Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Prediction: Coal has fallen. Nuclear is next then Oil.

- Thread starter nwdiver

- Start date

-

- Tags

- Energy Environment Policy

Nuclear about to make a comeback? Now we have Pink Hydrogen as another reason for more of these new nuclear plants.

Edit: Just watched the video. It's all politics. Never mind.

Gonna be interesting to see how this gets sorted out. The world relied on Ruzzia for almost half of its nuclear fuel. Enrichment plants are very capital intensive to build. Going to be hard to justify to investors to risk billions of dollars on the off chance Putin is still in power in 2030 so new enrichment capacity has the chance to come online and pay back the investment before Ruzzian fuel re-enters the market. So... yeah... more government handouts to keep nuclear afloat.

Ditching Russian Nuclear Fuel Is Easier Said Than Done

mspohr

Well-Known Member

Another reason not to rely on nuclearGonna be interesting to see how this gets sorted out. The world relied on Ruzzia for almost half of its nuclear fuel. Enrichment plants are very capital intensive to build. Going to be hard to justify to investors to risk billions of dollars on the off chance Putin is still in power in 2030 so new enrichment capacity has the chance to come online and pay back the investment before Ruzzian fuel re-enters the market. So... yeah... more government handouts to keep nuclear afloat.

Ditching Russian Nuclear Fuel Is Easier Said Than Done

View attachment 859035

ItsNotAboutTheMoney

Well-Known Member

Gonna be interesting to see how this gets sorted out. The world relied on Ruzzia for almost half of its nuclear fuel. Enrichment plants are very capital intensive to build. Going to be hard to justify to investors to risk billions of dollars on the off chance Putin is still in power in 2030 so new enrichment capacity has the chance to come online and pay back the investment before Ruzzian fuel re-enters the market. So... yeah... more government handouts to keep nuclear afloat.

Ditching Russian Nuclear Fuel Is Easier Said Than Done

View attachment 859035

Another market opportunity for China to take over.

CNN: This 100% solar community endured Hurricane Ian with no loss of power and minimal damage.

www.cnn.com

www.cnn.com

This 100% solar community endured Hurricane Ian with no loss of power and minimal damage | CNN

Climate resiliency was built into the fabric of Babcock Ranch with stronger storms in mind, and Hurricane Ian was a major test.

mspohr

Well-Known Member

CleanTechnica: Why Should We Pay Extra for Nuclear Power?. Why Should We Pay Extra for Nuclear Power?

The first of these makes very clear that in the opinions of the people running NextEra Energy, combustion generating sources and nuclear power are getting too expensive. Furthermore, their opinion is that the most expensive of these, at least in the late 2020s, will be small modular nuclear reactors (SMRs). The above chart, from their investor report, shows this.

One thing to make note of in the chart is that the term “near-firm,” applied to wind and solar power. It means that those power sources are backed up by a four-hour battery, which NextEra regards as sufficient to make the renewable power sources roughly equivalent to dispatchable sources during peak hours. Another thing is that the storage adder is seen to raise the costs of solar and wind power by about 0.5¢/kWh. This is represented in the chart by the shaded areas on the bars for solar and wind power.

Another thing to note is that in this chart, electricity from new, near-firm solar and wind plants is a good deal less expensive than electricity from existing nuclear plants. Let’s state this clearly: We are paying extra for electricity from nuclear plants, even after they have been paid down, and even though the sun can shine and the wind can blow almost all the time, because of really cheap battery storage. Put another way, it would be cheaper to close the nuclear plants and replace them with new renewable facilities.

The first of these makes very clear that in the opinions of the people running NextEra Energy, combustion generating sources and nuclear power are getting too expensive. Furthermore, their opinion is that the most expensive of these, at least in the late 2020s, will be small modular nuclear reactors (SMRs). The above chart, from their investor report, shows this.

One thing to make note of in the chart is that the term “near-firm,” applied to wind and solar power. It means that those power sources are backed up by a four-hour battery, which NextEra regards as sufficient to make the renewable power sources roughly equivalent to dispatchable sources during peak hours. Another thing is that the storage adder is seen to raise the costs of solar and wind power by about 0.5¢/kWh. This is represented in the chart by the shaded areas on the bars for solar and wind power.

