Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Since you are own counter indicator.....Nice early rally. How do you guys feel about 210 CC for Friday? Safe? Only 15% OTM….

That will cement a close over $215....

I am personally going to be out of an short term devices by tomorrow close.

Me, too, opening or rolling no earlier than 31Mar just in case of a post-FOMC spike. Then we have P&D ~2Apr.Since you are own counter indicator.....

That will cement a close over $215....

I am personally going to be out of a short term devices by tomorrow close.

Last edited:

R

ReddyLeaf

Guest

Ok, I’ll bite. Sold 2x -c190s at $3.20. Well, this is really still just a buy-write of lots that I filled out at $177, so not really much risk. Perhaps dumb, but I’ve collected $5 premium on these and willing to keep rolling or lose the shares to write ICs or buyback other longer options. Yes, I believe 210 is safe for Friday, but if FOMC says pivot and a rate cut, well, yikes, the rocket takes off.Nice early rally. How do you guys feel about 210 CC for Friday? Safe? Only 15% OTM….

juanmedina

Active Member

Nice early rally. How do you guys feel about 210 CC for Friday? Safe? Only 15% OTM….

I sold a few $205's I want to be careful here going into P&D. I really want to see how Troy's numbers are going to look compared to the consensus to decide how to position myself. If they look bad I wonder if I should sell some stock or sell aggressive leaps because that trip to $140-150 will be rough if we miss. I really hope that the numbers are great.

Well that didn’t work so great, didn’t pull the trigger before 10am during brief dip, but managed to replenish shares at $184.93 and wrote 31Mar$180 at $11.06 for a net $6.13 (11 DTE) anticipating rolling.Using a wrap non-taxable account, so no transaction or tax costs or considerations, and there’s always the chance to catch a MMD and snag an extra $3. With the bank and Fed actions often making news over weekends (see CS/UBS), it feels more nimble to wait until Monday, or possibly even the mid-week FOMC meeting.

I sold 210 and 212.5 CC on the pop this morning. Already getting close to 50% profit. I will see where we are at the end of the day today or tomorrow and may close them before Wednesday. These are on shares I don't want called away.

