Or maybe, just maybe, half of that was a weekend...4 F---ing days? Are you for real? Talk about cherry-picking your data points.

Here's a thought: how about MAYBE, just MAYBE those cars went to a country that doesn't do daily reporting? Or perhaps they are still on a boat? Transit times from Shanghai to EU are ~3-4 weeks if memory serves me.

Gordo, is that you?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Near-future quarterly financial projections

- Thread starter luvb2b

- Start date

StarFoxisDown!

Well-Known Member

Seriously.......who falls for this anymore?This is now getting away from the thread title but...

View attachment 863021

Tesla was sold just 23 vehicles in the four daily reporting European countries. Those countries make up ~2.7% of Tesla's deliveries YTD.

Nearly two weeks into Q4, you'd expect most of the ~20k vehicles "in transit" that could have been delivered in Q3 but for logistics costs would be delivered by now.

Obviously we will get the full picture at the end of the month when we see October sales for China and Europe, but right now...those ~20k just simply aren't showing up in delivery reports.

Apparently D&S...Seriously.......who falls for this anymore?

Well let's see. If Q1 was profitable, then all the operating expenses were already covered.Yahoo! Finance has lowered their EPS Consensus a couple of pennies to $1.01.

For reference:

- Tesla sold 310,048 EVs in Q1 2022 resulting in actual EPS of $1.07.

- Tesla sold 343,830 EVs in Q3 2022 resulting in actual EPS of...

I expect another significant Beat in the cards coming right up.

View attachment 863569

33k more vehicles * 50k ASP * 32% GM = $528 Million flow through profit/ 3B shares = $0.17 per share + Q1 = $1.24 (plus energy and service improvements)

BrownOuttaSpec

Active Member

"Analyst" continue to revise their estimate downward today the EPS was updated. It's down another $0.01 since Wednesday, now EPS is estimated at $1.00 on yahoo. I would assume we will drop another 1-2¢ before the actual earnings are announced with the current rate we've seen since the P&D was announced. Get youYahoo estimate is now down to $1.01

I'm wondering if Analyst are that naive or they are setting up the market for a recovery by settings expectations too low on purpose.

Trashing stock on purpose. They are everything but naive."Analyst" continue to revise their estimate downward today the EPS was updated. It's down another $0.01 since Wednesday, now EPS is estimated at $1.00 on yahoo. I would assume we will drop another 1-2¢ before the actual earnings are announced with the current rate we've seen since the P&D was announced. Get youready for Oct 19th

View attachment 863691View attachment 863694

I'm wondering if Analyst are that naive or they are setting up the market for a recovery by settings expectations too low on purpose.

Thekiwi

Active Member

Rob in his video today said his earnings estimate is $1.10

The Accountant

Active Member

That's his GAAP EPS. I believe his Non-GAAP is $1.21.Rob in his video today said his earnings estimate is $1.10

Diluted Non-GAPPIs the $1 Yahoo Analyst Estimates GAAP or Non-GAAP

Q1 is shown as 1.07 (split adjusted) Tesla's number was 3.22

petit_bateau

Active Member

QUESTION ?

