if ark is not selling it's a good sign. If they are selling its just a mandatory operation based on their guidelines. This information is worthless.Plus ARK not selling TSLA either...

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

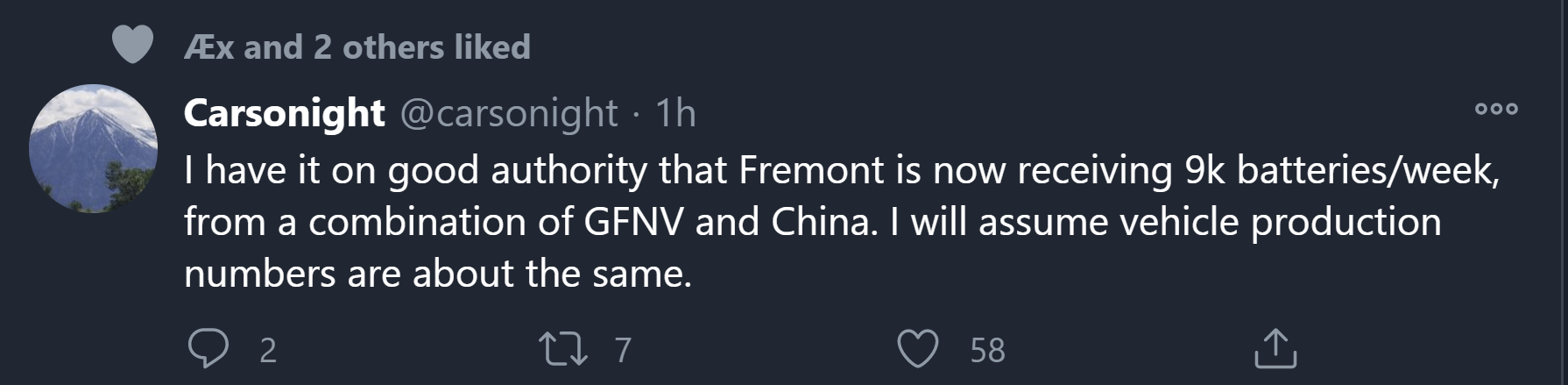

Carsonight has an update on Fremont cell volumes.

https://twitter.com/carsonight/status/1332418955386912768

https://twitter.com/carsonight/status/1332418955386912768

It's the timing of their sales, or no sale, that is very telling for me anyway. I absolutely take this into account.if ark is not selling it's a good sign. If they are selling its just a mandatory operation based on their guidelines. This information is worthless.

Tslynk67

Well-Known Member

It was definitely a joke buy. I searched around for anything that matched the $34.cc that was left in my settlement account., put in a limit bid for $0.34 the night before. I really didn’t expect it to hit and was amazed when I got the text confirmation. There was a little bit of a dip right after opening when it hit.

Seems as good a methodology as any other

Two quotes, one from Buffet:

Time in the market is more important than timing the market.

The investor with the best returns is a dead investor.

In the market, any particular pattern happens--until it doesn't. It's the "until it doesn't" that kills you.

Agree on your options assessment. It’s not a toy game.

I think most everyone can agree just buy and hold “forever” will be your best advice.

Read Elon’s biography if you haven’t and spend 100 hrs on everything Tesla, SpaceX, and Musk on YouTube. You won’t sell a share after.

I personally put negative article into the FUD basket automatically until I check here for credibility. Maybe 1 out of 1000 maybe legitimate?

No one knows. I personally think that the more the stock price increases prior to the inclusion date(s), the more likely the stock is to correct afterward. However, there are a number of upcoming catalysts that could support the price after the indexers buy their shares. Swing trading can be an effective way to acquire more shares - or get left behind. This very thread is littered with stories of those who unsuccessfully tried to employ the strategy. The general sentiment here is "time in the market beats timing the market."

Personally, when I make trades that cap my upside I'm weighing my fear of unrealized gains (and gauging the likelihood of said event) against my desire to acquire more shares, and responding accordingly.

No one knows of course but my only advice is to not sell all if you want to try and play with market timing. Think about how many shares you're willing to not get back if the price goes higher instead of pulling back as you expect. I've played the volatility over the years with a small portion of my holdings. I've been at it long enough that most of my short term plays have worked out well but have always been comforted by having the bulk of my shares untouched for the long term.

Thank you for confirming which I was already 99% decided was to hold them and just add to it. I hope to be able to put another 50-100k by the end of January.

I love the atmosphere in here and how everyone just wants to help everyone, and share their knowledge and experiences regardless of their position in life. It’s quite incredible.

