Brought in from The Wheel thread since its pretty far removed from The Wheel...

there are multiple kinds of butterflies?

Yeah. There's a slew of possibilities out there; butterfly typically refers to three legged, same-expiry positions with a P/L that peaks (as opposed to a four-legged same expiry position--like a condor--where the P/L plateaus). I know I post this like every 5 pages now, and no page can detail every single permeation of a option strategy, but ~half way down the page is where

the butterflies start.

You got my attention and double-take at "Annually that is near guaranteed profit on a fixed amount of capital; the variable is simply how much profit."

I figured it might.

In a terrible year of course, profit could be pretty dismal. You definitely wouldn't want to expose a majority of your capital to that kind of strategy.

Another fun strategy is what my trading partner and I call "The Mustache". Its a double diagonal ratio spread and works well in a low volatility environment when you're unsure of underlying movement.

For reference, here's a regular, ~symmetrical ZM DD with the front 'month' expiring just after earnings and the back month a week later. Small credit, decently wide profit window at front month expiration. At expiration you're left with two long contracts (assuming you didn't close one already) with which you can take profit or roll. One strategy here might be to open 10 DD's and then maybe close out the +P's at front month expiration and roll the value of the 10 remaining +C's into a single, farther expiration call that's free and clear. Anyway, I digress...

Here's that same DD but with instead with a ratio on the spreads (in this case, two long contracts for each short), with the "mustache" P/L at front month expiration. Total debit to you is $2600 and risk maxes at -$400 with--and this is huge--no change in volatility. You end up at expiration with four long contracts instead of two this time (unless you closed one or two of the losing longs) that you can again either close or roll.

And then when we factor volatility, you can see that an increasing volatility environment is a great thing. If volatility goes up 10 percentage points, at expiration your position returns profit regardless where underlying goes.

However, given that I built this around earnings, its most likely that volatility on the back month is also going to drop, so maybe this isn't the best example, but its still an interesting thought experiment.

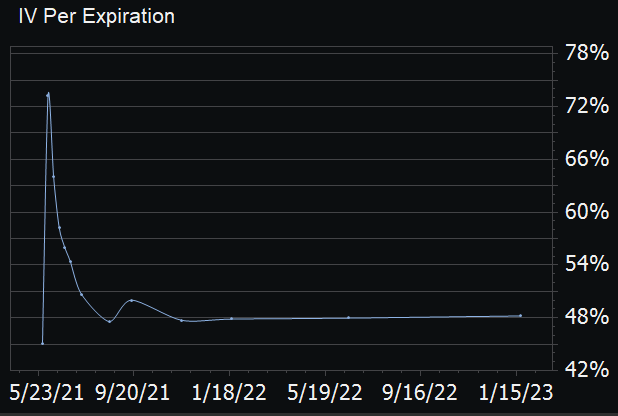

All the same, just playing this one out a little more, if we look at the IV/month chart for ZM we can see the peak at ~74% for this coming earnings, then a huge drop, a small bubble at ~50% for the September expiration (the next earnings) and then a plateau at 48% farther out. It stands to reason that the September bubble is going to grow over time relative to the plateau, but its probable that the plateau is probably going to move up and down generally together. The interesting expiry here is August, which is basically at that 48% plateau as well, and its probable that point will diverge from the farther expiration plateau in its up and down movement...if you imagine the wave of IV moving through time, you could imagine that expiration moving up the face of the wave more so than the plateau, so its more likely the IV for that expiry is going to rise over time than the plateau. So...maybe building a position around a back month of August is a good idea.

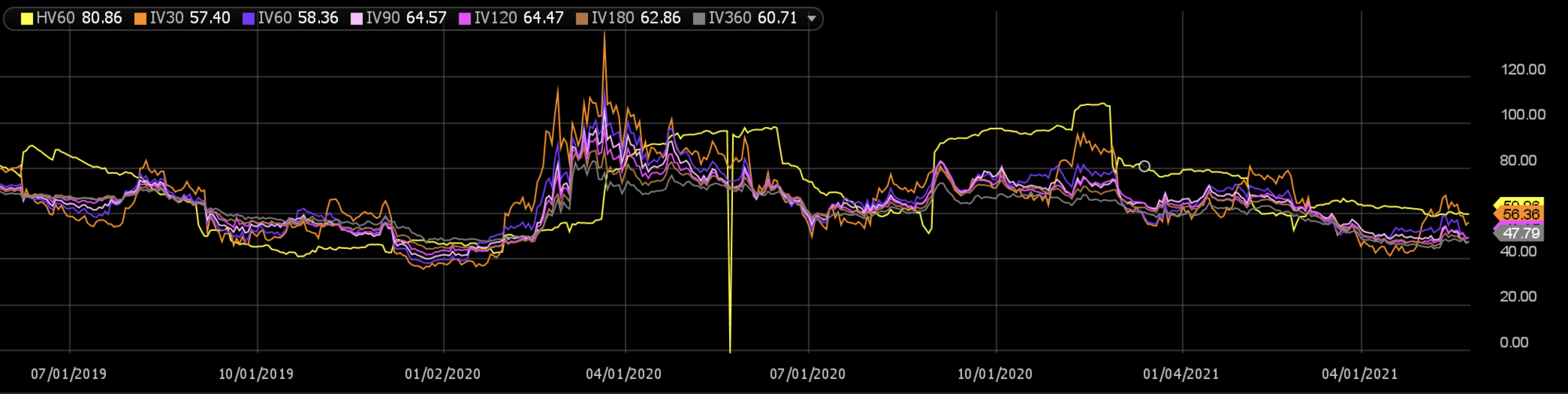

However, we're really only talking a week and a half until front month expiration, and its likely there will be a drop in IV across the board after earnings. So its a good idea to check out where we are relative to past volatility (2 years, since you can't trust 2020 to tell you about volatility for anything). Shown below, in early 2020 HV60 bottoms around 41 and IV60 bottoms around 38 (August will be ~2.5 months out at our 6/4 expiration). That, unfortunately, tells us there's a good potential for our back month volatility to go down...which unfortunately exposes our four long contracts to a potential drop in value.

The next step would be to fold some estimated drop in IV back into your P/L tool to determine whether or not its an acceptable risk. You might also decide to change up the ratio...say 3 longs for each 2 shorts, etc. You may decide to build something that's a little more assymetric, to provide more upside for a particular direction. There's all manner of knobs to turn and all kinds of fun to be had.