Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Papafox's Daily TSLA Trading Charts

- Thread starter Papafox

- Start date

-

- Tags

- elon is an ass TSLA

For June 14, www.shortvolume.com says Tesla shorts sold 50% of the shares today. That number suggests some mischief even on a "steamroller" day, and I suspect shorts were capping at 355 until they lost control and the stock ran higher.

pz1975

Active Member

This is definitely the best thread in the forum.

Well...second to the number 6 numerology thread of course.

Well...second to the number 6 numerology thread of course.

Today was the 5th green day in a row for TSLA and another big move upwards. As with previous big days, we saw a big run upwards shortly after opening, a decline from that peak brought about by profit-taker and/or shorts, and then various additional runs upward throughout the day. From about 1pm until about 3pm TSLA traded practically flat, which suggests to me that shorts were doing their best to cap TSLA below 355. By about 3:15pm it became apparent that the cap had been overpowered, and TSLA climbed for much of the next 45 minutes. Trading in the final minute of market hours amounted to 126,000 shares as shorts either covered to close or to reload after their efforts today.

What I find most interesting is that the upper bollinger band is climbing so vertically now that it is doing a good job of nearly keeping up with the stock. With the upper bb at 352.05 at close today, it is just a bit more than $5 below the SP. For all practical purposes, the upper bb has lost its relevance with such a steep climb underway. Points of resistance and Model 3 production ramp news are now the drivers for this rally. Why did the SP run up so furiously this week? I think it was merely the market trying to anticipate the good news with Model 3 ramping in June, which implies Tesla really can achieve GAAP profitability in Q3 and Q4. Once the run up began, no longs wanted to be left behind.

I include three separate rallies of TSLA below for the following time periods:

* April-October 2013

* June 2017

* June 2018

Let's see how they compare.

April-Oct 2013

The climb through about $60 (each of the horizontal grey lines refers to $50 of stock price) was at a moderately steep angle, and you can see how TSLA hugged the upper bb but mostly stayed within the bollinger bands. Then all hell broke loose on May 8, 2013, when Tesla reported GAAP profitability ($11 million) and TSLA started climbing at an angle that may even surpass this week's ascent, with frequent closings above the bollinger band for about 5 days (guessing by looking at chart) before it started some small downward consolidations then resumed significantly steep climbing within the top of the upper bb, with a few pops out the top.

Takeaway: the really steep climb for about 5 days after the GAAP profit announcement was so steep that the upper bb became irrelevant, just as we see this week, but the steep climb didn't last long before some consolidations began. May of 2013 is probably the best model of what we're seeing this week.

June 2017

Here is June of last year and TSLA climbed in a fashion that is much more predictable to me by popping above the upper bb for a few days in a row, experiencing a red day that brought it back inside the bb, and then resuming the climb until it eventually popped out the top and the process repeated itself.

Takeaway: This is a behavior that is typical of big rallies when the slope is more moderate and this is the model I was expecting to see TSLA follow this week. Instead, we are following the May of 2013 model.

June 2018

Finally, here is the current week's trading, which resembles May of 2013. How much of 2018's trading will resember 2013's? Standby. The catalyst for 2013's near-vertical climb was an announcement of GAAP profitability. The catalyst for 2018's near vertical climb is renewed confidence in Elon's stated expectations of GAAP profitability in Q3 and Q4.

What to expect for tomorrow? Much depends upon macros, news, and whether TSLA can eclipse 360. Expect a serious fight. If TSLA runs above, it will dishearten shorts and would likely lead to a nice run up from there as covering by shorts picks up steam. If it bounces hard off 360, look for a red day that will start a short consolidation into the bollinger bands, as we saw in 2013. After hours trading shows a decline of about 75 cents, which suggests concerns about the fight ahead tomorrow. For now, 2013 looks like it is our model.

Conditions:

* Dow down 26 (0.10%)

* NASDAQ up 65 (0.85%)

* TSLA 357.72, up 12.94 (3.75%)

* TSLA volume 10.8M shares

* Oil 66.97, up 0.08 (0.12%)

* Percentage of TSLA selling by shorts: 50%

Last edited:

jeewee3000

Active Member

I rarely post here to avoid interrupting the flow of your daily posts, but I just want to congratulate and thank you again for your thorough analysis.

