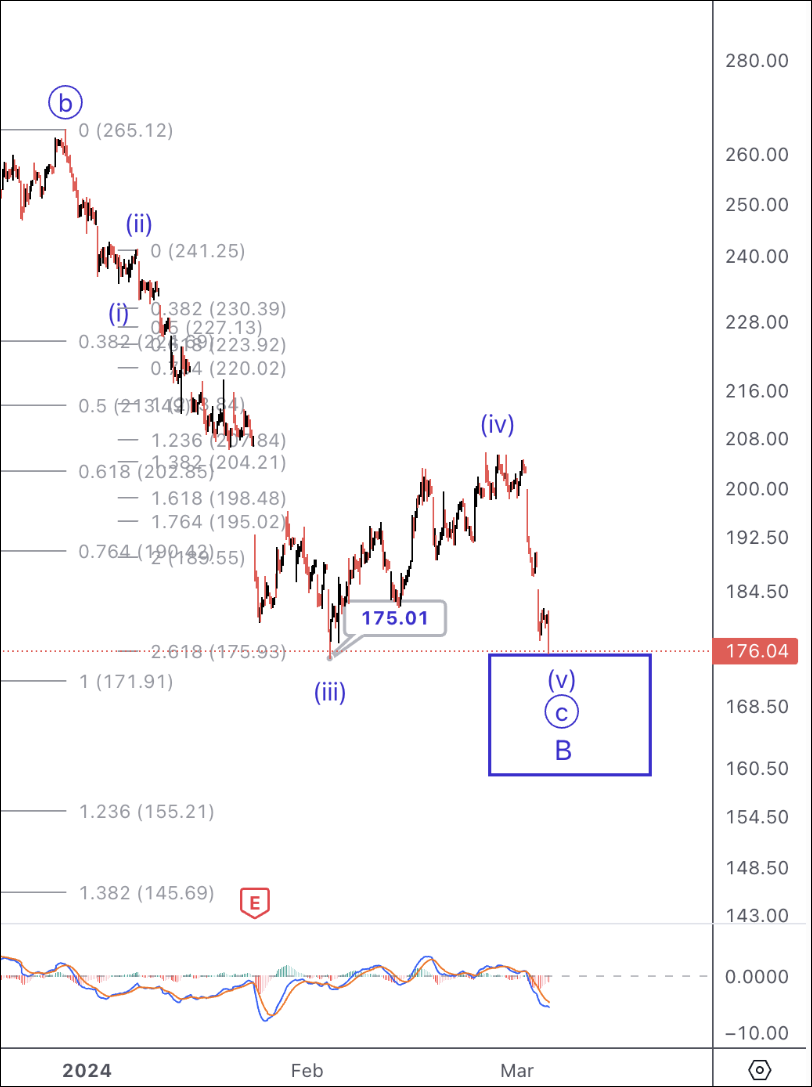

SW: Getting close to the target box for a possible low in this structure. Need evidence of a turn. If this is to be the a C of (B) back up, then we should start with 5 up to confirm.

Should try for a (iv)-(v) of v of C.

Credit: StockWaves. Consider a subscription to their excellent service at www.elliottwavetrader.net

Should try for a (iv)-(v) of v of C.

Credit: StockWaves. Consider a subscription to their excellent service at www.elliottwavetrader.net