Down would be my guess, they are building liquidity before dumping. Seen this movie played out on a lot of afternoons like this one lol.Stagnating at 161. Close up or down from here?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Yeah, I can't decide. I'm thinking a lot of short selling went into today's drop, so they may try to cover before the close (as they succeeded in getting shares from people like me). Then they can do it again tomorrow if there is any weakness in the QQQ at the open.i feel like algobots are playing ping pong right now. No obvious momentum in either direction. But I would guess an upward move followed by a close around $162-3

juanmedina

Active Member

I just want the stock to go into capitulation mode so we can move on.

yey or nay?

samppa

Active Member

Buckminster

Well-Known Member

For those not reading the main thread:

S&P500 rebalancing and non-index buying/selling

S&P500 rebalancing and non-index buying/selling

I set limit orders to buy the shares back (that I had sold at 159). I kept missing it by like .2. Finally got them back at 161.5, and sold 160CC at the same time for $6.05. So I'm up $3.55 and have that to play with. If the SP goes up, I can basically roll up and out to a higher strike for a $3.55 debit without losing any money, and keep my shares. If the SP drop again tomorrow, I can sell them again at 156 and not have lost any money. Now I'll have to see if I can stick to the plan....

Last edited:

EVNow

Well-Known Member

So today we got a backtest of the falling wedge. It held.

Since we made a new low, I'm expecting the hourly 200 EMA to act as resistance at least once more @ 180 sometimes this Friday - next Monday. What we are seeing is a rounding bottom developing with each new low looking less scary than the last.

If you're selling CC's now, as did, expect a strong bounce to 180 before pulling back. Close your CC @ 170 in that case. Though I said it was a bad time to sell CC's, a new low negates that.

Since we made a new low, I'm expecting the hourly 200 EMA to act as resistance at least once more @ 180 sometimes this Friday - next Monday. What we are seeing is a rounding bottom developing with each new low looking less scary than the last.

If you're selling CC's now, as did, expect a strong bounce to 180 before pulling back. Close your CC @ 170 in that case. Though I said it was a bad time to sell CC's, a new low negates that.

Last edited:

Double Top at ~163Stagnating at 161. Close up or down from here?

1.272 fib extension 160.73 is supp for today's Close 160.95?

intelligator

Active Member

Wow, wild ride today. I guess 150 isn't a distraction after all, it is a thing! The pull down continued, maybe 2:1 put heavy, still feeling good about the mid 170's the next couple days.

I closed all my CCs, sold 12/16 +126.67/-146.67 for .80.

Tried rolling two DITM BPS to Jan '25, no go. Although I set a decent limit for each, the price kept going up (from 7.50 , ended closer to 8.50) , yet the price of the underlying moved +/- $1 ... maybe had to do with IV ???

I closed all my CCs, sold 12/16 +126.67/-146.67 for .80.

Tried rolling two DITM BPS to Jan '25, no go. Although I set a decent limit for each, the price kept going up (from 7.50 , ended closer to 8.50) , yet the price of the underlying moved +/- $1 ... maybe had to do with IV ???

TSLA on FOMC DaysTSLA during FOMC days, is it volatile?

In 2022,

View attachment 869981

- there is 71% probability that the morning is green (before rate is released)

- there is 57% probability that 2-230pm is red (rate is released)

- there is 57% probability that 230-4pm is green (Fed speech about the release)

- there is 57% probability that the day is green (Close-Open)

- there is 57% probability that next day is red

tsla tanked the last 2 times the Fed spoke

OptionsGrinder

Member

I

any data on Fed day reaction when the stock was already down over 10% the two days prior lol

Nay. Todays drop was too ‘orderly’ to be a capitulation.

Also, I bought shares today. That guarantees we have not seen the bottom.

juanmedina

Active Member

Nay. Todays drop was too ‘orderly’ to be a capitulation.

Also, I bought shares today. That guarantees we have not seen the bottom.

Have we seen "capitulation" on Tesla before? The other times that we got cut in half I didn't have as much money on the line or margin so I didn't care

There are still 14 minutes as of this post. Maybe 12 by the time I hit submit. Sell those shares you just bought now. Please.Nay. Todays drop was too ‘orderly’ to be a capitulation.

Also, I bought shares today. That guarantees we have not seen the bottom.

So today we got a backtest of the falling wedge. It held.

Since we made a new low, I'm expecting the hourly 200 EMA to act as resistance at least once more @ 180 sometimes this Friday - next Monday. What we are seeing is a rounding bottom developing with each new low looking less scary than the last.

If you're selling CC's now, as did, expect a strong bounce to 180 before pulling back. Close your CC @ 170 in that case. Though I said it was a bad time to sell CC's, a new low negates that.

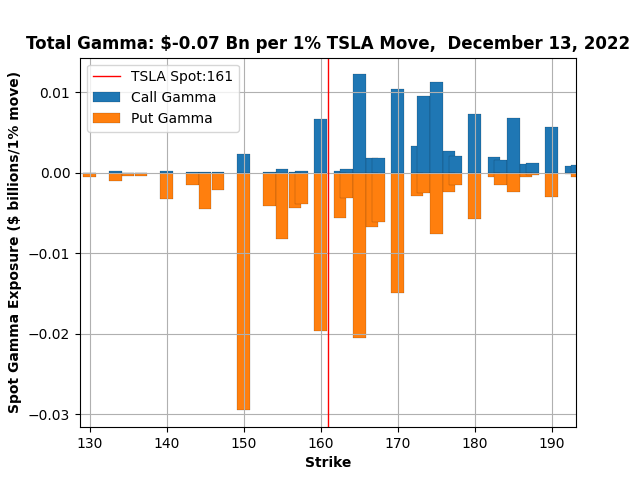

View attachment 884610

Thanks for this.

Where do you see the pullback landing and taking us in 2023. Some are talking about $150 and $120, even $60. For some of us stuck with margin (not always deliberate) that’s scary as hell

unfortunately I dont have an answer to that without seeing the structure of the bounce first. Cant say if we are going to make new lows or not.Thanks for this.

Where do you see the pullback landing and taking us in 2023. Some are talking about $150 and $120, even $60. For some of us stuck with margin (not always deliberate) that’s scary as hell

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K