If I am reading your post correctly and 2013 is indeed our model for the current SP rise, we are on our way to the $450 - $550 range. A rise of (only) 25% more and we are there. If Musk has planned this SP rise out a bit - as many posters in the Market thread seem to think - this should be doable by the end of July by announcing China GF specifics, reaching +5000/week Model 3 production, etc.

If this sounds too optimistic, the $450 - $550 range will be entered easily by early October if:

- M3 production keeps rising;

- the August autopilot update is on time and as good as Elon said it is;

- Q3 profitability is proven.

I don't want to sound like our most controversial bullish fellow poster, but a lot has to go wrong before the end of the year for us to return to below $300.

Not an advice, just personal opinion.

If I am reading your post correctly and 2013 is indeed our model for the current SP rise, we are on our way to the $450 - $550 range. A rise of (only) 25% more and we are there. If Musk has planned this SP rise out a bit - as many posters in the Market thread seem to think - this should be doable by the end of July by announcing China GF specifics, reaching +5000/week Model 3 production, etc.

If this sounds too optimistic, the $450 - $550 range will be entered easily by early October if:

- M3 production keeps rising;

- the August autopilot update is on time and as good as Elon said it is;

- Q3 profitability is proven.

I don't want to sound like our most controversial bullish fellow poster, but a lot has to go wrong before the end of the year for us to return to below $300.

Not an advice, just personal opinion.

I rarely post here to avoid interrupting the flow of your daily posts, but I just want to congratulate and thank you again for your thorough analysis.

If I am reading your post correctly and 2013 is indeed our model for the current SP rise, we are on our way to the $450 - $550 range. A rise of (only) 25% more and we are there. If Musk has planned this SP rise out a bit - as many posters in the Market thread seem to think - this should be doable by the end of July by announcing China GF specifics, reaching +5000/week Model 3 production, etc.

If this sounds too optimistic, the $450 - $550 range will be entered easily by early October if:

- M3 production keeps rising;

- the August autopilot update is on time and as good as Elon said it is;

- Q3 profitability is proven.

I don't want to sound like our most controversial bullish fellow poster, but a lot has to go wrong before the end of the year for us to return to below $300.

Not an advice, just personal opinion.

@jeewee3000, thanks for the kind words about the thread. My strengths are in analyzing the role short-sellers are playing in TSLA's SP movements and to look at fundamentals to see if our assumptions are on track. The high from this rally is going to be hard to nail down because with inevitable consolidations, it may be hard to say where this rally ends and the next begins. Further, issues such as gross margins and number of Model 3s delivered will determine how high this run goes. Let me just say that 450-550 is certainly not out of the question if you allow a stretch of this rally into 2019..

View attachment 310105

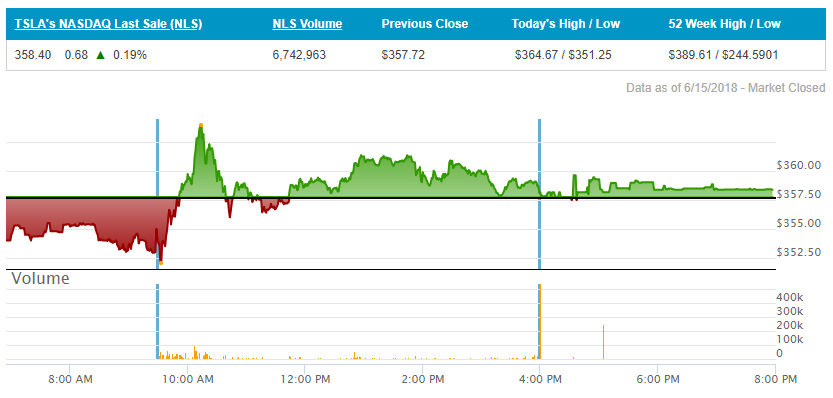

Today the battle for 360 raged at TSLA. Neither side won, and the battle will continue after the wounded are carried off the field this weekend. After a rather aggressive mandatory morning dip was dispatched, TSLA breached the defenses of the shorts and ran all the way up to 364 before being flanked and retreating behind the red/green hedgerow. The remainder of the day was forays above 360, followed by counterattacks of the "whack-a-mole" variety.. Please note that during the recent run-up, most important points of resistance required a capture, retreat, and a recapture on a different day before the objective could be held.In the final minute of market trading, over 533,000 shares changed hands, which suggests either covering or rearming by the shorts.

