Wicket

Member

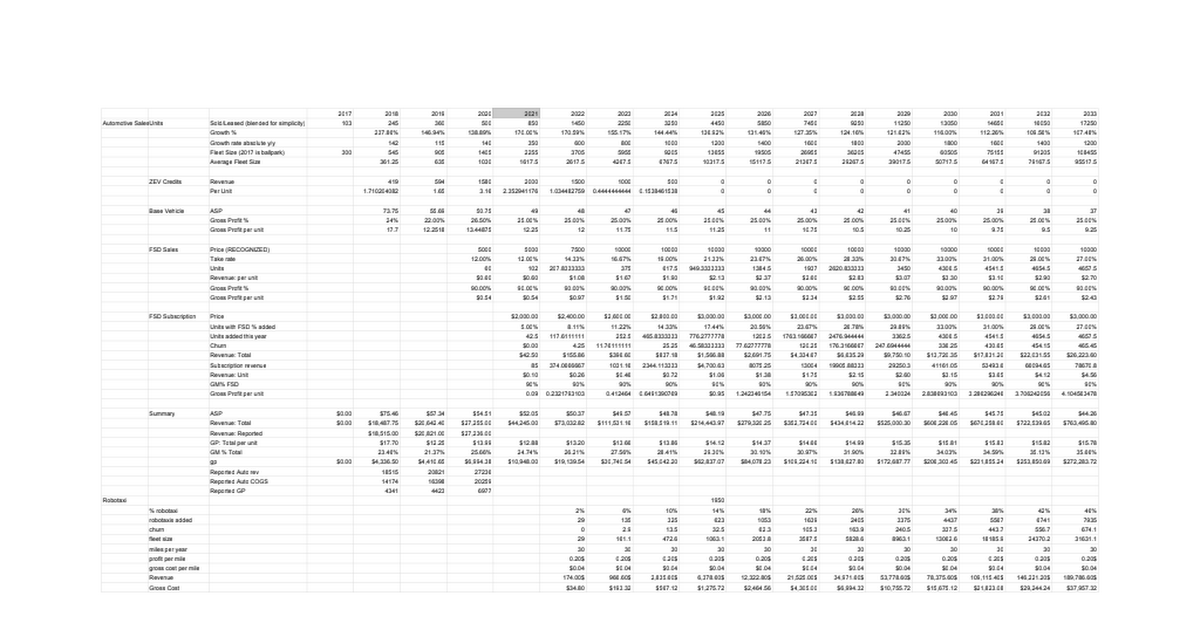

If anyone has *a lot* of time on their hands I would appreciate some comments on my first draft income model out to 2035. I tried to make it reasonably comprehensive. I'm sure there are some dramatically bad estimations here and I'm gonna keep tinkering with presentability and justification. I welcome any thoughts. Since I know you aren't tslaq I won't be offended by any critique. And if you are, don't bother because I am allergic.

Generally I am:

1) Reasonably optimistic that FSD contribution will expand well from here

2) Not particularly optimistic about robotaxi until 2025+ era (for a superbull I'm in a longer timeline to LVL 4 camp than most).

3) By 2030 I think everything they sell monetizes autopilot software 1 way or the other because it becomes such a significant piece of the puzzle. (I just split it -- 33% roughly for FSD buy, sub, and robotaxi).

4) Expect ASP to drop reasonably fast and consistently when only considering vehicle sans autopilot but stable gross margins.

5) I've only got 13m units for 2030 sold. This may very well be insanely conservative but I worry people will stop buying Teslas simply to express their individuality ;p

6) I feel a bit clueless how to project balance sheet debt (and thus income statement impact) and in particular direction of share count. This sheet doesn't have any kind of share buyback program which seems inevitable. So that's also conservative.

7) I have a feeling my target for Energy of 350GWh may be conservative for some but it's hard to talk huge numbers when they are still shipping ~6Gwh)

8) My usual modelling technique from an occam's razor mathematical function methodology is usually to ramp exponential up to a certain point and then switch to a fixed linear model of constant +X per year. This tends to approximate an S curve without the risks inherent in extrapolating exponentials too aggressively in distant years.

Since it is probably easy to quibble about details, I think it would be useful to also just generally characterize if I am being too conservative or too aggressive taken holistically maybe on a LOB granularity. The PT I come up with here is ~1200 end of year but I actually toned down a lot of my real expectations to make it imo moreso on the conservative end. Also I think it would be valuable to reconsider basic modelling premises. For instance, I try to have some accounting for how op.ex scales in proportion to each of the LOBs but it feels really sloppy and hand wavy to me.

I feel like I could take one extra step and better ponder how Tesla's decision process might look in pricing the various ways to sell FSD. It's made more complicated by the differing models involved where FSD purchase is upfront value and others require accumulation of fleet.

docs.google.com

docs.google.com

Generally I am:

1) Reasonably optimistic that FSD contribution will expand well from here

2) Not particularly optimistic about robotaxi until 2025+ era (for a superbull I'm in a longer timeline to LVL 4 camp than most).

3) By 2030 I think everything they sell monetizes autopilot software 1 way or the other because it becomes such a significant piece of the puzzle. (I just split it -- 33% roughly for FSD buy, sub, and robotaxi).

4) Expect ASP to drop reasonably fast and consistently when only considering vehicle sans autopilot but stable gross margins.

5) I've only got 13m units for 2030 sold. This may very well be insanely conservative but I worry people will stop buying Teslas simply to express their individuality ;p

6) I feel a bit clueless how to project balance sheet debt (and thus income statement impact) and in particular direction of share count. This sheet doesn't have any kind of share buyback program which seems inevitable. So that's also conservative.

7) I have a feeling my target for Energy of 350GWh may be conservative for some but it's hard to talk huge numbers when they are still shipping ~6Gwh)

8) My usual modelling technique from an occam's razor mathematical function methodology is usually to ramp exponential up to a certain point and then switch to a fixed linear model of constant +X per year. This tends to approximate an S curve without the risks inherent in extrapolating exponentials too aggressively in distant years.

Since it is probably easy to quibble about details, I think it would be useful to also just generally characterize if I am being too conservative or too aggressive taken holistically maybe on a LOB granularity. The PT I come up with here is ~1200 end of year but I actually toned down a lot of my real expectations to make it imo moreso on the conservative end. Also I think it would be valuable to reconsider basic modelling premises. For instance, I try to have some accounting for how op.ex scales in proportion to each of the LOBs but it feels really sloppy and hand wavy to me.

I feel like I could take one extra step and better ponder how Tesla's decision process might look in pricing the various ways to sell FSD. It's made more complicated by the differing models involved where FSD purchase is upfront value and others require accumulation of fleet.

Tesla public income valuation model

Sheet1 2017,2018,2019,2020,2021,2022,2023,2024,2025,2026,2027,2028,2029,2030,2031,2032,2033 Automotive Sales,Units,Sold/Leased (blended for simplicity),103,245,360,500,850,1450,2250,3250,4450,5850,7450,9250,11250,13050,14650,16050,17250 Growth %,237.86%,146.94%,138.89%,170.00%,170.59%,155.17%,14...

Last edited: