I published another article on Seeking Alpha about Tesla's demand in the long-term (2020). Here is the link: Analyzing Tesla's Demand And How It Will Drive The Stock - Tesla Motors (NASDAQ:TSLA) | Seeking Alpha

Here is the text (Because I know SeekingAlpha has a login wall):

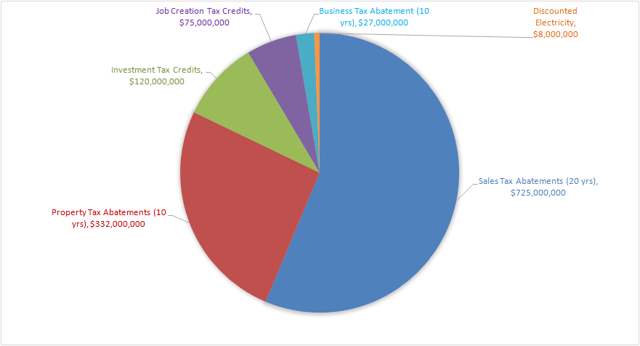

As Tesla (NASDAQ:TSLA) climbed over $280 per share in the first days of September, Lux Research released a report about Tesla's Gigafactory. The Gigafactory made news recently after Tesla announced that it would be built in Nevada. The state offered an incentive package worth $1.28 billion, with a breakdown like this:

(Source) (click to enlarge)

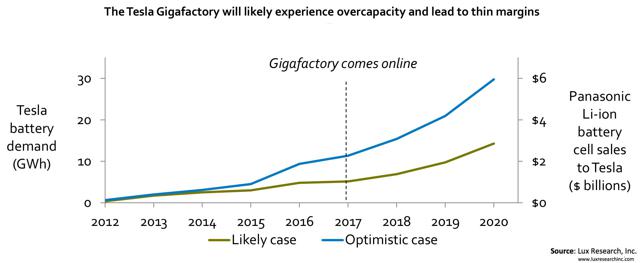

Previously, there were concerns about funding for the Gigafactory, and these concerns should be mitigated by this huge tax incentive package. But Lux Research brings up a different concern: overcapacity. According to Lux, Tesla will only be able to sell 240,000 vehicles in 2020, resulting in a 57% overcapacity in the Gigafactory. After publishing the report, the Lux Research Analyst went on Bloomberg TV to explain the reasoning behind the report. He said Lux predicts that in 2020, there will be 440,000 EVs sold globally, and that Lux assumed Tesla would take a little more than 50% market share with 240,000 vehicles.

There are multiple problems with Lux's assumptions. In 2013,220,000 electric vehicles were sold worldwide, whereas in 2012,120,000 electric vehicles were sold worldwide. This means that Lux is predicting that the growth in electric vehicle sales will slow down drastically from 85% to a measly 10.5% per year (average over the next 7 years). An even bigger flaw is the fact that Tesla's demand is not a function of overall electric vehicle sales. Tesla is a disruptor in the industry, as it is the first (and only) compelling electric vehicle that competes with gasoline vehicles in its class. In fact, Tesla outsold the Mercedes S-class, the second best selling car in its class, by almost 5,000 vehicles in 2013. Just like Apple in the smartphone market during 2007-2010, Tesla will probably remain a leader in the market due to competitive advantages that I laid out in my previousarticle. If Tesla does manage to do this, it is not unlikely that they will capture much more than 50% market share in 2020.

Lux Research also commented "The Gigafactory will only reduce the Tesla Model 3's cost by $2,800, not enough to sway the success of the planned lower-cost EV". This is inconsistent with other numbers in the report. According to their report, Tesla currently has a cost per kWh of $274, which is a lot less than the $397 that they predicted in 2012 for the 2020 timeframe. Here is the graph that Lux research provided:

(Source) (click to enlarge)

This graph shows a cost per kWh of $200, which goes along with Tesla's conservative estimates of 30% cost reduction in battery pack costs in 2017. These savings amount to much more than $2,800. Using the $274 per kWh estimate, Tesla's 60 kWh battery pack costs $16,440. If the Gigafactory gets costs down to $200 per kWh, then the 60 kWh battery pack would cost $12,000, which is already a savings of $4,440, and there are even further savings as the Model 3 will probably have a smaller battery pack due to its smaller size.

