Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Here's a great example:Think of CCS. It's not working out economically. Moreover it is not clear how CCS creates value apart from reducing emissions. So CCS is not a robust solution

Southern suspends work on Kemper coal gasification units

The 582 MW plant was designed to convert locally-mined coal into a synthetic gas and capture over half of its carbon emissions. But years of cost overruns and construction delays led Mississippi regulators to direct the utility to draw up a plan for the plant to run solely on natural gas,

Shareholders have already lost $3.1 billion on the plant and the utility could be on the hook for $3.4 billion more if the utility cannot reach a settlement with regulators.

That's astounding, a $6.5 B write off on a mere 581MW plant. That is a write off of over $11/W.

Now lets compare that with solar+storage. To match 85% capacity factor on 1W of this beast, 5W PV and 16Wh of Powerpacks should suffice. So that is would be about $10/W. So "baseload" solar would be cheaper than just what was lost on this boondoggle, not even counting the fuel differential, just the hardware alone. The utility still has a 581MW that runs on natural gas.

any updates on Australia 100megawatt battery project?

S.A. to announce storage winner, delays EST mechanism

S.A. to announce storage winner, delays EST mechanism

I came across this chart on green tech media. it has a few salient points i think affect tesla energy at least peripherally

mostly renewables, wind and commercial_solar (leaving out residential solar) , plus gas and a few others , increased 250 gigawatts in 10 years (including forecasts using projects in pipelines) AND Coal and gas and nuclear declining and going offline DECREASED 150 gigawatts.

I suspect and will investigate further sometime, Residential solar will "fatten" the solar as the wind/solar part of graph is ~100gW

The 100gW difference in gains vs losses indicates acceleration of wind/PV to me and the same for coal and a lesser extent gas.

note petroleum is only in the declining portion

The Rising Tide of Evidence Against Blaming Wind and Solar for Grid Instability

mostly renewables, wind and commercial_solar (leaving out residential solar) , plus gas and a few others , increased 250 gigawatts in 10 years (including forecasts using projects in pipelines) AND Coal and gas and nuclear declining and going offline DECREASED 150 gigawatts.

I suspect and will investigate further sometime, Residential solar will "fatten" the solar as the wind/solar part of graph is ~100gW

The 100gW difference in gains vs losses indicates acceleration of wind/PV to me and the same for coal and a lesser extent gas.

note petroleum is only in the declining portion

The Rising Tide of Evidence Against Blaming Wind and Solar for Grid Instability

adiggs

Well-Known Member

any updates on Australia 100megawatt battery project?

S.A. to announce storage winner, delays EST mechanism

Nothing yet - I've been checking in on Renew Economy pretty much daily. I'll be posting something to the Tesla Energy investors thread when something comes through.

There are actually 2 Australian states with storage winners due soon (SA roughly now, another I'd guess over the next month), and a 3rd Australian state with a storage tender announcement later this year. I think two of them in the 00's of MWh and 1 in the 0's of MWh.

neroden

Model S Owner and Frustrated Tesla Fan

That's my projection!

Saudi Arabia Reports First GDP Contraction Since 2009 | OilPrice.com

Saudi GDP falls in Q1 2017. One more quarter and I'll be a recession. The key driver is the enormous oil cut burden Saudis have carried. The Saudis were well over compliance with the oil cut to make up for other OPEC members who were not in full compliance. Clearly they have been high motivated to take up slack for the sake of the Aramco IPO, but this is of dubious value if their economy slides into recession.

I struggle to understand how this is supposed to work for them. Oil has fallen below $45/b and we see US rig counts begin to fall immediately. So if the Saudis are willing to accept $40/b, I think they should just increasing production whenever the price is above $40/b. They can make up for the price decline on volume. Very fell producers can afford to go down to $40, and if Saudis had a clear promise of volume expansion all the way down to $40, I think they could bully most producers out of the market.

I wonder how their view of peak demand is informing their strategy. In a peak @ 2022 scenario, it seems they would just want to go for market share. Basically, they would not want any excess competitor production lying about going into the peak. Furthermore, post demand peak withholding supply will not drive up a sustainable price, but will simply kill off demand faster. So ultimately the Saudis are in a price war with EVs and renewable electricity. The best way to sustain the longetivity of oil demand is to sell it super cheap.

