skitown

Member

I don't know that they pushed out the Semi target. From my re-reading, they only said they were not focused on Semi sales/ reservation numbers. Open to correction.

Well, they certainly pushed out the "Semi Range" target.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I don't know that they pushed out the Semi target. From my re-reading, they only said they were not focused on Semi sales/ reservation numbers. Open to correction.

The Semi wasn't even mentioned in the Q1 letter (seriously, do ctrl+f). The 10-Q now lists it as a pipeline project and does not give a firm date (quote below).I don't know that they pushed out the Semi target. From my re-reading, they only said they were not focused on Semi sales/ reservation numbers. Open to correction.

In addition, we have several future electric vehicles in our product pipeline, including those we unveiled in 2017 – an electric semi-truck and a new version of the Tesla Roadster.

You're correct. I only highlighted items that were known to be directly contradicted by what Tesla announced. Other items that Tesla's comment didn't directly contradict, I'm going to give Matt a pass.I don't know that they pushed out the Semi target. From my re-reading, they only said they were not focused on Semi sales/ reservation numbers. Open to correction.

You're correct. I only highlighted items that were known to be directly contradicted by what Tesla announced. Other items that Tesla's comment didn't directly contradict, I'm going to give Matt a pass.

I don’t know why people on dumping on MattEnth for posting this. It is useful information. It clearly shows why the bond markets are closed for Tesla right now, and why shorters are shorting. It also shows why the analysts on the call were so incredulous that Elon wasn’t going to raise money.

Ironically, I’ve been in Elon’s position before, just on a much, much smaller scale. I had raised $6m in our first VC round and deployed the cash rather rapidly. Thing is, I could easily see that we were going to bottom out with about $1m in the bank but the VCs, being financial money men (read: couldn’t run a company if their life depended on it), argued for a quick $10m second round. We never touched that money. We went public and raised $72m. Never touched that money either. I wasn’t the CEO anymore by that point for that bit of essentially financial malpractice. The point is that the CEO has the best view of what the company is going to need.

Elon is not an idiot, nor is Deepak. I have very little doubt they will manage their way around what looks like a liquidity problem. It isn’t as if they don’t know about it...

Matt, I won't argue with you. Just like your Q1 call, I will wait and see if your argument stand up in time.Erm, I'll defend and say the only "big ticket item" I missed on was Elon's backing down from Q3/Q4 profitability. And I'm still stunned that happened. I also missed on cash, though I still need to go through and figure out the relationships between cash and customer deposits (is Tesla using customer deposits for liquidity? or can we find enough evidence that they're specifically not doing that? Either would be interesting)

On the M3 ramp, I would argue that I was right. It seems to me like they certainly softened their commitment.

The first is a hard number with a fixed date. The latter is not.

- Q4 Letter: "5,000/week by the end of Q2"

- Q1 Letter: "approximately 5000/week in about 2 months."

The WSJ also reported that Tesla was making 325 cars per day just after the Q1 call, which comes out to 2275 per week. As far as I know, Tesla is yet to make 2500 Model 3s in a single week. The Q1 letter has 2270 as their record production.

They are more than a month behind February's production targets.

The Semi wasn't even mentioned in the Q1 letter (seriously, do ctrl+f). The 10-Q now lists it as a pipeline project and does not give a firm date (quote below).

The Model Y and Roadster also weren't mentioned in the Q1 letter.

The "about 2 months" thing is the same language that was used in the delivery report in early April. Of course it's a slight softening of the timeline in the Q4 letter, but it wasn't new for earnings.On the M3 ramp, I would argue that I was right. It seems to me like they certainly softened their commitment.

The first is a hard number with a fixed date. The latter is not.

- Q4 Letter: "5,000/week by the end of Q2"

- Q1 Letter: "approximately 5000/week in about 2 months."

I agree. Last night I drove my friend's new Model 3 (he ordered online, not previous owner). It's a great car. No identifiable manufacturing problems. He used to drive a Prius, and follows Tesla closely, but still was surprised at how wonderful the Model 3 is.

Rumblings in Chinese media of a large investment bank to build factories.

重磅:中国一家大型综合性集团,考虑深度入股美国特斯拉汽车_中原网

Tried posting it in the other thread (still needs moderator approval), but reposting here...

This is a company in financial distress. It makes Elon's statement that they won't raise capital all the more stunning.

