STO a bunch of calls maybe?Welp, bought a bunch of calls at the open and then couldn't help but close them a few minutes later for ~35% profit.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Does your tool enable calculation of the difference in $ and %? It would be interesting to compare the trend in up vs. down weeks.during the last 3 months, the sp closing price is approx 53/63 (84%) times above mp :

View attachment 708787

i have lots of -p720 so this better be true again!

i only grabbed the screenshot fromDoes your tool enable calculation of the difference in $ and %? It would be interesting to compare the trend in up vs. down weeks.

Options Max Pain - Calculations for SPY

Our Max Pain calculator displays the aggregate nominal value of options premium expiring at each strike price, for each expiration.

I was just going off your text that I quoted which was "the wide spread gives you much more room to adjust the trade while increasing your risk of total max loss". Regardless, yes, there are lots of aspects, but one thing you didn't really mention is that the the 10 point spread also has much lower premium as the 100 point spread as well, so you have to lever up a bit to compare them from a profit standpoint.I'm not confusing likelihood and size. I think earlier I said the likely hood was less. but the amount is more.

But it is a fact that a 100 point spread has the potential of a greater loss than a 10 point spread for the same side trade.

I compared 1 narrow BPS and the maintenance margin requirement with 1 wide spread BPS.

I did not include using a narrow spread to increase leverage.

I think all the variables highlights the fact that risk management has a multitude of aspects to it.

Guesses on the floor for today? I'm thinking of BTC some of my CC's today.

This week now seems like the battle of the put and call walls. The $700 walls are both big, but it seems like the $720 put wall might hold with 30.4k puts.

- GTC order to BTC 2/3 of my $765 position at $2 for a $7 profit -- hit.

- Will let the rest expire or close lower on Friday.

- Friday BTO at $760 for a Monday AM pop didn't work this week (bought too early, and Elon email plus noise seems to have overwhelmed FSDv10 news).

Last edited:

AquaY

Member

Sorry, I used the wrong word. Like when I call my GF by my Ex's name.I was just going off your text that I quoted which was "the wide spread gives you much more room to adjust the trade while increasing your risk of total max loss". Regardless, yes, there are lots of aspects, but one thing you didn't really mention is that the the 10 point spread also has much lower premium as the 100 point spread as well, so you have to lever up a bit to compare them from a profit standpoint.

That increases my risk of the size of the hurt I'm going to receive. LOL

I meant to say size instead of risk. Big difference

"I was just going off your text that I quoted which was "the wide spread gives you much more room to adjust the trade while increasing your SIZE of total max loss"."

In other news my short leg of my BPS of 710 Puts I STO last week is not being kind to me today

InTheShadows

Active Member

Can you share a link to that website?during the last 3 months, the sp closing price is approx 53/63 (84%) times above mp :

View attachment 708787

i have lots of -p720 so this better be true again!

Can you share a link to that website?

Options Max Pain - Calculations for SPY

Our Max Pain calculator displays the aggregate nominal value of options premium expiring at each strike price, for each expiration.

Knightshade

Well-Known Member

I did 615/715 BPSes, down over 82% presently.

Still not super concerned, esp after seeing the 700 put wall flip since Friday as well as the additional put wall appearing at 720.

Down 156% now. Fun stuff.

Knightshade

Well-Known Member

BTW, just poking around- as of a minute ago break-even price on buying $550 strike 10/8 (week after Q3 delivery #s are out) calls is ~$718.

Jan 21 of same (post Q4 delivery) is ~$741.

(without considering anything you can make on weeklies)

Not an advice.

Jan 21 of same (post Q4 delivery) is ~$741.

(without considering anything you can make on weeklies)

Not an advice.

I have a theory, based off of looking at max-pain for every week going out to 10/8.

This week I think that $700 call wall will disapear at some point. Guessing when SP drops close enough for whomever to take nice enough profits. When that happens it's game on for run to $750 to close the week.

Looking out further to 9/24 I'm being careful as it could run to $800 easily as there doesn't seem to be any calls impeding.

10/1 is a $800 small-ish call wall at 2.8k, but could disapear as well.

10/8 $800 call wall 4.9k.

The next few weeks look great for selling aggressive puts. I'm going to be very conservative with selling calls

Not advice.

This week I think that $700 call wall will disapear at some point. Guessing when SP drops close enough for whomever to take nice enough profits. When that happens it's game on for run to $750 to close the week.

Looking out further to 9/24 I'm being careful as it could run to $800 easily as there doesn't seem to be any calls impeding.

10/1 is a $800 small-ish call wall at 2.8k, but could disapear as well.

10/8 $800 call wall 4.9k.

The next few weeks look great for selling aggressive puts. I'm going to be very conservative with selling calls

Not advice.

What about if the entire market decides to take a dump?I have a theory, based off of looking at max-pain for every week going out to 10/8.

This week I think that $700 call wall will disapear at some point. Guessing when SP drops close enough for whomever to take nice enough profits. When that happens it's game on for run to $750 to close the week.

Looking out further to 9/24 I'm being careful as it could run to $800 easily as there doesn't seem to be any calls impeding.

10/1 is a $800 small-ish call wall at 2.8k, but could disapear as well.

10/8 $800 call wall 4.9k.

The next few weeks look great for selling aggressive puts. I'm going to be very conservative with selling calls

Not advice.