Another thing to note is that in this chart, electricity from new, near-firm solar and wind plants is a good deal less expensive than electricity from existing nuclear plants. Let’s state this clearly: We are paying extra for electricity from nuclear plants, even after they have been paid down, and even though the sun can shine and the wind can blow almost all the time, because of really cheap battery storage. Put another way, it would be cheaper to close the nuclear plants and replace them with new renewable facilities.

mspohr

Well-Known Member

Progressives Should Rally Around a Clean Energy Construction Boom https://nyti.ms/3CyeZe8

But it also suggests an obvious next step for the left side of the now fractured climate coalition: its own alternative permitting reform bill, focused on building more electric transmission lines and streamlining regulatory approval for clean energy projects (without allowing for more fossil fuel infrastructure or the stampeding of frontline communities). That’s because there are, I think, pretty strong climate arguments for permitting reform in principle: To more or less replace or rebuild the country’s whole energy infrastructure would require an enormous construction effort, ideally undertaken at warp speed.

There is at least one alternative bill floating around, the Environmental Justice for All Act, sponsored by Representative Raúl Grijalva, the chairman of the House Natural Resources Committee, which voted the bill out of committee in July. But though it includes reforms to the National Environmental Policy Act, it is focused not on the need to accelerate the construction of clean energy infrastructure but on measures to hold polluting industries accountable.

But it also suggests an obvious next step for the left side of the now fractured climate coalition: its own alternative permitting reform bill, focused on building more electric transmission lines and streamlining regulatory approval for clean energy projects (without allowing for more fossil fuel infrastructure or the stampeding of frontline communities). That’s because there are, I think, pretty strong climate arguments for permitting reform in principle: To more or less replace or rebuild the country’s whole energy infrastructure would require an enormous construction effort, ideally undertaken at warp speed.

There is at least one alternative bill floating around, the Environmental Justice for All Act, sponsored by Representative Raúl Grijalva, the chairman of the House Natural Resources Committee, which voted the bill out of committee in July. But though it includes reforms to the National Environmental Policy Act, it is focused not on the need to accelerate the construction of clean energy infrastructure but on measures to hold polluting industries accountable.

ThomasD

Active Member

It's good that Babcock Ranch had minimal damage. They have a decent elevation average. If those panels had been in Fort Myers or near the beach I doubt they would have survived a 15 foot storm surge. One thing I noticed was that there doesn't seem to be a lot of Trees in that area that would have taken down powerlines

Prospects for US solar electricity at $0/kWh

A new Credit Suisse report suggests that from 2025 through 2032, the United States could see solar and wind power purchase agreements regularly signed for under $0.01/kWh, due to a combination of manufacturing and project tax credits.

mspohr

Well-Known Member

Coal projects outside China becoming ‘uninsurable’, says climate group

New coal power projects are becoming “effectively uninsurable” outside China because so many insurance companies have ruled out support for them, a report has found. Recent commitments to stop underwriting coal by prominent US insurers AIG and Travelers have brought the number of coal insurance exit policies to 41, according to the latest industry scorecard by the climate campaign Insure Our Future. The scorecard ranks the top global fossil fuel insurers on the quality of their fossil fuel exclusion policies. It shows that 62% of the reinsurance market and 39% of the primary insurance market are now covered by coal exclusions, with Allianz, Axa and Axis Capital ranking top for the robustness and breadth of their policies.

There has also been a significant shift away from oil and gas. At the time of last year’s climate talks in Glasgow, only three companies had any restrictions on insuring conventional oil and gas projects. But in the past year, another 10 insurers have followed suit. The latest company to do so is the world’s largest reinsurer, Munich Re, which published an ambitious oil and gas exit policy earlier this month. That means more than a third of the reinsurance market is now covered by oil and gas exclusions.