Lux Research's analysis is lacking because it bases its prediction of Tesla's demand on their ultra conservative prediction of total electric vehicle demand in 2020. Also, their numbers for battery savings are inconsistent throughout their report. On top of this, Lux Research predicted in 2012 that battery costs would reach $397 per kWh by 2020, and acknowledged in this report that Tesla's current battery costs are $274 per kWh, which is 30% less, 6 years ahead of time. Overall, it seems that Lux Research didn't do the job well. In order to better understand Tesla's high valuation, it is necessary to analyze and extrapolate Tesla's future demand properly.

Model S, Model X, Model 3, and How They Will Drive Demand

It is well known that on Seeking Alpha, authors often mistakenly talk about Tesla's current model, the Model S, having peaked demand (when in reality it is just peaked deliveries). Tesla has a constantly growing amount of customer deposits ($228 million in the last quarter), and over the last few months, wait times have been increasing (averaging 3 months in US, 4-5 months everywhere else). This shows that demand has not peaked unless Tesla is lying on their balance sheet about customer deposits and hiding cars in warehouses to artificially increase wait times.

Also, the phrase "peaked demand" implies that Tesla cannot generate any more demand. However, Tesla is currently opening stores at a very slow rate compared to Supercharger and Service Center expansion, has no budget for advertising, and has operations in only 14 countries. As Tesla ramps up production, they will come closer to being demand constrained, and when that happens, Tesla will be able to generate more demand simply by opening more stores, advertising, and expanding operations into more countries. Also, Model S demand can be increased by simply offering new features that many buyers need in order to be confident in purchasing the Model S. For example, Supercharging stations and destination chargers might drive demand as more and more of them open. Another possibility is that Tesla introduces an all-wheel drive version of the Model S, which would appeal to drivers in harsher climates, as well as drivers who like sporty vehicles (AWD would increase performance). With all of these future developments, the demand for the Model S could potentially grow to 70,000 units worldwide per year, which is a similar volume to the Mercedes S-Class and the Lexus LS. A base case for the Model S would be 55,000 units per year, which is on par with the BMW 7 series. If the Model S flops, a bearish case for its sales would be 35,000 units per year, which is a similar volume to the Mercedes CLS-class and the Audi A8, which are less successful models in the ultra-luxury sedan market.

Tesla is currently ramping up production of the Model S in order to shorten wait times as the Model X comes online and adds thousands of customers to the waitlist. Currently, the Model X has 20,510 reservations, and the count increases by about 40-45 per day. This rate will probably increase as Tesla reveals more about the Model X and offers test drives, and in all probability, the Model X will have 30,000+ reservations by the time it enters production. The Model X will lure many consumers as it will be one of the highest performing SUVs on the market. Other desirable features for consumers include higher safety, more cargo space, and unique doors. The Model X could potentially reach 100,000 units worldwide per year, which is a similar volume to the BMW X5 and the Mercedes M-Class. In the base case, the Model X would probably sell around 55,000 units per year, as demand is expected to be similar if not more than for the Model S. A bearish case for the Model X's sales would be 35,000 units per year, which is similar to the BMW X6 and Audi Q7 sales volumes, which are at the bottom of the market in the ultra-luxury SUV market.

