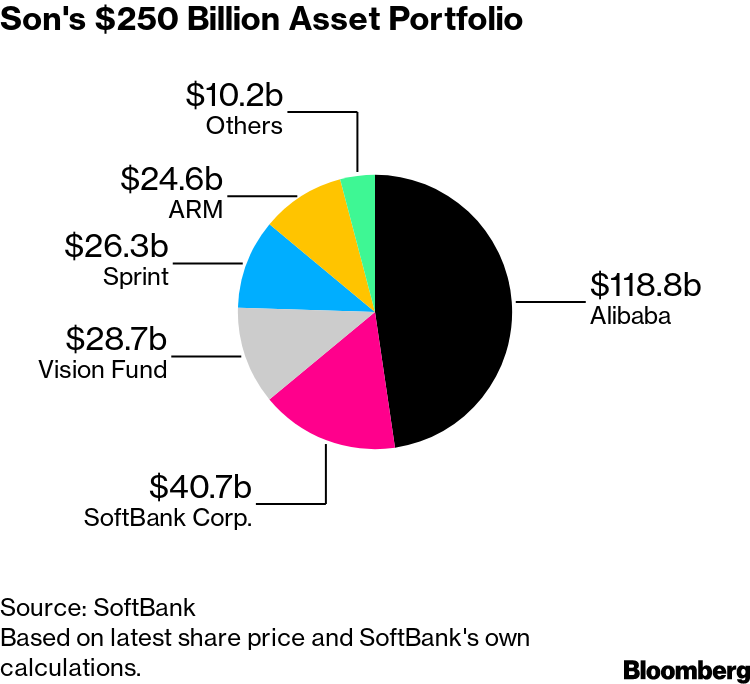

Anyone want to talk me out of buying Softbank?

P/E ratio is 12 vs BABA at 26. What's not to like.

P/E ratio is 12 vs BABA at 26. What's not to like.

JRP3

Hyperactive Member

Previously discussed starting here: What other tech stock to consider?

Stock getting hit for some reason, only thing I see is this which doesn't seem negative American Battery Metals Corporation Establishes New Development Center at the Nevada Center for Applied Research

Stock getting hit for some reason, only thing I see is this which doesn't seem negative American Battery Metals Corporation Establishes New Development Center at the Nevada Center for Applied Research

Thanks. I hadn't seen that, must have been around the time of the website maintenance. Stock was tanking the last few days and I was curious as to why... the only thing that popped up was the report I posted.

Previously discussed starting here: What other tech stock to consider?

Stock getting hit for some reason, only thing I see is this which doesn't seem negative American Battery Metals Corporation Establishes New Development Center at the Nevada Center for Applied Research

Any thoughts on this Spruce Point Capital overview/report on ABML and LODE. I know a lot of people on here (myself included) have some ABML holdings.

Thoughts? Well, it is pretty damning. I haven't been following ABML. From what people here know, is this true:

"ABML was incorporated in 2011 but has spent most of its corporate life as a bulletin board penny stock shell that owns some mineral rights in Nevada. Having never generated any revenue from acquiring or developing mineral properties, in 2H 2019 the Company underwent a strategic review to find new market opportunities and settled upon battery recycling."

If you read the full report (just click through), it is pretty bad. The CEO's linked in profile (https://www.linkedin.com/in/dougcolebiz/) isn't someone who inspires confidence that he would know how to crack to very hard nut of battery recycling. And the Spruce Point capital report about the CEO's real experience doesn't inspire confidence.

I hope people realize that battery recycling is not an easy problem. NO ONE has solved it yet, and very smart people like JB Straubel are working hard on the problem. I looked at the rest of the ABML management team. So, their CTO has three years experience at Tesla, even working on battery recycling. However if you read his linked in resume carefully, you'll see that he is a thermodynamics modelling engineer. Which is fine, but that doesn't mean he has all the expertise to solve battery recycling. Also, the company he went to between Tesla and ABML went nowhere.

OK, this post is for all you non-US investors out there. Just came across an interesting US based company, that has recently listed on the London AIM market. TinyBuild (tinyBuild GAMES - Indie Game Developer And Publisher) is an indie game publishing company. From what I've been able to learn from public articles about them, I like their philosophy and plucky startup vibe.

They raised £154 with a market cap of £340. IF this company succeeds (and with their new war chest and management, sounds like they can), then this seems like a bargain, if risky.

