Question on valuation of options. I have a call debit spread at $470 and 630 for Jan 21 2022. Right now it's valued at 8k. Max return is 16k. I know we are a long way off but 8k seems low for what is a pretty sure bet. Is it because of the sold 670 call? With a capped upside it feels like selling at this point is the smart move. Thoughts?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Advanced TSLA Options Trading

- Thread starter smorgasbord

- Start date

-

- Tags

- TSLA

Yeah, the sold call (is it 630 or 670?) limits the max return along with initial coast and max loss.Question on valuation of options. I have a call debit spread at $470 and 630 for Jan 21 2022. Right now it's valued at 8k. Max return is 16k. I know we are a long way off but 8k seems low for what is a pretty sure bet. Is it because of the sold 670 call? With a capped upside it feels like selling at this point is the smart move. Thoughts?

Options profit calculator will show you the return curve vs time/SP.

It is low risk, but seems like other possibilities could give you more return over the next 1.5+ years than waiting for the time value to burn out.

$630. Yeah that's what I'm thinking. My single call buys seem ok to hold as upside is unlimited.Yeah, the sold call (is it 630 or 670?) limits the max return along with initial coast and max loss.

Options profit calculator will show you the return curve vs time/SP.

It is low risk, but seems like other possibilities could give you more return over the next 1.5+ years than waiting for the time value to burn out.

$630. Yeah that's what I'm thinking. My single call buys seem ok to hold as upside is unlimited.

All depends what you like. The deeper they are, the more 1:1 on stock movement. If you only hold a fixed number of options, then that is ideal. If you hold some fixed $ worth of options, rolling them into more contracts at high strikes can increase your leverage.

Noting wrong with pocketing gains when they come.

Captkerosene

Member

How can I protect my large gain on TSLA shares. I'm in the highest tax bracket and hate to just sell. I think long-term the shares will go much higher but that we're in a trading range for the next year. If people are overpaying for options (which I think is likely) then I want to be a seller ... right? Sorry for my ignorance. I've been an investor for 45 years but never bought an option.

Hold.How can I protect my large gain on TSLA shares. I'm in the highest tax bracket and hate to just sell. I think long-term the shares will go much higher but that we're in a trading range for the next year. If people are overpaying for options (which I think is likely) then I want to be a seller ... right? Sorry for my ignorance. I've been an investor for 45 years but never bought an option.

JusRelax

Active Member

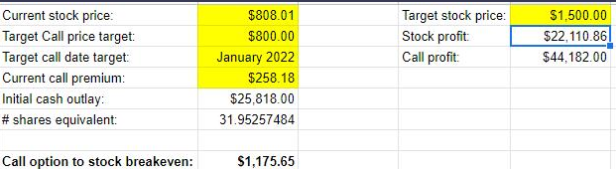

Basic call options courses have a 'breakeven' -- the point at which you would breakeven compared to not investing at all. But for our purposes, I'm wondering if it makes more sense to look at a 'call to stock breakeven' instead, which is the point where buying a call becomes equivalent to buying the underlying stock instead. I created a rudimentary calculator for that... it will help you to compare when (and by how much) a call becomes more worth it to purchase when compared to the stock itself. Feel free to make a copy of it and play around with the highlighted cells to get a better understanding of how much you expect a stock to go up by the call expiration date to determine if it's more worth it to buy a call, or just buy the stock:

Google Sheets - create and edit spreadsheets online, for free.

Here's an example using a TSLA January 2022 $800 call option:

So if you bought the call option, the stock would have to be at $1175.65 or above at expiration for you to make more money by buying the call option when compared to buying an equivalent amount of stock with the $25,818 initially. If the stock price is at $1500 in January 2022, you will have made twice as much money by buying the call instead of the stock ($44,182 vs $22,110.86 profit)

Google Sheets - create and edit spreadsheets online, for free.

Here's an example using a TSLA January 2022 $800 call option:

So if you bought the call option, the stock would have to be at $1175.65 or above at expiration for you to make more money by buying the call option when compared to buying an equivalent amount of stock with the $25,818 initially. If the stock price is at $1500 in January 2022, you will have made twice as much money by buying the call instead of the stock ($44,182 vs $22,110.86 profit)

Last edited:

I think IV collapse will be countered by raising stock price and delta. I'm not too worried, although I also don't have all that many options far away from the current strike.is any of you folks concerned about an IV crush on the LEAPS upon S&P inclusion due to the decreased volatility we can assume after that event?

