Batteries and the Balance of Energy

I've been trying to imagine what could slow up the transition to EVs. The most fundamental problem I see is building out battery production fast enough. Tesla has been battery constrained in its history, and other OEMs will as well. But what happens at a macro level when the whole battery supply chain is at a bottleneck? In such periods, the market will tend to allocate the marginal MWh of battery to the products with highest marginal return. This has profound implications for the price of various fuels that batteries compete with.

So envision a world where batteries compete primarily in three segments.

- Power markets dominated by natural gas

- Private autos dominated by gasoline

- Commercial vehicles dominated by diesel

This is a simplified world to be sure but the point is to characterize the relationships batteries may have with natural gas, gasoline and diesel. When batteries are scarce, the marginal MWh will tend to offset the fuel which affords the maximum savings in fuel cost. That is all other factors are priced into battery powered products than their fossil fuel burning alternatives such that the tightness in the battery supply is dominant binding constraint on the economy. In this sort of scenario, the market is simply trying to figure out which fuel is most economical to displace with the marginal MWh of batteries.

So I will attempt to gauge the displacement rates for each fuel dominating the three segments.

In the power markets, batteries facilitate displacement of natural gas (and hence coal and other fuels with which gas competes) in two ways. First, batteries directly compete with gas peakers. The displacement here is 11.214 mmBtu per discharged MWh, the heat rate of a gas turbine. A battery used for peaking will discharge daily, let's suppose, at an average 75% of capacity. Thus, the average annual discharge is 273.75 MWh per MWh of battery capacity. This is an annual displacement of 3070 mmBtu of natural gas. At a reference price of $3/mmBtu, the marginal MWh battery used as a peaker can result in a annual savings of $9209. (This of course is not a net savings netting out the cost of power to charge the battery and other operating costs. I envision this as being supplied by solar or wind which are almost entirely capex.)

Second, batteries in the power generation markets facilitate more integration of solar and wind. Thus, the marginal MWh can enable more wind and solar to be brought into the grid than would be economic with out firming up with incremental storage. Let us suppose that on our hypothetical grid incremental wind and solar capacity requires that 20% of power generated must be stored. This enables 20% of the power generated when market prices are lowest to be shift to times when the price is highest. This amount of time shifting is critical for incremental capacity to be profitable. But it is not necessary for incremental capacity to be 100% stored. So for every 1 MWh a battery stores and sells into peaker market, it makes another 4 MWh of renewable power economic to sell into the baseload market. This 4 to 1 ratio is a sort of leverage ratio, extending the displacement impact of a battery beyond what it can directly discharge into the market. So this combine impact of one cycle of a MWh battery is 11.412 mmBtu (gas turbine peaker) plus 4×7.652 mmBtu (combined cycle gas baseload). The total displacement is 41.8 mmBtu per cycle, and at 75% daily cycling 11,449 mmBtu per year, a nominal gross savings of $34,346 per year.

Clearly, when the battery supply is constrained, it makes more sense for the power market to leverage the marginal MWh battery to offset 11.4 billion Btu (BBtu) per year rather than just 3.1 BBtu. The gross savings of $34.3k factors into the value that the power market will place on that marginal battery.

Now let's look at the private auto market. ICEVs are about 22% efficient as EVs. This implies that one discharge cycle on 1MWh capacity (~20 cars) offsets about 15.5 mmBtu of gasoline (0.124 mmBtu/gallon). A key limiting factor for private vehicles is that families will want substantially more range than they need in an average day. In a tight battery supply situation, consumers with higher daily driving will have greater demand for the marginal battery. So suppose the marginal EV buyer wants range four times that of daily driving, e.g. a person driving 60 miles per day seeks out a car with 240 miles range. This implies daily charging at 25% depth or charging 75% once every 3 days. So assuming this charging rate, the annual offset for private autos is 1414 mmBtu. At a nominal reference price of $3/gal, gasoline is $24.19/mmBtu. And the gross savings is $34,219 per year per marginal MWh of battery supply.

