And then it might have gone straight to to 100 from there so I can still find plenty of stress at that point.Or you could have just waited for it to raise from 120 to 130 and not given yourself the stress.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Or you could have just waited for it to raise from 120 to 130 and not given yourself the stress.

I think you overestimate the ability of us mortals to predict the future. Easy to say what one could have done in hindsight, but the point is that when it was at 130, that could have been the bottom. All you can do is find a price you like and place your bet.

FANGO

Active Member

Or you could have just waited for it to raise from 120 to 130 and not given yourself the stress.

Or he could be happy making 40% in 6 months or whatever. Or 100% if you count from the top. Or he could just never ever buy because maybe it will go down after he buys, gasp.

The solution is to buy when you're comfortable and when you think you'll be fine with the results either way. Every other maxim holds a backseat to that.

GravityPull

Member

North America Demand??

I realize you're talking about China but have to throw out this other comment on demand. I'm still not convinced demand is a non-issue in North America.

i know everybody loves this line from the Shareholder Letter.

"North American net orders grew sequentially by more than 10% in the quarter."

My concern is why did they have to qualify it so much? And why didn't they specify that they're only talking about the Model S? Could it include the Model X reservations made in 1st Qtr too?

why was elon musk in the q&a so reserved to give out the number of reservations in china?? if the demand is so high, why the hesitation?? or arent they that high!?

I realize you're talking about China but have to throw out this other comment on demand. I'm still not convinced demand is a non-issue in North America.

i know everybody loves this line from the Shareholder Letter.

"North American net orders grew sequentially by more than 10% in the quarter."

My concern is why did they have to qualify it so much? And why didn't they specify that they're only talking about the Model S? Could it include the Model X reservations made in 1st Qtr too?

Cwin

Member

And then it might have gone straight to to 100 from there so I can still find plenty of stress at that point.

And it could've gone from 120 to 100 as well. Its totally better to pick it up at 130 the second time, not the first.

FANGO

Active Member

I realize you're talking about China but have to throw out this other comment on demand. I'm still not convinced demand is a non-issue in North America.

i know everybody loves this line from the Shareholder Letter.

"North American net orders grew sequentially by more than 10% in the quarter."

My concern is why did they have to qualify it so much? And why didn't they specify that they're only talking about the Model S? Could it include the Model X reservations made in 1st Qtr too?

He said its not a problem THREE times on the call. Three. After saying it once, two more people asked the same question. They got the same answer. Three times. The first time, the second time, and the third time. All of these times the answer was the same.

What was that answer?

Does anyone know?

The answer is the answer which we all already knew was the answer. Because the question was dumb even before the first time it was asked.

The answer is: There's no demand problem.

So why are we still talking about this?

So far we have had double and triple bottoms at $155, $145, $130, $118, $208, and $200 - all of which, by definition, had a rebound (often significant) before heading lower, often peeking out of the channel before heading lower. Buying at those peaks would have been much worse. Catching a falling knife only occurs in retrospect, and sometimes smugly commented on by others with similar hindsight. The best that one can do is identify potential points of resistance (right now, likely the 200d) and buy in increment, hoping it doesn't break through.

FANGO

Active Member

And it could've gone from 120 to 100 as well. Its totally better to pick it up at 130 the second time, not the first.

And it could have gone to TEN BILLION RIGHT NOW!!!! BUY BUY BUY!!!!

What exactly is your goal here, to convince people that buying is never a good idea if a stock is anywhere above zero?

RobotGrease

Member

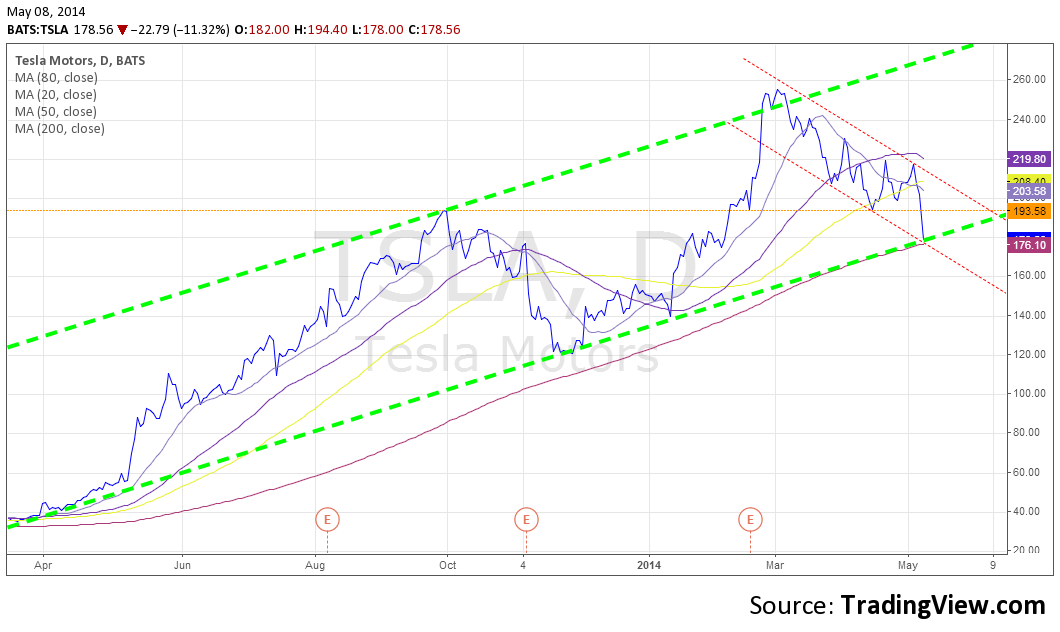

Stay calm everyone, we're still in the channel

On a serious note, it would be great to see the 200dma act as strong support tomorrow and next week. And be careful with a possible dead cat bounce tomorrow.

