tivoboy

Active Member

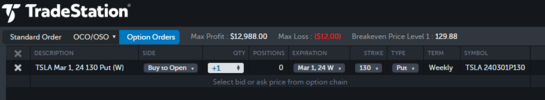

It was, inevitable. And now we’re here. GLTA50sma/200sma death cross

View attachment 1014391

:max_bytes(150000):strip_icc()/What-Is-a-Stock-Exchange-56a0937a3df78cafdaa2d9be.jpg)

Death Cross Definition: How and When It Happens

A death cross is a chart pattern that occurs when a security's short-term moving average drops below its longer-term moving average.www.investopedia.com