Finally, we look at commercial vehicles. The big difference here is simply that commercial uses, think semi trucks, will cycle batteries much more heavily. Let's suppose the segment cycles at three time the rate as private autos, specifically daily at 75% depth. (Think of a semi with 600 miles range that goes 450 miles on an average day.) Here our marginal MWh of battery offsets 4243 mmBtu per year. At a nominal price of $3/gal of diesel (0.137 mmBtu/ gal), or $21.90/mmBtu, the gross fuel savings is $92,915 per year.

In sum, the marginal displacements of 1 MWh battery are as follows:

- NG 41.8 mmBtu/cycle, 11.4 BBtu/yr, $34.4k/yr

- Gasoline 15.5 mmBtu/cycle, 1.4BBtu/yr, $34.2k/yr

- Diesel 15.5 mmBtu/cycle, 4.2 BBtu/yr, $92.9k/yr

In terms of reducing primary fossil energy (and carbon emissions), Powerpacks have highest impact while Tesla cars have the least, but the gross saving in fuel is about the same. However, Tesla Semi would deliver nearly 3 times as much gross savings. Indeed many other factors go into the net saving of these three options. This mostly depends on how much capex is required and financing on that capital. Even so, the gross savings nearly 3 times as much on diesel is a huge difference for other costs differences to overwhelm. My view is that during times of limited battery supply, commercial EVs will grow faster than than private EVs and grid batteries.

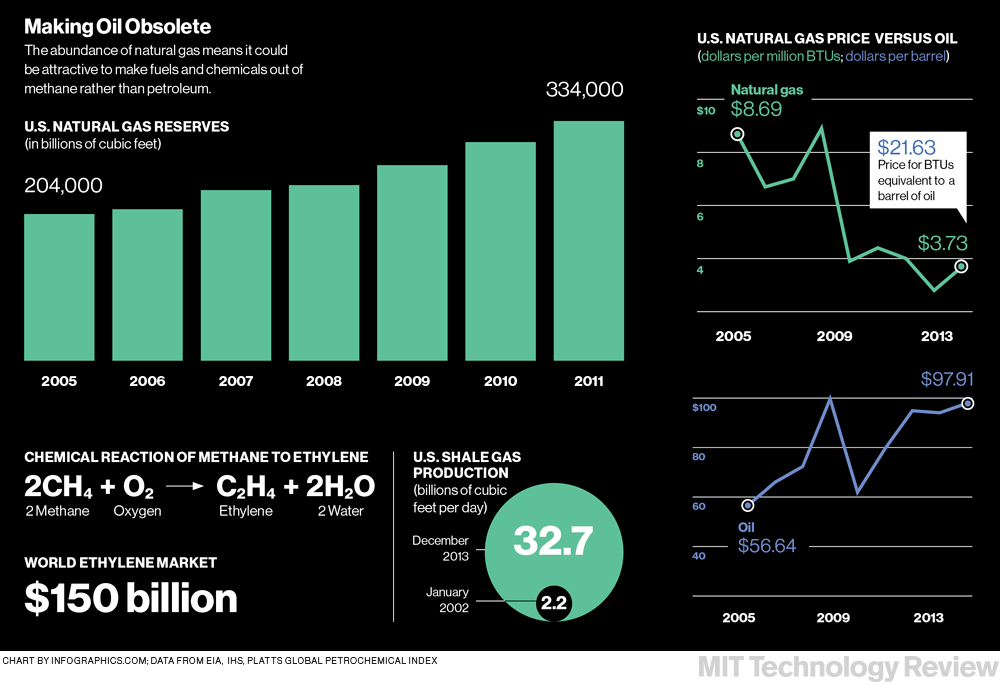

Another implication of this analysis is that the price ratio of diesel to natural gas may need to shrink. Under these nominal prices, diesel is about 7.3 times the price of natural gas, but to equalize gross savings a ratio of 2.7 is needed. Nominally, diesel needs to fall to $1.11/gal to be at parity with natural gas at $3/mmBtu. I don't believe it will be able to close this gap, but price pressure will be there.

Curiously, I think that a carbon tax would help to support a higher diesel to natural gas price ratio, but this would only increase aggregate demand for batteries.

Fundamentally, as demand for batteries heats up the markets will decide which fossil revenue streams are most economical to displace. Tesla is playing in each of these segments. This will give Tesla exposure to whatever market is willing to pay the most for batteries, making it relatively indifferent to which market needs the batteries the most.