Depends on what I'm doing. If I'm not day trading then probably no.When you plan according to the Fib levels, do you consider established resistances and supports between the fib levels?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

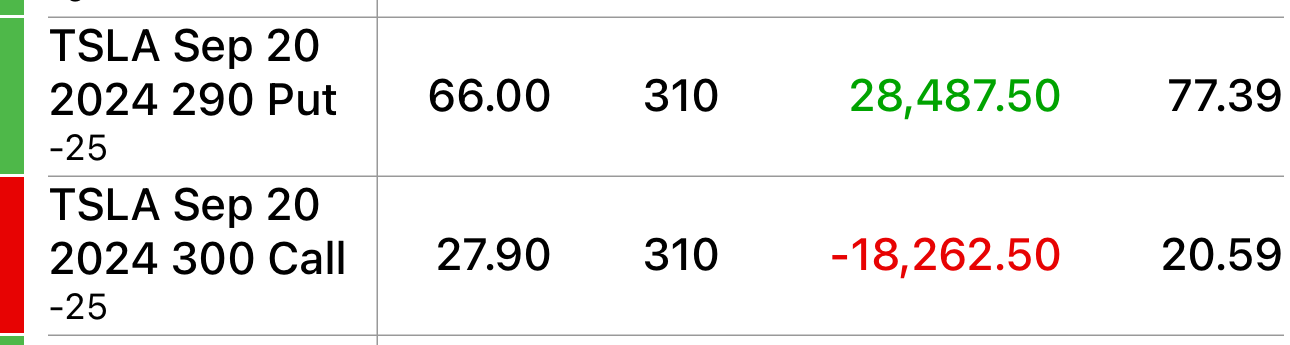

I see a possible pull back tomorrow, but I don't care. I bought 9,000 shares at 243 to cover 60X 247.5CC for this Friday. I also sold 30X 255CCs on the rest for next Friday. Soon I plan to use those shares to sell Jan 2025 300CCs for around $40 and have income for the next year. They are a buy-write.

Edit: I see MAcro as solid after CPI, etc. With Cybertruck coming, I see the SP over 250 in two weeks.

Edit: I see MAcro as solid after CPI, etc. With Cybertruck coming, I see the SP over 250 in two weeks.

Don't forget, it's a short trading week coming up, closed for Thanksgiving on Thursday and half-day, early close on the Friday

