InTheShadows

Active Member

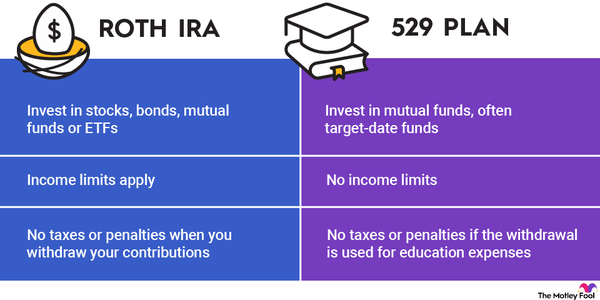

I’d pay the taxes to do options and return close to 100% annually. And what’s not used for college can continue to grow for their retirement.They will have earned income this year. Discussing the finer points with the CPA, but they will have enough to fully fund a Roth contribution.

However, everything I've read is that if you withdraw the Roth IRA funds for college, you owe taxes on it (well, the kids do - but not the 10% penalty). That would defeat the purpose of using that vehicle for college expenses.

Roth IRA vs. 529 Plan for College Savings: Which Is Better? | The Motley Fool

Both of these tax-advantaged plans can help you save for education expenses for yourself or someone else. But which one is best for you?www.fool.com