No, the max loss calculation already takes into account the premium you collected when you opened the trade. So max loss on 100 contracts is closer to $440k. (From what @juanmedina showed.)Obviously. But if it goes to max loss you still make $4,240. If it doesn't go in the money at all you make $54,240 on 100 contracts. It's a beautiful crack in the Matrix!

View attachment 738656

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Sorry! Big error. Max loss

NEVER MIND!!! Max loss is $500,000 on 100 contracts. Brain fart!!!Obviously. But if it goes to max loss you still make $4,240. If it doesn't go in the money at all you make $54,240 on 100 contracts. It's a beautiful crack in the Matrix!

Edit: NEVER MIND!!! Max loss is $500,000 on 100 contracts. Brain fart!!!

View attachment 738656

corduroy

Active Member

Isn't this impossible, like free energy or perpetual motion?12/3 1050-1300 is my best IC to date, first time in very rare situation where credit is 20% higher/taller than the max loss...

llirk

Member

If this was the case, I wouldn't want to be the house anymore.Isn't this impossible, like free energy or perpetual motion?

With the big move up today I opened some cc for this Friday - 1200s @ 9.00.

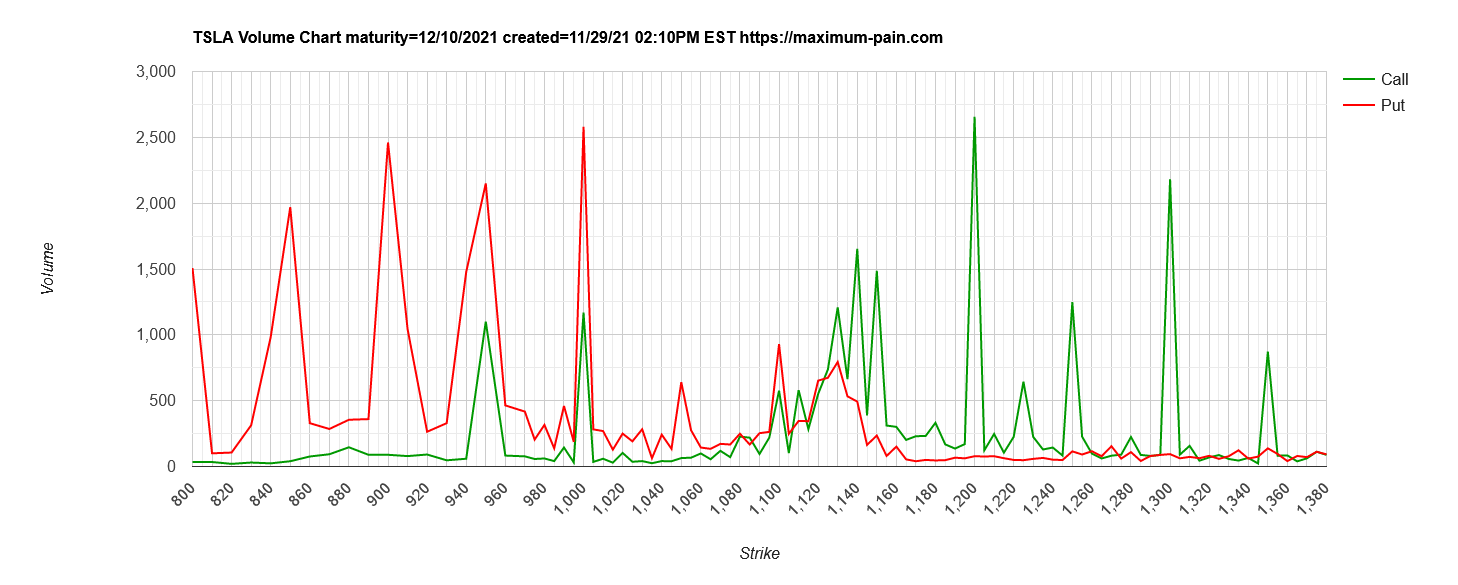

I don't have a strong opinion one way or the other whether 1200 is in play for this Friday. I did see a big hunk of activity at that strike (call wall) and I'm confident I can roll that along to higher strikes if necessary. Definitely not advice as I'm going to tend towards being more aggressive with my cc - especially as we get closer to the ATH.

I don't have a strong opinion one way or the other whether 1200 is in play for this Friday. I did see a big hunk of activity at that strike (call wall) and I'm confident I can roll that along to higher strikes if necessary. Definitely not advice as I'm going to tend towards being more aggressive with my cc - especially as we get closer to the ATH.