On a serious note, it would be great to see the 200dma act as strong support tomorrow and next week. And be careful with a possible dead cat bounce tomorrow.

Citizen-T

Active Member

Wall Street has more conflicting sayings that any other industry on the planet. You aren't supposed to catch a falling knife, but you are also supposed to be greedy when others are fearful. Well, I don't know if you've noticed this or not, but often when you have a falling knife people are fearful. It's all nonsense.

This is what I know: never in the history of TSLA has it been a bad idea to buy at the 200-day.

This is what I know: never in the history of TSLA has it been a bad idea to buy at the 200-day.

RobotGrease

Member

Wall Street has more conflicting sayings that any other industry on the planet. You aren't supposed to catch a falling knife, but you are also supposed to be greedy when others are fearful. Well, I don't know if you've noticed this or not, but often when you have a falling knife people are fearful. It's all nonsense.

This is what I know: never in the history of TSLA has it been a bad idea to buy at the 200-day.

+1billion

I recall your comment on the 200dma last time we approached it. did you buy shares today?

Cwin

Member

And it could have gone to TEN BILLION RIGHT NOW!!!! BUY BUY BUY!!!!

What exactly is your goal here, to convince people that buying is never a good idea if a stock is anywhere above zero?

The goal here is to be cautious, to be smart, and wait 3-4 days before doing something on impulse which a lot of people have done today.

We very well might not see 185$ again for the next 6 months, or we could be at 200$ again tomorrow. But its better to buy at 200$ and be confident than to see a quick bounce, like today, and go balls to the wall.

GravityPull

Member

U

Fango

dont you care to know specifically what they meant by this statement?

"North American net orders grew sequentially by more than 10% in the quarter."

if it includes the Model X would you want to know? Or....?

He said its not a problem THREE times on the call. Three. After saying it once, two more people asked the same question. They got the same answer. Three times. The first time, the second time, and the third time. All of these times the answer was the same.

What was that answer?

Does anyone know?

The answer is the answer which we all already knew was the answer. Because the question was dumb even before the first time it was asked.

The answer is: There's no demand problem.

So why are we still talking about this?

Fango

dont you care to know specifically what they meant by this statement?

"North American net orders grew sequentially by more than 10% in the quarter."

if it includes the Model X would you want to know? Or....?

Citizen-T

Active Member

+1billion

I recall your comment on the 200dma last time we approached it. did you buy shares today?

Yes. I bought the Jan16 240s for $25 ea.

It says "orders", not "deposits". I don't think you can have an order on an X at this point."North American net orders grew sequentially by more than 10% in the quarter."

if it includes the Model X would you want to know? Or....?

FANGO

Active Member

U

Fango

dont you care to know specifically what they meant by this statement?

"North American net orders grew sequentially by more than 10% in the quarter."

if it includes the Model X would you want to know? Or....?

I don't really care if it includes model x, actually (and I don't think it does). And what it means is that orders increased, which we all expected and is pretty plain, and is happening without advertising or anything. Demand is increasing at about the rate it ought to be increasing. Ten percent per quarter annualizes to 50% btw. Considering that doesn't account for Asia and Europe coming online, I think that's just fine demand wise.

Demand just flat out isn't a problem. This is not a bridge Tesla will need to cross for a while.

RobotGrease

Member

yahoo shows 200 dma at 182.17, didn't we already go under it?

look at 1month+ : 200dma is 175.82

Or you could have just waited for it to raise from 120 to 130 and not given yourself the stress.

And here it is, the bad press to kick the stock when its down. It happened the exact same way with Q3 and the fires. ANY AND ALL lies, slander and misdirection are going to be spun out next week to keep this going.

I would if I had Elon's elusive crystal ball he won't admit to owning. A little easy to say with 20/20 hindsight. One could say the same about the move from 183 up to 194 today, doesn't mean the stock won't go lower again in the short term.

moltenfire

Member

Stay calm everyone, we're still in the channel

On a serious note, it would be great to see the 200dma act as strong support tomorrow and next week. And be careful with a possible dead cat bounce tomorrow.

I'm not a technicals expert, so correct me if I'm wrong.

According to this chart TSLA never even came close to hitting the 200 day ma in the last 12 months. So the fact that it's sitting there now (strong support tomorrow or not) shows weakness, right?

- Status

- Not open for further replies.

Similar threads

- Replies

- 23

- Views

- 761

- Replies

- 21

- Views

- 6K

- Replies

- 0

- Views

- 215

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 6

- Views

- 604