Looking at the technical chart, you can see that today's small gain allowed the upper bollinger band to retake the stock price. Although the upper bb is rather irrelevant during a week such as this, once the climb moderates, the upper bb is important again, and so it is nice to be inside again. Check out how many days in a row TSLA ran above the upper bb. I call this kind of climbing "going ballistic" since the upper bb has lost all relevance and has taken on a path far more vertical than horizontal.

For the week, TSLA closed at 358.17, up 40.51 from last Friday's.317.66.

* The previous 4 weeks had a progression of: up 2.03, up 12.97 and up 25.84. For the record, I don't think we're going to eclipse the 40.51 next week.Have a great weekend.

A comparison between the 2013-14 run up and the present SP run will be forthcoming within the hour, graphics loading permitted.

Conditions:

* Dow down 85 (0.34%)

* NASDAQ down 15 (0.19%)

* TSLA 358.17, up 0.45 (0.13%)

* TSLA volume 10.3M shares

* Oil 65.06, down 1.83 (2.74%)

* Percentage of selling by shorts: 49.9%

Today the battle for 360 raged at TSLA. Neither side won, and the battle will continue after the wounded are carried off the field this weekend. After a rather aggressive mandatory morning dip was dispatched, TSLA breached the defenses of the shorts and ran all the way up to 364 before being flanked and retreating behind the red/green hedgerow. The remainder of the day was forays above 360, followed by counterattacks of the "whack-a-mole" variety.. Please note that during the recent run-up, most important points of resistance required a capture, retreat, and a recapture on a different day before the objective could be held.In the final minute of market trading, over 533,000 shares changed hands, which suggests either covering or rearming by the shorts.

Looking at the technical chart, you can see that today's small gain allowed the upper bollinger band to retake the stock price. Although the upper bb is rather irrelevant during a week such as this, once the climb moderates, the upper bb is important again, and so it is nice to be inside again. Check out how many days in a row TSLA ran above the upper bb. I call this kind of climbing "going ballistic" since the upper bb has lost all relevance and has taken on a path far more vertical than horizontal.

For the week, TSLA closed at 358.17, up 40.51 from last Friday's.317.66.

* The previous 4 weeks had a progression of: up 2.03, up 12.97 and up 25.84. For the record, I don't think we're going to eclipse the 40.51 next week.Have a great weekend.

A comparison between the 2013-14 run up and the present SP run will be forthcoming within the hour, graphics loading permitted.

Conditions:

* Dow down 85 (0.34%)

* NASDAQ down 15 (0.19%)

* TSLA 358.17, up 0.45 (0.13%)

* TSLA volume 10.3M shares

* Oil 65.06, down 1.83 (2.74%)

* Percentage of selling by shorts: 49.9%

Last edited:

Please refer to the chart above in which I continue to compare the run up of 2013-14 with that of the present.

* Notice that the 2013-2014 SP chart and the 2018 chart have the same "zero" point and same scale. The price point "300" on the 2018 chart aligns with the 300 price line of the 2013-14 chart.

* In a few seconds of looking at the combined chart, you will realize that in 2018 we're pretty much continuing the TSLA SP climb that peaked in early 2014. A stockholder who was shipwrecked in March of 2014 could look at his TSLA portfolio in May 2018 and say, "Hmm, nothing has happened with my TSLA stock while I've been gone.".

* Much good has happened at TSLA without it being reflected in the SP during this time. Model X was introduced, debugged, and has become a strong revenue source. Stores, service centers, and superchargers have multiplied to make way for the Model 3 ramp up. Tesla energy, semi, and Roadster 2 have appeared. These are huge accomplishments, but without profitability, they have not yet raised the SP.

* The value of the false starts in which TSLA exceeded $380 on Model 3 excitement does offer value to shareholders, however, because it gives the market a reference point of where to begin valuing TSLA once the Model 3 ramp up is real and on target. Where it goes from there is another matter.

* Those runs marked "Ballistic" were so steep that the upper bb became momentarily irrelevant and I identify 2 in 2013-2014.