But I suspect the Saudis may actually believe a peak @ 2040 scenario. They would need to to think that withholding supply is a winning strategy for extracting a higher price. They still believe that demand is stubbornly inelastic. But the essence of the peak demand theory is that demand becomes increasingly elastic to the point that price high enough to sustain production growth cannot be obtained.

I know I keep cycling back to these ideas, but it keeps perplexing me. The Saudis are wrecking their economy as window dressing for an ill timed IPO.

Saudi GDP falls in Q1 2017. One more quarter and I'll be a recession. The key driver is the enormous oil cut burden Saudis have carried. The Saudis were well over compliance with the oil cut to make up for other OPEC members who were not in full compliance. Clearly they have been high motivated to take up slack for the sake of the Aramco IPO, but this is of dubious value if their economy slides into recession.

I struggle to understand how this is supposed to work for them. Oil has fallen below $45/b and we see US rig counts begin to fall immediately. So if the Saudis are willing to accept $40/b, I think they should just increasing production whenever the price is above $40/b. They can make up for the price decline on volume. Very fell producers can afford to go down to $40, and if Saudis had a clear promise of volume expansion all the way down to $40, I think they could bully most producers out of the market.

I wonder how their view of peak demand is informing their strategy. In a peak @ 2022 scenario, it seems they would just want to go for market share. Basically, they would not want any excess competitor production lying about going into the peak. Furthermore, post demand peak withholding supply will not drive up a sustainable price, but will simply kill off demand faster. So ultimately the Saudis are in a price war with EVs and renewable electricity. The best way to sustain the longetivity of oil demand is to sell it super cheap.

But I suspect the Saudis may actually believe a peak @ 2040 scenario. They would need to to think that withholding supply is a winning strategy for extracting a higher price. They still believe that demand is stubbornly inelastic. But the essence of the peak demand theory is that demand becomes increasingly elastic to the point that price high enough to sustain production growth cannot be obtained.

I know I keep cycling back to these ideas, but it keeps perplexing me. The Saudis are wrecking their economy as window dressing for an ill timed IPO.

Running out of time to reduce stockpiles in 2017, Statoil says

A little more flavor on how Statoil sees the situation...

So even new North Sea production is coming online. These projects were decided on back in 2010. So I guess Statoil needs to explain to investors why this oil supply will be needed. This may be important to their outlook on peak demand.

So now you can see where Statoil stands with their three scenarios. The Rivalry scenario is not sustainable environmentally or economically. The Reform scenario may just give them enough time to get a positive return on recent multidecade investments, but it is not consistent with Paris Agreement 2D scenario. Finally, the Renewal scenario hits 2D, but means oil peaks in 2022. I suspect the implication is that Statoil investments are screwed in the 2D Renewal scenario.

So using a hermeneutic of suspicion regarding oil company public scenarios, I suspect that when a company like Statoil, BP, or Shell tells us when they think peak demand will happen, they are actually signaling what they need to be a going concern. For example, if your chief economist goes on record and says that demand is likely to peak before 2025, then the corporation is under obligation to say which assets need to be impaired under this expectation. So basically they need to play a game around talking up the long term uncertainty. If there is a reasonable chance that certain assets will break even, then the accountants can delay making impairments. Essentially, much of these assets are an option on the global failure to halt climate change. They make money in a >2D world, but lose money in <2D world.

The impairment issue also is in play with the enormous oil stockpile. If this does not come down soon, then prices won't recover quickly enough to avoid asset impairments. Indeed the last 2 years have been lousy with write downs, so this is nothing new. But Statoil seems to be hinting that if prices do not recover soon, then peak demand will seal off the window forever. Remember we are talking about North Sea deepwater projects that take 7 years to bring online. So ten years or more of "sustainable" prices may be needed just to break even. They need a broad window of happy prices between the current glut and peak demand to break even.