Finally, the Model 3 will be the main driver of demand for Tesla. The Model 3 will be attractive to many buyers because it will be at the $35,000 price range, and after gasoline savings and maintenance savings, it could be comparable in cost to vehicles in the $25,000 price range, yet have the performance and luxury of vehicles that are in the $35,000 price range (if Tesla executes properly). Another reason that the Model 3 will have a strong allure is the fact that it will be an almost completely American made green vehicle due to the fact that Tesla is going to build its batteries in the Gigafactory which will be located in Nevada. The Model 3 could potentially sell in similar volumes to the BMW 3 series, which would be 500,000 units per year. A base case for Model 3 demand would be 400,000 units per year, which is competitive with the Audi A4 and the Mercedes C-Class. However, if the Model 3 doesn't live up to expectations, sales would still be high because it will be an electric car with a 200 mile driving range, and thus will be acceptable to many buyers. Based on this, a bearish case for the Model 3 is 150,000 units per year.

In total, if Tesla executes well and receives demand akin to the most successful models in their price range, Tesla has the potential to have demand of 670,000 cars in 2020, which would mean that Tesla would have to open a new assembly plant and not enter the battery storage business yet because of such large demand for their cars. In the base case, Tesla would be selling 510,000 units per year in 2020 as their Model S/X/3 compete with slightly less successful models in their respective price ranges. The base case is in line with what Tesla projects in 2020 currently.

However, Tesla could become a niche player, and the Model S/X/3 might only appeal to buyers because they are electric and environmentally sound. In this bearish case, Tesla would sell only 220,000 cars in 2020, which would be comparable to Porsche, which sold 165,808 cars in 2013. All three of these cases have some conservatism built in because the sales are based on sales of other models in 2013, and don't account for growth in automobile sales between 2013-2020. Also, all three cases are based on sales of other cars in the price range, however, electric cars are cheaper to operate, so shoppers in lower price ranges might step up. Furthermore, the cars on which these sales projections are based on are competitive in their price range because they offer superior performance, luxury, and/or safety. Because Tesla's cars are electric, their sales will get a boost from people who are concerned about the environment. Although these projections all seem overly ambitious, they actually have a variety of conservative assumptions built into them.

Competition

Although there is a very real possibility that Tesla will have competition, it is unlikely and will not take market share from Tesla. Competition is unlikely because Tesla is ahead of everyone else with their Supercharger network, and also because no other company has plans to build a Gigafactory that will allow it to reduce prices for their batteries and allow them to manufacture their cars on a mass scale. Also, even if other companies overcome these obstacles, their electric cars are more likely to take away market share from other ICEs rather than Tesla. In other words, if GM introduces an electric car that sells 200,000 units in that year, it is likely that most of the people who buy that car are switching from a gasoline car rather than a Tesla, which means the electric car market simply increased by 200,000 cars that year.

Tesla Motors Valuation

So what does each of these cases mean for Tesla's valuation? In all three cases an average selling price of $105,000 for Tesla's Model S and X and an average selling price of $45,000 for Tesla's Model 3 is fair. Also, for all three cases, an annual increase of 2% in the amount of shares is also a fair assumption, resulting in 140 million shares in 2020. Also, all three cases will assume an annual discount rate of 10%, and a tax rate of 25%.

The bearish case would result in $14.1 billion in revenues. Using an 8% operating margin would yield $1.128 billion in operating profits and $846 million in net profits. A P/E ratio of 25 is fair because Tesla will probably be expanding their model offering in order to try to maximize production in their factory. This results in a market capitalization of $21.15 billion, which is a per share price of $151 in 2020. Discounted back to 2014, this translates into a share price of $85, which represents a 66.5% downside from today's price.

The base case would result in $29.55 billion in revenues. Using a 15% operating margin would yield $4.433 billion in operating profits and $3.325 billion in net profits. A P/E ratio of 20 is fair because Tesla will probably have accomplished most of their growth, but will still be growing faster than the rest of the industry. This results in a market capitalization of $66.49 billion, which is a per share price of $475. Discounted back to 2014, this translates into a share price of $268, which represents a 5.5% upside from today's price.

The bullish case would result in $40.35 billion in revenues. Using a 15% operating margin would yield $6.053 billion in operating profits and $4.539 billion in net profits. A P/E ratio of 20 is fair because Tesla will still be expanding their selection of models and will be entering the stationary storage business. This results in a market capitalization of $90.788 billion, which is a per share price of $648. Discounted back to 2014, this translates into a share price of $366, which represents a 44% upside from today's price.

