I am tempted to buy some post ER calls, but they are so pricey.After falling victim on several quarters in the past while adding to my position during run-ups to prior ER's that had a long stock price increase up to the ER over great news but proved to be 'buy the rumor-sell the news' events, I have found the 'sell the rumor-buy the news' ER's to be much more rewarding (and less painful to watch). Given the amount of selling we have had into some rather wonderful news of late, it sure looks like the ball is being set on the tee to allow for Tesla to decide the stock price direction next week as the market has already suppressed the price enough to allow for a 10% - 20% recovery without even a blink if the ER news and periphery discussion is a home run. Here's to a 'sell the rumor-buy the news' ER.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

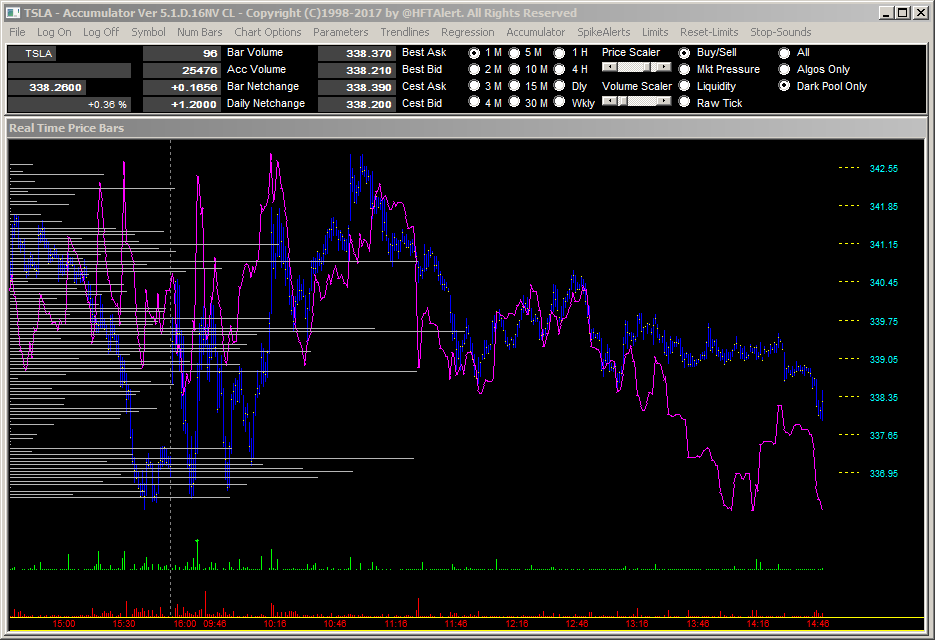

I spy... dark pools trying to drive price down

Last few hours has been a pattern of short, cover, short, cover, short, short, short, cover, short... Helps prevent a rise when macros rose, then sold more as soon as macros went soft.

Last few hours has been a pattern of short, cover, short, cover, short, short, short, cover, short... Helps prevent a rise when macros rose, then sold more as soon as macros went soft.

Navin

Active Member

So, for each employee that is posting a picture of their Model 3, how many are not?

Navin

Active Member

4th day down. Bought to close the short legs of my bull call spreads at a nice gain.

dennis

Model S Plaid

Elon has stated publicly several times that future GigaFactories will produce both batteries and cars at the same location.Is the bolded sentence a factual statement or an informed opinion? I do think that it is likely, but I'm not sure if Tesla ever confirmed that.

CyberDutchie

Active Member

This is a pretty horrible article, well timed just before the close to push TSLA in the red

http://www.marketwatch.com/story/tesla-slammed-by-einhorns-greenlight-capital-2017-10-24

http://www.marketwatch.com/story/tesla-slammed-by-einhorns-greenlight-capital-2017-10-24

Might want to check that closing price again.This is a pretty horrible article, well timed just before the close to push TSLA in the red

http://www.marketwatch.com/story/tesla-slammed-by-einhorns-greenlight-capital-2017-10-24

This is a pretty horrible article, well timed just before the close to push TSLA in the red

Tesla slammed by Einhorn’s Greenlight Capital

Yep Einhorn/Greenlight capital was all over my IPhone stock app for TSLA

jelloslug

Active Member

Now the "analysts" just flat out lie in their reports.This is a pretty horrible article, well timed just before the close to push TSLA in the red

Tesla slammed by Einhorn’s Greenlight Capital

ValueAnalyst

Closed

Elon has stated publicly several times that future GigaFactories will produce both batteries and cars at the same location.

Sure, but how future are we talking?

Paracelsus

Active Member

I am tempted to buy some post ER calls, but they are so pricey.

I find that to be a very interesting data point given the long walk-down despite much good news. Thanks for sharing. Do you think that suggests the MM's already have a 'heads-up' of the most likely post ER direction?

Elon and JB mentioned this at the GF1 event. I took it as any future GF will Ben designed this way, so GF3 and beyond.Sure, but how future are we talking?

BLSmith2112

Member

High option premiums imply an expected high level of price volatility (i.e. Price will move significantly up or down). Happens every time with ER.I find that to be a very interesting data point given the long walk-down despite much good news. Thanks for sharing. Do you think that suggests the MM's already have a 'heads-up' of the most likely post ER direction?

Sure, but how future are we talking?

At the Gigafactory party I remember Elon saying their next (and probably all future) Gigafactories would almost certainly produce both batteries and cars. So how far in the future depends on when they build the next one. Was that your question?

Big-ish market-on-close to the buy side

View attachment 255915

Note the 150k share trade 14 seconds later - that was like another big down day we had on the way down from 380 if I recall.

Perhaps worth noting the last red day I noticed this was Oct 16th. Will be interesting if we rebound tomorrow, like Oct 17th...

FredTMC

Model S VIN #4925

VINs or it didn't happen.

But it is nice to see a bunch of instagram posts employees taking new deliveries over the past few days. So in other words, these aren't random street sightings of the same cars over and over again

NEW delivery pics are more useful than random street sightings.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Article

- Replies

- 29

- Views

- 6K

- Replies

- 1

- Views

- 870