Since Statoil willing to say that the peak will come before 2030, I suspect that they see a path to continued solvency. BP, OTOH, says peak happens 2035 or so. Why do they say that when surely they know as well that oil needs to peak near 2022 to be in line with the Paris Agreement? They are painting a picture of solvency that depends on blowing past 2D and sustaining production well into 2030. Perhaps, they are signaling that BP is not prepared for a peak prior to 2030. Why would that be a fair interpretation? Suppose they really did believe the peak come 2022 and that they were fully prepared to be solvent under such a scenario. If so, why not communicate this confidence to the public. They could outright say they would be solvent if peak oil came as early as 2022, but that they were also prepared to be profitable well past that if demand were to persist. Instead of simply saying that they are prepared for an early oil peak, they want to redirect and say that the peak won't come until well past 2030. It is this redirect away from a simple affirmation of preparedness that suggests that they simply are not prepared for any peak prior to 2030. It's like asking a Californian if their home is ready for the Big One. If they say that the Big One will probably not happen for many decades, but fail to say that they are prepared in any case, then you know that they are not prepared, at least not well prepared. (I survived to major quakes in Santa Cruz and Los Angeles. Even after moving to North Carolina we still screwed book cases into the wall just in case.)

My guess is that no major oil company is prepared for peak oil in 2022.

A little more flavor on how Statoil sees the situation...

Analysts have been surprised by the intransigence of global oil stockpiles, according to Waerness. That’s because the focus has been mostly on U.S. shale, missing the "flow of oil from projects that were decided back in 2010” and now are coming online. Production is even increasing in the North Sea, where analysts expected a decline, he said.

This makes it more difficult for OPEC to increase prices, according to Waerness.

"At some point, impact from an ebbing flow of projects will slow down," he said. "Patience is the name of the game. Current prices are unsustainably low. Producers are not making enough to cover production cost."

So even new North Sea production is coming online. These projects were decided on back in 2010. So I guess Statoil needs to explain to investors why this oil supply will be needed. This may be important to their outlook on peak demand.

Unlike the International Energy Agency, Statoil expects oil demand to peak in 2030 under its central scenario. That is too late to meet the temperature target outlined in the Paris Climate agreement.

"Peak oil has to happen extremely rapidly, by 2022, or we won’t reach that target," said Waerness.

So now you can see where Statoil stands with their three scenarios. The Rivalry scenario is not sustainable environmentally or economically. The Reform scenario may just give them enough time to get a positive return on recent multidecade investments, but it is not consistent with Paris Agreement 2D scenario. Finally, the Renewal scenario hits 2D, but means oil peaks in 2022. I suspect the implication is that Statoil investments are screwed in the 2D Renewal scenario.

So using a hermeneutic of suspicion regarding oil company public scenarios, I suspect that when a company like Statoil, BP, or Shell tells us when they think peak demand will happen, they are actually signaling what they need to be a going concern. For example, if your chief economist goes on record and says that demand is likely to peak before 2025, then the corporation is under obligation to say which assets need to be impaired under this expectation. So basically they need to play a game around talking up the long term uncertainty. If there is a reasonable chance that certain assets will break even, then the accountants can delay making impairments. Essentially, much of these assets are an option on the global failure to halt climate change. They make money in a >2D world, but lose money in <2D world.

The impairment issue also is in play with the enormous oil stockpile. If this does not come down soon, then prices won't recover quickly enough to avoid asset impairments. Indeed the last 2 years have been lousy with write downs, so this is nothing new. But Statoil seems to be hinting that if prices do not recover soon, then peak demand will seal off the window forever. Remember we are talking about North Sea deepwater projects that take 7 years to bring online. So ten years or more of "sustainable" prices may be needed just to break even. They need a broad window of happy prices between the current glut and peak demand to break even.

Since Statoil willing to say that the peak will come before 2030, I suspect that they see a path to continued solvency. BP, OTOH, says peak happens 2035 or so. Why do they say that when surely they know as well that oil needs to peak near 2022 to be in line with the Paris Agreement? They are painting a picture of solvency that depends on blowing past 2D and sustaining production well into 2030. Perhaps, they are signaling that BP is not prepared for a peak prior to 2030. Why would that be a fair interpretation? Suppose they really did believe the peak come 2022 and that they were fully prepared to be solvent under such a scenario. If so, why not communicate this confidence to the public. They could outright say they would be solvent if peak oil came as early as 2022, but that they were also prepared to be profitable well past that if demand were to persist. Instead of simply saying that they are prepared for an early oil peak, they want to redirect and say that the peak won't come until well past 2030. It is this redirect away from a simple affirmation of preparedness that suggests that they simply are not prepared for any peak prior to 2030. It's like asking a Californian if their home is ready for the Big One. If they say that the Big One will probably not happen for many decades, but fail to say that they are prepared in any case, then you know that they are not prepared, at least not well prepared. (I survived to major quakes in Santa Cruz and Los Angeles. Even after moving to North Carolina we still screwed book cases into the wall just in case.)