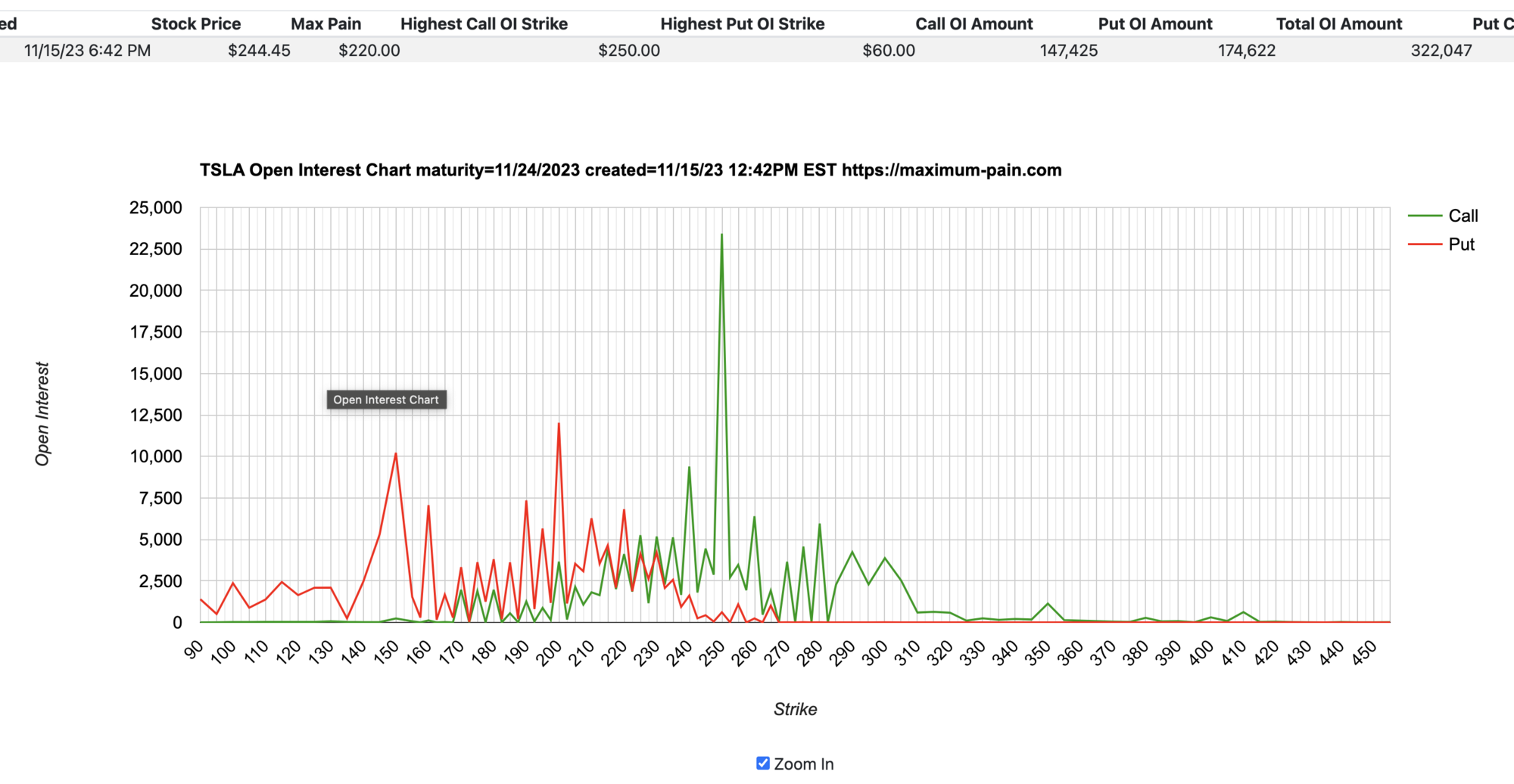

For what it's worth, 11/24 already has a sizeable c250 building up, but then again this week is quarterly OPEX and look how that turned-out...

For what it's worth, 11/24 already has a sizeable c250 building up, but then again this week is quarterly OPEX and look how that turned-out...

I see a possible pull back tomorrow, but I don't care. I bought 9,000 shares at 243 to cover 60X 247.5CC for this Friday. I also sold 30X 255CCs on the rest for next Friday. Soon I plan to use those shares to sell Jan 2025 300CCs for around $40 and have income for the next year. They are a buy-write.

Edit: I see MAcro as solid after CPI, etc. With Cybertruck coming, I see the SP over 250 in two weeks.

juanmedina

Active Member

I added a few $247.5 at $4. The 10-year is a +2% and Tesla just keeps on climbing, great.

I closed them at $2.37.

TSLA fighting over the 50-day currently

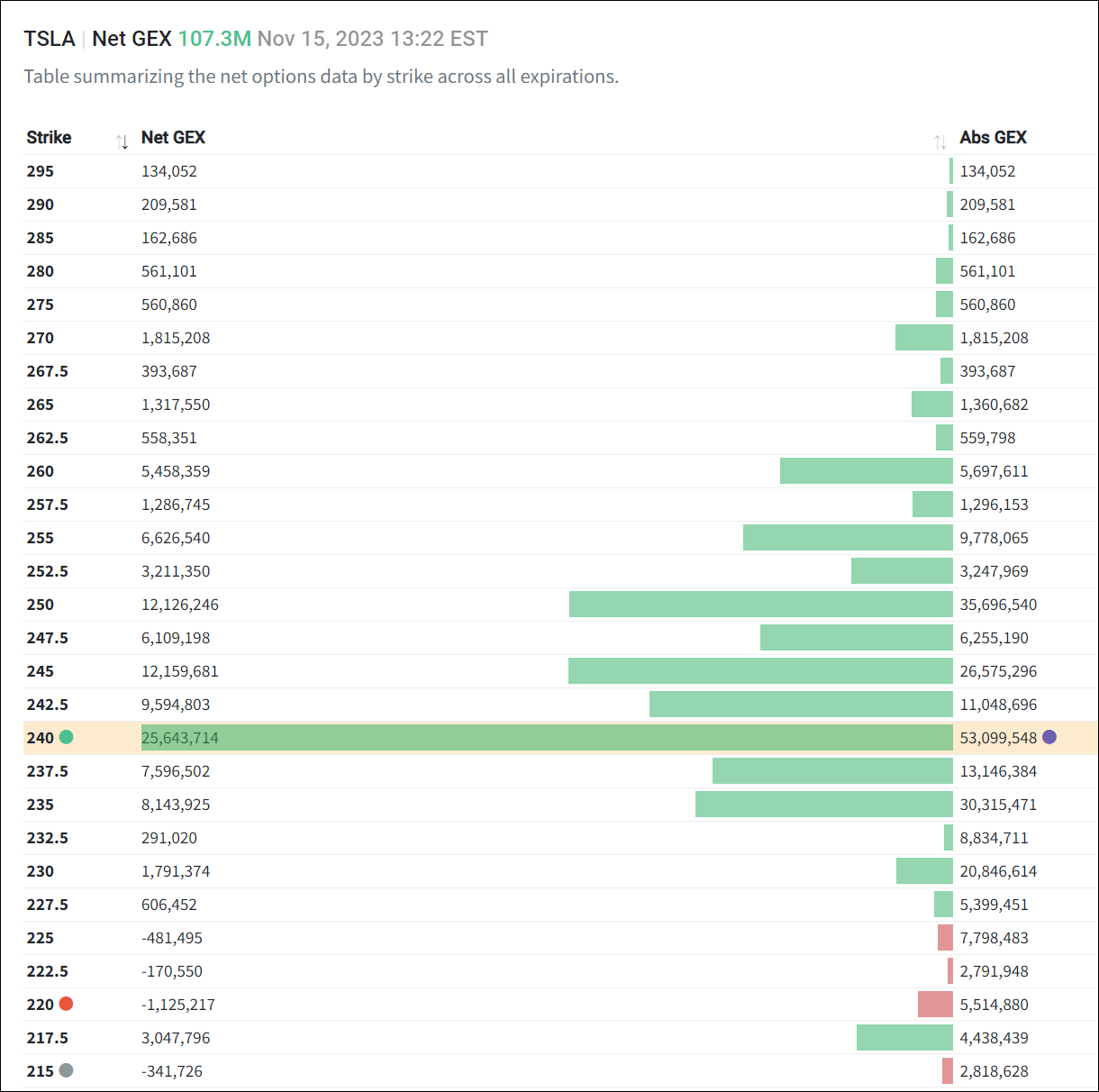

The huge 11/17 $240 call wall may be putting negative pressure.

The huge 11/17 $240 call wall may be putting negative pressure.

I hope you used that drop to 240 to your advantage...?TSLA fighting over the 50-day currently

The huge 11/17 $240 call wall may be putting negative pressure.

View attachment 990940

Still holding the below covered calls for next Friday (9 days). Will likely leave for next week to deal with unless we make it over $247 this week.

30x -C235 11/24 @ 3.15 (currently13.62 11.60) - Effective share sale price if I do nothing $238.15

15x -C240 11/24 @1.00 (currently10.20 8.39) - Effective share sale price if I do nothing $241.00

10x - C250 11/24 @ 2.00 (currently5.10 3.92)- Effective share sale price if I do nothing $252.00

Rolled the ITM 15x -C230 11/17 yesterday to 15x -C265 1/19/24 (65 days) for an even roll (~$9.00).

30x -C235 11/24 @ 3.15 (currently

15x -C240 11/24 @1.00 (currently

10x - C250 11/24 @ 2.00 (currently

Rolled the ITM 15x -C230 11/17 yesterday to 15x -C265 1/19/24 (65 days) for an even roll (~$9.00).

