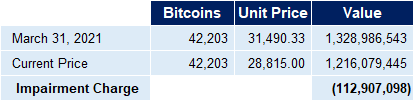

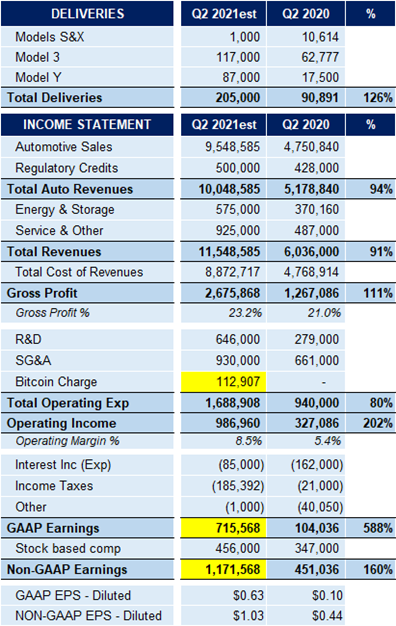

Here is my estimate for the Bitcoin Impairment Charge for Q2 2021:

Q2 Earnings Outlook with this Impairment:

Q2 Earnings Outlook with this Impairment:

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

They can only revalue in two cases:Bitcoin was $58,700 on 31st March. They either didn't revalue the holding on that date in which case why would they need to now, or the holding back then using your other figures was $2,477M. The value today is circa $30k a coin as you say, so the total holding is $1.2B or so, so in total they've had a little overa $1B hit on the bitcoin investment in the last quarter (although a much smaller one compared to what they paid). I not a US accountant so I don't know if they have to revalueevery quarter, but of they did, I think they're in for a dreadful number.

Bitcoin was $58,700 on 31st March. They either didn't revalue the holding on that date in which case why would they need to now, or the holding back then using your other figures was $2,477M. The value today is circa $30k a coin as you say, so the total holding is $1.2B or so, so in total they've had a little overa $1B hit on the bitcoin investment in the last quarter (although a much smaller one compared to what they paid). I not a US accountant so I don't know if they have to revalueevery quarter, but of they did, I think they're in for a dreadful number.

What makes you think that they purchased around Feb 8th? We know it was much earlier than that. They announced the purchase had already occurred in their January 27th 10k filing:

So it seems that they purchased sometime in January before the 27th.

So we know the price of BTC went down after they purchased it. The low price in Q1 for BTC was January 21st at about $28.9, let's assume that they purchased after that point. The next lowest point was on January 27th was about $29.3k. So they purchased between the 21st and 27th. (Which lines up with disclosure rules that they had to announce their BTC purchase within 4 days.) Making the 27th the low point in Q1 that they have already written the value down to.

So I have to revise my math now. 29.3k-28.8k= 0.5k loss per BTC. 0.8 * 42069 BTCs = $21M loss to recognize.

If they purchased before January 21st they would have already written it down to $28.9, meaning they need to recognize even less of a loss.

Can anyone, calling @The Accountant, find where I messed up that calculation?

Some discussion in another thread lead me to writing this post:

If that is correct the impairment should be closer to $21M for Q2.

The problem with my calculation is that I cannot reconcile the March 31, 2021 book value per unit of $31,603 with the low in Q1 (the Q1 impairment).

Yes, it resets there cost basis. So when they sell, it is off the impaired lower value and the gain is higher.Does an impairment reset their cost basis? eg If BTC falls to 25K this quarter, then goes to 50K next quarter, would they then have a gain of $25K/coin if they sold?

I'm not an accountant, so sorry if this is a dumb question.

I was playing around with that scenario (bitcoin obtained from vehicle orders) as well but saw it couldn't work.Yeah, that was my problem as well. The only thing I could come up with is if they had received ~3,300 Bitcoins for vehicle orders near the $58k top, and only held ~38,769 Bitcoins at the Q1 impaired level. Doing the math that way would come out with a Q2 impairment of ~$118M.

But could they really have gotten paid ~$194M worth of Bitcoins in order fees during the little time they had it available as an option in Q1? The only way I could see that being possible is if there were more than 700 Roadster orders placed and they paid the whole $250k purchase price in Bitcoins upfront. (Where they even taking Bitcoins for Roadster orders?)

Does an impairment reset their cost basis? eg If BTC falls to 25K this quarter, then goes to 50K next quarter, would they then have a gain of $25K/coin if they sold?

Yeah, I guess they could have tested for large liquidity and then bought most of it back. But I would think they would have ended up with more than $127M of profit doing that.I was playing around with that scenario (bitcoin obtained from vehicle orders) as well but saw it couldn't work.

Another scenario was they sold to test liquidity (booking the gain) and later repurchased more in Feb/Mar in the 50k range. However, I think if they had done this they would likely have mentioned it in the 10Q.

Hats off to you on this one!@MP3Mike @st_lopes

See my new post above on the Bitcoin Impairment.

I believe I solved the puzzle. I was never able to solve the puzzle in the past looking a the lows of each day in January. I finally figured out that Tesla purchased on Jan 28 after the low of the day and was only subject to the impairment on a slight dip in price that day after they had purchased their bitcoin.

Yes - That's possible. The Q2 10Q will give us another data point to nail this down better.I do doubt that they bought, or sold

Our operating income improved in Q2 compared to the same period last year to $1.3B, resulting in an 11.0% operating margin. This profit level was reached while incurring SBC expense attributable to the 2018 CEO award of $176M in Q2, driven by a new operational milestone becoming probable. Operating income increased YoY mainly due to volume growth and cost reduction. Positive impacts were partially offset by growth in operating expenses including increased SBC, Model S/X ramp (negative margin in Q2), additional supply chain costs, lower regulatory credit revenue, Bitcoin-related impairment of $23M and other items.

So we know the price of BTC went down after they purchased it. The low price in Q1 for BTC was January 21st at about $28.9, let's assume that they purchased after that point. The next lowest point was on January 27th was about $29.3k. So they purchased between the 21st and 27th. (Which lines up with disclosure rules that they had to announce their BTC purchase within 4 days.) Making the 27th the low point in Q1 that they have already written the value down to.

So I have to revise my math now. 29.3k-28.8k= 0.5k loss per BTC. 0.5 * 42069 BTCs = $21M loss to recognize.