If everyone on this thread consistently closed out trades at 50%, 40%, even 30% or 20% when available, there'd be a lot less stress and a lot more profits over timeCall me a sissy if you like! Just closed my BPS $550/450 for this week.

Even bailed on my single $750c purchased for fun Monday when all that call activity was noticed at $800. In for $1.22 out for $.80.....disgraceful.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

NOT-ADVICE

I've been thinking about Market orders vs. Limit orders and I find myself increasingly making use of Market orders.

They don't work for spreads, so this only applies to single leg trades. As long as they bid/ask spread is "small" - for me that typically means $0.20 on the short options I mostly deal with, then the midpoint is .10 between the two. I conclude that using a limit order - my upside is to gain that missing .10. There won't be any $1 moves in my favor as the limit order is filled at my limit, or even up to the ask, and the rest of that move up going to somebody else.

But I have big downside. I try to enter a position at 3.90/4.00/4.10 with a 4.00 limit. That price goes down and doesn't fill. So I update and try to fill at 3.90 and continue to miss. I've had these situations go on until I either give up on the position entirely, or finally do a market order for much less than I started at.

That being said I use limit orders for start of day / end of day trading (say the first and last 15 minutes) and on any position with a large(r) bid/ask, and/or low volume. So the July '24 calls I bought - those were all using limit orders. Those had about $15-20 bid/ask spreads. On those I was aiming to get the midpoint, and they usually filled pretty quickly. Suggests to me that I could do a bit better than midpoint with patience that I mostly don't have.

If nothing else part of my trading strategy is to do things in such a way that I can be at my desk, ready to trade, 1 or maybe 2 times per day. I do a lot of "it looks good, market order" kind of decision making.

I've been thinking about Market orders vs. Limit orders and I find myself increasingly making use of Market orders.

They don't work for spreads, so this only applies to single leg trades. As long as they bid/ask spread is "small" - for me that typically means $0.20 on the short options I mostly deal with, then the midpoint is .10 between the two. I conclude that using a limit order - my upside is to gain that missing .10. There won't be any $1 moves in my favor as the limit order is filled at my limit, or even up to the ask, and the rest of that move up going to somebody else.

But I have big downside. I try to enter a position at 3.90/4.00/4.10 with a 4.00 limit. That price goes down and doesn't fill. So I update and try to fill at 3.90 and continue to miss. I've had these situations go on until I either give up on the position entirely, or finally do a market order for much less than I started at.

That being said I use limit orders for start of day / end of day trading (say the first and last 15 minutes) and on any position with a large(r) bid/ask, and/or low volume. So the July '24 calls I bought - those were all using limit orders. Those had about $15-20 bid/ask spreads. On those I was aiming to get the midpoint, and they usually filled pretty quickly. Suggests to me that I could do a bit better than midpoint with patience that I mostly don't have.

If nothing else part of my trading strategy is to do things in such a way that I can be at my desk, ready to trade, 1 or maybe 2 times per day. I do a lot of "it looks good, market order" kind of decision making.

jeewee3000

Active Member

Up or down day is not important in this buy-write scenario IMO. You want to open the position at as high IV as possible to maximize returns on the call sale. Shares cost the same no matter the IV.Meant to include - optimizing for the share purchase price is probably the safest choice. So enter the buy-write on a down day. The likelihood of a regression that pushes above your short strike is that much higher, and you get an in and out / big $$ credit 1 week position.

I agree with the details, but not the conclusion.Up or down day is not important in this buy-write scenario IMO. You want to open the position at as high IV as possible to maximize returns on the call sale. Shares cost the same no matter the IV.

My rationale for buy-write at relatively low share price (down day) is that I want a regression that takes me above the short strike, and a close for the strike to strike gain plus the opening credit.

The reason I optimize that way is that strike to strike changes in the share price tend to overwhelm the short call credits.