I'm in 400 & 1800 Jun 2022 CALLs

adiggs

Well-Known Member

I think IV collapse will be countered by raising stock price and delta. I'm not too worried, although I also don't have all that many options far away from the current strike.

It seems like there is some degree of ongoing IV reduction in the near (1-3 week) options. The lowest previous reading I've seen is .59. Today the 5/29 IV is down under .53 (ATM options).

This doesn't address the question about LEAP IV. I haven't done any research nor am I following those, so I don't have an opinion on those.

Hey guys I'm currently looking at doing a Jun 22 1300/1800 call spread but have a few questions as I haven't done this before. From what I understand:

Max risk = $5,320

Max gain = $45,000

Call spread calculator: Buy and write two calls at different strike prices

In order to sell the 1800 call option does one need to own 100 shares to put those up as leverage? If the SP is > 1800 by Jun 22 expiry, the owner of the 1800 call can execute it and purchase my shares correct? I've read lots about bull call spreads but the only "risk" that seems to get mentioned is the net entry cost and not what happens if the short call option gets executed. If this is true, any way to mitigate this?

PS. Fairy Modfather approved this posting, deleted the other one.

Max risk = $5,320

Max gain = $45,000

Call spread calculator: Buy and write two calls at different strike prices

In order to sell the 1800 call option does one need to own 100 shares to put those up as leverage? If the SP is > 1800 by Jun 22 expiry, the owner of the 1800 call can execute it and purchase my shares correct? I've read lots about bull call spreads but the only "risk" that seems to get mentioned is the net entry cost and not what happens if the short call option gets executed. If this is true, any way to mitigate this?

PS. Fairy Modfather approved this posting, deleted the other one.

Last edited by a moderator:

No worries, the written call is covered by the bought call at a lower price. For it to be exercised the other one has to be well in the money, so if you need to just exercise it.Hey guys I'm currently looking at doing a Jun 22 1300/1800 call spread but have a few questions as I haven't done this before. From what I understand:

Max risk = $5,320

Max gain = $45,000

Call spread calculator: Buy and write two calls at different strike prices

In order to sell the 1800 call option does one need to own 100 shares to put those up as leverage? If the SP is > 1800 by Jun 22 expiry, the owner of the 1800 call can execute it and purchase my shares correct? I've read lots about bull call spreads but the only "risk" that seems to get mentioned is the net entry cost and not what happens if the short call option gets executed. If this is true, any way to mitigate this?

No worries, the written call is covered by the bought call at a lower price. For it to be exercised the other one has to be well in the money, so if you need to just exercise it.

Thanks for the response, appreciate it. So you can sell a naked call option that is not backed by stock? I don't have any intention of exercising the 1300c but instead would like sell it before expiry. In order to close the spread I would have to buy the 1800c?

Well, it isn't a naked call, because it is backed by the purchased call. But yeah, if someone exercises your written call, you just exercise the bought call to satisfy it. Unless the stock price manages to drop 400 points in the ten seconds it would take for you to do this, you're golden.Thanks for the response, appreciate it. So you can sell a naked call option that is not backed by stock? I don't have any intention of exercising the 1300c but instead would like sell it before expiry. In order to close the spread I would have to buy the 1800c?

Criscmt

Member

Taxes: Options and Constructive Sale

When the long call (a LEAP) is already in profits, if a short call (again a LEAP) is sold against a long call, would it be Constructive Sale?

Let's take these hypothetical trades

When the long call (a LEAP) is already in profits, if a short call (again a LEAP) is sold against a long call, would it be Constructive Sale?

Let's take these hypothetical trades

- On 08/15/2020: Bought TSLA Sep-2022 350C at $120 (Long call)

- On 08/31/2020: Sold Jan-2022 360C at $210 (Short Call). By this date, 08/31/2020, before my short call sale, my long call was $215 in value. In other words, I had unrealized gains of $95 on my long call.

- Do I have to pay taxes in my 2020 filing seeing this as constructive sale?

- If yes, what if the expiry dates are different rather than being the same?

- Again, if yes, would a significant difference between the strikes of long and short calls make it to be a not constructive sale?

- As the share price kept moving up, I kept cashing out by writing vertical spread, and used the cash to buy another call at strike close to the latest share price.

