mspohr

Well-Known Member

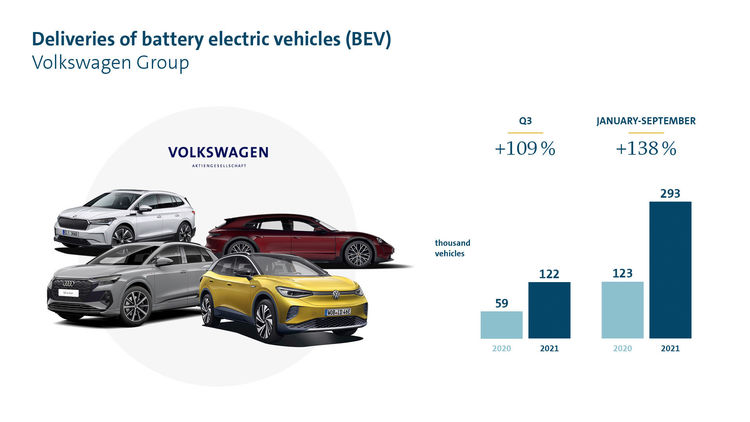

More on market share. Looks like Ford, GM, etc can get enough batteries. The problem seems to be that they are having problems making and selling EVs.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Interesting tidbit: Giga BB can start production within 2 hours of receiving permission.More on market share. Looks like Ford, GM, etc can get enough batteries. The problem seems to be that they are having problems making and selling EVs.

I like the $700B auto revenue target, 20M unit in 2030 @ $35k ASP. But I think this APS excludes FSD, which I would expect to have universal uptake by 2030, even if only for the reason that Tesla cars will be sold without steering wheels in 2030. So I think more realistically that an ASP inclusive of FSD is closer to $45k in 2030. Hence, $900B in new auto sales revenue.GM admits defeat

electrek.co

electrek.co

cleantechnica.com

cleantechnica.com

Single month is pretty useless. Should be quarterly, or at least rolling three month average.This is a very good chart for thinking about EV market share.

Tesla sold 74k cars in China in Q3, roughly 1.3% of the 5.75m total.Tesla has roughly a 2% share of China's domestic auto market (= 12% * 17%). It would nice to know what share of China's export auto market Tesla has.

