Help! Any advice on how best to sell my X. It was delivered in April this year for my wife's birthday but we want to downsize to a Model 3 and must sell this first. Like brand new with only 7k miles. Ready to sell but firm on price of $79,500. This is like buying the car and getting the upgraded paint and enhanced autopilot free. Located in Vancouver Washington so easy delivery to anywhere on the west coast from Northern California to Vancouver BC. Any advice or serious buyers are welcome. Thank you Tesla family! Text or call me 8016617886. York

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Super_Popular

Well-Known Member

There is a For Sale section on this site.

Help! Any advice on how best to sell my X. It was delivered in April this year for my wife's birthday but we want to downsize to a Model 3 and must sell this first. Like brand new with only 7k miles. Ready to sell but firm on price of $79,500. This is like buying the car and getting the upgraded paint and enhanced autopilot free. Located in Vancouver Washington so easy delivery to anywhere on the west coast from Northern California to Vancouver BC. Any advice or serious buyers are welcome. Thank you Tesla family! Text or call me 8016617886. York

Does anyone wanna tell him?

rocketshipp85

Member

It appreciated even more if he got a state incentive. Seems like a great dealSo your cost was $79,200 after the tax credit. After driving 7,000 miles it appreciated $300. Nice.

So your cost was $79,200 after the tax credit. After driving 7,000 miles it appreciated $300. Nice.

welcomewagon

Member

Devil's advocate here. I get why everyone tries to factor in the tax credit to say that you didn't really pay that much, but that doesn't really make sense does it? You still bought an item worth x amount of dollars, regardless of whether someone gives you a rebate for part of it or not.

Take the Model X for instance. People are claiming business use of the vehicle and essentially writing off 50% of the purchase price. If someone tried to sell a $120k 100D, would you be all upset and only offer them $60k?

Take the Model X for instance. People are claiming business use of the vehicle and essentially writing off 50% of the purchase price. If someone tried to sell a $120k 100D, would you be all upset and only offer them $60k?

Super_Popular

Well-Known Member

Anyone from this site or anyone familiar with Tesla that buys a fairly new Tesla will want the tax credit deducted. It's just a fact.

Devil's advocate here. I get why everyone tries to factor in the tax credit to say that you didn't really pay that much, but that doesn't really make sense does it? You still bought an item worth x amount of dollars, regardless of whether someone gives you a rebate for part of it or not.

Take the Model X for instance. People are claiming business use of the vehicle and essentially writing off 50% of the purchase price. If someone tried to sell a $120k 100D, would you be all upset and only offer them $60k?

In general if folks place a “for sale” on a Tesla forum they will definitely get some critical feedback

robby

Member

Devil's advocate here. I get why everyone tries to factor in the tax credit to say that you didn't really pay that much, but that doesn't really make sense does it? You still bought an item worth x amount of dollars, regardless of whether someone gives you a rebate for part of it or not.

Take the Model X for instance. People are claiming business use of the vehicle and essentially writing off 50% of the purchase price. If someone tried to sell a $120k 100D, would you be all upset and only offer them $60k?

It's not that folks are upset; it just doesn't make any economic sense for a buyer to pay OP's asking price when they can get the same tax credit that OP got on a new vehicle. The X example is different -- not everyone owns a $100k/year+ business that can buy the vehicle and use the write-off, so there is a genuine arbitrage opportunity there.

Devil's advocate here. I get why everyone tries to factor in the tax credit to say that you didn't really pay that much, but that doesn't really make sense does it? You still bought an item worth x amount of dollars, regardless of whether someone gives you a rebate for part of it or not.

Take the Model X for instance. People are claiming business use of the vehicle and essentially writing off 50% of the purchase price. If someone tried to sell a $120k 100D, would you be all upset and only offer them $60k?

Its not about the offer. Its about the fact someone can buy a brand new Model X with that same exact configuration for less money, especially with the tax credit. So why someone would pay more money for a used car is baffling.

Devil's advocate here. I get why everyone tries to factor in the tax credit to say that you didn't really pay that much, but that doesn't really make sense does it? You still bought an item worth x amount of dollars, regardless of whether someone gives you a rebate for part of it or not.

Take the Model X for instance. People are claiming business use of the vehicle and essentially writing off 50% of the purchase price. If someone tried to sell a $120k 100D, would you be all upset and only offer them $60k?

Technically they would have to claim the 50% as recaptured income and be taxed on it if they sold it right away as they didnt keep it for 5 years.

Also since the credit is still available to everyone you can buy new for the same price or less. So the actual value of a new car is 7500 less than msrp. At least until the end of the year. So why would someone buy used for same .

Unfortunately this is how the used market goes for Tesla. We actually learned that from Tesla itself as they'd gladly take back your 1-day old new car by deducting 7500 at minimum if you decided to trade in to get the latest and greatest. They are very upfront about this deduction whenever they have to "buy" a Tesla.Devil's advocate here. I get why everyone tries to factor in the tax credit to say that you didn't really pay that much, but that doesn't really make sense does it? You still bought an item worth x amount of dollars, regardless of whether someone gives you a rebate for part of it or not.

Take the Model X for instance. People are claiming business use of the vehicle and essentially writing off 50% of the purchase price. If someone tried to sell a $120k 100D, would you be all upset and only offer them $60k?

testarossa

Member

That section 179 "loophole" is a slippery slope, and an invitation for the IRS to start snooping. Bonus depreciation is $25k on the first year and god forbid you decide to sell your Tesla in a year or two and you'll be hit with depreciation recapture. Point being people can claim whatever they want on their tax returns, but upon a red flag audit you'll need to substantiate your business use and miles.Devil's advocate here.

Take the Model X for instance. People are claiming business use of the vehicle and essentially writing off 50% of the purchase price. If someone tried to sell a $120k 100D, would you be all upset and only offer them $60k?

Supercharging is not transferable. That itself is $2.5K value gone for new buyer.

One can order brand new Model X now included Premium Upgrade Pkg + EAP for $88K - 7.5K tax rebate = $80.5K with no miles on it.

So for $1K extra, new buyer will get a brand new car with latest MCU2 + Free Super Charging + Premium Pkg Upgrade + Full tire threads + Full Warranty + less than 50 miles.

You have priced it quite high.

One can order brand new Model X now included Premium Upgrade Pkg + EAP for $88K - 7.5K tax rebate = $80.5K with no miles on it.

So for $1K extra, new buyer will get a brand new car with latest MCU2 + Free Super Charging + Premium Pkg Upgrade + Full tire threads + Full Warranty + less than 50 miles.

You have priced it quite high.

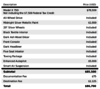

Similar threads

- Replies

- 4

- Views

- 984

- Replies

- 0

- Views

- 688

- Replies

- 2

- Views

- 1K