* Each "Ballistic" run was preceded by a "Pre-run" in which knowledgeable traders started bidding the SP up before the masses realized what had taken place. For 2018, this "Pre-run" took place in late May as TMC members and other "in the know" investors started bidding the SP up from the 270s to about 292.

* The first Pre-run/Ballistic combo of 2013-14 took place in April of 2013. The pre-run preceded the 1Q 13 ER in which profits were announced.

* The second combo of 13-14 took place around the 4Q ER, when greatly expanded Model S production, significant non-GAAP profits, and more than $40M of positive cash flow was announced.

* The combo of 2018 occurred as Elon convinced investors that TSLA would reach its Model 3 production target in June and that Q3 and Q4 remained poised for GAAP profitability. The pre-run took place when TMC forum investors plus others anticipated the run up.

* A sag took place between the 2013 run up and the 2014 run up and a similar sag could take place in 2018 should investors begin to doubt Elon's message about M3 ramping and Q3, Q4 profits or if Tesla fails to deliver these achievements close to schedule

* All of the enduring run ups at Tesla so far have been associated with production progress that led to improved profitability for the company. For this reason, the Q3 and Q4 profitability is an essential component of the Model 3 ramping in June. It's the combination of production, gross-margins for M3, and controlling other operating expenses that will bring the profitability.

Last edited:

TrendTrader007

Active Member

your analogy to 2013-2014 run up is correct. i have similar thoughts. looking at quarterly and monthly charts as well as weekly my best guess is that the price rise from $244.59 bottom in April 2018 to current is similar to rise from August 2012 bottom at $25,52 to Nov/Dec 2012 $35.80View attachment 310155

Please refer to the chart above in which I continue to compare the run up of 2013-14 with that of the present.

* Notice that the 2013-2014 SP chart and the 2018 chart have the same "zero" point and same scale. The price point "300" on the 2018 chart aligns with the 300 price line of the 2013-14 chart.

* In a few seconds of looking at the combined chart, you will realize that in 2018 we're pretty much continuing the TSLA SP climb that peaked in early 2014. A stockholder who was shipwrecked in March of 2014 could look at his TSLA portfolio in May 2018 and say, "Hmm, nothing has happened with my TSLA stock while I've been gone.".

* Much good has happened at TSLA without it being reflected in the SP during this time. Model X was introduced, debugged, and has become a strong revenue source. Stores, service centers, and superchargers have multiplied to make way for the Model 3 ramp up. Tesla energy, semi, and Roadster 2 have appeared. These are huge accomplishments, but without profitability, they have not yet raised the SP.

* The value of the false starts in which TSLA exceeded $380 on Model 3 excitement does offer value to shareholders, however, because it gives the market a reference point of where to begin valuing TSLA once the Model 3 ramp up is real and on target. Where it goes from there is another matter.

* Those runs marked "Ballistic" were so steep that the upper bb became momentarily irrelevant and I identify 2 in 2013-2014.

* Each "Ballistic" run was preceded by a "Pre-run" in which knowledgeable traders started bidding the SP up before the masses realized what had taken place. For 2018, this "Pre-run" took place in late May as TMC members and other "in the know" investors started bidding the SP up from the 270s to about 292.

* The first Pre-run/Ballistic combo of 2013-14 took place in April of 2013. The pre-run preceded the 1Q 13 ER in which profits were announced.

* The second combo of 13-14 took place around the 4Q ER, when greatly expanded Model S production, significant non-GAAP profits, and more than $40M of positive cash flow was announced.

* The combo of 2018 occurred as Elon convinced investors that TSLA would reach its Model 3 production target in June and that Q3 and Q4 remained poised for GAAP profitability. The pre-run took place when TMC forum investors plus others anticipated the run up.