The Risks

The potential is high for Tesla, but it comes with a fair share of risks. If Tesla fails to keep consumers attention as they release new models, or they do not execute as well as they had with the Model S, they will probably end up in the bearish case. But these are moderate risks that are accounted for in the valuation model. However, there are larger risks that could damage the company severely enough to force Tesla into bankruptcy. For example, if Tesla continues to ramp up expenses, but production ramp up stutters, then Tesla could burn through their cash and be forced to file bankruptcy. Also, Tesla has a risk of facing recalls like all other auto manufacturers, and this could damage the company's finances. Also, another problem could be more states making it illegal to sell directly. Consumers may not want to adopt online ordering of cars, and thus Tesla would not be able to sell through stores and struggle to sell online.

These risks are unusual events, and should not be priced into the stock because they are dependent on Tesla's own execution. Tesla has been executing well, therefore these events shouldn't be priced in. On top of that, these unusual events are negative risks, and for lack of a better word, positive risks exist as well. For example, Tesla might become the leader of electric car development by producing batteries, developing drivetrains for other manufacturers, and selling rights to use their charging networks. Tesla can also potentially strike gold in the stationary storage business, or sell even more cars than the bullish case in this model. But these events are also unlikely in the 2020 timeframe, or at least there is no clear path laid out publicly. Just like the negative risks, these events should not be priced into the stock until there is a clear path towards them.

Conclusion

The Lux Research report did not do sufficient research and extrapolation and did not gauge Tesla's potential demand properly. Gauging Tesla's demand must be done by comparing it to ICE cars in the price range and extrapolating sales from that data. Next, we take the cars that are doing the best in those markets and take the cars that are doing the worst in those markets as bullish and bearish cases for Tesla's models. The bearish case is that Tesla will be selling 220,000 cars in 2020 and will become a niche player like Porsche with a $21.15 billion market cap. The base case is that Tesla will be selling 510,000 cars in 2020 and will become a premium automaker like BMW with a $66.49 billion market cap. The bullish case is that Tesla will be selling 670,000 cars in 2020 and will become a high volume premium automaker like Daimler with a $90.79 billion market cap. Although Tesla faces many risks, they should not be priced into the stock, just like surprise revenue streams shouldn't be priced into the stock.

Here is the text (Because I know SeekingAlpha has a login wall):

- Lux Research's predictions regarding Tesla's demand shows a lack of research and extrapolation, and is based on assumptions on how the rest of the EV market will do.

- The Model X already has 20k pre-orders and is growing at a rate of 40-45 per day. The Model S "refresh" and Model 3 release will generate even more demand.

- Tesla's valuation is based on Tesla being able to achieve their targets for 2020, and will remain that way until Tesla gives investors a reason to be less confident.

- Although Tesla will likely not have a demand problem for a long time, there could be problems with ramping up production, recalls, and not being able to sell directly.

- Tesla will not have a serious threat from competition until the competition develops a fast charging network as well as a Gigafactory that allows them to mass produce batteries cheaply.

As Tesla (NASDAQ:TSLA) climbed over $280 per share in the first days of September, Lux Research released a report about Tesla's Gigafactory. The Gigafactory made news recently after Tesla announced that it would be built in Nevada. The state offered an incentive package worth $1.28 billion, with a breakdown like this:

(Source) (click to enlarge)

Previously, there were concerns about funding for the Gigafactory, and these concerns should be mitigated by this huge tax incentive package. But Lux Research brings up a different concern: overcapacity. According to Lux, Tesla will only be able to sell 240,000 vehicles in 2020, resulting in a 57% overcapacity in the Gigafactory. After publishing the report, the Lux Research Analyst went on Bloomberg TV to explain the reasoning behind the report. He said Lux predicts that in 2020, there will be 440,000 EVs sold globally, and that Lux assumed Tesla would take a little more than 50% market share with 240,000 vehicles.