New coal power projects are becoming “effectively uninsurable” outside China because so many insurance companies have ruled out support for them, a report has found. Recent commitments to stop underwriting coal by prominent US insurers AIG and Travelers have brought the number of coal insurance exit policies to 41, according to the latest industry scorecard by the climate campaign Insure Our Future. The scorecard ranks the top global fossil fuel insurers on the quality of their fossil fuel exclusion policies. It shows that 62% of the reinsurance market and 39% of the primary insurance market are now covered by coal exclusions, with Allianz, Axa and Axis Capital ranking top for the robustness and breadth of their policies.

There has also been a significant shift away from oil and gas. At the time of last year’s climate talks in Glasgow, only three companies had any restrictions on insuring conventional oil and gas projects. But in the past year, another 10 insurers have followed suit. The latest company to do so is the world’s largest reinsurer, Munich Re, which published an ambitious oil and gas exit policy earlier this month. That means more than a third of the reinsurance market is now covered by oil and gas exclusions.

mspohr

Well-Known Member

Carbon emissions from energy to peak in 2025 in ‘historic turning point’, says IEA

Worldwide government spending on clean energy in response to the Ukraine invasion would mark a “historic turning point” in the transition away from fossil fuels as global carbon emissions from energy peak in 2025, the International Energy Agency has projected. Government spending on clean fuels in response to Russia’s invasion of Ukraine has massively increased, according to analysis by the world’s leading organisation in the sector. “None of the government leaders complained about too much clean energy,” Fatih Birol, the IEA’s executive director, said. “They complain that they don’t have enough clean energy.” Under the new plans investment in low-carbon energy such as solar, wind and nuclear power will rise to $2tn a year by 2030, an increase of more than 50% from today. “The golden age of gas is approaching the end,” Birol said.

The IEA analysis showed that current government policies would still lead to global temperatures rising by 2.5C, which would have catastrophic climate impacts. That would be far above the target of limiting global heating to 1.5C above pre-industrial levels. The 1.5C target, agreed at the Paris climate conference, would prevent the worst effects of climate breakdown. The analysis adds to a consensus among scientists that governments are not doing enough to prevent climate disaster. A separate UN study, published on Wednesday, also found that government pledges so far to cut emissions will lead to 2.5C of heating.

Worldwide government spending on clean energy in response to the Ukraine invasion would mark a “historic turning point” in the transition away from fossil fuels as global carbon emissions from energy peak in 2025, the International Energy Agency has projected. Government spending on clean fuels in response to Russia’s invasion of Ukraine has massively increased, according to analysis by the world’s leading organisation in the sector. “None of the government leaders complained about too much clean energy,” Fatih Birol, the IEA’s executive director, said. “They complain that they don’t have enough clean energy.” Under the new plans investment in low-carbon energy such as solar, wind and nuclear power will rise to $2tn a year by 2030, an increase of more than 50% from today. “The golden age of gas is approaching the end,” Birol said.

The IEA analysis showed that current government policies would still lead to global temperatures rising by 2.5C, which would have catastrophic climate impacts. That would be far above the target of limiting global heating to 1.5C above pre-industrial levels. The 1.5C target, agreed at the Paris climate conference, would prevent the worst effects of climate breakdown. The analysis adds to a consensus among scientists that governments are not doing enough to prevent climate disaster. A separate UN study, published on Wednesday, also found that government pledges so far to cut emissions will lead to 2.5C of heating.

ItsNotAboutTheMoney

Well-Known Member

Carbon emissions from energy to peak in 2025 in ‘historic turning point’, says IEA

Worldwide government spending on clean energy in response to the Ukraine invasion would mark a “historic turning point” in the transition away from fossil fuels as global carbon emissions from energy peak in 2025, the International Energy Agency has projected. Government spending on clean fuels in response to Russia’s invasion of Ukraine has massively increased, according to analysis by the world’s leading organisation in the sector. “None of the government leaders complained about too much clean energy,” Fatih Birol, the IEA’s executive director, said. “They complain that they don’t have enough clean energy.” Under the new plans investment in low-carbon energy such as solar, wind and nuclear power will rise to $2tn a year by 2030, an increase of more than 50% from today. “The golden age of gas is approaching the end,” Birol said.

