Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

MitchJi

Trying to learn kindness, patience & forgiveness

I'd sell some shares and buy some J19 LEAPS. I'd buy strike prices of about $240-$260.The upward trend is unbroken, up in Europe as of 10:30 MEZ +1.4%, 238.70 €, or 256.53 USD.

If ever the mother of squeezes ( as in Porsche / VW) would happen, are you trading guys (as opposed to me boring buy & hold investor) prepared to profit from it an how ? Having sell orders at ridiculous heights in different steps ? Can somebody compute to what max the SP could top if the +-30m shares short have to be covered ?

If the SP goes up to only $280-$300 by mid 2018 that will be a wildly profitable strategy.

Last edited:

Premarket 256.90.

$257.69 now. Any other news beyond Elon's twitter storm on Tillerson and digging tunnels? Was that enough to start the feeding frenzy? Bizarre, but I will take it...

Electric evangelist Musk backs ex-oil man Tillerson

Chickenlittle

Banned

I do not consider myself a member of forum anymore but feel the obligation of warning about something I previously recommended. I suspect a developing short squeeze. May not pan out but if it does anyone loaning out shares are at risk. If shorts default there is collateral reserved based on previous days price to back up your loan and you would get cash but not shares. You would be left trying to buy shares with rapid appreciation in share price. This risk does not seem worth the 1% interest rate paid for the shares

I do not know how they allocate defaulted shares to each investor loaning out shares. I suspect there is a pool of shares loaned and yours are not loaned to a tracked short. So there would be discretion by brokerage of whose shares were defaulted if true I suspect the non institutional loaners would be hit. For comparison, I always thought there was a identified buyer of every call option I sold but there isn't. Sometimes in the money calls at expiration are not not called or options in the money are exercised prior to expiration. The brokerage will assign these to arbitrary option sellers (supposedly) without bias. They do not allocate these by percentage of calls sold either

I do not know how they allocate defaulted shares to each investor loaning out shares. I suspect there is a pool of shares loaned and yours are not loaned to a tracked short. So there would be discretion by brokerage of whose shares were defaulted if true I suspect the non institutional loaners would be hit. For comparison, I always thought there was a identified buyer of every call option I sold but there isn't. Sometimes in the money calls at expiration are not not called or options in the money are exercised prior to expiration. The brokerage will assign these to arbitrary option sellers (supposedly) without bias. They do not allocate these by percentage of calls sold either

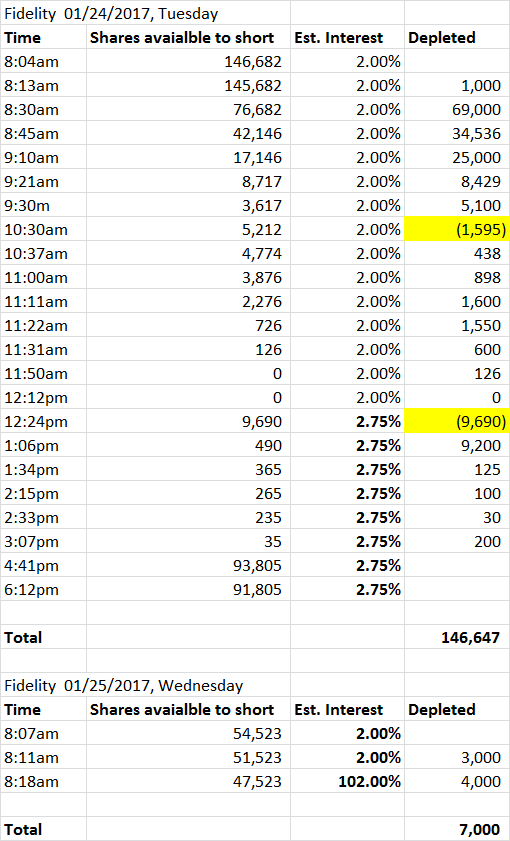

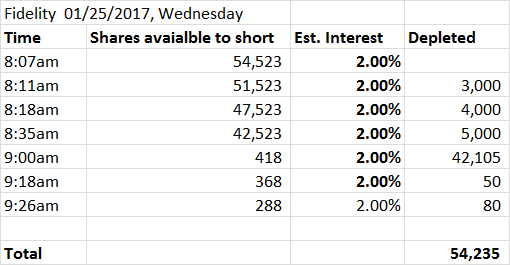

Today's update. Note that interest is back to 2%.

