Ulmo

Active Member

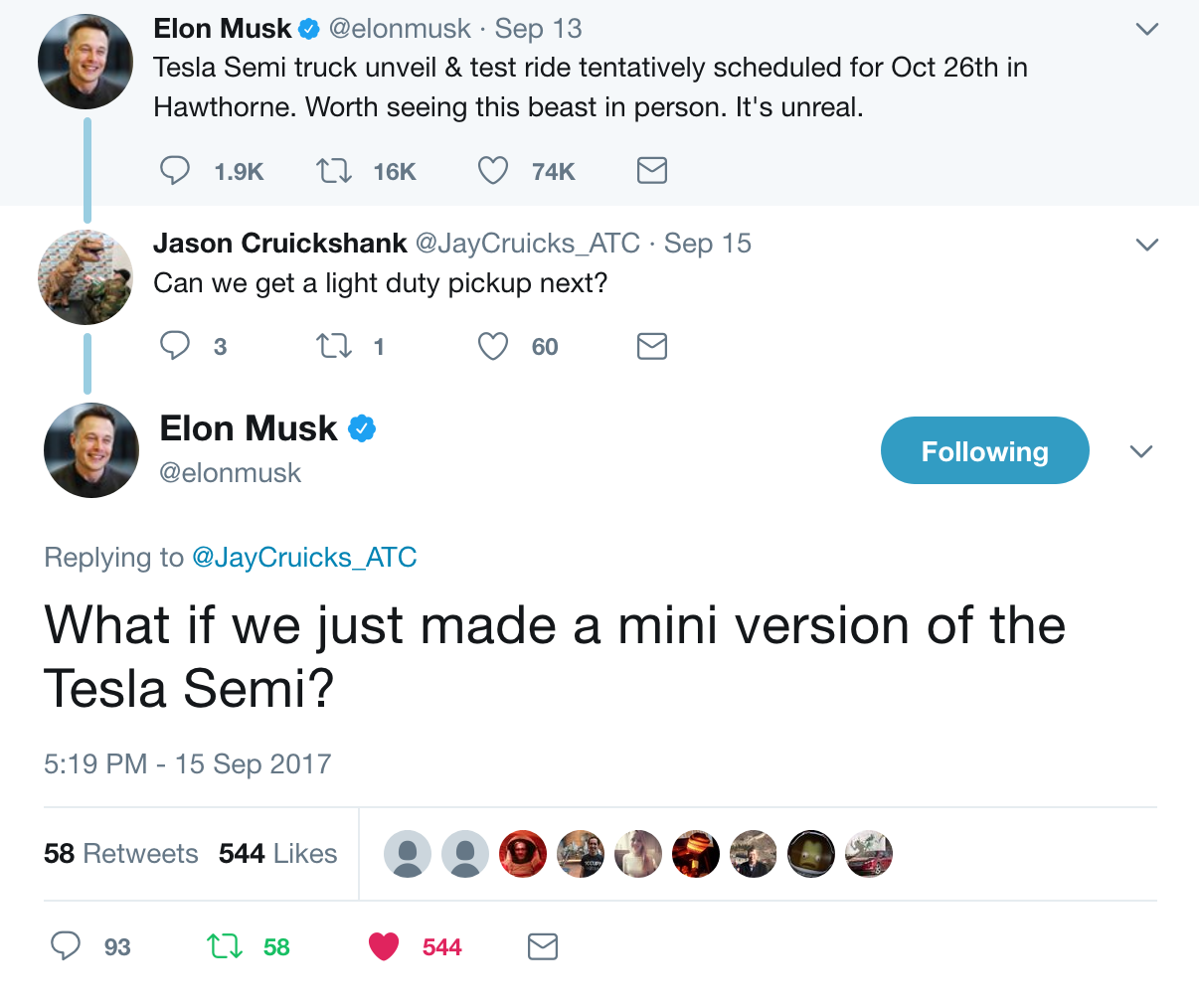

I work in construction. I never discuss Tesla at work, and no one knows I owned one, or own stock, or am interested in it. I'm surrounded by construction pollution and construction workers willing to do a lot of pollution. This morning my regular construction boss told me that Tesla is planning to come out with a pickup truck, and he really sounded excited about it, and anyone who heard him seemed intrigued and happy. Read Elon's tweet and see what he said about that:

Yes, you read that right.

Conclusions:

Yes, you read that right.

Conclusions:

- People are really enthused by the concept of owning a decent price good quality electric pickup truck with all the necessary bits (long range, good hauling, etc.)

- People who you don't think are paying attention to Tesla are, but just are not interested in things that don't provide anything to their market needs.

- The above tweet was thrice interpreted from English to English to come up with that conclusion. That means that we have kind of no idea where they're headed with that, and when. It also means people are so excited that they are reading into things.