Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

FredTMC

Model S VIN #4925

I remember last time we were hovering around 250, on the way up, trading was light, stock was flat, and I guessed it would continue that way until ER (and sold 270 calls, followed by a massive run up).

Trading these days feels very similar to that time.... I think 250 is a "neutral spot" at this moment. Maybe the bank(s) buying into the cap raise know this is a natural happy spot to do it.

Well, part of my assumption about $250 pinning by bankers is that prior Cap Raise round was under $242. If TSLA is below that price, then a new round is once again a "down round". Generally, "down rounds" aren't favorable to the company or investors. Better to have all Cap Raise rounds at incrementally higher stock price.

I believe $242 was 2 raises ago. Prior raise was at $215. I do agree they probably want $250+, though.Well, part of my assumption about $250 pinning by bankers is that prior Cap Raise round was under $242. If TSLA is below that price, then a new round is once again a "down round". Generally, "down rounds" aren't favorable to the company or investors. Better to have all Cap Raise rounds at incrementally higher stock price.

This is an interesting article about how, maybe, BMW "gets it" with regards to the path Tesla has set for the automotive future. Oc course it really serves to highlight how far behind they are, but then again this puts them light years ahead of Ford, FCA, and basically any Japanese manufacturer.

BMW Is Making a Short-Term Bet on Boring

BMW Is Making a Short-Term Bet on Boring

sundaymorning

Active Member

larmor

Active Member

Investopedia: home of the low frequency trader, with bonus phase shift by several weeks...

DragonWatch

Small FootPrint

This is an interesting article about how, maybe, BMW "gets it" with regards to the path Tesla has set for the automotive future. Oc course it really serves to highlight how far behind they are, but then again this puts them light years ahead of Ford, FCA, and basically any Japanese manufacturer.

BMW Is Making a Short-Term Bet on Boring

Looks like Elon is right again. Fossil Fule or ICE vehicle manufacturers do no have a vision that humans can follow. As herd animals most of us just follow what we are told, like sheep, right or wrong. The sales force will push whatever management wants or whatever management is told to do. None of that crap about the LT getting killed and Seargeant Jeep picking up the ball and winning the battle. Fossil Fuels/money so control the playing field that clean renuable energy sourced transportation cannot get a foothold within the fossil fuel system. Hence an all new car manufacturer ~ Tesla ~ sells online and is not strapped down by the old tried and false. The article presents that case, if you were not reading between the lines.

Now, for Autopilot technology. We are at the same crossroads the army experienced in the late '70s as computer technology began taking away military jobs. The Generals were afraid of putting down the slide rules, the charts with pins, the robust fire direction crews (built in redundancy) ~ eventually having to rely on only a three person crew and one computer. They were really horrified when a three person crew led by a Staff Sargent could fire twelve rockets without a Lieutenant betting his or her bars. Yes, probably our daughter can use the Tesla Autopilot better than us, and yes I hit the brake manually when doing the test drive AP parking, but we are buying it to ensure our safety and independence in our old age. Get over yourselves, it has to be designed, tested, proven and then maybe you will venture out and buy it. Other auto manufacturers are letting someone else do the leg work instead of designing it from the ground up.

We have invested and are buying it because Tesla is light years ahead of the pack ~ it is the right and responsible thing to do

Question.... The assumption is the 250 pin is a result of an external force, keeping it there while the cap raise is happening? Then why the low volume? If there was an external force applying up or down pressure, wouldn't that cause more volume as opposed to less?

This feels like a general lack of interest on both the longs and the shorts to change positions.... IDK, I'm just learning as I go, a cap raise announcement won't surprise me!

Or the big holders of the largest blocks may choose to work together to stablize at this point prior to cap raise. Retail traders seen sustained 250 and think it is safe and not going anywhere so, why trade it? Options markets premiums erode as well, good for options sellers, not buyers. Seen it before.

Well.. cap raise by equity issuance isn't the only option. Is it?

There is doubt that bonds could go out large enough to the need. They need 2.4B or more this time around. A convertible might be possible but enormous hedging fees again, if they went that route.