* A sag took place between the 2013 run up and the 2014 run up and a similar sag could take place in 2018 should investors begin to doubt Elon's message about M3 ramping and Q3, Q4 profits or if Tesla fails to deliver these achievements close to schedule

* All of the enduring run ups at Tesla so far have been associated with production progress that led to improved profitability for the company. For this reason, the Q3 and Q4 profitability is an essential component of the Model 3 ramping in June. It's the combination of production, gross-margins for M3, and controlling other operating expenses that will bring the profitability.

however, this time the SP may rise even faster and more relentlessly in a parabolic fashion. it's a fool's errand to guess the eventual SP high but based on Jesse Livermore's Time Element concept i would give it another 7 months before a major pullback so end of December 2018. even that will be only a minor pause before the next leg starts.

those who are heavily leveraged and superlong $TSLA are about to become super rich by end of 2018 provided they do not lose their nerve and sell prematurely

So far this weekend, it looks like all systems are go for reaching 5,000 M3/wk before end of June. Originally I thought we'd see a dip Monday morning (after 6 green days in a row), but the news is positive enough over the weekened so that I wouldn't be surprised to see another green day on Monday.

Here's the electrek.co story about Elon's Saturday note to employees.in which he says 500/day is in the bag and shooting for 700/day. To reach a weekly rate of 5,000 Model 3s, Tesla would need to exceed 715/day, assuming factory running 7 days a week.

Additionally, the first performance Model 3 just rolled off the 4th Model 3 General Assembly line at the Fremont factory. The line is enclosed by a temporary tent-like structure. Let's hope that in the future Tesla can make the GA lines more efficient and reduce the number needed. For now, it looks like General Assembly is no longer a bottleneck.

For shorts, I have one short message this weekend, "tick, tick, tick."

Here's the electrek.co story about Elon's Saturday note to employees.in which he says 500/day is in the bag and shooting for 700/day. To reach a weekly rate of 5,000 Model 3s, Tesla would need to exceed 715/day, assuming factory running 7 days a week.

Additionally, the first performance Model 3 just rolled off the 4th Model 3 General Assembly line at the Fremont factory. The line is enclosed by a temporary tent-like structure. Let's hope that in the future Tesla can make the GA lines more efficient and reduce the number needed. For now, it looks like General Assembly is no longer a bottleneck.

For shorts, I have one short message this weekend, "tick, tick, tick."

your analogy to 2013-2014 run up is correct. i have similar thoughts. looking at quarterly and monthly charts as well as weekly my best guess is that the price rise from $244.59 bottom in April 2018 to current is similar to rise from August 2012 bottom at $25,52 to Nov/Dec 2012 $35.80

however, this time the SP may rise even faster and more relentlessly in a parabolic fashion. it's a fool's errand to guess the eventual SP high but based on Jesse Livermore's Time Element concept i would give it another 7 months before a major pullback so end of December 2018. even that will be only a minor pause before the next leg starts.

those who are heavily leveraged and superlong $TSLA are about to become super rich by end of 2018 provided they do not lose their nerve and sell prematurely

Yes, with so much potential room to run, it is easy to bail too early, expecting to buy back in after the next dip, only to find the stock still galloping upward at a rapid pace. We've waited 4 years after the early 2014 run up for Tesla to enter this next round of profitability. Neither Model X nor Tesla Energy turned Tesla around, but all these segments are now ready to help take Tesla to a whole new level as a business. Plus... look at us spitting distance from 360 and still towing a boatload of short-sellers along for the ride. There's no such thing as a zero-risk investment, risk is always there, but the stock price looks poised for epic future growth. I'll patiently sit out any consolidations because I know what's likely to come later this year and in 2019. At the same time, I'm watching the boards carefully, looking for anything that would be a threat to this rally. I think what separates now from the false-start runs to 380 and above is that those runs required much time and much work to reach a real Model 3 ramp up, with corresponding opportunities for disappointments. Time is now compressed with the ramp up happening at such a quick pace and the unknowns of Model 3 production, quality, and demand are no longer such unknowns to Tesla and to its investors.

Last edited:

neroden

Model S Owner and Frustrated Tesla Fan

I'm currently expecting a dip on Monday, because I think the weekend's news can be spun negatively. And frankly I think the paint shop problems may prevent getting to 5000/week by the end of June, because paint shop problems can be slow to fix.

P.S. Chart! Chart! Chart! I'm getting hooked on your daily charts!

P.S. Chart! Chart! Chart! I'm getting hooked on your daily charts!

I'm currently expecting a dip on Monday, because I think the weekend's news can be spun negatively. And frankly I think the paint shop problems may prevent getting to 5000/week by the end of June, because paint shop problems can be slow to fix.

