Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

TrendTrader007

Active Member

TrendTrader007

Active Member

Tesla actually I was kidding about 10s of Ks my total position in Tesla is only 675 shares and I bought 10 extra sharesThe shares you were throwing out of earlier was 10s of Ks so that would mean your recent buys are houndreds of shares to have almost zero cost average movement?

Sorry for confusion

PS: I'm just a small timer hoping to make it big someday

It's nice to dream though

Never made more than $40000 a year in my life

Sorry! It was a typo my total position in Tesla is only 375 shares that is it got nothing more

Last edited:

geneclean55

Active Member

That shooting star from yesterday almost bankrupted me. Glad I got out this morning premarket.. NOT

Mike Smith

Active Member

Obvious attempt this morning by the shorts to blunt the Baron bounce. Very fitting, Ron having pointed out that shorts allow stocks to be bought on sale.

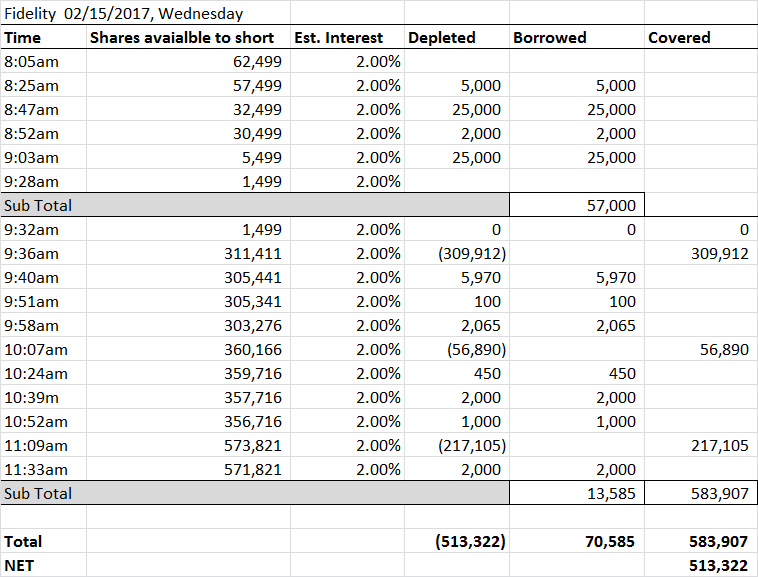

Looks like today's morning dip presented itself as an attractive opportunity for some short sellers to close their positions. Approximately 584k (**) shares were covered at Fidelity so far:

I'm waiting for the SA article pointing out that on his previous appearance Baron said 30-50X, and now it's only 30X.

Ron Baron Losing Faith In Tesla

He was also talking beyond 13 years the last time.

durkie

Member

MitchJi

Trying to learn kindness, patience & forgiveness

Bottom line: Because of the big run to the upside, TSLA could have a pullback so my strategy is to buy strength. Buy on a close above $288 and consider adding on a close above $291. Risk? I would pick a dollar amount you can afford to lose and then enter an appropriate order.

@TrendTrader007 - I'd love to interview you (via Google Video Hangout) and have you share about your trading insights and stories. I tried PM'ing you but it would let me (something about your profile but being public). So, PM me when you get the chance. (Ps, you can look at the google hangout thread in the investors section and see some of the folks I've interviewed in the past.)

@TrendTrader007 - I'd love to interview you (via Google Video Hangout) and have you share about your trading insights and stories. I tried PM'ing you but it would let me (something about your profile but being public). So, PM me when you get the chance. (Ps, you can look at the google hangout thread in the investors section and see some of the folks I've interviewed in the past.)

Another silly idea... a bunch of us are in the CA Bay Area, and it would we interesting to organize a meet at a restaurant or pub and hang out. Be fun to meet in person.

We've organized meetups in the past, usually right after the annual shareholder meeting for lunch.Another silly idea... a bunch of us are in the CA Bay Area, and it would we interesting to organize a meet at a restaurant or pub and hang out. Be fun to meet in person.

The good thing about a google hangout though is that it's recorded so that everyone who'd like can watch it later.

Now even more confused. The root of my question is to distinguish a material trade of your post. If one adds 20% to his holdings is significant vs. one that adds 2%. It gives a different read... that's all. Seems like you took a different approach.Tesla actually I was kidding about 10s of Ks my total position in Tesla is only 675 shares and I bought 10 extra shares

Sorry for confusion

PS: I'm just a small timer hoping to make it big someday

It's nice to dream though

Never made more than $40000 a year in my life

Sorry! It was a typo my total position in Tesla is only 375 shares that is it got nothing more

MitchJi

Trying to learn kindness, patience & forgiveness

I think it's mostly due to the fact that income from all of the catalysts we've been talking about here for the last couple of years is imminent.I'm no great predictor, but absent more positive info on model 3 ramp it looks like this rally has just been a sentiment shift and massive institutional buying due to that shift. I don't think sentiment alone can carry it much beyond ATH because institutions don't tend to be trendsetters when it comes to ATH prices unless they have inside information.

A short squeeze would obviously cause short term price explosion though.

Let me ask you, absent a squeeze, how high do you think this runs before we get some reversal or a new flat channel? I doubt your guess would be much higher than 320 either, but I may be totally wrong about your thinking here.

I don't have any idea what the price might be, not even a guess, but I do think that the surge might not be over.

My post was not disagreeing with you thinking that the surge might be over, but the fact that you seemed to be too sure that it was over, and the reasons for that certainty seemed dicey to me.

I'd be pretty happy with $320!

MartinAustin

Active Member

I think we're about to test your theoryThink we just saw support at high $276 range. Hopefully up from here.

I think it's a loose 280 support... give or take a few bucks.I think we're about to test your theory

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Article

- Replies

- 29

- Views

- 6K

- Replies

- 1

- Views

- 870