My guess is that no major oil company is prepared for peak oil in 2022.

adiggs

Well-Known Member

...Analysts have been surprised by the intransigence of global oil stockpiles...

I saw this bit of the quote, and I was wondering how many articles had this sentiment in them 10 years ago with 1 word changed?

...Analysts have been surprised by the intransigence of global <coal> stockpiles...

I'm perplexed as well. I like the interpretation of playing up long term uncertainty as a means for avoiding a formal accounting adjustment, and change in investment strategy. I doubt it's all that conscious - if you're steeped in the paradigm of "stubbornly inelastic demand", then you can produce lots of data and analysis that supports your conclusion of peak oil demand in 2030, 2040, or later.

It looks to me like a well prepared oil production company would cut most of the exploration budget immediately. New wells inside of areas with good infrastructure and well known geology where the company is already operating - those are the only new wells that get drilled starting now. All the speculative wells, or wells that will also require extensive infrastructure, to support them, work their way down the investment list and mostly stop being funded.

Interestingly, a company that did this probably becomes hugely cash flow positive just as fast as they can close down the big exploration expenses, as they start looking more like a company with big already built infrastructure that has been paid for. The only meaningful expenses / revenue will be associated with each marginal barrel of oil. That company can pay down it's debt and then pay dividends down to the last well, when somebody calls the electric company to turn off the service

Of course billions of market cap will also evaporate along that road.

I saw this bit of the quote, and I was wondering how many articles had this sentiment in them 10 years ago with 1 word changed?

...Analysts have been surprised by the intransigence of global <coal> stockpiles...

I'm perplexed as well. I like the interpretation of playing up long term uncertainty as a means for avoiding a formal accounting adjustment, and change in investment strategy. I doubt it's all that conscious - if you're steeped in the paradigm of "stubbornly inelastic demand", then you can produce lots of data and analysis that supports your conclusion of peak oil demand in 2030, 2040, or later.

It looks to me like a well prepared oil production company would cut most of the exploration budget immediately. New wells inside of areas with good infrastructure and well known geology where the company is already operating - those are the only new wells that get drilled starting now. All the speculative wells, or wells that will also require extensive infrastructure, to support them, work their way down the investment list and mostly stop being funded.

Interestingly, a company that did this probably becomes hugely cash flow positive just as fast as they can close down the big exploration expenses, as they start looking more like a company with big already built infrastructure that has been paid for. The only meaningful expenses / revenue will be associated with each marginal barrel of oil. That company can pay down it's debt and then pay dividends down to the last well, when somebody calls the electric company to turn off the service

Of course billions of market cap will also evaporate along that road.

The US dollar index (DXY) is also down to pre election levels and lowers profit for companies outside the US..

If oil stays below $45/b and all major produces suffers would a scenario be to try and control the price directly? Perhaps expanding Opec to create a large cartel (like Standard Oil pre 1911)? They decide not to sell below $50/b and if it's ~80% of world production perhaps it would work? It would probably not work politically though.

If oil stays below $45/b and all major produces suffers would a scenario be to try and control the price directly? Perhaps expanding Opec to create a large cartel (like Standard Oil pre 1911)? They decide not to sell below $50/b and if it's ~80% of world production perhaps it would work? It would probably not work politically though.

The US dollar index (DXY) is also down to pre election levels and lowers profit for companies outside the US..

If oil stays below $45/b and all major produces suffers would a scenario be to try and control the price directly? Perhaps expanding Opec to create a large cartel (like Standard Oil pre 1911)? They decide not to sell below $50/b and if it's ~80% of world production perhaps it would work? It would probably not work politically though.