P.S. Chart! Chart! Chart! I'm getting hooked on your daily charts!

Your point is well taken. Nothing is set in stone until it happens, and the paint shop could well be the most difficult bottleneck to solve prior to reaching 5,000/wk on M3. Let's say, though, that Tesla reports 4500/wk rate at end of June and Tesla says it needs another week or two to reach 5,000. Will the stock tank? Nope, because we're so close to 5,000/wk and sustained profitability. It comes down to playing the short term for a dip to buy back in cheaper vs. potentially missing another $25 up day if you play the dip. My feeling is that as long as Tesla has a clear path to profitability, it's better to let it ride than to play the dip. Solutions such as the tent-like building for M3 GA line 4 cost money and impact gross margin in the short run, but with M3 performance about to be built with huge margins, with huge numbers of vehicles being carried from Q2 to Q3, and with 9% fewer employees at Tesla, Q3 is still going to be very profitable and by the time we get to Q4 the lines will have been improved to the point that Q4 will show excellent returns as well.BTW, I am going to expect closer to 6K/wk M3 production in Q4, progressing higher as we get into 2019.

Last edited:

Hmm, I wouldn't bet against Elon in the next 3 weeks. Monday is going to be fun!

It's a shame this message came over the weekend, as we'll never know how Neroden's guess vs. Papafox's guess would have turned out without it.

Last edited:

neroden

Model S Owner and Frustrated Tesla Fan

You already know I'm a long-term investor only, no short-term plays for me.

Anyone for TSLA at 370? The wild rally continues. Over the weekend, a leaked email to Tesla employees revealed a few trouble spots in the ramp that would require substantial work, but Elon was still focused on 5K/wk production rate for M3. That news might have given shorts a reason for optimism but then Elon tweeted that shorts have about 3 weeks until their short position "explodes" and the momentum turned against the shorts. There are suggestions of a half-hearted attempt at a mandatory morning dip but once that was defeated, the rally roared like a hungry lion and TSLA closed a dozen dollars higher.

Such a rapid and extreme climb has led to substantial margin calls hitting many shorts now. One possible victim of the margin calls is Mark Speigel, who sold his stock (or was forced into a liquidation of a portion of his short position) and instead established a virtual short position with Jan20 200 strike puts. Other evidence of the shorts in turmoil is the level of buying in the final minute of market trading today: over 279,000 shares. Finally, selling by shorts dropped to a surprisingly-low 36.2%, according to FINRA data.

In the past week, two potential cases of sabotage by employees may have occurred. There was an unexplained fire that was put out before doing much damage, and Tesla caught an employee intentionally damaging its operations software code and sharing sensitive data with outsiders. Finally, an actress filmed a fire in her husband's Model S that she says had nothing to do with any accident. These events may negatively affect trading tomorrow, just as growing pressure on shorts was stoking the rally.

With Elon determined to crank up M3 to 5K/week production rate before month's end, and with an ominous warning to shorts about what will transpire in about 3 weeks, I'm not in a mood to try to play a dip and jump back in lower. This rally will recommence soon enough. In many ways we don't want to see the big exodus of shorts picking up too much steam quite yet (they've been exiting this past week) because this rally is mostly based upon speculation that Tesla is going to hit 5K M3s/wk soon and achieve 3Q and 4Q profitability. It would be far better for us longs for that 5K/wk rate to happen before the mass exodus picks up too much speed because it will then be based upon facts rather than speculation and the effect upon the stock price will be all the greater.

Looking at the technical chart, you can see the moderated climb in the "pre-run" trading which led to the big run that ran above the upper bollinger band and started the "going ballistic" portion of the rally. Today marks 7 days of green trading in a row for TSLA and a readjustment in SP that takes us to less than $20 below ATH.

Conditions:

* Dow down 103 (0.41%)

* NASDAQ up 1 (0.01%)

* TSLA 370.83, up 12.66 (3.535%)

* TSLA volume 11.7M shares

* Oil 65.60, down 0.25 (0.38%)

* Percentage of TSLA selling by shorts: 36.2%

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 21

- Views

- 6K

- Replies

- 6

- Views

- 1K

- Replies

- 1

- Views

- 307

- Article

- Replies

- 240

- Views

- 20K