There are multiple problems with Lux's assumptions. In 2013,220,000 electric vehicles were sold worldwide, whereas in 2012,120,000 electric vehicles were sold worldwide. This means that Lux is predicting that the growth in electric vehicle sales will slow down drastically from 85% to a measly 10.5% per year (average over the next 7 years). An even bigger flaw is the fact that Tesla's demand is not a function of overall electric vehicle sales. Tesla is a disruptor in the industry, as it is the first (and only) compelling electric vehicle that competes with gasoline vehicles in its class. In fact, Tesla outsold the Mercedes S-class, the second best selling car in its class, by almost 5,000 vehicles in 2013. Just like Apple in the smartphone market during 2007-2010, Tesla will probably remain a leader in the market due to competitive advantages that I laid out in my previousarticle. If Tesla does manage to do this, it is not unlikely that they will capture much more than 50% market share in 2020.

Lux Research also commented "The Gigafactory will only reduce the Tesla Model 3's cost by $2,800, not enough to sway the success of the planned lower-cost EV". This is inconsistent with other numbers in the report. According to their report, Tesla currently has a cost per kWh of $274, which is a lot less than the $397 that they predicted in 2012 for the 2020 timeframe. Here is the graph that Lux research provided:

(Source) (click to enlarge)

This graph shows a cost per kWh of $200, which goes along with Tesla's conservative estimates of 30% cost reduction in battery pack costs in 2017. These savings amount to much more than $2,800. Using the $274 per kWh estimate, Tesla's 60 kWh battery pack costs $16,440. If the Gigafactory gets costs down to $200 per kWh, then the 60 kWh battery pack would cost $12,000, which is already a savings of $4,440, and there are even further savings as the Model 3 will probably have a smaller battery pack due to its smaller size.

Lux Research's analysis is lacking because it bases its prediction of Tesla's demand on their ultra conservative prediction of total electric vehicle demand in 2020. Also, their numbers for battery savings are inconsistent throughout their report. On top of this, Lux Research predicted in 2012 that battery costs would reach $397 per kWh by 2020, and acknowledged in this report that Tesla's current battery costs are $274 per kWh, which is 30% less, 6 years ahead of time. Overall, it seems that Lux Research didn't do the job well. In order to better understand Tesla's high valuation, it is necessary to analyze and extrapolate Tesla's future demand properly.

Model S, Model X, Model 3, and How They Will Drive Demand

It is well known that on Seeking Alpha, authors often mistakenly talk about Tesla's current model, the Model S, having peaked demand (when in reality it is just peaked deliveries). Tesla has a constantly growing amount of customer deposits ($228 million in the last quarter), and over the last few months, wait times have been increasing (averaging 3 months in US, 4-5 months everywhere else). This shows that demand has not peaked unless Tesla is lying on their balance sheet about customer deposits and hiding cars in warehouses to artificially increase wait times.

Also, the phrase "peaked demand" implies that Tesla cannot generate any more demand. However, Tesla is currently opening stores at a very slow rate compared to Supercharger and Service Center expansion, has no budget for advertising, and has operations in only 14 countries. As Tesla ramps up production, they will come closer to being demand constrained, and when that happens, Tesla will be able to generate more demand simply by opening more stores, advertising, and expanding operations into more countries. Also, Model S demand can be increased by simply offering new features that many buyers need in order to be confident in purchasing the Model S. For example, Supercharging stations and destination chargers might drive demand as more and more of them open. Another possibility is that Tesla introduces an all-wheel drive version of the Model S, which would appeal to drivers in harsher climates, as well as drivers who like sporty vehicles (AWD would increase performance). With all of these future developments, the demand for the Model S could potentially grow to 70,000 units worldwide per year, which is a similar volume to the Mercedes S-Class and the Lexus LS. A base case for the Model S would be 55,000 units per year, which is on par with the BMW 7 series. If the Model S flops, a bearish case for its sales would be 35,000 units per year, which is a similar volume to the Mercedes CLS-class and the Audi A8, which are less successful models in the ultra-luxury sedan market.