- I did this multiple times as the share price saw a significant ride up. The reason I did this was to move the cash to options that were giving me better leverage (x% move in option price for each 1% move in the stock price), keeping taxes LTCG while at it. Selling/Closing the original call above would lead to STCG.

- I thought Downside protection and upside limitation influence whether this would be considered a constructive sale.

- I am avoiding the downside risk through the short call.

- On the upside, technically I am not giving up the upside.

- At expiry TSLA might close above $360+$120=$480. And my final gain is $95+$10. Does this yet to be determined final profit make it appropriate to be reported in 2021 taxes, rather than 2020 taxes?

kengchang

Active Member

Any Sold Call/Put is Short term tax gain, if it doesn't work out you book the loss when you close.Taxes: Options and Constructive Sale

When the long call (a LEAP) is already in profits, if a short call (again a LEAP) is sold against a long call, would it be Constructive Sale?

Let's take these hypothetical trades

Through Dec-31-2020 I continue to hold both the positions.

- On 08/15/2020: Bought TSLA Sep-2022 350C at $120 (Long call)

- On 08/31/2020: Sold Jan-2022 360C at $210 (Short Call). By this date, 08/31/2020, before my short call sale, my long call was $215 in value. In other words, I had unrealized gains of $95 on my long call.

Why I opened a spread like this?

- Do I have to pay taxes in my 2020 filing seeing this as constructive sale?

- If yes, what if the expiry dates are different rather than being the same?

- Again, if yes, would a significant difference between the strikes of long and short calls make it to be a not constructive sale?

Constructive Sale aspects

- As the share price kept moving up, I kept cashing out by writing vertical spread, and used the cash to buy another call at strike close to the latest share price.

- I did this multiple times as the share price saw a significant ride up. The reason I did this was to move the cash to options that were giving me better leverage (x% move in option price for each 1% move in the stock price), keeping taxes LTCG while at it. Selling/Closing the original call above would lead to STCG.

- I thought Downside protection and upside limitation influence whether this would be considered a constructive sale.

- I am avoiding the downside risk through the short call.

- On the upside, technically I am not giving up the upside.

- At expiry TSLA might close above $360+$120=$480. And my final gain is $95+$10. Does this yet to be determined final profit make it appropriate to be reported in 2021 taxes, rather than 2020 taxes?

Criscmt

Member

Thanks @kengchangAny Sold Call/Put is Short term tax gain, if it doesn't work out you book the loss when you close.

Sure. I would think the reporting of gains/losses fall into the year when the position is closed, right?

In other words, for a call I sell expiring in Jan-2021, if I take the action to close (buyback or let it expire) in Jan-2021, the proceeds would be part of 2021 tax year?

I am assuming, you don't have any inputs to add on Constructive Sale for options?

kengchang

Active Member

Thanks @kengchang

Sure. I would think the reporting of gains/losses fall into the year when the position is closed, right?

In other words, for a call I sell expiring in Jan-2021, if I take the action to close (buyback or let it expire) in Jan-2021, the proceeds would be part of 2021 tax year?

I am assuming, you don't have any inputs to add on Constructive Sale for options?

If you sell the call expiring in Jan 2021 in 2020, the short term profit goes onto your 2020 tax year.

If it expires worthless in 2021, nothing to do in 2021 tax year since you already booked the gain.

If it doesn't expire worthless in 2021, you claim the amount back from the gain you booked in 2020.

I have nothing to add on strategy

Criscmt

Member

Even if covered call expiring in Jan-2022 is sold (against your existing long call) in 2020, the value of that short call sold should be treated as income in 2020?If you sell the call expiring in Jan 2021 in 2020, the short term profit goes onto your 2020 tax year.

If it expires worthless in 2021, nothing to do in 2021 tax year since you already booked the gain.

If it doesn't expire worthless in 2021, you claim the amount back from the gain you booked in 2020.

I have nothing to add on strategy

kengchang

Active Member

Yes, you have the money now in 2020.Even if covered call expiring in Jan-2022 is sold (against your existing long call) in 2020, the value of that short call sold should be treated as income in 2020?

Similar threads

- Replies

- 28

- Views

- 1K

- Locked

- Replies

- 0

- Views

- 3K

- Poll

- Replies

- 16

- Views

- 2K

- Replies

- 2

- Views

- 701