Irishjugg

Member

I'm pretty certain that up and down rounds are based on market cap, not stock price. If that's correct this would be a larger up round than you are thinking.Well, part of my assumption about $250 pinning by bankers is that prior Cap Raise round was under $242. If TSLA is below that price, then a new round is once again a "down round". Generally, "down rounds" aren't favorable to the company or investors. Better to have all Cap Raise rounds at incrementally higher stock price.

Looks like we have a large TE project we were waiting for coming up, complements of Edison International. The author, of course, had committed the usual butchering act with power/energy units. If the project size (largest in the world so far) 360MWh, it would be able to deliver 15MW for a day. However, given the long lead timeline of 2020 mentioned in the article, it can be envisioned that it could be much bigger project, and the author really meant 360MW/h for a day, which would be 8.64MWh project ! Going with the minimum of 360MWh still makes this project eclipse the AES 200MWh installation. It looks like this is one of the projects that was mulled by the Bob Rudd, VP of SolarCity development, energy storage and microgrids back in November of last year.

Electric car manufacturer Tesla, Inc. is supplying batteries to Los Angeles area network that will serve Edison International, to create the largest storage facility in the world if no one builds a bigger one by 2020 when it’s slated to be completed. The facility will be able to deliver 360 mw/h to the grid for a full day on short notice.

racer26

Active Member

Why do you think they need 2.4B+?There is doubt that bonds could go out large enough to the need. They need 2.4B or more this time around. A convertible might be possible but enormous hedging fees again, if they went that route.

Elon says they have enough now to survive through Model 3 launch - that cap raise is just to derisk, because going through Model 3 launch without a cap raise would take us right up to the $1B cash on hand wire that we're not comfortable going below. Seems to me that 1B or maybe even less would satisfy that.

Some time around the fall we expect ~20%+ margins on Model 3s rolling off the line at 5k/wk. 5,000/wk * 20% * $45,000 * 11wks/4Q = ~$495M profit in the 4th Quarter from Model 3 alone.

Looks like we have a large TE project we were waiting for coming up, complements of Edison International. The author, of course, had committed the usual butchering act with power/energy units. If the project size (largest in the world so far) 360MWh, it would be able to deliver 15MW for a day. However, given the long lead timeline of 2020 mentioned in the article, it can be envisioned that it could be much bigger project, and the author really meant 360MW/h for a day, which would be 8.64MWh project ! Going with the minimum of 360MWh still makes this project eclipse the AES 200MWh installation. It looks like this is one of the projects that was mulled by the Bob Rudd, VP of SolarCity development, energy storage and microgrids back in November of last year.

Here is a more coherent description of the project, which is clarified to be based on 360MWh worth of batteries being supplied by Tesla for 100 commercial buildings that are capable of being agregated into the grid:

Meanwhile, Tesla, Inc., is supplying batteries to a Los Angeles-area network tied together in a microgrid of 100 office buildings and industrial properties. Reports the Journal:

When [Edison International] needs more electricity on its system, the batteries would be able to deliver 360 megawatt hours of extra power to the buildings and the grid, enough to power 20,000 homes for a day, on short notice. At other times, the batteries would help firms hosting the arrays to cut their utility bills.

dabendan

Member

Paul, How can I get invited to this event? Thanks

Powerwall 2 launch event in Australia next Thursday: https://teslamotorsclub.com/tmc/attachments/img_3218-jpg.217406/

Another piece of information related to the Tesla commercial batteries/aggregation project is that it is being installed by Advaned Microgrid Solutions:

Tesla Inc. is supplying batteries to a Los Angeles-area network that would serve Edison International, which would be the world's largest of its kind when finished in 2020, according to the developer, Advanced Microgrid Solutions. The network would spread across more than 100 office buildings and industrial properties.

It has been interesting to watch the China story (finally) being picked up by the press, even though very credible reports and data predicting a 300% increase in sales have been available since at least October.