www.visualcapitalist.com

www.visualcapitalist.com

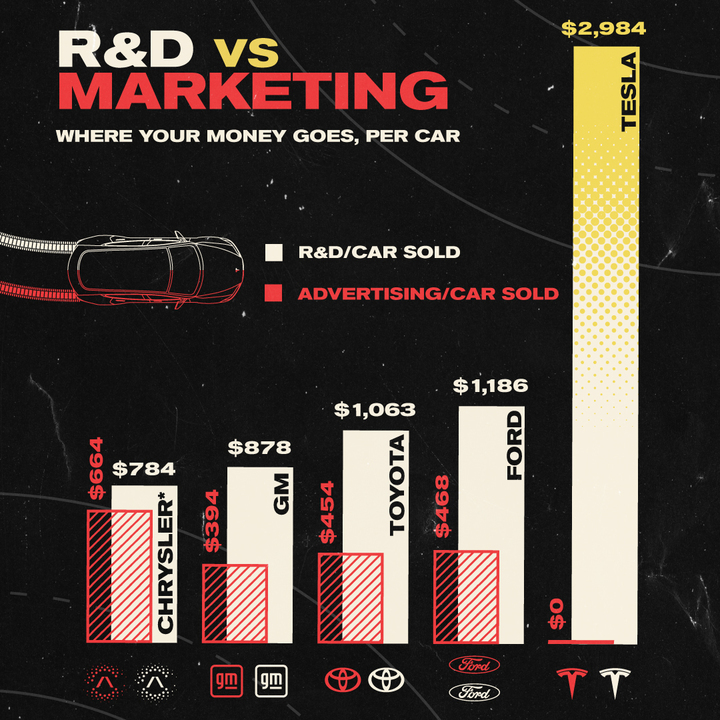

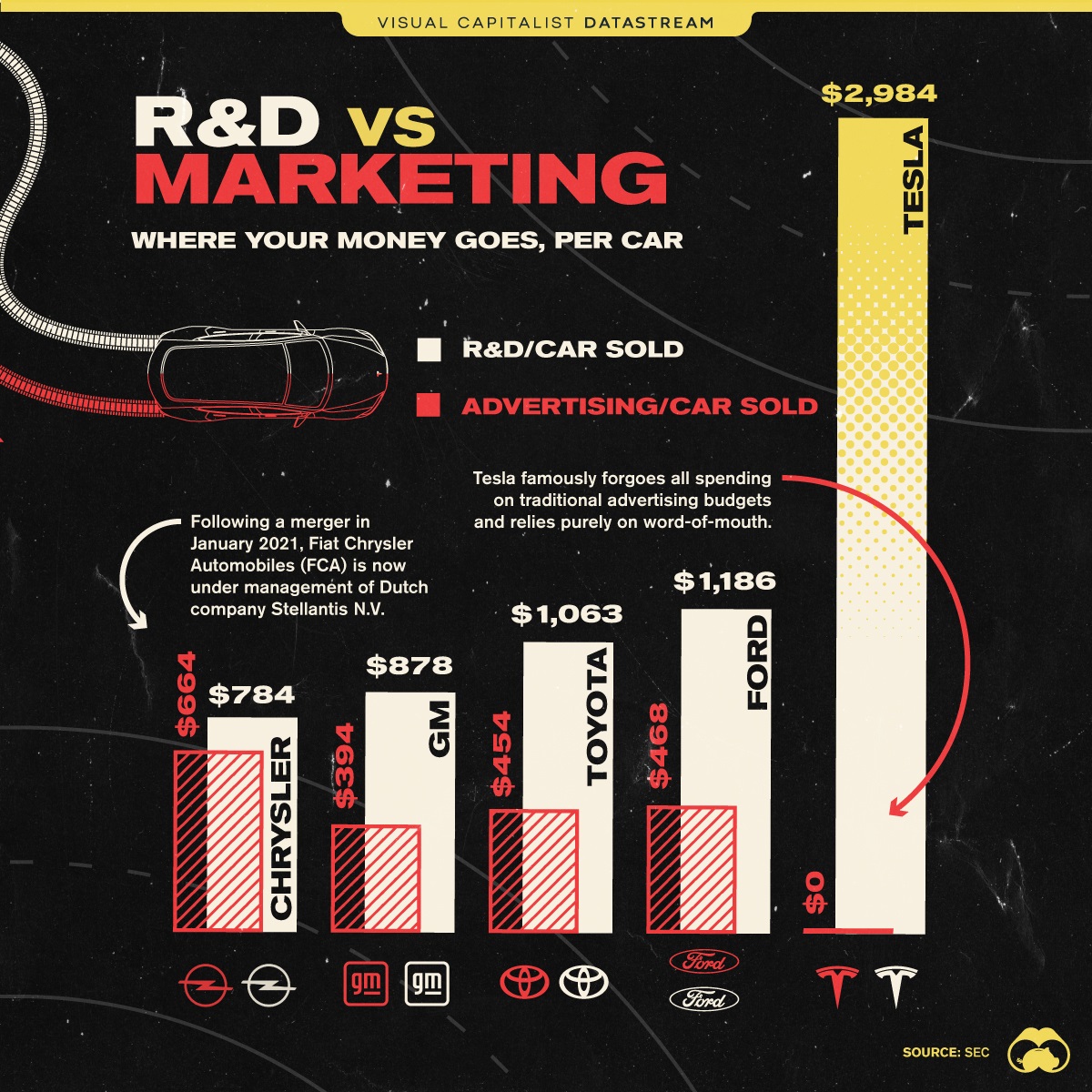

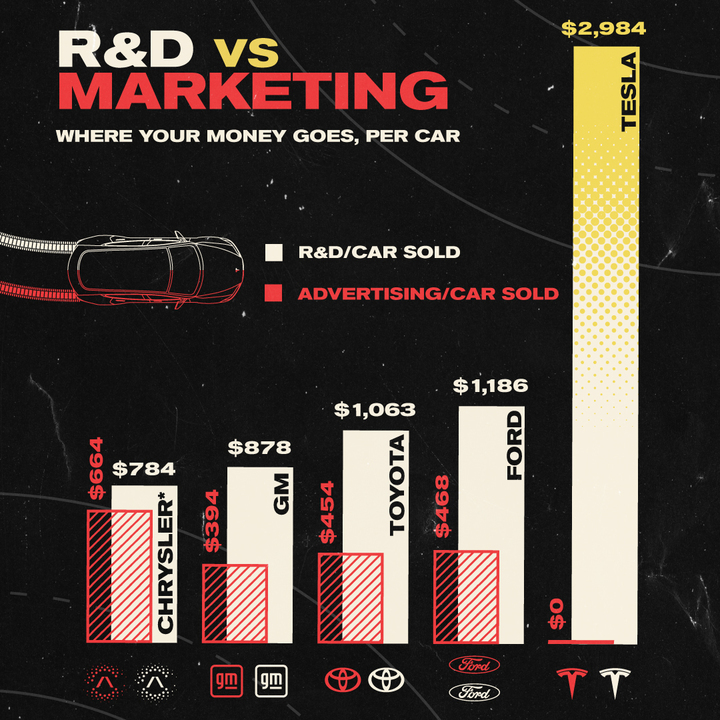