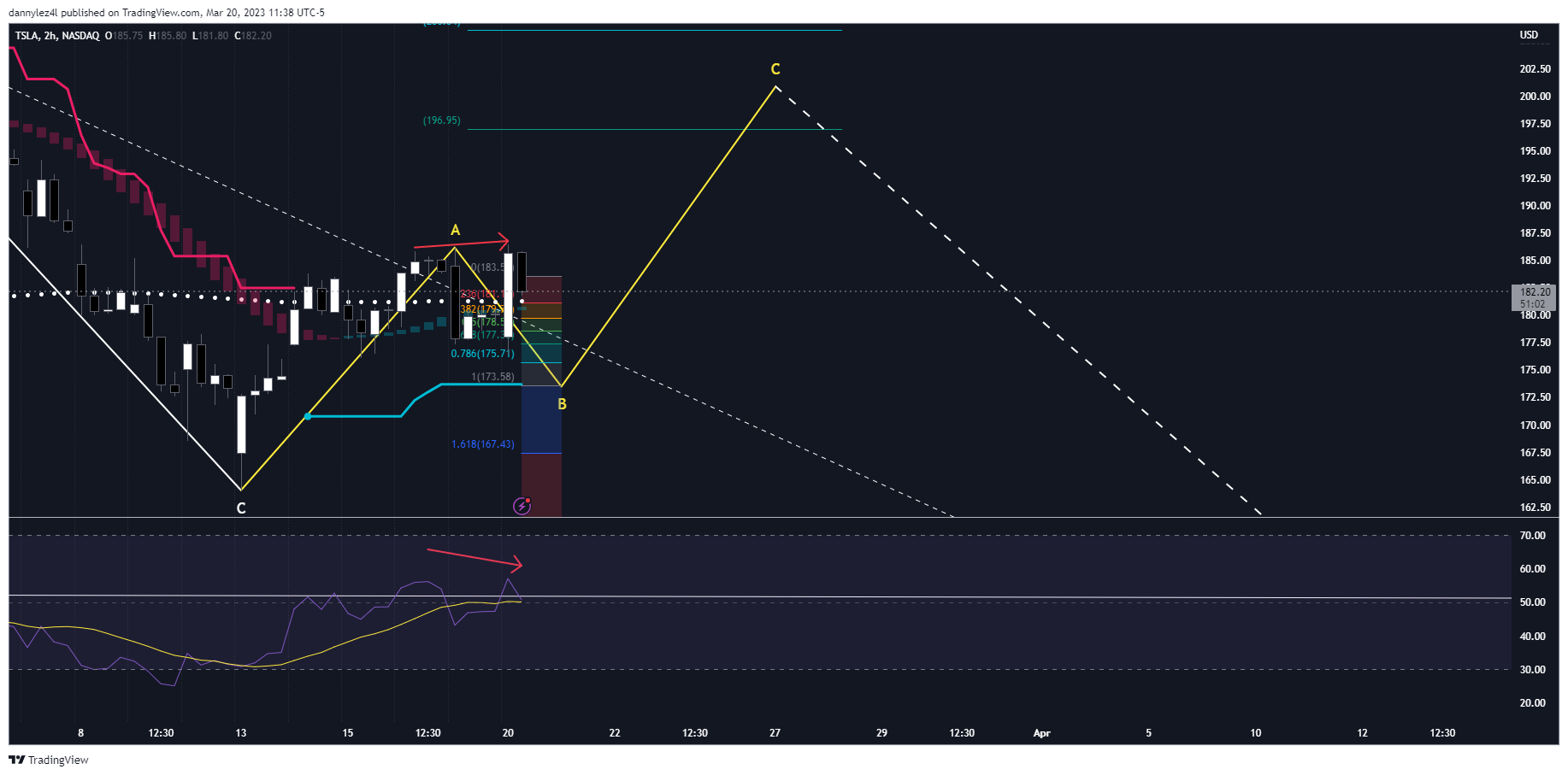

Very clear bearish divergence going on on the 2h timeframe. I give it a very high chance of breaking the weak 1h uptrend at 177 in order to test the 2h uptrend at 173.5. I think we'll bounce there to target 195-200 by 3/31.

If we break 173.5 and hold there for 2 hours, be very very careful with your short puts.

If we break 173.5 and hold there for 2 hours, be very very careful with your short puts.

Please help me understand this part of you message…”to test the 2h uptrend at 173.5.”Very clear bearish divergence going on on the 2h timeframe. I give it a very high chance of breaking the weak 1h uptrend at 177 in order to test the 2h uptrend at 173.5. I think we'll bounce there to target 195-200 by 3/31.

If we break 173.5 and hold there for 2 hours, be very very careful with your short puts.

View attachment 919520

A stock can be up or down on different timeframes. The higher the timeframe, the stronger the trend. Right now TSLA is down on the 4h and Daily timeframe. We were also down on the 2h timeframe until late last week - now we're up but this is still considered a danger zone. In order to reverse the trend on the 4h and then the daily timeframe, I think it is necessary to test the strength of the 2h timeframe and bounce off that support @ 173.5.Please help me understand this part of you message…”to test the 2h uptrend at 173.5.”

On the 1h timeframe, we've tested the support twice and yet even the 2nd time failed to produce a breakout. That's why I said the 1h uptrend is weak. Coupled with the bearish divergence, I think we ought to break down at some point and test the 2h support.

Last edited:

dc_h

Active Member

I will counter the bearish sentiment with the fact that I have cleared out all my near term ITM CC's and just opened 2 190CC, 3 195CC, 5 200CC and 8 205CC's. The market loves to steamroll my calls. I will avoid selling puts though. I don't need more shares and the risk reward is way too low.

Fab! Which DTE?I will counter the bearish sentiment with the fact that I have cleared out all my near term ITM CC's and just opened 2 190CC, 3 195CC, 5 200CC and 8 205CC's. The market loves to steamroll my calls. I will avoid selling puts though. I don't need more shares and the risk reward is way too low.

dc_h

Active Member

This week. I'll probably take next week off, or stay way out of the money. Traveling for work and the week after is P&D.Fab! Which DTE?

I made a bit of a pig's ear of today... Deciding to close the 20x -p175's sold Friday @$4.1 for $2.5, with the plan to resell them when we hit and fell from 183 resistance, which we blasted through early on... so next plan to sell some calls*, looking at the options, 187.5's look a good bet, but I had the idea just as we hit the day high, set the same limit price, but never got back there, and chased it down all day, finally selling for $3.2, way off the $5.1 top...