Thanks for pointing out the error everyone!!! I was able to close out that IC without losing any money. Now back to our regularly scheduled programming....

What do you have in mind for 12/9 given the chance of needing to roll this 12/3 CC $1200?With the big move up today I opened some cc for this Friday - 1200s @ 9.00.

I don't have a strong opinion one way or the other whether 1200 is in play for this Friday. I did see a big hunk of activity at that strike (call wall) and I'm confident I can roll that along to higher strikes if necessary. Definitely not advice as I'm going to tend towards being more aggressive with my cc - especially as we get closer to the ATH.

It'll depend (of course) on how far ITM they went, but my bias right now is towards more aggression with these rather than less. So probably something like a max roll less 1 or 2 strikes ($5 or $10). That might get me a big strike improvement and $7ish as a net credit - something along those lines.What do you have in mind for 12/9 given the chance of needing to roll this 12/3 CC $1200?

If we go deeper ITM then it's all strike improvement all the time

Even if we don't go ITM on those 1200s I'm probably biasing towards more aggressive calls anyway. Maybe a 1220 or 1250ish strike next week assuming that this week is on track to be OTM but close to 1200.

A very good reason to not follow me into these positions - having these shares called away, most of them in retirement accounts, is something I'm actively taunting to have happen. I earn extra premium and am in danger of realizing gains on the underlying long calls as well (but I'm also out of capital accumulation mode; even though capital is accumulating way faster in retirement than it did while employed).

Hesitant to write any calls on core shares after crawling out of THAT hole + see a good chance of a big move up in December. Today rolled the contracts on the trading shares buy-write to avoid 12/3 assignment, stay away from 12/9, and catch a $7 credit and $50/share of potential capital gains. If let assign 12/17 = a one-month total return of 15%, or twice monthly income goal (excludes gains on core shares and long calls/LEAPs).

- BTC 120321C1150

- STO 121721C1200

That is, what i also see. But on the other hand: Will we get a Turnaround-Tuseday like last week & it is possible to get a better entry? Especially for things like ditm leaps (small, because more like ~6 months, not 12+ months).Hesitant to write any calls on core shares after crawling out of THAT hole + see a good chance of a big move up in December.

Closed all my 12/3 BPS at 50% profit. Will wait for a red day to venture into next week but no clarity which puts will be safe:

Is it just me or are the premiums for 12/10 calls sort of ridiculous? For example you can role a 12/3 $1205 to a 12/10 $1295 for a credit. A $90 strike improvement seems unheard of...

Are they inflated because of all the 12/9 talk?

Are they inflated because of all the 12/9 talk?

ZeApelido

Active Member

Ok am I nuts? I know most here like to do short term plays, but I am usually more comfortable with estimated long term price drops.

So I can do the usual selling conservative weekly BPS or more aggessively puts, and maybe $1-$2 per contract per week.

Or I could sell around a 600/800 Jan 23 BPS for $60-$70 per contract. Breakeven around $740. Would certainly close early depending on gain and time, so I don't have to keep for a year unless price drops low soon and stays low for a long time.

Given Tesla's earnings ramp, I find it extremely unlikely that the price could end up and stay lower than $740 for most of next year. Netting EPS over $2 per quarter would make this seem very low chance.

Benefit is then I don't have to worry weekly about new positions, just to probably end up in the same place or likely lower in total premium gained.

Thoughts?

So I can do the usual selling conservative weekly BPS or more aggessively puts, and maybe $1-$2 per contract per week.

Or I could sell around a 600/800 Jan 23 BPS for $60-$70 per contract. Breakeven around $740. Would certainly close early depending on gain and time, so I don't have to keep for a year unless price drops low soon and stays low for a long time.

Given Tesla's earnings ramp, I find it extremely unlikely that the price could end up and stay lower than $740 for most of next year. Netting EPS over $2 per quarter would make this seem very low chance.

Benefit is then I don't have to worry weekly about new positions, just to probably end up in the same place or likely lower in total premium gained.

Thoughts?

juanmedina

Active Member

Ok am I nuts? I know most here like to do short term plays, but I am usually more comfortable with estimated long term price drops.

So I can do the usual selling conservative weekly BPS or more aggessively puts, and maybe $1-$2 per contract per week.

Or I could sell around a 600/800 Jan 23 BPS for $60-$70 per contract. Breakeven around $740. Would certainly close early depending on gain and time, so I don't have to keep for a year unless price drops low soon and stays low for a long time.

