Ok, I'll chip in my estimated deliveries for Q3: 6100. I have tracked VINs, not in terms of assignment, but in terms of actual deliveries, as I think this (surprise) captures deliveries better ;-)

Was very close on deliveries in Q2, but it is more uncertain now due to the EU pipe. I have actually subtracted almost 1000 cars net increase of the delivery pipeline in Q3 and some additional loaners.

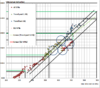

Finally, it is rather complex to estimate actual average this Q due to the late arrival of VINs to EU. You see this clearly in the different cluster of data points in the graph, you also see clearly the batching going on (blue circles).

I'm fairly certain of 6100, as this seem to be a reasonable surprise to continue the momentum toward some 23000 deliveries for the year (what my data point at right now). Notice the progressively higher surprises Q to Q. You cant reasonably expect more progress than this. However, it might be even better if the pipe to EU is really well managed. I.e., the EU cars delivered in Q3 were (very strategically) mostly batched (i.e., built) in the middle of Q3, so it might be that fewer are in the pipe!

Also, I believe that the ASP will be great, my guess is 95kUSD, leading to non GAAP revenue of 664 m (GAAP 523).

For the bottom line I only think there will be very slight non-GAAP profit, and a GAAP loss on par with Q2, due to the rapid expansion of everything, and associated increasing costs. I also think Elon et al. were very cautious of us expecting to much of a profit for Q3 in the Q2 conference call. I think they will make it, but not by much. So, on average, unless there is surprise again in the revenue figures (I have been to conservative with these before) the market is now quite on par. (Yahoo finance say average (non-GAAP) revenue will be 533m). I don't expect a huge surprise this time, which is also reasonable, as the market now have had a full year of surprises to digest, they should be better at estimating Tesla's books by now.

/Buran

Additional legend for the figure:

Black vertical lines = Qs

Black horizontal lines =Guidance delivery

Green horizontal lines, past time = actual delivery

Green horizontal lines, future time = my estimates

Black trend lines: Top = naked eye linear regression based on my feeling of how much is end of the Q rush.

Black trend lines: Bottom = Same slope as top line, centered on EU deliveries

Black trend lines: Mid = Same slope as top and bottom line, placed at 2/3 US deliveries, and 1/3 EU deliveries (reported balance between them at TMC as far as I can judge)