- They delayed an 82.5M debt payment from February to August

- They have 30% of all cash overseas.

- They have -2.2B net working capital

- Their accounts payable (2.6B) is almost larger than their cash position (2.67B)

- They moved >50% of cash out of money market funds and into cash balance (around 930M still in money market, which is pretty close to customer deposits).

- They're planning 2.35B more in CapEx this year

- They amended their credit agreement to be able to lever Freemont

- Elon is personally approving every 1M+ expense

- They're cracking down on contractors

- They're being adversarial to their suppliers

- They have an upcoming company reorganization/restructure

- They've had significant turnover in their finance department in the months prior

Yeah, Galli is a class act. I wish I was as on top of things when I was 25. Instead I was chasing coeds.. wait NM i was working at 25, but still pretty clueless and chasing girls that where not in school anymore. But anyway, I hope my kids are more like Galli then like I was when I was 25. I had a good work ethic but was still just a wild child.God, could those Bloomberg interviewers have been any more condescending? They were almost laughing at him. The joke's on Bloomberg though. This may indeed be the start of a sea change in quarterly conference calls. We can only hope.

Yeah, Galli is a class act. I wish I was as on top of things when I was 25. Instead I was chasing coeds.. wait NM i was working at 25, but still pretty clueless and chasing girls that where not in school anymore. But anyway, I hope my kids are more like Galli then like I was when I was 25. I had a good work ethic but was still just a wild child.

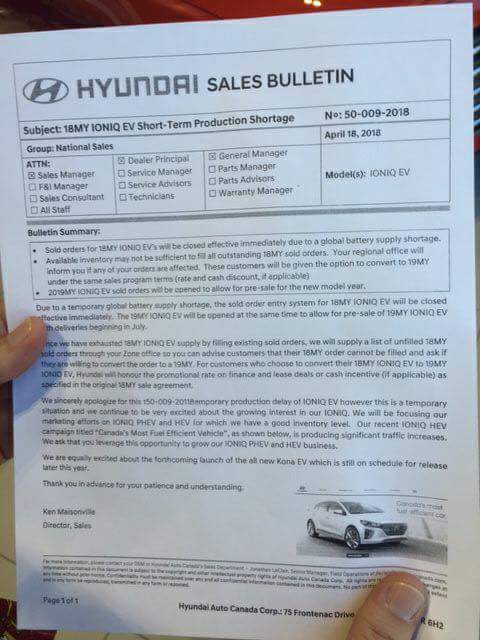

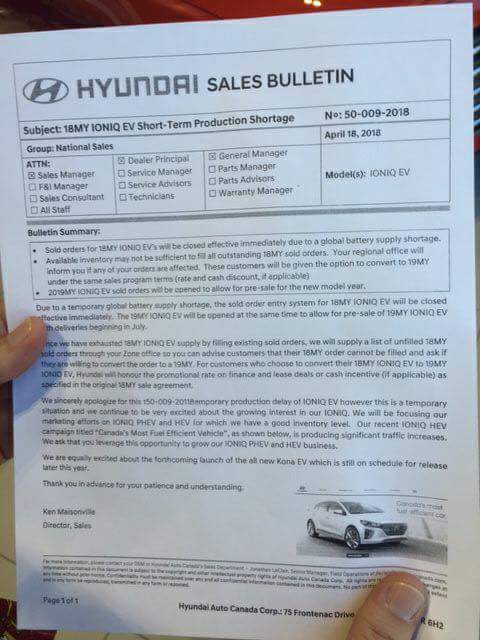

Battery shortage interrupts Hyundai Ioniq Electric sales

In a memo entitled "18My Ioniq EV Short-Term Production Shortage," which the reader provided to GCR, Hyundai Canada informed dealers that:

"Due to a temporary global battery supply shortage, the sold order entry system for 18MY Ioniq EV will be closed effective immediately. The 19MY Ioniq EV will be opened at the same time to allow for pre-sale of 19My Ioniq EV, with deliveries beginning in July."

I'm pretty sure he is proud to be a nerd. Elon is the king of the nerds. I only knowkbecause I am one as well.I saw that too! Pretty sad to treat a young man like that. Also was a title of article callin him a “nerd”. I wish I was half as mature as him at 25. My mane concern at 25 was where to go on date. He was the most prepared of any of the “Wall Street” experts. I give the young man great props and wish him nothing but the best. Hope this may help him propel whatever future endeavors he wants to pursue.