Given Tesla's earnings ramp, I find it extremely unlikely that the price could end up and stay lower than $740 for most of next year. Netting EPS over $2 per quarter would make this seem very low chance.

Benefit is then I don't have to worry weekly about new positions, just to probably end up in the same place or likely lower in total premium gained.

Thoughts?

I have been thinking the same, the BPS pay better than a straight put, they obviously will pay less than a weekly BPS but you don't have to deal with the trading headache every week.

I remember you sold some shares at $1200 have you bought them back?

I bought some DITM LEAPS in the 500s during the dip that have done very well. I went DITM to squeeze out the time value as much as possible, as it was ridiculous as you noted. Only got about 100% leverage (control twice the number of TSLA shares then if I bought TSLA straight up) but c'mon, we are spoiled here, this is an excellent result for what I calculated as extremely low risk.Yes and no. I bought LEAPS back in May 2021 when we dropped to $550 from $900. The IV was so high on these that their value stayed flat whilst the SP recovered. Only after we broke to ATH and beyond they went profitable decently. But buying stock were a better move in hindsight.

Best scenario is low SP and low IV. So a huge drop and then some days/weeks of flat SP. Then you buy the LEAPS. Takes cojones of course to expect the SP to not climb again.

Seems like “the market“ is saying price will rise next week, but not this week. What force is counteracting immediate adjustment arbitrage?Is it just me or are the premiums for 12/10 calls sort of ridiculous? For example you can role a 12/3 $1205 to a 12/10 $1295 for a credit. A $90 strike improvement seems unheard of...

Are they inflated because of all the 12/9 talk?

I’m guilty of buying some of those… I bought a few vertical spreads for the 17th a couple weeks ago. I‘m not a believer in the numerology, but I am a firm believer in herd behaviors. I took some long odds/ gambles hoping the value of those would run up enough I could cash out most of them before the 9th at a small profit and hang on to a few house money long shot spreads on the off chance something exciting does get announced on the 9th.Is it just me or are the premiums for 12/10 calls sort of ridiculous? For example you can role a 12/3 $1205 to a 12/10 $1295 for a credit. A $90 strike improvement seems unheard of...

Are they inflated because of all the 12/9 talk?

Keep in mind also that the 17th is a quarterly expiration. Meaning weeklies, monthlies and quarterly options expirations, so there will be very high volume with the option chain for that week.I’m guilty of buying some of those… I bought a few vertical spreads for the 17th a couple weeks ago. I‘m not a believer in the numerology, but I am a firm believer in herd behaviors. I took some long odds/ gambles hoping the value of those would run up enough I could cash out most of them before the 9th at a small profit and hang on to a few house money long shot spreads on the off chance something exciting does get announced on the 9th.

I don't like to pay for time if I am buying options for a gamble or "YOLO" as the kids say, so I will be looking for something on Tuesday or Wednesday if I am going to buy anything on the call side next week.

Cheers

$60 for the next 57 weeks is pretty low return. You can go really low risk on weeklies if you are happy with $1.05/contract.Ok am I nuts? I know most here like to do short term plays, but I am usually more comfortable with estimated long term price drops.

So I can do the usual selling conservative weekly BPS or more aggessively puts, and maybe $1-$2 per contract per week.

Or I could sell around a 600/800 Jan 23 BPS for $60-$70 per contract. Breakeven around $740. Would certainly close early depending on gain and time, so I don't have to keep for a year unless price drops low soon and stays low for a long time.

Given Tesla's earnings ramp, I find it extremely unlikely that the price could end up and stay lower than $740 for most of next year. Netting EPS over $2 per quarter would make this seem very low chance.

Benefit is then I don't have to worry weekly about new positions, just to probably end up in the same place or likely lower in total premium gained.

Thoughts?

mickificki

Member

Probably a naive question but is there a reason NOT to buy some calls? Even if 12/9 doesn't happen (I'm a big believer in it, please don't be mad at me folks), with giga shanghai just churning out cars, Elon stressing not to worry about getting every car delivered by the end of the Q but to reduce costs, talk of 900k 2021 production/deliveries, Berlin on the cusp of opening, quickly followed by Texas....BAF imo (@SpaceCash where you at?)...I’m guilty of buying some of those… I bought a few vertical spreads for the 17th a couple weeks ago. I‘m not a believer in the numerology, but I am a firm believer in herd behaviors. I took some long odds/ gambles hoping the value of those would run up enough I could cash out most of them before the 9th at a small profit and hang on to a few house money long shot spreads on the off chance something exciting does get announced on the 9th.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K