Note that despite my rationale for buy-write on a down day / relatively low share price, my buy-writes I did today are on an up day. I clearly don't feel strongly about these on a down day

A recent experience - the day that shares hit 1150 recently, I made a decision that day that I needed to sell some shares to reach my target cash %. Shares were 1133 at the time and I decided to sell.

I did that sale in the form of an 1100 strike cc ($48 credit), figuring that at anything over 1100 I'd get the 1133 I wanted plus another $15 for the privilege. Then the shares dropped down to 1080 before expiration. I kept the $45 net - that was nice. I could be rebuying those shares today at $680; would have rebought around 830. I've had no chance to sell enough cc to have captured the $300(+) strike to strike benefit that was available has I just sold the shares.

Of course I didn't know that, but the thing is - I had decided to sell the shares. It was time, the cash % was too low for my own discipline and trading approach, and I got greedy. Note that I'm not really lamenting the outcome - one benefit is that I didn't need to decide later when to buy back in. Nor did I know if there would be a good future option to buy back in.

But my trading strategy demand this of me (I always maintain 50%+ account value in shares, so I have lots of exposure to breakouts), and I didn't carry through. That is the real problem

With a buy-write, the purchase price of the shares does matter. Had I executed a buy-write at 1133, selling the 1100 call, looking to earn $18 in 3 or 4 days, and then continued selling cc to today, then I'd be looking at something like a $450 strike to strike (unrealized) loss while having collected maybe $100 in cc gains. To reach a strike to strike gain I'd be (and am) selling pretty far OTM calls, with the hope that I'll be able to roll far enough, fast enough, to get back to a neutral strike to strike position.

scubastevo80

Member

Closed my BPS (90+% up) and BCS (15% up) before the fed minutes to avoid any wild up or down swings, which obviously didn't happen. Depending on tomorrow's volatility, I may call it a week. If we have a +/-5% day early, I'll consider selling spreads for 5/26 around 10% OTM.

A couple of us (@CHGolferJim ) have been doing these for a while. Really good premium because you want the shares called away... but sometimes when the momentum is going up, makes you want to HODL. It has been one of the more fun and profitable strategies I have used.

The challenges are twofold — 1) being willing to let shares assign at a price sometimes well below market in order to do a quick in/out vs. rolling, and 2) rolling exposes one to a downturn below purchase price at which it is easy to become reluctant to let the b-w assign. I have tended towards getting into the second situation, and now have shares purchased specifically for buy-writes at $974 and $1073 that I certainly don’t want to let get assigned at current levels. What I’ve done is reclassified, at least in my mind and on the spreadsheets, core shares with lower cost basis to be the b-w shares, and shifted those high-cost shares into core holdings. It’s somewhat arbitrary, but it allows me to accept more aggressive strike prices with better premiums on the “new” buy-writes.

Meanwhile, I’ve sold CC for 6/3 at $730 and $755, so will be watching these more closely after today’s action. Down day tomorrow?

I too had 2 925 puts this morning that got exercised. I was hoping to roll it out few more weeks to wait for more certainty in this market before taking assignment.I had a $910 put I sold for next week exercised this morning.

At some point in the recent slide down, I sold several 1/23 $800 CCs to trim some spreads. They decreased so much in value that I bought them back today. I sense we’re at or near the bottom, so I pulled the trigger.

I’m making 10-20 day trades every day. Almost all are options spreads. About 90% of my trades are profitable. But almost every day I break at least one of my trading rules and it costs me money. Today I didn’t want to take a $50 loss and waited and it turned into a $250 loss. I’m better at accepting a modest profit instead of waiting for a better price that may never come and even turn into a loss. That’s why I make so many trades every day. I’m averaging about $1,000 profit per day. The only problem I have are long dated bps that I’ve been managing for months now. I’d be so much better off if I took the loss on them before they went completely under water.

I’ve found that the more disciplined I am the more money I make. Who knew?