Tesla is currently ramping up production of the Model S in order to shorten wait times as the Model X comes online and adds thousands of customers to the waitlist. Currently, the Model X has 20,510 reservations, and the count increases by about 40-45 per day. This rate will probably increase as Tesla reveals more about the Model X and offers test drives, and in all probability, the Model X will have 30,000+ reservations by the time it enters production. The Model X will lure many consumers as it will be one of the highest performing SUVs on the market. Other desirable features for consumers include higher safety, more cargo space, and unique doors. The Model X could potentially reach 100,000 units worldwide per year, which is a similar volume to the BMW X5 and the Mercedes M-Class. In the base case, the Model X would probably sell around 55,000 units per year, as demand is expected to be similar if not more than for the Model S. A bearish case for the Model X's sales would be 35,000 units per year, which is similar to the BMW X6 and Audi Q7 sales volumes, which are at the bottom of the market in the ultra-luxury SUV market.

Finally, the Model 3 will be the main driver of demand for Tesla. The Model 3 will be attractive to many buyers because it will be at the $35,000 price range, and after gasoline savings and maintenance savings, it could be comparable in cost to vehicles in the $25,000 price range, yet have the performance and luxury of vehicles that are in the $35,000 price range (if Tesla executes properly). Another reason that the Model 3 will have a strong allure is the fact that it will be an almost completely American made green vehicle due to the fact that Tesla is going to build its batteries in the Gigafactory which will be located in Nevada. The Model 3 could potentially sell in similar volumes to the BMW 3 series, which would be 500,000 units per year. A base case for Model 3 demand would be 400,000 units per year, which is competitive with the Audi A4 and the Mercedes C-Class. However, if the Model 3 doesn't live up to expectations, sales would still be high because it will be an electric car with a 200 mile driving range, and thus will be acceptable to many buyers. Based on this, a bearish case for the Model 3 is 150,000 units per year.

In total, if Tesla executes well and receives demand akin to the most successful models in their price range, Tesla has the potential to have demand of 670,000 cars in 2020, which would mean that Tesla would have to open a new assembly plant and not enter the battery storage business yet because of such large demand for their cars. In the base case, Tesla would be selling 510,000 units per year in 2020 as their Model S/X/3 compete with slightly less successful models in their respective price ranges. The base case is in line with what Tesla projects in 2020 currently.

However, Tesla could become a niche player, and the Model S/X/3 might only appeal to buyers because they are electric and environmentally sound. In this bearish case, Tesla would sell only 220,000 cars in 2020, which would be comparable to Porsche, which sold 165,808 cars in 2013. All three of these cases have some conservatism built in because the sales are based on sales of other models in 2013, and don't account for growth in automobile sales between 2013-2020. Also, all three cases are based on sales of other cars in the price range, however, electric cars are cheaper to operate, so shoppers in lower price ranges might step up. Furthermore, the cars on which these sales projections are based on are competitive in their price range because they offer superior performance, luxury, and/or safety. Because Tesla's cars are electric, their sales will get a boost from people who are concerned about the environment. Although these projections all seem overly ambitious, they actually have a variety of conservative assumptions built into them.

Competition

Although there is a very real possibility that Tesla will have competition, it is unlikely and will not take market share from Tesla. Competition is unlikely because Tesla is ahead of everyone else with their Supercharger network, and also because no other company has plans to build a Gigafactory that will allow it to reduce prices for their batteries and allow them to manufacture their cars on a mass scale. Also, even if other companies overcome these obstacles, their electric cars are more likely to take away market share from other ICEs rather than Tesla. In other words, if GM introduces an electric car that sells 200,000 units in that year, it is likely that most of the people who buy that car are switching from a gasoline car rather than a Tesla, which means the electric car market simply increased by 200,000 cars that year.