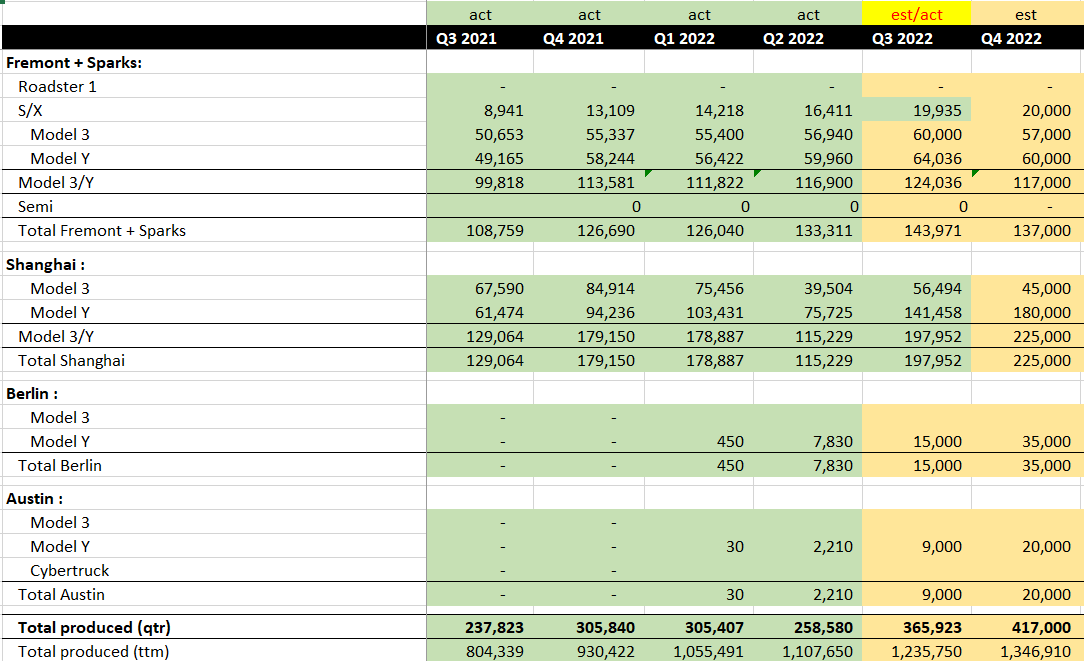

Tesla announced the following Q3 2022 production numbers:

- S/X = 19,935

- 3/Y = 345,988

From China we have approximately the following Shanghai Q3 production :

- 3 = 56,494 = 11261+14976+30257

- Y = 141,458 = 27458+62169+51831

Q1. What are the best approximations any of you can come up with for 3 and Y production respectively between variously Fremont, Austin, and Berlin ?

Q2. Does anyone have more accurate production numbers on Shanghai ?

The reason is that quite apart from anything else I'd like to update this. I can take my own SWAG at the apportionment but y'all may have some extra tidbits of data that help get a fix on things.

Tesla announced the following Q3 2022 production numbers:

- S/X = 19,935

- 3/Y = 345,988

From China we have approximately the following Shanghai Q3 production :

- 3 = 56,494 = 11261+14976+30257

- Y = 141,458 = 27458+62169+51831

Q1. What are the best approximations any of you can come up with for 3 and Y production respectively between variously Fremont, Austin, and Berlin ?

Q2. Does anyone have more accurate production numbers on Shanghai ?

The reason is that quite apart from anything else I'd like to update this. I can take my own SWAG at the apportionment but y'all may have some extra tidbits of data that help get a fix on things.

Troy's numbers are below although I believe he is not counting vehicles that were in-transit from q3 in his q4 estimate.Q1. What are the best approximations any of you can come up with for 3 and Y production respectively between variously Fremont, Austin, and Berlin ?

Q2. Does anyone have more accurate production numbers on Shanghai ?

Todd Burch

14-Year Member

Lol Troy. A couple weeks ago Tesla implied they’re going to shoot for the upper 400s.

I’ll bet you Troy’s initial delivery estimate here is a minimum of 50,000 cars too low.

I’ll bet you Troy’s initial delivery estimate here is a minimum of 50,000 cars too low.

Are those numbers deliveries or production?Thanks. I'll have a look this evening. This was my own best guess in advance of the P&D numbers. I'll get my thinking cap on this evening.

View attachment 864644

I want to be sure I'm using the right source.

CPCA

January: 59,845

February: 56,515

March: 65,814

April: 10,757

May: 32,165

June: 78,906

July: 28,217

August: 76,965

September: 83,135

Giving totals of:

Q1: 182,174

Q2: 121,828

Q3: 188,317

Thank you!

petit_bateau

Active Member

I am discussing production. I may have inadvertently picked up the wrong China numbers, which I'll correct if so. My intent is to discuss production.Are those numbers deliveries or production?

I want to be sure I'm using the right source.

CPCA

January: 59,845

February: 56,515

March: 65,814

April: 10,757

May: 32,165

June: 78,906

July: 28,217

August: 76,965

September: 83,135

Giving totals of:

Q1: 182,174

Q2: 121,828

Q3: 188,317

Thank you!