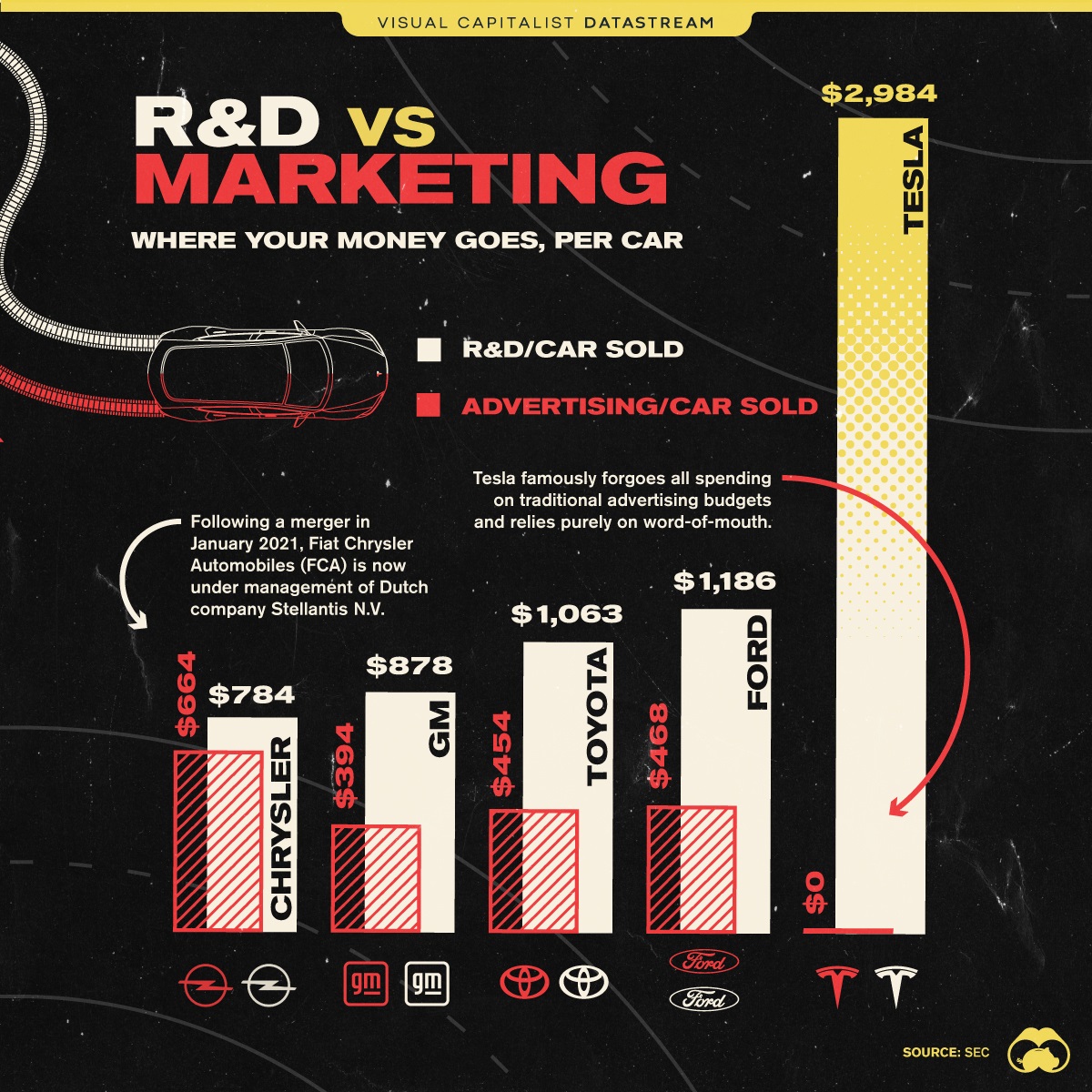

As volume increases, they can amortize RD over more cars.another competitive advantage for Tesla... $0 for marketing and $3K for R&D for every car sold.

