Wouldn’t that be 2500 in old money?This was typed before we hit $500 I'm sure. I pressed F5 the moment we hit it and you had time to type this entire sentence?

You don't fool me.

Either way, let's burn some shorts now that we've busted through $3000 a share (yeah I still think in old money).

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Ya gotta be quicker!BAM 500

EDIT: Big Time. How in the hell did you beat me? I was sitting here with "Bam 500" already written. All I had to do was hit the Post Button.

This was typed before we hit $500 I'm sure. I pressed F5 the moment we hit it and you had time to type this entire sentence?

You don't fool me.

Either way, let's burn some shorts now that we've busted through $3000 a share (yeah I still think in old money).

Haha I’m trying for quote of the day

Easy peasy. There now is no ceiling.

These clowns have been squirming around for years creating greater and greater pressure. Shorting, misinformation, snubbing. When are they gonna learn?

All their collusion has done is double their cost basis at inclusion. Can't imagine where we're going from here.

lafrisbee

Active Member

DragonWatch

Small FootPrint

Forward Observing

Probably folks woke up to it is fourth quarter 2020. Traditionally speaking 4Q for Tesla (TSLA) is the biggest quarter to the concern of 1Q next year. Plus Tesla has been gaining steam (voltage) since 2010 ~ shocking, right. This quarter, of all quarters stands to bring us one of the self fulfilling prophecy’s of Elon’s projections. So far, Tesla has run over everyone in 2020 in spite of the pandemic.

Toyota’s great grandson recently joined GMC’s Lutz’s by declaring too many cooks in the car kitchen. Toyota had a leg up with their Prius, we owned two of them, including the one with solar panels. But Toyota had an electrical short in their brain waves and dropped the ball about the fifteen yard line. Probably had someone my height run into refrigerator man.

Tesla has been taking the luxury, and mid-size markets by storm; therefore, you might be aware traditional fossil fuel automakers are suffering in the sales department. Not the service department ~ still require 5K or 6 months service (Toyota anyway).

Toyota boasted they were converting to all electric. Dedicated another grandson to head that department years back. Well, not sure what his lab has produced, since before that it was all about Prius.

In case you had your eye on the ball ~ Tesla/Elon has been playin chess while the average automakers, despite the board had colored squares have been playing checkers. See, you had your eye on the ball, and not the chessboard. Tesla has/is building gigafactory, after gigafactory ~ internationally too, improved battery structure/output, self driving, deploying supercharger systems, backup solar storage, solar production, and . . . Sorry, got distracted watching my otter swim up to my neighbors log. Nice sunrise by the way. Damned shiny things.

Elon put the Cybertruck gigafactory in Texas as a precursor to landing on Mars, knowing full well that water was hard to find and life signs were limited. Now that is taking the bull by the horns. Still playing chess though.

Anything old (fossil fuel industry) can and should be replaced. Me too, but I am figuring on at least another 30 years.

Go green!

Probably folks woke up to it is fourth quarter 2020. Traditionally speaking 4Q for Tesla (TSLA) is the biggest quarter to the concern of 1Q next year. Plus Tesla has been gaining steam (voltage) since 2010 ~ shocking, right. This quarter, of all quarters stands to bring us one of the self fulfilling prophecy’s of Elon’s projections. So far, Tesla has run over everyone in 2020 in spite of the pandemic.

Toyota’s great grandson recently joined GMC’s Lutz’s by declaring too many cooks in the car kitchen. Toyota had a leg up with their Prius, we owned two of them, including the one with solar panels. But Toyota had an electrical short in their brain waves and dropped the ball about the fifteen yard line. Probably had someone my height run into refrigerator man.

Tesla has been taking the luxury, and mid-size markets by storm; therefore, you might be aware traditional fossil fuel automakers are suffering in the sales department. Not the service department ~ still require 5K or 6 months service (Toyota anyway).

Toyota boasted they were converting to all electric. Dedicated another grandson to head that department years back. Well, not sure what his lab has produced, since before that it was all about Prius.

In case you had your eye on the ball ~ Tesla/Elon has been playin chess while the average automakers, despite the board had colored squares have been playing checkers. See, you had your eye on the ball, and not the chessboard. Tesla has/is building gigafactory, after gigafactory ~ internationally too, improved battery structure/output, self driving, deploying supercharger systems, backup solar storage, solar production, and . . . Sorry, got distracted watching my otter swim up to my neighbors log. Nice sunrise by the way. Damned shiny things.

Elon put the Cybertruck gigafactory in Texas as a precursor to landing on Mars, knowing full well that water was hard to find and life signs were limited. Now that is taking the bull by the horns. Still playing chess though.

Anything old (fossil fuel industry) can and should be replaced. Me too, but I am figuring on at least another 30 years.