(I'm not at my desk now, just trying to clarify)

thx1139

Active Member

I think he is way over compensating for the ending the wave. I believe the ending the wave is really focused on ending the mad scramble to get as many of the final week or 2 production delivered as physically possible. Not having a bunch of boats leaving China the final month of the final quarter of the year for Europe. Maybe I could believe if it was another quarter, but not 4th quarter. To me take out the last week of quarter production as the number of cars not delivered.Lol Troy. A couple weeks ago Tesla implied they’re going to shoot for the upper 400s.

I’ll bet you Troy’s initial delivery estimate here is a minimum of 50,000 cars too low.

Last edited:

To me take out the last week of quarter production as the number of cars not delivered.

Well, that's about 35K cars, right? (Rough math: 450,000/13) Maybe 40K if they hit 495K production and it's back-loaded? That's not so incredibly far from Troy's numbers, but it's still a higher discrepancy than I'd expect. By that logic, they have the last week of production from Q3 to deliver in Q4, so it would really only be the difference between a week of end-of-Q4 production and a week of end-of-Q3 production, which would be 10K or under, right? And we already know there were 20K+ produced but not delivered at the end of Q3. Seems like a pretty bad case would be they can't deliver 40K from end-of-Q4 production, but they do deliver 20K of Q3 production, leaving a ~20K discrepancy.

If this *was* all caused by China demand unexpectedly falling slightly under upgraded production capacity -- that is, not enough deliveries to perform really close to Shanghai to soak up its end-of-quarter production -- AND if that recurs in Q4 (neither of which is a given) -- then I'd expect Tesla to better manage that in Q4. Geographically, they have demand all over the place, and they can manage production/shipping accordingly. Maybe they put more on trains in early December so they can deliver more really near the factory in late December, or whatever.

Todd Burch

14-Year Member

Agree. Tesla is ending the wave, but they'll still try to have as many cars delivered by EOQ as possible--and EOY in particular.I think he is way over compensating for the ending the wave. I believe the ending the wave is really focused on ending the mad scramble to get as many of the final week or 2 production delivered as physically possible. Not having a bunch of boats leaving China the final month of the final quarter of the year for Europe. Maybe I could believe if it was another quarter, but not 4th quarter. To me take out the last week of quarter production as the number of cars not delivered.

petit_bateau

Active Member

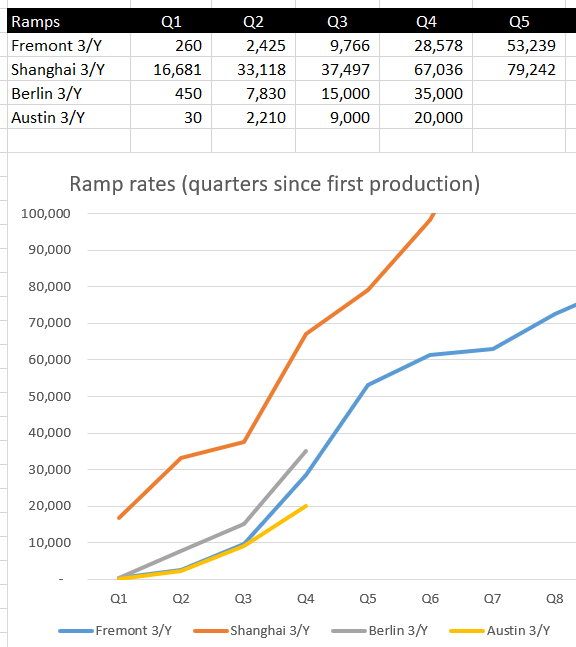

As we all know there are more variables than there are data points so a bit of judicious guessing is required to fill in the likely Q3 production numbers.

Here is my updated best stab at it. To be truthful I'm not quite sure which is the right China data to use as production versus sales, but I don't think it matters greatly in the overall scheme of things given the size of the other error terms in model/factory production apportionment.