Unfortunately, since they haven't done any US SEC filings, US investors are barred from investing, and indeed, cannot even see or download any listing documents. If a US person tries to click on the Investors tab on their website, they get a blocked message. While I cannot invest in them, I wouldn't mind reading their Admissions Document just to keep tabs on them since they will eventually list on the NASDAQ when they get big enough and/or get their financial act together. So if such an Admissions Document ended up in my TMC inbox, I will erase it immediately. So don't PM me a copy

Anyways, I would also be curious to know how easy it is for even UK investors to purchase shares in it, since it seems liquidity is still tiny. More info on the listing:

Video game maker Tinybuild debuts in record £340m Aim listing - CityAM

Video game maker Tiny Build has become the largest ever US company to list on Aim after its shares debuted on London’s junior index this morning.www.cityam.com

Seattle-area game publisher tinyBuild valued at $474M after IPO on London Stock Exchange

Bellevue, Wash.-based indie video game publisher tinyBuild today completed an initial public offering on the London Stock Exchange’s AIM market, at a market capitalization of £340.6 million ($474 million). The… Read Morewww.geekwire.com

So I would urge all potential investors to do DD. Here are some things to think about:

While they raised £154M on the public markets, TinyBuild only got £28.6M of that. The rest went to selling shareholders and commissions. Two VC fund investors are selling during this IPO (which isn't terribly unusual, although more normally, VCs would wait until a 6 month or 1 year lockup expires post IPO before selling). But more worryingly, the CEO and COO are also significant selling shareholders. The CEO sold about 1/3 of his shares during this IPO, netting him about £50M, while the COO sold about 1/2 of his shares netting him about £22M (napkin math on my part, I could have made mistakes). By itself, this isn't a red flag, just something to think about. I too sold shares during my company's IPO way back when, but it was only like 5% or less of my shares. These guys have been building TinyBuild for eight years, so I can cut them slack on this.

On the positive side, TinyBuild is nicely profitable with a large backlog of titles coming out, looks like they deliver true value into the market, and I like their business strategies. I'm pretty sure I would invest if I could.

Incidentally, to do real DD on this company, you really should play a couple of their games, check out their multi-media, etc. I can't invest in this company, so I haven't gone to that level of detail.

Buckminster

Well-Known Member

QuantumScape seeks additional funding to double its solid-state battery pilot line - Electrek

Suggests they are bullish about the tech.

Down 11% today...

Suggests they are bullish about the tech.

Down 11% today...

Buckminster

Well-Known Member

JRP3

Hyperactive Member

Just looks like some large buyer put in a buy order and the execution is just being parceled out a bit each day to not move the stock price too much.

So I would urge all potential investors to do DD. Here are some things to think about:

While they raised £154M on the public markets, TinyBuild only got £28.6M of that. The rest went to selling shareholders and commissions. Two VC fund investors are selling during this IPO (which isn't terribly unusual, although more normally, VCs would wait until a 6 month or 1 year lockup expires post IPO before selling). But more worryingly, the CEO and COO are also significant selling shareholders. The CEO sold about 1/3 of his shares during this IPO, netting him about £50M, while the COO sold about 1/2 of his shares netting him about £22M (napkin math on my part, I could have made mistakes). By itself, this isn't a red flag, just something to think about. I too sold shares during my company's IPO way back when, but it was only like 5% or less of my shares. These guys have been building TinyBuild for eight years, so I can cut them slack on this.

On the positive side, TinyBuild is nicely profitable with a large backlog of titles coming out, looks like they deliver true value into the market, and I like their business strategies. I'm pretty sure I would invest if I could.

Incidentally, to do real DD on this company, you really should play a couple of their games, check out their multi-media, etc. I can't invest in this company, so I haven't gone to that level of detail.

A little bit more DD. It is trading at something like 10x sales, and a PE of something like 70 (this from memory, I might be a bit off). RBLX isn't a good comparison since RBLX has a platform and more going for it. ATVI (Activision/Blizzard) would be a stock that you could compare TinyBuild to. ATVI trades at a PE of 32 and a price to sales of 8.6x. So TinyBuild is a little bit expense right now in comparison.

Here's a different company I'm just starting to look at, Coupang, the Amazon of South Korea. They just IPOed on NASDAQ a couple of weeks ago (CPNG). It is trading at a low right now. Just 6x price to sales. Here's their prospectus:

Similar threads

- Replies

- 198

- Views

- 35K

- Article

- Replies

- 56

- Views

- 22K

- Replies

- 101

- Views

- 20K