The IEA analysis showed that current government policies would still lead to global temperatures rising by 2.5C, which would have catastrophic climate impacts. That would be far above the target of limiting global heating to 1.5C above pre-industrial levels. The 1.5C target, agreed at the Paris climate conference, would prevent the worst effects of climate breakdown. The analysis adds to a consensus among scientists that governments are not doing enough to prevent climate disaster. A separate UN study, published on Wednesday, also found that government pledges so far to cut emissions will lead to 2.5C of heating.

Well, if the IEA is saying 2025, it must be imminent.

PG&E to Offer Nation’s First Vehicle-To-Grid Export Rate for Commercial Electric Vehicles

New V2G Export Rate to Accelerate EV Support of Grid During Peak Energy Demand Pacific Gas and Electric Company (PGE) has received approval to establish the nation’s first “vehicle-to-grid” (V2G) export compensation mechanism for commercial electric vehicle (EV) charging customers in its...

This will definitely mean EVs actually help the grid.

mspohr

Well-Known Member

More fossil stupidity from the UK

The Guardian: Britain faces £100m loss over drilling at biggest new oil field, says research. Britain faces £100m loss over drilling at biggest new oil field, says research

The government faces making a loss of more than £100m if drilling at the UK’s largest undeveloped oil field is approved, according to new research examining a tax break introduced by Rishi Sunak. Sunak performed a dramatic U-turn last May when he introduced the “energy profits levy” as chancellor – effectively a windfall tax on energy producers. However, he also introduced a very generous tax break for fossil fuel producers to ensure that “the more investment a firm makes, the less tax they will pay”.

The Guardian: Britain faces £100m loss over drilling at biggest new oil field, says research. Britain faces £100m loss over drilling at biggest new oil field, says research

The government faces making a loss of more than £100m if drilling at the UK’s largest undeveloped oil field is approved, according to new research examining a tax break introduced by Rishi Sunak. Sunak performed a dramatic U-turn last May when he introduced the “energy profits levy” as chancellor – effectively a windfall tax on energy producers. However, he also introduced a very generous tax break for fossil fuel producers to ensure that “the more investment a firm makes, the less tax they will pay”.

Promising! Though, even with a hydrogen infrastructure, BEV still make sense.

Promising, yes, but one caveat. That video seems to be about the new coolant for the reactor. The H2 production was simply a side benefit. One of the listed benefits, was not being sited near a source of water. BUT in order to produce H2, you need pure WATER!

Engineers developed a breakthrough method to generate hydrogen gas in one-step process

The method requires only visible light and no external heating.interestingengineering.com

Sewer gas? LOL

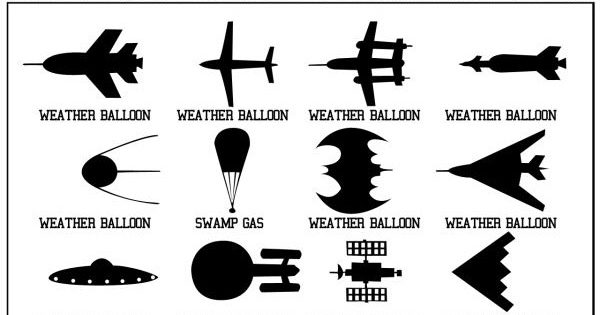

U.S Air Force Aircraft Identification Chart

No Description. #airforce #airplane #chart #identification #ufo

militaryhumor.net

ItsNotAboutTheMoney

Well-Known Member

Engineers developed a breakthrough method to generate hydrogen gas in one-step process

The method requires only visible light and no external heating.interestingengineering.com

Sewer gas? LOL

Unfortunate misreporting. This should really just be seen as a potentially efficient and productive way to manage hydrogen sulfide in sewer gas.

Similar threads

- Replies

- 13

- Views

- 2K

- Replies

- 1

- Views

- 2K

- Replies

- 77

- Views

- 12K

- Replies

- 32

- Views

- 7K