Yes, I suspect the politics would work against it. China is going whole hog into EVs and renewables. Much of Europe is already there (IIRC Portugal has had several days of 100% renewable energy use). India is seriously looking to move in this direction, and developing countries will likely take advantage of the new technology to avoid investing in dinosaur infrastructure costs (look at cell phone use in Africa vs. land lines).

IMO, if the oil producers decide to do this, they would give the incentive for all major oil consuming countries to cut the pipeline by using renewables and batteries. The cartel model is essentially a blackmail ploy to force the customer to pay what the producer wants. Now, however, there is a much better ability for countries to be free of any extortion by the producers.

adiggs

Well-Known Member

The US dollar index (DXY) is also down to pre election levels and lowers profit for companies outside the US..

If oil stays below $45/b and all major produces suffers would a scenario be to try and control the price directly? Perhaps expanding Opec to create a large cartel (like Standard Oil pre 1911)? They decide not to sell below $50/b and if it's ~80% of world production perhaps it would work? It would probably not work politically though.

One of the articles that's been linked not too long ago (couple weeks?) was talking about talks between OPEC and Russia (primarily) about how they can formalize the NOPEC supply constraint they have in place now - make it easier to continue colluding over the price. It wasn't only Russia that OPEC was thinking of, but primarily.

Fortunately for energy consumers and users, the market is fragmented enough, and the players have enough different ways of seeing the world and constraints they are living under, it'll be hard to really corral the whole thing and force the oil price up.

Especially since if they try, companies and countries that aren't on board will produce every single barrel they can, plus a few they borrow from grandma, while the price is being held high. NOPEC will be giving away a lot of market share if it goes on for very long.

SebastianR

Active Member

So using a hermeneutic of suspicion regarding oil company public scenarios, I suspect that when a company like Statoil, BP, or Shell tells us when they think peak demand will happen, they are actually signaling what they need to be a going concern. For example, if your chief economist goes on record and says that demand is likely to peak before 2025, then the corporation is under obligation to say which assets need to be impaired under this expectation.

... and we will see how this is working for the big oil companies if we follow the Exxon case in NY:

New York prosecutor says Exxon misled investors on climate change

"Exxon's own documents suggest that if Exxon had applied the proxy cost it promised to shareholders, at least one substantial oil sands project may have projected a financial loss, rather than a profit, over the course of the project's original timeline," Schneiderman wrote.

Oil companies today will need to be very careful to be "optimistic" yet sneak in enough warnings so that their executives are protected, once it all falls down. And here is I see increasing issues: How will anybody be able to dismiss the issued Carbon Tracker report in 5 years and pretend we didn't know? So oil companies need to get moving pretty soon...

I could imagine Statoil in particular to do some drastic steps pretty soon: the Norwegian state is very keen on making sure that Statoil doesn't destroy the state's wealth...

As to Saudi Arabia? I guess the decision is: either have civil unrest now (recession) and try to extract one last piece of money (Aramco IPO) or have the hangover come later. I suspect they will try to "just scrape by" while somehow having the IPO go...

Without getting into politics, I find it interesting, that - at least in my mind - a lot of the financial damage to oil + gas will come in this administration's time. And I wonder what impacts that will have. With the aggressive moves of the current administration to prop-up coal, oil and gas, I wonder who will be blamed when the inevitable will happen...

One opportunity oil producers have for international cooperation on oil production is climate change. One of the big needs in climate change action is a rationalized process for winding down fossil fuel production. If done is a coordinated way, this subletting of fossils could remain profitable for all producers and minimize asset stranding (impairments). This would yield a maximum return to investors and those countries that depend on fossil fuel production for their livelihood. And remember that there is a lot of embedded emissions in all stranded asset that does nothing to help the transition to sustainability.The US dollar index (DXY) is also down to pre election levels and lowers profit for companies outside the US..

If oil stays below $45/b and all major produces suffers would a scenario be to try and control the price directly? Perhaps expanding Opec to create a large cartel (like Standard Oil pre 1911)? They decide not to sell below $50/b and if it's ~80% of world production perhaps it would work? It would probably not work politically though.

So If OPEC wanted to cut a climate deal, I think there would be compelling reasons for international cooperation. When Trump was threatening to pull out of the Paris Agreement, we heard from oil and coal executives not to do that. The reality is that these industries really do need international coordination for a reasonable exit plan. Of course, Trump disregarded all this to grab attention and play to his "base". In any case, I suspect that climate change cooperation will be a last ditch chance for oil, gas, and coal to have a soft landing.