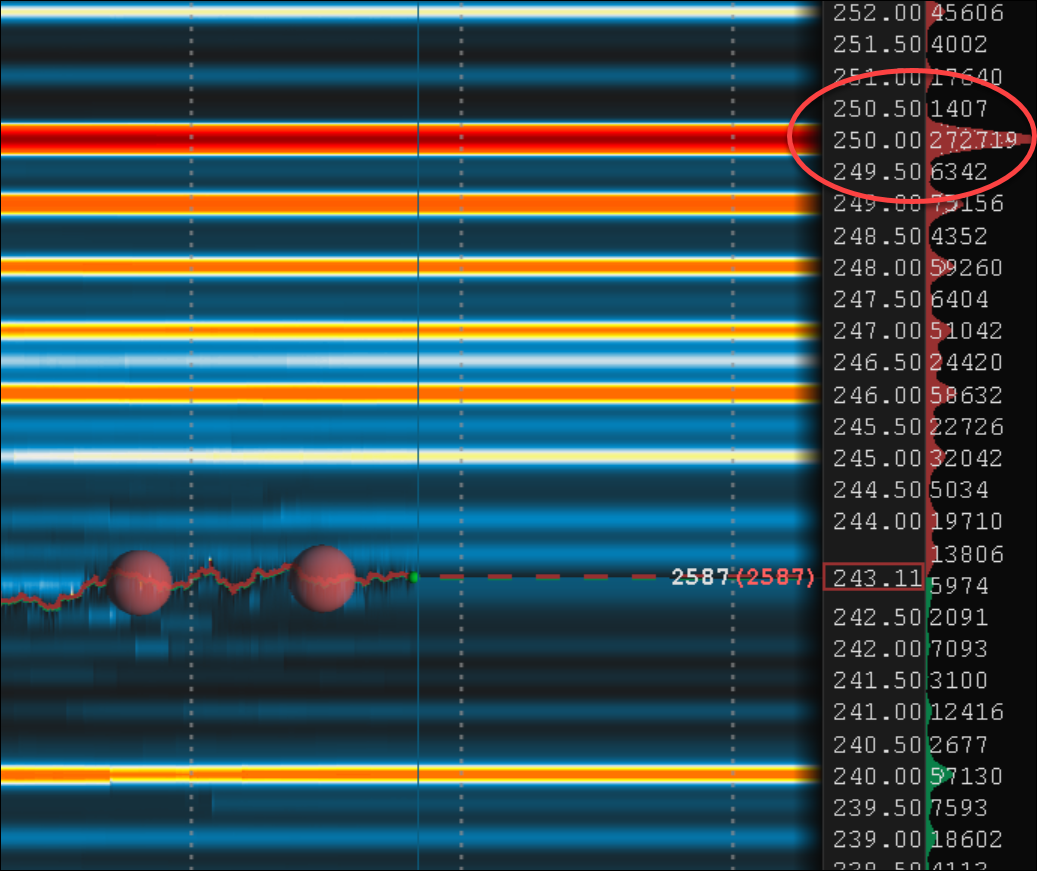

Never saw so many sell orders sitting at a strike on TSLA ($250). Most I've seen at major resistance levels were around 150k-175k, this is almost 300k. I don't think the big bois would show their hand like that, yet I'm still curious if that's a tip about our magic target before next decent leg down.

What app is that Jim?Never saw so many sell orders sitting at a strike on TSLA ($250). Most I've seen at major resistance levels were around 150k-175k, this is almost 300k. I don't think the big bois would show their hand like that, yet I'm still curious if that's a tip about our magic target before next decent leg down.

View attachment 990953

What app is that Jim?

It's called "Bookmap" and is offered as an add-on in TOS (about $30/mo). I find it very useful.

They also offer a standalone if you don't use TOS.

I dipped my toes in the water, using leaps to back cc (aka poor man's covered call). I decided, fairly quickly, that I didn't like the dynamic. The fundamental problem is that leaps don't move as fast as the share price does, and can move much more slowly than the short call (delta goes higher on the short call). Figuring out in real time how close I was to the transition, along with changes in IV - the end result was a much more complex equation that I was reasonably confident was costing me money, and was definitely stressing me out.I'm finding LEAPs too stressful TBH, will look to start acquiring shares instead

With share backed cc, even if margin backed, the shares are ALWAYS gaining value faster than the short call is losing value. It might not be by much, and the bid/ask spread on the short call might overwhelm the changing value of the shares (pretty easily actually when the call is a week+ out and/or DITM), but the fundamental relationship holds. The shares always have a delta of 1.

So I buy leaps for capital gains purposes, and I buy shares for income / cc purposes.

I missed out on the first half of the trading day, so I haven't rolled. Looking at it now - we've entered that range where I've found myself before. Sometimes it works out just fine, and some times this is the moment where the positions gets run over, with months of DITM coming.So, did you roll ?

The problem with having so much time still left this week is that the strike improvement is minimal. Right now it is just $5. That new strike could soon be over taken just today !

I'll have to rethink the thumb rules - esp. on how and when to roll or how to manage "stop loss".

*sigh*

Thumb rules are just that - guidance developed ahead of time on what to do when situations arise. They are well short of mechanistic trading rules - if the trades could be reduced to an algorithm that won over a wide range of market conditions, then somebody with more money, analytical power, and other resources (than me) would already be running the trading algorithm and squeezing the pennies out of it. As long as there was a big enough supply of that profitable trade, that entity would be demanding all of it and looking for more. Thereby eliminating the value in the trading pattern.

Thanks for asking - you've prompted me to make a decision. I decided to roll to the Jan '24 expiration and 270 strike. If I get assigned in January then I'll have earned an additioanl $30 (plus the additioanl .80 credit on this roll) over the period of holding the shares. That's a good deal right there. The alternative of finishing OTM isn't great, but its also still profit and opportunity cost, vs. actual loss.