Tesla Motors Valuation

So what does each of these cases mean for Tesla's valuation? In all three cases an average selling price of $105,000 for Tesla's Model S and X and an average selling price of $45,000 for Tesla's Model 3 is fair. Also, for all three cases, an annual increase of 2% in the amount of shares is also a fair assumption, resulting in 140 million shares in 2020. Also, all three cases will assume an annual discount rate of 10%, and a tax rate of 25%.

The bearish case would result in $14.1 billion in revenues. Using an 8% operating margin would yield $1.128 billion in operating profits and $846 million in net profits. A P/E ratio of 25 is fair because Tesla will probably be expanding their model offering in order to try to maximize production in their factory. This results in a market capitalization of $21.15 billion, which is a per share price of $151 in 2020. Discounted back to 2014, this translates into a share price of $85, which represents a 66.5% downside from today's price.

The base case would result in $29.55 billion in revenues. Using a 15% operating margin would yield $4.433 billion in operating profits and $3.325 billion in net profits. A P/E ratio of 20 is fair because Tesla will probably have accomplished most of their growth, but will still be growing faster than the rest of the industry. This results in a market capitalization of $66.49 billion, which is a per share price of $475. Discounted back to 2014, this translates into a share price of $268, which represents a 5.5% upside from today's price.

The bullish case would result in $40.35 billion in revenues. Using a 15% operating margin would yield $6.053 billion in operating profits and $4.539 billion in net profits. A P/E ratio of 20 is fair because Tesla will still be expanding their selection of models and will be entering the stationary storage business. This results in a market capitalization of $90.788 billion, which is a per share price of $648. Discounted back to 2014, this translates into a share price of $366, which represents a 44% upside from today's price.

The Risks

The potential is high for Tesla, but it comes with a fair share of risks. If Tesla fails to keep consumers attention as they release new models, or they do not execute as well as they had with the Model S, they will probably end up in the bearish case. But these are moderate risks that are accounted for in the valuation model. However, there are larger risks that could damage the company severely enough to force Tesla into bankruptcy. For example, if Tesla continues to ramp up expenses, but production ramp up stutters, then Tesla could burn through their cash and be forced to file bankruptcy. Also, Tesla has a risk of facing recalls like all other auto manufacturers, and this could damage the company's finances. Also, another problem could be more states making it illegal to sell directly. Consumers may not want to adopt online ordering of cars, and thus Tesla would not be able to sell through stores and struggle to sell online.

These risks are unusual events, and should not be priced into the stock because they are dependent on Tesla's own execution. Tesla has been executing well, therefore these events shouldn't be priced in. On top of that, these unusual events are negative risks, and for lack of a better word, positive risks exist as well. For example, Tesla might become the leader of electric car development by producing batteries, developing drivetrains for other manufacturers, and selling rights to use their charging networks. Tesla can also potentially strike gold in the stationary storage business, or sell even more cars than the bullish case in this model. But these events are also unlikely in the 2020 timeframe, or at least there is no clear path laid out publicly. Just like the negative risks, these events should not be priced into the stock until there is a clear path towards them.

Conclusion

The Lux Research report did not do sufficient research and extrapolation and did not gauge Tesla's potential demand properly. Gauging Tesla's demand must be done by comparing it to ICE cars in the price range and extrapolating sales from that data. Next, we take the cars that are doing the best in those markets and take the cars that are doing the worst in those markets as bullish and bearish cases for Tesla's models. The bearish case is that Tesla will be selling 220,000 cars in 2020 and will become a niche player like Porsche with a $21.15 billion market cap. The base case is that Tesla will be selling 510,000 cars in 2020 and will become a premium automaker like BMW with a $66.49 billion market cap. The bullish case is that Tesla will be selling 670,000 cars in 2020 and will become a high volume premium automaker like Daimler with a $90.79 billion market cap. Although Tesla faces many risks, they should not be priced into the stock, just like surprise revenue streams shouldn't be priced into the stock.