Last edited:

SebastianR

Active Member

So If OPEC wanted to cut a climate deal, I think their would be compelling reasons for international cooperation. When Trump was threatening to pull out of the Paris Agreement, we heard from oil and coal executives not to do that. The reality is that these industries really do need international coordination for a reasonable exit plan.

Indeed, in a world with market coordination and without prisoner's dilemma climate change would be THE golden ticket for the oil industry: 2C defines the amount we can burn so we could auction that amount to the highest bidder. In such a world oil could easily be north of $75/barrel (if you don't believe in renewable energy) or be at $10/barrel (if you believe renewables can do the job). But in absence of coordination we will have chaos with wide economic and social consequences...

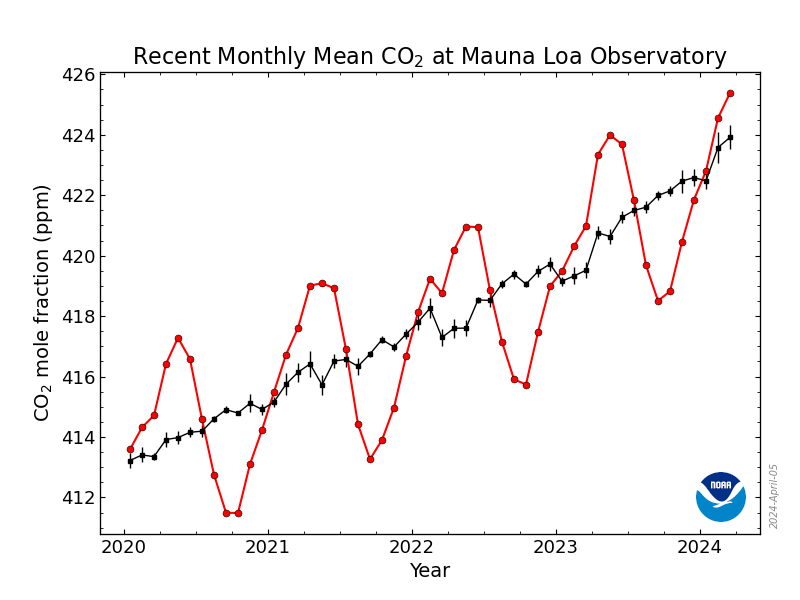

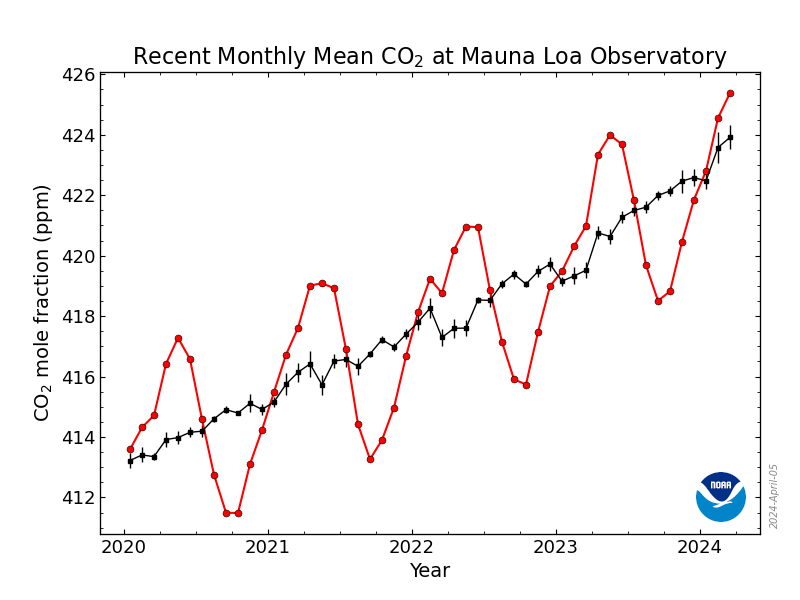

The earth has it's own ways of keeping score on how we're doing on emissions. One can measure it directly. The Mauna Loa Observatory has been measuring atmospheric CO2 levels since 1958. The data are here, ESRL Global Monitoring Division - Global Greenhouse Gas Reference Network.