Comparing Tesla’s Spending on R&D and Marketing Per Car to Other Automakers

How much does Tesla spend on a per car basis on innovation and marketing, compared to more traditional automakers?www.visualcapitalist.com

"It’s often said that word of mouth is the best form of advertising. In the case of Tesla and their rapid ascent to the top of the global automobile business, this might be true. After all, the electric vehicle company somehow manages to spend $0 on advertising year after year, despite the fact that marketing is typically a significant expense line item for most other auto manufacturers.

On the flip side, Tesla is spending an average of $2,984 per car sold on research and development (R&D)—often triple the amount of other traditional automakers. On this per vehicle sold basis, Tesla’s $2,984 in R&D spend per car is far greater than that of other car manufacturers. It’s even higher than the collective amount going to R&D per car from three of the other automakers (Ford, GM, and Chrysler) combined.

When it comes to advertising, the average spend among traditional automakers is $495 per vehicle. And while Tesla technically spends nothing on advertising, the company is a marketing machine that is rated as the world’s fastest growing brand, and Tesla often dominates press mentions and social media chatter."

As volume increases, they can amortize RD over more cars.

I am remarkably ok with big R&D cost / car for Tesla. It leaves me asking the question - where is the R&D going to come from that the other manufacturers need to be engaged in? They're being outspent pretty handily by their big competitor - where is the money they'll need to catch up? Which ignores the issue of whether they can hire the people they'd need for doing the work.another competitive advantage for Tesla... $0 for marketing and $3K for R&D for every car sold.

Comparing Tesla’s Spending on R&D and Marketing Per Car to Other Automakers

How much does Tesla spend on a per car basis on innovation and marketing, compared to more traditional automakers?www.visualcapitalist.com

"It’s often said that word of mouth is the best form of advertising. In the case of Tesla and their rapid ascent to the top of the global automobile business, this might be true. After all, the electric vehicle company somehow manages to spend $0 on advertising year after year, despite the fact that marketing is typically a significant expense line item for most other auto manufacturers.

On the flip side, Tesla is spending an average of $2,984 per car sold on research and development (R&D)—often triple the amount of other traditional automakers. On this per vehicle sold basis, Tesla’s $2,984 in R&D spend per car is far greater than that of other car manufacturers. It’s even higher than the collective amount going to R&D per car from three of the other automakers (Ford, GM, and Chrysler) combined.

When it comes to advertising, the average spend among traditional automakers is $495 per vehicle. And while Tesla technically spends nothing on advertising, the company is a marketing machine that is rated as the world’s fastest growing brand, and Tesla often dominates press mentions and social media chatter."

The ICEmakers are already deep in debt ($100 billion apiece). ICE car sales are falling. They aren't making a profit on their EVs. They are 5-10 years behind. They don't have EV expertise.I am remarkably ok with big R&D cost / car for Tesla. It leaves me asking the question - where is the R&D going to come from that the other manufacturers need to be engaged in? They're being outspent pretty handily by their big competitor - where is the money they'll need to catch up? Which ignores the issue of whether they can hire the people they'd need for doing the work.

That big R&D budget is another reason I see Tesla staying ahead of the rest of the pack

The ICEmakers are already deep in debt ($100 billion apiece). ICE car sales are falling. They aren't making a profit on their EVs. They are 5-10 years behind. They don't have EV expertise.

It doesn't look good.

I agree that they will increase RD for new products. They won't be investing much in existing products.. Just ramp up production. (They do seem to be investing in streamlining production. Gigapress, etc.True, but I also think that the total amount of R&D will also go up as Tesla expands into other categories.

The ICEmakers are already deep in debt ($100 billion apiece). ICE car sales are falling. They aren't making a profit on their EVs. They are 5-10 years behind. They don't have EV expertise.

It doesn't look good.