I’m making 10-20 day trades every day. Almost all are options spreads. About 90% of my trades are profitable. But almost every day I break at least one of my trading rules and it costs me money. Today I didn’t want to take a $50 loss and waited and it turned into a $250 loss. I’m better at accepting a modest profit instead of waiting for a better price that may never come and even turn into a loss. That’s why I make so many trades every day. I’m averaging about $1,000 profit per day. The only problem I have are long dated bps that I’ve been managing for months now. I’d be so much better off if I took the loss on them before they went completely under water.

I’ve found that the more disciplined I am the more money I make. Who knew?

Last edited:

I too had 2 925 puts this morning that got exercised. I was hoping to roll it out few more weeks to wait for more certainty in this market before taking assignment.

Also 6/3 expiration?

Last week I had 1100 strike puts for my mom’s account, with ten more days until expiration, assigned early. Don’t know the extrinsic value that was left. But all these early assignments tells me that the owners expect the SP to reverse and climb now, which is why they are willing to take a small loss on the time value now vs hoping for more of a stock drop and the increase in value that would follow a drop…. Bullish!

the last time there were 2 consecutive green days was May 3-4... 3 weeks agoMeanwhile, I’ve sold CC for 6/3 at $730 and $755, so will be watching these more closely after today’s action. Down day tomorrow?

Also had 2x 5/27 $930's assigned last night. They were the short legs of a BPS, was under the impression that if they would be assigned, the long leg would be simultaneously exercised but apparently not.

Sounds like a lot of reasonably DITM and reasonably low DTE puts are being assigned these days.

So people that own puts are exercising fairly DITM puts to sell shares at high values, to people that would rather avoid buying the shares. That sounds to me like people with shares that are getting margin calls or some other form of "raise cash now", where one way of handling the problem is to sell shares at a better strike than the current share price.

If those were early assignments on calls, then that would be call purchasers acquiring shares that might not otherwise be available.

Though I've been DITM on csp, I don't think I've ever been as deep as some of these. I had more like 760p with shares in the 560-660 range, that I kept rolling for 4 or 5 months. I think that with $300 ITM I'd be looking at monthly rolls - maybe a 3 month roll. Something that gets a decent whack of time value, even if the strike price still won't budge (decent chance that it won't).

So people that own puts are exercising fairly DITM puts to sell shares at high values, to people that would rather avoid buying the shares. That sounds to me like people with shares that are getting margin calls or some other form of "raise cash now", where one way of handling the problem is to sell shares at a better strike than the current share price.

If those were early assignments on calls, then that would be call purchasers acquiring shares that might not otherwise be available.

Though I've been DITM on csp, I don't think I've ever been as deep as some of these. I had more like 760p with shares in the 560-660 range, that I kept rolling for 4 or 5 months. I think that with $300 ITM I'd be looking at monthly rolls - maybe a 3 month roll. Something that gets a decent whack of time value, even if the strike price still won't budge (decent chance that it won't).