The Jan '24 monthly is also a big expiration with contracts accumulating for a couple of years now. My past experience with that expiration is that it tends to be a big expiration for restraining the share price, sometimes by a LOT. Maybe that'll help out as well.

That handles my 1 batch of shares / cc's.

That leaves me with cash for a 2nd batch of shares that I don't currently own. Also with cash for 2 batches of csp. I'll be looking at:

- regular income focused csp

- aggressive csp with intent to take assignment

- NOT looking at bps at this share price

I am avoiding outright buying the shares at this point, though its really not a bad time to buy in my longer term view of things.

I like @BornToFly idea of selling far out cc with a high strike for income. That will be easier to do in the account where I own uncovered shares, with a cost basis that is a lot lower than today's share price.

Knightshade

Well-Known Member

Still holding the below covered calls for next Friday (9 days). Will likely leave for next week to deal with unless we make it over $247 this week.

30x -C235 11/24 @ 3.15 (currently13.6211.60) - Effective share sale price if I do nothing $238.15

15x -C240 11/24 @1.00 (currently10.208.39) - Effective share sale price if I do nothing $241.00

10x - C250 11/24 @ 2.00 (currently5.103.92)- Effective share sale price if I do nothing $252.00

Rolled the ITM 15x -C230 11/17 yesterday to 15x -C265 1/19/24 (65 days) for an even roll (~$9.00).

I've got a couple dozen -C235 11/17s still to deal with... looks like I can net $1.50/sh following your 1/19 -C265 roll idea so seriously thinking about doing so... (could also do 270 strike for about even but if we get the 260 top and pullback suggested taking the $1.50 makes more sense)... still like $2/sh time value showing on the 11/17s though...

tivoboy

Active Member

$254.xx resistance is now moved up to $260.41 today, same VERY strong strength. If we ring that bell I doubt we’ll move higher. Still short covered calls @ $245 for next week 11/24.. bought back 5 of 12 today and resold same strike for +$2.85 credit.$242 is the target, but we could stretch up to $246 IMO.. $254.xx is VERY big resistance.. if we break that, well all upper strikes are in play.

@Max Plaid I got a question for you, the straddle I put on earlier is now green around +$10k on the put side. What are some ways to “harvest” it in case we fizzle out around here and leg down? I still need to carry a similar position to cover the deficit, but at least it can reduce it by the “gains.”

Last edited:

Yes, this is my conclusion too - in fact all longer-dated longs move less than the weeklies, so that's always something to bear in mind, but shorter dated longs lessI dipped my toes in the water, using leaps to back cc (aka poor man's covered call). I decided, fairly quickly, that I didn't like the dynamic. The fundamental problem is that leaps don't move as fast as the share price does, and can move much more slowly than the short call (delta goes higher on the short call). Figuring out in real time how close I was to the transition, along with changes in IV - the end result was a much more complex equation that I was reasonably confident was costing me money, and was definitely stressing me out.

With share backed cc, even if margin backed, the shares are ALWAYS gaining value faster than the short call is losing value. It might not be by much, and the bid/ask spread on the short call might overwhelm the changing value of the shares (pretty easily actually when the call is a week+ out and/or DITM), but the fundamental relationship holds. The shares always have a delta of 1.

So I buy leaps for capital gains purposes, and I buy shares for income / cc purposes.

And every time I buy LEAPS when the SP is low, I sell calls against them and then the SP rockets and I miss out what could have been considerable profits, so change of tack from now on - will also buy LEAPS if the SP dumps (although I'm more inclined to take shares if I have the funds), but if I do sell against them, sell literally for beer money

Edit: I see a trend today...

EVNow

Well-Known Member

Somehow longer term CCs don't appeal to me !Thanks for asking - you've prompted me to make a decision. I decided to roll to the Jan '24 expiration and 270 strike.

Esp. now when the calls are just $4 ITM and might even end up OTM in a couple of days.

Thumb rules are just that - guidance developed ahead of time on what to do when situations arise. They are well short of mechanistic trading rules - if the trades could be reduced to an algorithm that won over a wide range of market conditions, then somebody with more money, analytical power, and other resources (than me) would already be running the trading algorithm and squeezing the pennies out of it. As long as there was a big enough supply of that profitable trade, that entity would be demanding all of it and looking for more. Thereby eliminating the value in the trading pattern.

That is why there is so much algorithmic trading now. Infact most of the trading is algorithmic, esp. the high frequency type. We can't compete with them.

Still, I want to figure out a thumb rule that can work to mitigate a situation like this. Basically the SP moving in the "wrong direction" soon after we sell an option.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K