ChefBoyardee

Member

Hell yeah - closed most of the bear side of my 720/710/700 butterflies (Sep 24) while we were at 710. The hedge is working

Leaving a few to close tomorrow since selloffs tend to happen over 3 days and we're on day 2

Leaving a few to close tomorrow since selloffs tend to happen over 3 days and we're on day 2

Always a macro worry, yes. But then just buy more TSLA stock. Don't worry about optionsWhat about if the entire market decides to take a dump?

corduroy

Active Member

Well this morning was definitely a gut check. Nothing like seeing your positions swing 90% one way and back,

InTheShadows

Active Member

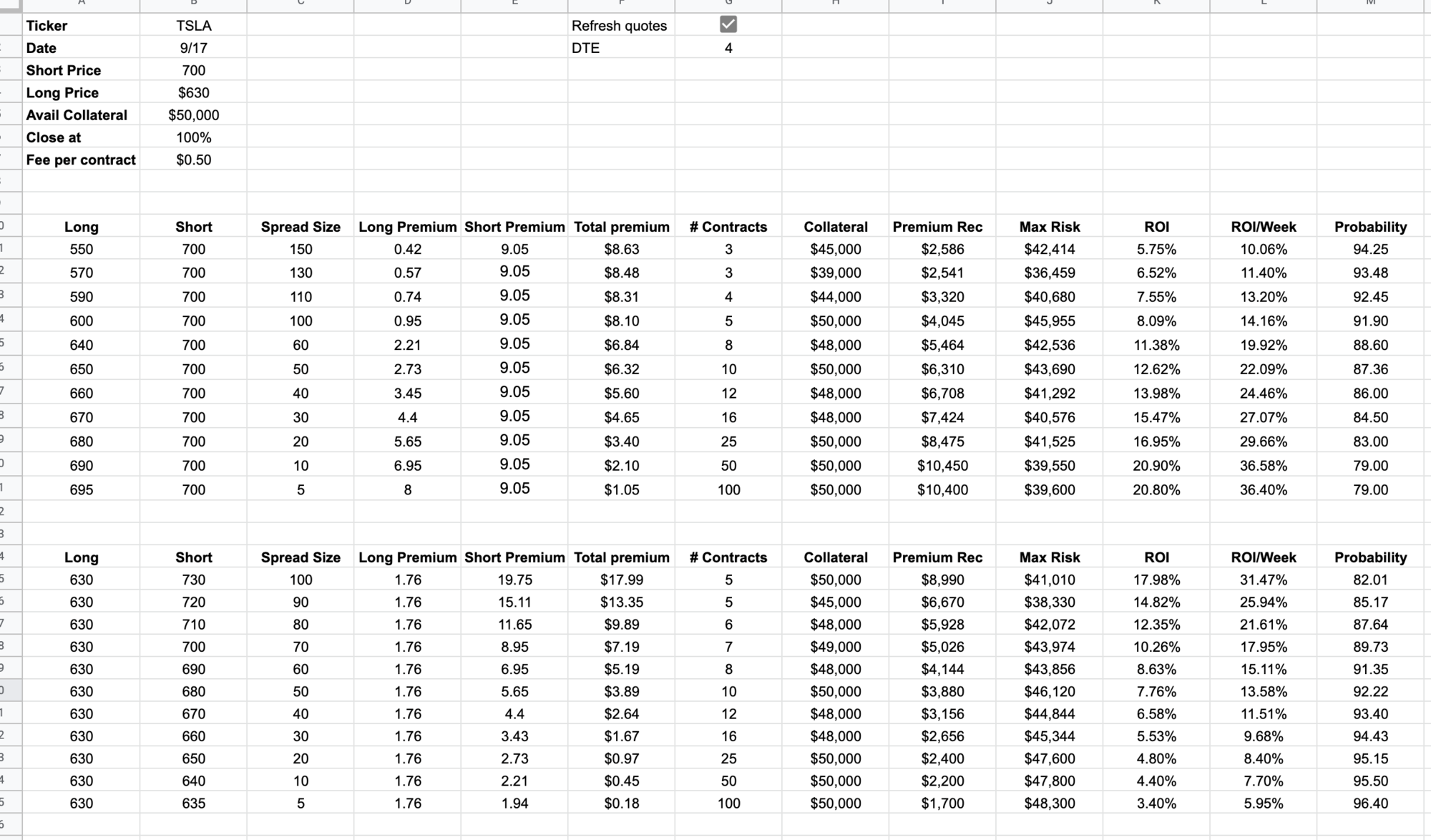

Here is a sheet I made to help me figure out how to leverage put spreads and how much risk I want to take. I can enter different values and it will go out and fetch the latest option prices and do the calculations for me.

(jealous) THAT'S REALLY AMAZING!Here is a sheet I made to help me figure out how to leverage put spreads and how much risk I want to take. I can enter different values and it will go out and fetch the latest option prices and do the calculations for me.View attachment 708818

there's formula to grab realtime options prices?!?

InTheShadows

Active Member

Yes. Same tools I PM’d a month or two ago.(jealous) THAT'S REALLY AMAZING!

there's formula to grab realtime options prices?!?

Well, looking at how SP was falling this a.m. I decided 710 might be in play and rolled these into lower strikes.STO 50x 9/17 bps 710/660 for 3.55 credit.

May add next week if SP goes down.

Won't sell CCs rn. Already have -40x 9/24 820c

that are not doing very well. Only 50% profit in 2+ weeks.

-100x bps 9/17 690/685 @0.85

-200x bps 9/24 690/680 @2.65

Prices were all over the place while I was scrambling to put the trades in and close old position, but got about $5k credit from this and will make me sleep better.

Too bad I didn't follow my suggestion to wait until this week to see what MM will be up to instead of selling puts last week

Edit: Beta 10 seems to still have some major screw ups based on @wholemarsblog and @Frenchie videos, so not at prime time for robotaxi yet, but the progress is obvious.

Wouldn't be surprised if it's near perfect in 6mo.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K