Here's how we're doing.

And more recently...

There is a lot of seasonality. So let's look at the annual averages for atmospheric CO2 ppm.

year mean unc

1959 315.97 0.12

1960 316.91 0.12

1961 317.64 0.12

1962 318.45 0.12

1963 318.99 0.12

1964 319.62 0.12

1965 320.04 0.12

1966 321.38 0.12

1967 322.16 0.12

1968 323.04 0.12

1969 324.62 0.12

1970 325.68 0.12

1971 326.32 0.12

1972 327.45 0.12

1973 329.68 0.12

1974 330.18 0.12

1975 331.11 0.12

1976 332.04 0.12

1977 333.83 0.12

1978 335.40 0.12

1979 336.84 0.12

1980 338.75 0.12

1981 340.11 0.12

1982 341.45 0.12

1983 343.05 0.12

1984 344.65 0.12

1985 346.12 0.12

1986 347.42 0.12

1987 349.19 0.12

1988 351.57 0.12

1989 353.12 0.12

1990 354.39 0.12

1991 355.61 0.12

1992 356.45 0.12

1993 357.10 0.12

1994 358.83 0.12

1995 360.82 0.12

1996 362.61 0.12

1997 363.73 0.12

1998 366.70 0.12

1999 368.38 0.12

2000 369.55 0.12

2001 371.14 0.12

2002 373.28 0.12

2003 375.80 0.12

2004 377.52 0.12

2005 379.80 0.12

2006 381.90 0.12

2007 383.79 0.12

2008 385.60 0.12

2009 387.43 0.12

2010 389.90 0.12

2011 391.65 0.12

2012 393.85 0.12

2013 396.52 0.12

2014 398.65 0.12

2015 400.83 0.12

2016 404.21 0.12

I would point out that this series trends very well with cumulative carbon emissions from fossil fuels as reported by sources like the BP Energy Statistical Review. It should be an exercise in every elementary statistics class to try this. Its really simple and really compelling. Basically, each year's worth of energy emmissions bumps up the atmospheric CO2 levels by a certain amount. Moreover, atmospheric CO2 levels drive the ill effects of climate change. So the best measure of load we are actually putting on the climate system is this measure.

Now science tells us that we have about a 50% chance of keeping global warming within 2 degrees Celsius if atmospheric CO2 levels remain below 450 ppm. This is the essential stop sign we need to break for. So far we have not applied the breaks at all. Last year we were at 404.21 ppm, which gives us just 45.79 ppm of stopping distance. Over the last 3 years we have traveled 404.21 - 396.52 = 7.69, which is a growth rate of 2.5633 ppm/year. Emmissions have been level over these three years, so this should be a fairly accurate estimate of the annual rate.

So we need to stop in 45.79 ppm and we're travelling at 2.5633 ppm/year. Now we need our seventh grade pre-algebra students to tell us how many years we've got if we maintain this pace. Answer, 17.86 years past 2016, or by end of 2034. So obviously we've got to slow this down, or our seventh graders will not have a happy future.

How much should we down? The minimum rate of annual decrease is 1/17.86 = 5.6%. If we cut all emissions by 5.6% each year we would never have to stop using fossil fuels entirely. Now an algebra II student in high school should be able to do the math on a geometric series. Interestingly, if emissions decay at this rate we always remain 17.86 years away from 450 ppm if we continue at current pace. If we fail to reduce by this amout, then the time to 450 decrease and we have start decreasing at a faster rate.

Even so, the planet will keep score for us.

Here's how we're doing.

And more recently...