Go green!

jeewee3000

Active Member

Woops. I got a little too excited there for a second.Wouldn’t that be 2500 in old money?

Edited the post. Thanks for the correction.

Driver Dave

Member

TSLA reaches escape velocity from the gravitational influences of the massive body called 500.

Next stop $10,000 / share!

Apparently, a few bottles had been opened early.

Why not? I'll take 10K a pop.

Haha what do you use to trade? I’m on the floor with the big boardYou're right. Big Time should be given a time out by The Momerators. I literally saw the stock price in the $499 area and wrote out my post of "BAM 500" and sat there for 30 seconds waiting for the "5" to appear. And hit the post button within 3 seconds of it appearing.

You know nothing about "Buffet."

He is known for just the opposite of what you present. He buys family businesses who will only sell to him because he DOESN'T restructure them and strip out the assets. He only shuts down businesses if there is no hope of at least breaking even in the future - which has happened very few times and was caused by factors other than poor management. He doesn't resell businesses he's bought either - which is the standard venture capital model. No hostile takeovers either.

He DOES buy stock on the open market in good companies selling at big discounts to their value. Was buying AAPL at 10X earnings unethical? He DOES run a tight ship - no wasting money at his businesses. He IS 100% trustworthy.

He does NO financial engineering. BRK's borrowing is often in their financing units to re-lend that money consumers to buy things like their homes. Very little leverage. Tons of cash. He doesn't give guidance, have quarterly conference calls or manipulate the financials to boost reported profits. He paints an unbiased view of the companies strengths and weaknesses and presents all the information an investor needs to value the business.

In an earlier post I stated that he does nothing that would give an opening to anyone for any kind of criticism. Even then, there are those who attack him for no other reason than his success.

thank you for writing that, I was not going to waste my words to try to correct people.

Obviously people that talk like that have never even listened to a full interview or a shareholders meeting of Berkshire.

Charlie Munger is even more impressive and a true thinker in my opinion.

That’s why I recommend everyone that haven’t read the Poor Charlie’s Almanack to do it.

jeewee3000

Active Member

We should really split the stock 5:1 to make it more accessible to small time investors

MissAutobahn

Elon, please ramp up Berlin GF in plaid mode!

What can I do !??I couldn't decide today where to spend some money.