And while pissing about with those, I didn't pay attention to the puts, has set a sell order for the original $4.1, but was clear this wasn't going to hit, but other than one dip of the SP to 181.20's I would have had to re-enter with less than I closed them, hmmm. So in the end went for 20x -p180's, was again looking for too much and again chased those around for an hour, finally selling right at the close @$3.55

TBH I got wrong-footed by the pop this morning after a very bearish pre-market and open. Would have been better to just leave the p-175's in place and look for calls on the pop

Still, I think there's a decent chance of the whole lot expiring and will be a decent week if this happens

The $CS LEAPS LEAPS still open, will be interesting to see what happens with those, I'm assuming a total loss, not keeping me awake at night and may help me drink a bit less

(* yes I know, I said I wouldn't sell calls until after FOMC, but my brilliant plan was to sell calls on a pop, rebut on the dip, do the converse with puts, but after the initial dip/spike/dip it all looked to be stuck at Max Pain all ready)

And while pissing about with those, I didn't pay attention to the puts, has set a sell order for the original $4.1, but was clear this wasn't going to hit, but other than one dip of the SP to 181.20's I would have had to re-enter with less than I closed them, hmmm. So in the end went for 20x -p180's, was again looking for too much and again chased those around for an hour, finally selling right at the close @$3.55

TBH I got wrong-footed by the pop this morning after a very bearish pre-market and open. Would have been better to just leave the p-175's in place and look for calls on the pop

Still, I think there's a decent chance of the whole lot expiring and will be a decent week if this happens

The $CS LEAPS LEAPS still open, will be interesting to see what happens with those, I'm assuming a total loss, not keeping me awake at night and may help me drink a bit less

(* yes I know, I said I wouldn't sell calls until after FOMC, but my brilliant plan was to sell calls on a pop, rebut on the dip, do the converse with puts, but after the initial dip/spike/dip it all looked to be stuck at Max Pain all ready)

Moody's upgraded TSLA to the lowest investment grade: Baa3 - too low, but still unlocks achievement level 1 for some institutional investors, tbh I'm surprised AH hasn't moved at all on this news because it will likely add some buying pressure, but maybe it's going to be more of a drip-drip than a tsunami

I think we all owe Alexandra a beer/hug/box of chocolates for all the work, nagging, calling out and general hounding of Moodys she's done over the past year:

I think we all owe Alexandra a beer/hug/box of chocolates for all the work, nagging, calling out and general hounding of Moodys she's done over the past year:

Moody's upgraded TSLA to the lowest investment grade: Baa3 - too low, but still unlocks achievement level 1 for some institutional investors, tbh I'm surprised AH hasn't moved at all on this news because it will likely add some buying pressure, but maybe it's going to be more of a drip-drip than a tsunami

I think we all owe Alexandra a beer/hug/box of chocolates for all the work, nagging, calling out and general hounding of Moodys she's done over the past year:

Since there will be a stock swap of UBS for CS, I wonder if CS LEAPs will convert into UBS LEAPs? Have a look at the 10-year comparison between the stocks. Probably not enough growth and volatility to be that interesting, but perhaps not a total loss.I made a bit of a pig's ear of today... Deciding to close the 20x -p175's sold Friday @$4.1 for $2.5, with the plan to resell them when we hit and fell from 183 resistance, which we blasted through early on... so next plan to sell some calls*, looking at the options, 187.5's look a good bet, but I had the idea just as we hit the day high, set the same limit price, but never got back there, and chased it down all day, finally selling for $3.2, way off the $5.1 top...

And while pissing about with those, I didn't pay attention to the puts, has set a sell order for the original $4.1, but was clear this wasn't going to hit, but other than one dip of the SP to 181.20's I would have had to re-enter with less than I closed them, hmmm. So in the end went for 20x -p180's, was again looking for too much and again chased those around for an hour, finally selling right at the close @$3.55

TBH I got wrong-footed by the pop this morning after a very bearish pre-market and open. Would have been better to just leave the p-175's in place and look for calls on the pop

Still, I think there's a decent chance of the whole lot expiring and will be a decent week if this happens

The $CS LEAPS LEAPS still open, will be interesting to see what happens with those, I'm assuming a total loss, not keeping me awake at night and may help me drink a bit less

(* yes I know, I said I wouldn't sell calls until after FOMC, but my brilliant plan was to sell calls on a pop, rebut on the dip, do the converse with puts, but after the initial dip/spike/dip it all looked to be stuck at Max Pain all ready)

Cary seems to feel TSLA still in a constructive pattern above $173 and $200+ not impossible with a close over $192.97. Good China numbers may help and Daddy Powell may throw cold water on it. We’ll see. I’m holding off selling any puts until after he speaks on Wednesday and will decide then. I added to some -C’s on the pop and hope to add more as we rise (if we rise) and BTC on the drop.

intelligator

Active Member

Held onto -167.5/+162.5 BPS opened last week. Near the top of the day I'd placed an order to open -197.5/+202.5 BCS but the value quickly eroded, it didn't hit at the set and forget 1.00 ask, I wasn't around to chase it down to .75 or .50, will try again Tuesday and increase the strike if the SP gets lofty.

18,712 in China this week, I think I’m gonna close CCs if I get a chance tomorrow.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K