Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Rates are up by 50% ??

- Thread starter soguinness

- Start date

-

- Tags

- tesla model y

WilliamG

Hinge Fanatic

Unreal... Ugh.Confirming that my insurance doubled in Florida as well with Progressive.

State Farm. Also have homeowners. NorCal. Monthly. 60yo, 57yo, and 30yo drivers. Been with SF for at least a decade. CA did away with low mileage discounts, iirc, which hurt a bit since 2 of the vehicles get less than 5k mi per year.

02 wrangler 44.32

11 sorento 65.77

20 grand Cherokee 95.93

23 m3 95.84

2 mil umbrella 45.80

02 wrangler 44.32

11 sorento 65.77

20 grand Cherokee 95.93

23 m3 95.84

2 mil umbrella 45.80

FLRifleman

Member

Geico has an on-line quote function where you can enter the VIN or make/model of the prospective vehicle. Out of curiosity, I checked to see how my insurance would be affected if I switched to a Model 3. The result was insurance cost would go up by ~$980 annually. If I replaced it with a new GMC Canyon 4X4 which costs more than the Model 3, it would go up by $160 annually. The Model 3 was 6X more, so there is a not insignificant vehicle penalty.

The take-away is it's wise to get a quote for your different potential purchase options before you buy.

The take-away is it's wise to get a quote for your different potential purchase options before you buy.

EatsShoots

Member

Spoke to insurance agent yesterday. 4 drivers, two of whom are teens, on a '22 Ram, 22, rav4 hybrid, and 23 model 3 standard we're at $5700/annually now. Replacing the rav4 with a LR Model Y will push us to $6800 and if we instead replaced the rav4 with a model y performance $7700/annually. These teslas definitely are not cheap to insure. I bet a lot of people are saving less on gas than they are paying in increased insurance. Going from that rav4 hybrid to a model Y we'd need to do something like 20k/year just to break even. I may replace it anyway, but it's not gonna save us anything that's for sure.Geico has an on-line quote function where you can enter the VIN or make/model of the prospective vehicle. Out of curiosity, I checked to see how my insurance would be affected if I switched to a Model 3. The result was insurance cost would go up by ~$980 annually. If I replaced it with a new GMC Canyon 4X4 which costs more than the Model 3, it would go up by $160 annually. The Model 3 was 6X more, so there is a not insignificant vehicle penalty.

The take-away is it's wise to get a quote for your different potential purchase options before you buy.

jebinc

Well-Known Member

And, lest us not forget how rapidly our Teslas depreciate - especially with all the Tesla price drops the last 13 months. I paid nearly $160k for my 2021 Plaid and would struggle to get $60k for it today...Spoke to insurance agent yesterday. 4 drivers, two of whom are teens, on a '22 Ram, 22, rav4 hybrid, and 23 model 3 standard we're at $5700/annually now. Replacing the rav4 with a LR Model Y will push us to $6800 and if we instead replaced the rav4 with a model y performance $7700/annually. These teslas definitely are not cheap to insure. I bet a lot of people are saving less on gas than they are paying in increased insurance. Going from that rav4 hybrid to a model Y we'd need to do something like 20k/year just to break even. I may replace it anyway, but it's not gonna save us anything that's for sure.

EatsShoots

Member

In fact I do wonder the same--a decent chunk of the cost comes into write-off value of the vehicle, and if they are lower one would think it should have a softening effect on the premium.And, lest us not forget how rapidly our Teslas depreciate - especially with all the Tesla price drops the last 13 months. I paid nearly $160k for my 2021 Plaid and would struggle to get $60k for it today...You would think the cost of insurance would reflect these facts, but no… they are still assuming the replacement costs are the highs they once were…. BOHICA.

HankE-LA

Member

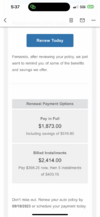

Don't have a Tesla yet. Waiting for the Highland to come out. Meanwhile we have a 2015 Accord, 2018 Accord, and a 2010 Tundra. Both drivers are over 60. Neither of us has had so much as a parking ticket in the last 20 years. Granted we did file a claim with the homeowners' insurance when a tree fell and crushed the house from Hurricane Gustav in 2008. That claim was over $125,000 USD. However, the carrier didn't drop us or raise our rates over that. In fact, we're still insured with them.

From May 2022 to May 2023 when the policy renewed, our premiums went up 19% for our vehicles combined. Homeowners went up a bit over 26%. Then the flip side is my 18' bass boat. It has everything including nearly 1 million in fuel spill cleanup costs. It went from $183 to $188.

For grins, got a quote from Geico. $3120 a year for a M3RWD. Just the car by itself and not bundled with the other vehicles. The biggie was dropping uninsured motorist bodily injury. If you get injured by an uninsured motorist your medical insurance gets tapped first anyway. So as the agent said you're paying for double coverage that you'll probably never use. The downside is you give up suing for pain and suffering. If I added in that coverage the annual premium is $4380.

Still shopping around. I'll get with my current carrier tomorrow and report back.

From May 2022 to May 2023 when the policy renewed, our premiums went up 19% for our vehicles combined. Homeowners went up a bit over 26%. Then the flip side is my 18' bass boat. It has everything including nearly 1 million in fuel spill cleanup costs. It went from $183 to $188.

For grins, got a quote from Geico. $3120 a year for a M3RWD. Just the car by itself and not bundled with the other vehicles. The biggie was dropping uninsured motorist bodily injury. If you get injured by an uninsured motorist your medical insurance gets tapped first anyway. So as the agent said you're paying for double coverage that you'll probably never use. The downside is you give up suing for pain and suffering. If I added in that coverage the annual premium is $4380.

Still shopping around. I'll get with my current carrier tomorrow and report back.

EatsShoots

Member

Was just renewed, with my annual premium decreasing from $6348 to $6163. The letter explicitly says that my insurer has a "First Accident Forgiveness" policy, so totaling the car has been "forgiven". They are so magnanimous.It’s all about the bottom line. They paid out to you for the repair and need to replenish the coffers somehow. Post back here after the renewal and let us know what actually happened!

When two kids are off in the fall we're selling one of our cars and downgrading their coverage as much as possible, so that will save some money.

Similar threads

- Replies

- 40

- Views

- 2K

- Replies

- 7

- Views

- 242

- Replies

- 8

- Views

- 881