TrendTrader007

Active Member

Thanks a lot! I'm recalling all my shares immediatelyI do not consider myself a member of forum anymore but feel the obligation of warning about something I previously recommended. I suspect a developing short squeeze. May not pan out but if it does anyone loaning out shares are at risk. If shorts default there is collateral reserved based on previous days price to back up your loan and you would get cash but not shares. You would be left trying to buy shares with rapid appreciation in share price. This risk does not seem worth the 1% interest rate paid for the shares

I do not know how they allocate defaulted shares to each investor loaning out shares. I suspect there is a pool of shares loaned and yours are not loaned to a tracked short. So there would be discretion by brokerage of whose shares were defaulted if true I suspect the non institutional loaners would be hit. For comparison, I always thought there was a identified buyer of every call option I sold but there isn't. Sometimes in the money calls at expiration are not not called or options in the money are exercised prior to expiration. The brokerage will assign these to arbitrary option sellers (supposedly) without bias. They do not allocate these by percentage of calls sold either

Fidelity told me they will recall the shares immediately but they have up to 3 business days to recall them

I believe you're totally right. I have thousands of shares lent out and if a major short squeeze occurs i would have been left holding the bag with only cash and no shares and that too as of yesterday's close!

So I sincerely thank you and really appreciate the timely warning. As of today shorts have thousands of shares less to play with

Last edited:

I do not consider myself a member of forum anymore but feel the obligation of warning about something I previously recommended. I suspect a developing short squeeze. May not pan out but if it does anyone loaning out shares are at risk. If shorts default there is collateral reserved based on previous days price to back up your loan and you would get cash but not shares. You would be left trying to buy shares with rapid appreciation in share price. This risk does not seem worth the 1% interest rate paid for the shares

I do not know how they allocate defaulted shares to each investor loaning out shares. I suspect there is a pool of shares loaned and yours are not loaned to a tracked short. So there would be discretion by brokerage of whose shares were defaulted if true I suspect the non institutional loaners would be hit. For comparison, I always thought there was a identified buyer of every call option I sold but there isn't. Sometimes in the money calls at expiration are not not called or options in the money are exercised prior to expiration. The brokerage will assign these to arbitrary option sellers (supposedly) without bias. They do not allocate these by percentage of calls sold either

Thank you for this very good point. I was surprised that both on Monday and yesterday, although shares available for shorting were essentially depleted before market open, Fidelity did not replenish the supply as they usually do. after reading your post I am wondering if they are getting more conservative on the internal limit of shares (percentage of total) they are willing to lend and reduced it based on assessment that is perhaps similar to yours. If this is true this could turn very ugly for those holding short positions.

Hogfighter

Professional Lurker

I do not consider myself a member of forum anymore but feel the obligation of warning about something I previously recommended. I suspect a developing short squeeze. May not pan out but if it does anyone loaning out shares are at risk. If shorts default there is collateral reserved based on previous days price to back up your loan and you would get cash but not shares. You would be left trying to buy shares with rapid appreciation in share price. This risk does not seem worth the 1% interest rate paid for the shares

I do not know how they allocate defaulted shares to each investor loaning out shares. I suspect there is a pool of shares loaned and yours are not loaned to a tracked short. So there would be discretion by brokerage of whose shares were defaulted if true I suspect the non institutional loaners would be hit. For comparison, I always thought there was a identified buyer of every call option I sold but there isn't. Sometimes in the money calls at expiration are not not called or options in the money are exercised prior to expiration. The brokerage will assign these to arbitrary option sellers (supposedly) without bias. They do not allocate these by percentage of calls sold either

For whatever reason you choose not to participate in this forum anymore, your insight is missed.