I think this is a great example of the press highlighting any perceived negatives about Tesla while tending to ignore or play down the positives. For example, as mentioned in the post quoted below and a few others I made in the fall, as early as October an analyst with a solid track record was predicting 322% increase in sales and deliveries of over 10,000 units in China in 2016. The same analyst has made a big splash in the press in the past when she reported negative Tesla developments in China, but was basically ignored (with the exception of one blog post) when she reported what clearly should have been a newsworthy 300% increase/trending toward 10,000 units sold in China in 2016.

Also, the larger number of imports than deliveries that have been reported by Bertel Schmitt have a very simple explanation -- cars were imported in Q4 but too late to get them into customers hands so did not count as deliveries. This does suggest the January China numbers will be very good. Of course, Bertel being Bertel he is constitutionally unable to write a positive article about Tesla so he ignores this incredibly obvious explanation.

Here is a post from October in last year's short-term thread (can't use the quote function -- maybe because it is a closed thread?):

I think this is a great example of the press highlighting any perceived negatives about Tesla while tending to ignore or play down the positives. For example, as mentioned in the post quoted below and a few others I made in the fall, as early as October an analyst with a solid track record was predicting 322% increase in sales and deliveries of over 10,000 units in China in 2016. The same analyst has made a big splash in the press in the past when she reported negative Tesla developments in China, but was basically ignored (with the exception of one blog post) when she reported what clearly should have been a newsworthy 300% increase/trending toward 10,000 units sold in China in 2016.

Also, the larger number of imports than deliveries that have been reported by Bertel Schmitt have a very simple explanation -- cars were imported in Q4 but too late to get them into customers hands so did not count as deliveries. This does suggest the January China numbers will be very good. Of course, Bertel being Bertel he is constitutionally unable to write a positive article about Tesla so he ignores this incredibly obvious explanation.

Here is a post from October in last year's short-term thread (can't use the quote function -- maybe because it is a closed thread?):

Haven't seen this posted -- sounds promising:

Tesla Motors: It’s Working?

"Elon Musk’s strategy in China is working. First, the reasonably priced Model X (relative to the competition SUVs and to its Model S) which had its China debutin June, has rapidly become one of the most sought after SUVs in the market. The Model X has significantly contributed to exceptional y/y growth the in the Chinese SUV market this year. Secondly, the introduction of the Model S P60D has improved the S’s affordability and expanded the addressable market in China. Consequently, Tesla is likely to deliver more than 10,000 cars in 2016 in China, 322% growth year-over-year.

The surge of import units in August was largely due to Model X deliveries. Model X has certainly benefited from the astronomical growth in the Chinese SUV market. SUV sales in China grew 45.9% vs only 2.7% for sedans in the first 9 months of this year (Jan to September 2016). Given the Chinese preference of bigger cars, the fact that the Model X provides more interior space, while not sacrificing on either power or driving range vs. the Model S, has been well received by Chinese consumers even though it sells for a price premium over the Model S."

"Elon Musk’s strategy in China is working. First, the reasonably priced Model X (relative to the competition SUVs and to its Model S) which had its China debutin June, has rapidly become one of the most sought after SUVs in the market. The Model X has significantly contributed to exceptional y/y growth the in the Chinese SUV market this year. Secondly, the introduction of the Model S P60D has improved the S’s affordability and expanded the addressable market in China. Consequently, Tesla is likely to deliver more than 10,000 cars in 2016 in China, 322% growth year-over-year.

The surge of import units in August was largely due to Model X deliveries. Model X has certainly benefited from the astronomical growth in the Chinese SUV market. SUV sales in China grew 45.9% vs only 2.7% for sedans in the first 9 months of this year (Jan to September 2016). Given the Chinese preference of bigger cars, the fact that the Model X provides more interior space, while not sacrificing on either power or driving range vs. the Model S, has been well received by Chinese consumers even though it sells for a price premium over the Model S."

Last edited:

Californians!! Signatures and calls needed to stop legislation that will charge EV owners $165 per year for each EV you own!!

http://hq-org.salsalabs.com/o/2711/t/0/blastContent.jsp?email_blast_KEY=1362240

And as many of us suspected Trumps infrastructure to be paid by your money going to corporate tolls roads.