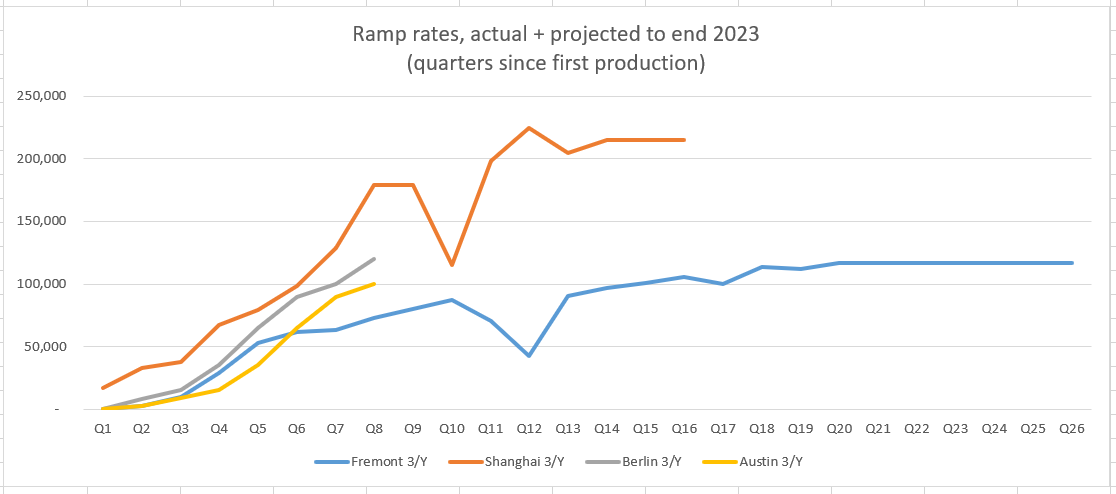

The thing to pay attention to is that either Fremont has unlocked additional production, or that Berlin+Austin have steeper ramp rates than Fremont did. For now I am tentatively assuming that the Fremont ramp rate is more typical than the Shanghai ramp rate. I am tentatively assuming this because Shanghai benefitted greatly from being stuffed by Fremont, and quite a lot of new stuff is happening both at Berlin and Austin. That in turn suggests that Fremont is perhaps increasing production now, up perhaps from 116k to 124k, so an extra 7k of 3/Y (plus an extra 2k of S/Z). I am unsure - there simply isn't enough firm data. In the ramp rate graph below I have dialed in the Q4 as well on a similarly matched trajectory and you'll see it gets to 1,346,910 production for the year.

One can pick holes in this. For example is LFP pack supply to Berlin enough to meet the 15k ramp at Berlin ? Might Austin even be ahead of Berlin and if so is that reliant on Sparks cells, or 4680 cells, or what ? Can Fremont really have increased production by a further 7k of 3/Y in the last quarter ? I don't know the answers to these questions and woukd be grateful if anyone with hard data could help fill in the gaps a bit.

Here is my updated best stab at it. To be truthful I'm not quite sure which is the right China data to use as production versus sales, but I don't think it matters greatly in the overall scheme of things given the size of the other error terms in model/factory production apportionment.

The thing to pay attention to is that either Fremont has unlocked additional production, or that Berlin+Austin have steeper ramp rates than Fremont did. For now I am tentatively assuming that the Fremont ramp rate is more typical than the Shanghai ramp rate. I am tentatively assuming this because Shanghai benefitted greatly from being stuffed by Fremont, and quite a lot of new stuff is happening both at Berlin and Austin. That in turn suggests that Fremont is perhaps increasing production now, up perhaps from 116k to 124k, so an extra 7k of 3/Y (plus an extra 2k of S/Z). I am unsure - there simply isn't enough firm data. In the ramp rate graph below I have dialed in the Q4 as well on a similarly matched trajectory and you'll see it gets to 1,346,910 production for the year.

One can pick holes in this. For example is LFP pack supply to Berlin enough to meet the 15k ramp at Berlin ? Might Austin even be ahead of Berlin and if so is that reliant on Sparks cells, or 4680 cells, or what ? Can Fremont really have increased production by a further 7k of 3/Y in the last quarter ? I don't know the answers to these questions and woukd be grateful if anyone with hard data could help fill in the gaps a bit.

Similar threads

- Replies

- 192

- Views

- 20K

- Replies

- 41

- Views

- 7K