$257.69 now. Any other news beyond Elon's twitter storm on Tillerson and digging tunnels? Was that enough to start the feeding frenzy? Bizarre, but I will take it...

Electric evangelist Musk backs ex-oil man Tillerson

I think we can call this run a (groan) Trump bump. The de-risking associated with being tight with Orange is turning TSLA from a market pariah to market darling. The recipe is perfect if you think about it. The knock on TSLA is that east coast traders didnt' understand it, figured it is a fad. But if their buddy Trump is on board? Well that flips the script.

God I hope it is really 102%.

Fidelity shares available for shorting essentially depleted.

ruralectric

Member

I do not consider myself a member of forum anymore but feel the obligation of warning about something I previously recommended. I suspect a developing short squeeze. May not pan out but if it does anyone loaning out shares are at risk. If shorts default there is collateral reserved based on previous days price to back up your loan and you would get cash but not shares. You would be left trying to buy shares with rapid appreciation in share price. This risk does not seem worth the 1% interest rate paid for the shares

I do not know how they allocate defaulted shares to each investor loaning out shares. I suspect there is a pool of shares loaned and yours are not loaned to a tracked short. So there would be discretion by brokerage of whose shares were defaulted if true I suspect the non institutional loaners would be hit. For comparison, I always thought there was a identified buyer of every call option I sold but there isn't. Sometimes in the money calls at expiration are not not called or options in the money are exercised prior to expiration. The brokerage will assign these to arbitrary option sellers (supposedly) without bias. They do not allocate these by percentage of calls sold either

I am not a seasoned trader, nor am I an expert in fully paid share lending programs. However my understanding of how the program worked at Schwab, and after a quick reread of the program overview at Fidelity, it is my understanding that the collateral associated with these programs protects the lender in the event of a default on the part of the BROKER, not the from the party that the shares are ultimately loaned out to. in fact, I can sell my shares online at any time and in the usual manner and the broker is responsible for coming up with the shares to make good on the trade.

In short, I am not buying any of this nonsense about risk of losing a position through loaned out shares and the default of a short seller.

Regards.

Last edited:

Nate the Great

Member

.

If ever the mother of squeezes ( as in Porsche / VW) would happen, are you trading guys (as opposed to me boring buy & hold investor) prepared to profit from it an how ? Having sell orders at ridiculous heights in different steps ? Can somebody compute to what max the SP could top if the +-30m shares short have to be covered ?

I personally am not preparing to do anything as of now, since i am convinced that my selling would mean releaving to a short, something i am not prepared to do...

Thanks for your input.

I went into this with the specific strategy of about half long term hold, half trading.

In the even of a short-squeeze spike, I would sell all medium term options, and at least 25% of shares. Then try to find a dip to buy back in shares or LEAPs. One would assume a dip is coming after a short squeeze, right? Especially if it happens soon, before major M3 news.

Nate the Great

Member

I think Fidelity tends to run out of shares quicker than IB.

Any body have an IB account?

IB has 211,406 shares available to lend at 2.11%

Opening wasn't as strong, as yesterday.

It was a bit overbought in the premarket and settled down a bit....

BTW this made me think of the following strategy. When it's up premarket by like 3 points with no solid reason, I will place sell orders on some of the medium term options at insane prices, and if they trigger, buy back later in the day when the bidding calms down.

BTW, is it just me, or does it feel like there is a slight acceleration of our current trend?

Opening wasn't as strong, as yesterday.

You spoke too soon. Actually the last 4 days have been strong open, sag, return to higher, roll over sag for an hour then slowly grind up to session highs or near session hights.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Article

- Replies

- 29

- Views

- 6K

- Replies

- 1

- Views

- 883