For today I decided to support $TSLA by ordering a car instead of stock

I am not willing to buy a Tesla every time we hit a new ATH

Navin

Active Member

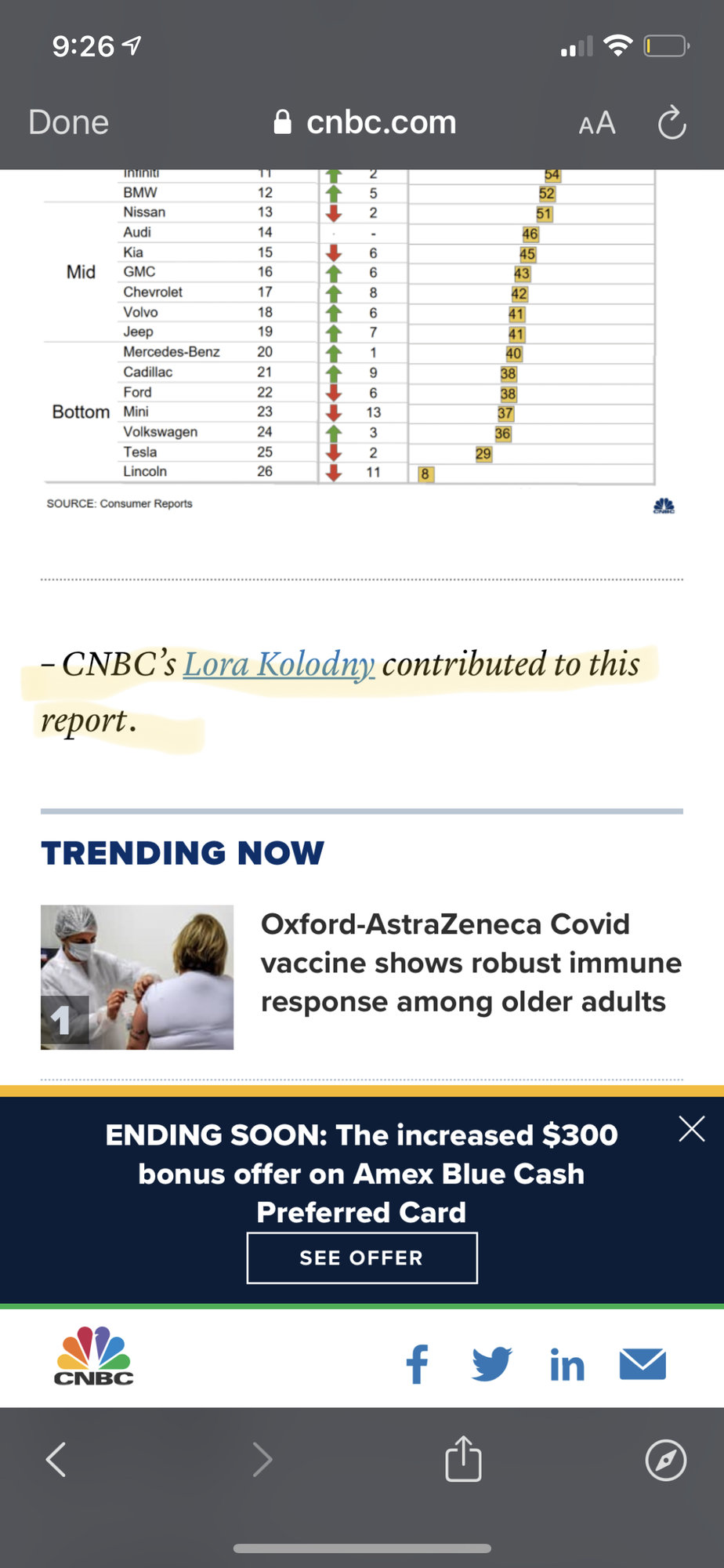

Tesla Model S no longer 'recommended' by Consumer Reports due to reliability concerns

Lora - you are loyal to your cause and deserve whatever consulting fees you are getting.

Lora - you are loyal to your cause and deserve whatever consulting fees you are getting.

lafrisbee

Active Member

The biggest bit that we are missing is:

WHO IS SELLING?

I could understand people that have to put shoes on their children's feet due to Winter coming, but that's it.

24 million shares in the first hour? Why? Even the ETF's have to be smart enough to suspend their selling of a stock that is this sure a bet?

Is this ALL from MM's still trying to keep it close to $500?

WHO IS SELLING?

I could understand people that have to put shoes on their children's feet due to Winter coming, but that's it.

24 million shares in the first hour? Why? Even the ETF's have to be smart enough to suspend their selling of a stock that is this sure a bet?

Is this ALL from MM's still trying to keep it close to $500?

Crapro’s dumpin

ATH intra day yes?

Someone yesterday mentioned the intra day ATH. I think it was higher. Anyone have that number still?

juanmedina

Active Member

Tesla Model S no longer 'recommended' by Consumer Reports due to reliability concerns

Lora - you are loyal to your cause and deserve whatever consulting fees you are getting.

View attachment 609922

she tries so hard and her articles have no effect on the SP anymore

strago13

Member

The biggest bit that we are missing is:

WHO IS SELLING?

I could understand people that have to put shoes on their children's feet due to Winter coming, but that's it.

24 million shares in the first hour? Why? Even the ETF's have to be smart enough to suspend their selling of a stock that is this sure a bet?

Is this ALL from MM's still trying to keep it close to $500?

There was at least 54% short selling yesterday. Shorty doesnt want the price over 500. Its like standing in front of a moving bus.

chiptoe

Member

I am still learning the ropes to option buying, but feel pretty well positioned at the moment given my share foundation and the calls I have purchased (mostly by mimicking trades posted on this board from time to time so Thanks!), but in trying to develop some skills of my own, I am trying to look for and analyze the available calls (timeframes, strike and prices) and be able to identify sweetspots where call prices seem to be lagging behind the market.

As I go through them one by one, there seems to be some that are better bargains than others, but I find it hard to make objective comparisons. How should I approach this (there must be a tool for this), and at this point are there any obvious ranges I should be looking at?

As I go through them one by one, there seems to be some that are better bargains than others, but I find it hard to make objective comparisons. How should I approach this (there must be a tool for this), and at this point are there any obvious ranges I should be looking at?

lafrisbee

Active Member

On a different note but still relevant to the stock...

I watch just about every Youtube "Stock analyst" that does TSLA. And they are never right.

And a big shout out to CHicken Genius because he's "stopped being a donkey" because he no longer even tries. All the others still look at numbers in relation to what every other stock is supposed to do.

The funniest are the ones that will declare "The stock is going to go up or down in the next two days, and a week later the stock moves and they claim they got it right. They were not correct in the direction, and most crucially they were wrong about the timing.

Today the only number that matters is 5.

I watch just about every Youtube "Stock analyst" that does TSLA. And they are never right.

And a big shout out to CHicken Genius because he's "stopped being a donkey" because he no longer even tries. All the others still look at numbers in relation to what every other stock is supposed to do.

The funniest are the ones that will declare "The stock is going to go up or down in the next two days, and a week later the stock moves and they claim they got it right. They were not correct in the direction, and most crucially they were wrong about the timing.

Today the only number that matters is 5.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K