There is a lot of seasonality. So let's look at the annual averages for atmospheric CO2 ppm.

year mean unc

1959 315.97 0.12

1960 316.91 0.12

1961 317.64 0.12

1962 318.45 0.12

1963 318.99 0.12

1964 319.62 0.12

1965 320.04 0.12

1966 321.38 0.12

1967 322.16 0.12

1968 323.04 0.12

1969 324.62 0.12

1970 325.68 0.12

1971 326.32 0.12

1972 327.45 0.12

1973 329.68 0.12

1974 330.18 0.12

1975 331.11 0.12

1976 332.04 0.12

1977 333.83 0.12

1978 335.40 0.12

1979 336.84 0.12

1980 338.75 0.12

1981 340.11 0.12

1982 341.45 0.12

1983 343.05 0.12

1984 344.65 0.12

1985 346.12 0.12

1986 347.42 0.12

1987 349.19 0.12

1988 351.57 0.12

1989 353.12 0.12

1990 354.39 0.12

1991 355.61 0.12

1992 356.45 0.12

1993 357.10 0.12

1994 358.83 0.12

1995 360.82 0.12

1996 362.61 0.12

1997 363.73 0.12

1998 366.70 0.12

1999 368.38 0.12

2000 369.55 0.12

2001 371.14 0.12

2002 373.28 0.12

2003 375.80 0.12

2004 377.52 0.12

2005 379.80 0.12

2006 381.90 0.12

2007 383.79 0.12

2008 385.60 0.12

2009 387.43 0.12

2010 389.90 0.12

2011 391.65 0.12

2012 393.85 0.12

2013 396.52 0.12

2014 398.65 0.12

2015 400.83 0.12

2016 404.21 0.12

I would point out that this series trends very well with cumulative carbon emissions from fossil fuels as reported by sources like the BP Energy Statistical Review. It should be an exercise in every elementary statistics class to try this. Its really simple and really compelling. Basically, each year's worth of energy emmissions bumps up the atmospheric CO2 levels by a certain amount. Moreover, atmospheric CO2 levels drive the ill effects of climate change. So the best measure of load we are actually putting on the climate system is this measure.

Now science tells us that we have about a 50% chance of keeping global warming within 2 degrees Celsius if atmospheric CO2 levels remain below 450 ppm. This is the essential stop sign we need to break for. So far we have not applied the breaks at all. Last year we were at 404.21 ppm, which gives us just 45.79 ppm of stopping distance. Over the last 3 years we have traveled 404.21 - 396.52 = 7.69, which is a growth rate of 2.5633 ppm/year. Emmissions have been level over these three years, so this should be a fairly accurate estimate of the annual rate.

So we need to stop in 45.79 ppm and we're travelling at 2.5633 ppm/year. Now we need our seventh grade pre-algebra students to tell us how many years we've got if we maintain this pace. Answer, 17.86 years past 2016, or by end of 2034. So obviously we've got to slow this down, or our seventh graders will not have a happy future.

How much should we down? The minimum rate of annual decrease is 1/17.86 = 5.6%. If we cut all emissions by 5.6% each year we would never have to stop using fossil fuels entirely. Now an algebra II student in high school should be able to do the math on a geometric series. Interestingly, if emissions decay at this rate we always remain 17.86 years away from 450 ppm if we continue at current pace. If we fail to reduce by this amout, then the time to 450 decrease and we have start decreasing at a faster rate.

Even so, the planet will keep score for us.

TheTalkingMule

Distributed Energy Enthusiast

Looks like the Saudis followed thru with their plan to cut shipments to the US in the hope that a US inventory draw would bouy prices.

Near all time low in shipments and there was still crude inventory growth.

What's next?

OPEC’s Crude Exports To The U.S. Near All-Time Lows | OilPrice.com

Near all time low in shipments and there was still crude inventory growth.

What's next?

OPEC’s Crude Exports To The U.S. Near All-Time Lows | OilPrice.com

neroden

Model S Owner and Frustrated Tesla Fan

I think your analysis is entirely correct.I know I keep cycling back to these ideas, but it keeps perplexing me. The Saudis are wrecking their economy as window dressing for an ill timed IPO.

It's worth remembering that the Saudi government is not very bright. It's a family descended from a desert warlord, with really no background in geopolitics, economics, trade, etc. Yes, a few of the family members did go to school and learn this stuff, but it never sunk in as a cultural norm among the royals. There's no permanent bureaucracy of experts as there is in the US or UK or China. The leadership is fundamentally incompetent. By contrast, the UAE and Qatar leadership is essentially competent, having a history as trading posts and a cultural background where the royals value understaning of this stuff.

Similar threads

- Replies

- 1

- Views

- 488

- Replies

- 0

- Views

- 764

- Replies

- 19

- Views

- 4K

- Replies

- 3

- Views

- 482