Transportation secretary admits that infrastructure plan is to make you pay tolls to corporations

http://hq-org.salsalabs.com/o/2711/t/0/blastContent.jsp?email_blast_KEY=1362240

And as many of us suspected Trumps infrastructure to be paid by your money going to corporate tolls roads.

Transportation secretary admits that infrastructure plan is to make you pay tolls to corporations

Last edited:

SunCatcher

Member

Sean O'Reilly talks with Motley Fool senior auto specialist John Rosevear about the state of autonomous driving tech today, and when consumers will start to see the fruits of the industry's labors.

How Long Until I Get My Driverless Car? -- The Motley Fool

Not as soon as I would have hoped for.

How Long Until I Get My Driverless Car? -- The Motley Fool

Not as soon as I would have hoped for.

MitchJi

Trying to learn kindness, patience & forgiveness

Thanks to everyone who helped!Is this accurate or FUD?:

Tesla Drivers Are Paying Big Bucks to Test Flawed Self-Driving Software

Particularly @Papafox , @EinSV and @AudubonB!

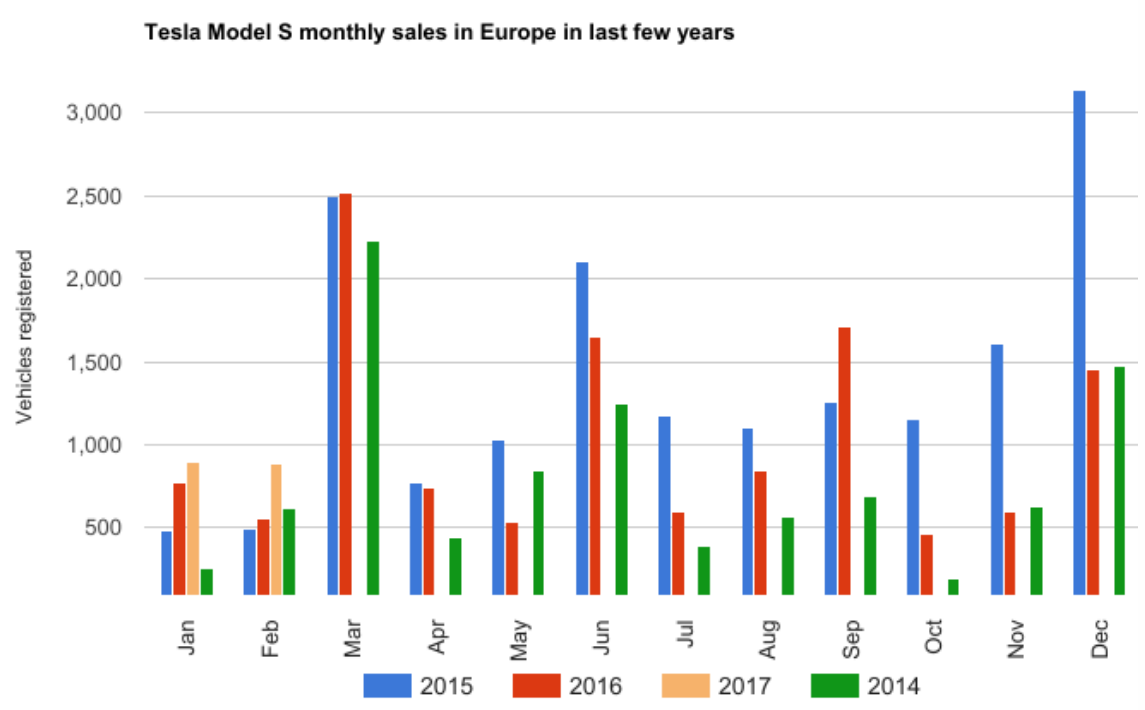

Pretty good registration numbers for Europe in Jan/Feb. Everything depends on March for Q1 total, but still a good start. Tesla Europe Registration Stats

- Status

- Not open for further replies.

Similar threads

- Replies

- 6

- Views

- 11K

- Sticky

- Replies

- 458K

- Views

- 50M

- Locked

- Replies

- 27K

- Views

- 3M

- Replies

- 28

- Views

- 14K