R

ReddyLeaf

Guest

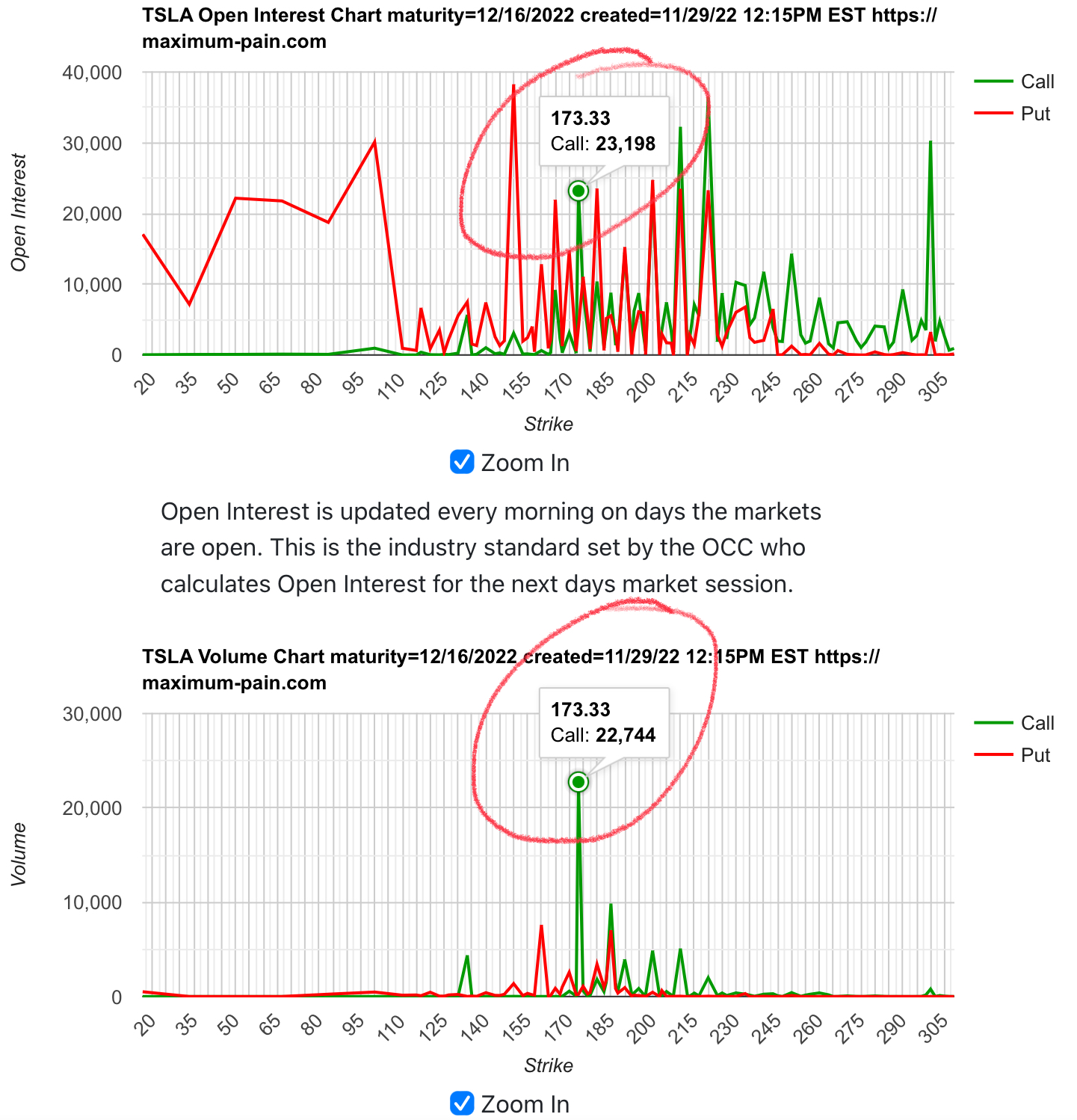

Lots of OI this week, much more than usual, close to Dec monthly numbers. Seems 180-185 is the target. Also, looks like IV is higher this week, so probably anticipation of the Semi delivery announcement. Guessing there will be an IV crush on Friday.

Some interesting Dec c173.33s traded today. If anyone can find the trade it would be nice to see if this is a close out or more opened. If closed out, which is my guess, then Dec is very very put dominated.

The SP is hovering at a seeming 2-yr low, probably for a reason, such as a big stare down, waiting to see who flinches first. I’m sitting this week out, just watching the lack of action with relaxed relief.

Some interesting Dec c173.33s traded today. If anyone can find the trade it would be nice to see if this is a close out or more opened. If closed out, which is my guess, then Dec is very very put dominated.

The SP is hovering at a seeming 2-yr low, probably for a reason, such as a big stare down, waiting to see who flinches first. I’m sitting this week out, just watching the lack of action with relaxed relief.