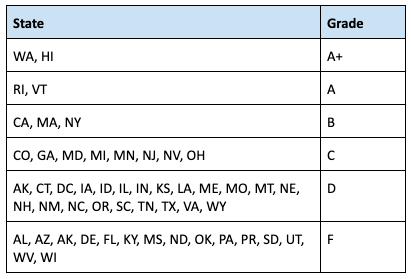

It’s more useful to just look at a map. Here is the latest Electrify America Cycle 1 map showing approximate charging locations planned to be operational by the end of this year.

View attachment 407472

No, there’s no delay — that was a screwup in the May 6 press release. I’ve been told it’s going to be corrected online soon (meaning probably in the next day or two).

They are still saying the same thing they have been saying for at least the last year or so which is that they will have all ~484 of the locations leased and “under development” by June 30 but won’t have them all fully constructed, energized by the utilities, and open for business until the end of this year.

I was at the media workshop at their HQ in Virginia a couple of weeks ago and wrote this:

Electrify America shows new mobile app, reveals new pricing plans

Yep. They recently rolled out a major software update to their sites which may fix some of the problems people have been having.

They still have some inconsistent site design issues with the local subcontractors they are using but those are typically issues that can be easily fixed such as concrete parking stops that keep cars from getting close enough.

They are installing longer cables at some sites and are also changing the rotation of the cables so they don’t have to be twisted as much when plugging into a car inlet. The recently updated site in Livermore in California, for example, is now much easier to use.

I’d say Tesla is averaging more like 9 charging spaces now where Electrify America is going to average about 5 in Cycle 1 for their highway sites. Obviously, some of Tesla’s sites are now 20 or even 40 charging spaces while Electrify America tops out now at 10 but they have hinted they might have a small number of sites with slightly more.

At the end of this year I’m guessing Tesla might have around 700-800 sites in the US (about 640 now). Electrify America will have close to 500 (with maybe a few Cycle 2 sites online).

But, Tesla’s sites are more evenly dispersed, have about twice the number of charging spaces on average, and overall will likely have 7,000-8,000 charging spaces in the US vs 2,000+ for Electrify America.

It’s too soon to compare electricity dispensing and utilization rates because right now there are still large gaps in EA’s network which inhibits long-distance road trips to many destinations. Also, there are fewer CCS cars on the road to use them. Drivers inclined toward road trips today are far more likely to have bought a Tesla. For local charging, many Tesla customers still have “free” Supercharging which encourages use.