intelligator

Active Member

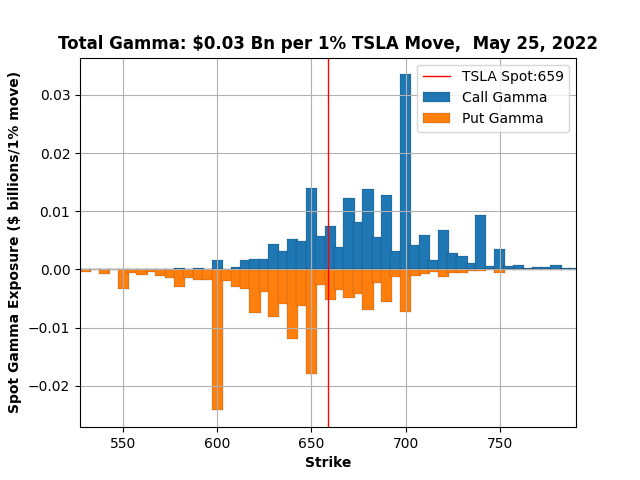

Pre-market is green, gamma may have flipped, I'm looking forward to a green day @CHGolferJim and @Yoona  , are you with me ? Today I got a good credit on June BPS roll to August, kept the 625 and 620 short side BPS for this week and traded 1 buy-write following @adiggs. I was going to buy shares regardless, why not wrap it with some additional credit. I like the close on down, roll up if needed, also attending to the challenges and strategies you all are posting. And if it is all wrong, we move to safer ground. Plan Thursday is to take profit by closing the two spreads for this week, if indeed it is an up day; thanks for keeping us honest @Max Plaid and for all the others who have contributed such helpful posts !!!

, are you with me ? Today I got a good credit on June BPS roll to August, kept the 625 and 620 short side BPS for this week and traded 1 buy-write following @adiggs. I was going to buy shares regardless, why not wrap it with some additional credit. I like the close on down, roll up if needed, also attending to the challenges and strategies you all are posting. And if it is all wrong, we move to safer ground. Plan Thursday is to take profit by closing the two spreads for this week, if indeed it is an up day; thanks for keeping us honest @Max Plaid and for all the others who have contributed such helpful posts !!!

Sounds like a lot of reasonably DITM and reasonably low DTE puts are being assigned these days.

For those that don't want the early assignment you might want to consider a monthly roll for those, with the plan being to roll them with 2 (or even 3!) weeks to expiration. I really track extrinsic value - it sounds like even $1 might be cutting it thin.

As @BornToFly observes - that level of assignment sure sounds bullish to me. I think that in the 2 years I've been doing this I've never heard of this level of early assignment.

I agree it does seem bullish.

If enough people think we’ve reached the bottom, we’ve reached the bottom.

I agree it does seem bullish.

If enough people think we’ve reached the bottom, we’ve reached the bottom.

Why is this bullish? IMO this indicates there is a negative sentiment in the market for the short term to medium term.

The person who bought the 920 put for example is willing to let go his/her shares instead of selling the put with the time premium left on it. Hopefully this is just retail exercising their puts and not institutions. If this is institutions then I think it’s not a good look.

edited to clarify: If the put buyer thinks we are at the bottom wouldn’t he/she be more inclined to sell the put and hold on to the shares?

Last edited:

A put holder doesn't even have to own any shares. It could be that they think we have reached the bottom and that this is the lowest that they can buy shares and then forcibly sell them to people who have sold them puts. i,e. maximum profit for them.Why is this bullish? IMO this indicates there is a negative sentiment in the market for the short term to medium term.

The person who bought the 920 put for example is willing to let go his/her shares instead of selling the put with the time premium left on it. Hopefully this is just retail exercising their puts and not institutions. If this is institutions then I think it’s not a good look.

Sure but we are specifically talking about a put assignment scenario that happens when there is another person on the other side that wants to let go of their shares.A put holder doesn't even have to own any shares. It could be that they think we have reached the bottom and that this is the lowest that they can buy shares and then forcibly sell them to people who have sold them puts. i,e. maximum profit for them.

Why is this bullish? IMO this indicates there is a negative sentiment in the market for the short term to medium term.

The person who bought the 920 put for example is willing to let go his/her shares instead of selling the put with the time premium left on it. Hopefully this is just retail exercising their puts and not institutions. If this is institutions then I think it’s not a good look.

edited to clarify: If the put buyer thinks we are at the bottom wouldn’t he/she be more inclined to sell the put and hold on to the shares?

The way I see it, the put buyer is looking to profit from the current stock price and the strike price. If they expect the stock price to rise quickly sometime soon they have an incentive to exercise now.

They can then pocket the difference and re-buy the shares at a much lower price than they sold them for if they wanted to.

You don't know if they own the shares or not. They could be going short the stock by forcing the assignment. Or they could have just bought the shares before asking for the put to be executed.Sure but we are specifically talking about a put assignment scenario that happens when there is another person on the other side that wants to let go of their shares.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K