Jared

Hope you all have a good weekend.

Go outside walk in nature..hug your loved ones.

Be thankful for all you have.

Then put the helmet and seat belts on because next week is going to be a wild fun ride!

Go outside walk in nature..hug your loved ones.

Be thankful for all you have.

Then put the helmet and seat belts on because next week is going to be a wild fun ride!

I'm doing some end of year tax planning, and when start the conversation with the various Accountants and Planners I am dealing with, they keep telling me that it's impossible to have a balance as high as I have in my Tax Free Savings Account (TFSA). I tell them I invested in some company that makes electronic cars.

I recall @Causalien once mentioning that a $500K+ balance would attract some unwanted attention from the CRA, although I've been told this more relates to penny stocks or some other speculative investment and not publicly traded companies. Supposedly, one's day job can affect this, should you happen to be a Financial Professional, which I am not.

In any case, I expect to be audited this year.

I recall @Causalien once mentioning that a $500K+ balance would attract some unwanted attention from the CRA, although I've been told this more relates to penny stocks or some other speculative investment and not publicly traded companies. Supposedly, one's day job can affect this, should you happen to be a Financial Professional, which I am not.

In any case, I expect to be audited this year.

Last edited:

MC3OZ

Active Member

You can't replace more than 50% of ICE vehicles in just a few years if you don't have enough batteries to build 40+ million EVs- and nobody (and no collection of anybody) has nearly that many batteries anytime soon.

While that is true there are several new dynamics at play here.

Reduced importance of brand - I talked about Tesla sell selling a wide range of cars under the one brand. While other car makers e.g. VW own different brands, VW, Audi, Porsche. Up to now "brand loyalty" has been important for ICE cars as lots of tiny aspects go in the look and feel of a brand. Brand is now less important, because specifications and aesthetics are changing rapidly.

Specifications are equally important perhaps more important than brand, Tesla has the brand and the specifications.

With the right specifications and battery volumes, EV market share us up for grabs, once there is a race, there are always willing runners.

Rather than being something fixed and permanent, battery factory plans are very fluid, changing rapidly and constantly being upscaled. There is a 5 year lag on spinning up new mines and factories, but there are always ways of dragging forward timelines we people are highly motivated, or putting it more accurately, some are desperate.

China will at least match Tesla in scaling battery production IMO, that is 40 Million EVs by 2030. The rest of the world Japanese, Koreans and Europeans can probably do 10-15 Million by 2030 if they can find the raw materials.

Very few will buy an ICE due to brand loyalty, when they want an EV. if they can't get an EV, many will simply delay purchase, that should be a trend 2025-2035.

Those buying an ICE in 2030 are people that want an ICE even though gas stations are closing, fast chargers are everywhere, and EVs are better than ICE on every single metric, including purchase price. The word for that is hobbyist, or someone with a strong sense of nostalgia.

...You can't replace more than 50% of ICE vehicles in just a few years if you don't have enough batteries to build 40+ million EVs....

Yes you can -- with electric robotaxis. As shown by your example of the NYC subway, over 50% of car owners could switch to a much cheaper and convenient alternative when it becomes available to them.

But regardless of whether you believe that, please note that ICE new car sales will drop below 50% well before ICE car usage. As people realize EVs are the future and ICE resale values collapse, people will stop buying new ICE cars even if they don't buy EVs right away. They will delay buying any new car, especially if robotaxis are available. This is the tsunami coming for the automajors, which will hit sooner than they expect.

Last edited:

UnknownSoldier

Unknown Member

So does this mean 500k in 2020 is within sight? Where are we at now with this projection?Carsonight has an update on Fremont cell volumes.

View attachment 612410

https://twitter.com/carsonight/status/1332418955386912768

UnknownSoldier

Unknown Member

The meme makers are way ahead of you there. I first saw this image at least a year ago, probably longer.Tesla Storms the S&P 500. Here’s the Bull Case.

-Barron's

View attachment 612416

OK, all you meme-makers. Have at it!

Tes La Ferrari

Active Member

I'm doing some end of year tax planning, and when start the conversation with the various Accountants and Planners I am dealing with, they keep telling me that it's impossible to have a balance as high as I have in my Tax Free Savings Account (TFSA). I tell them I invested in some company that makes electronic cars.

I recall @Causalien once mentioning that a $500K+ balance would attract some unwanted attention from the CRA, although I've been told this more relates to penny stocks or some other speculative investment and not publicly traded companies. Supposedly, one's day job can affect this, should you happen to be a Financial Professional, which I am not.

In any case, I expect to be audited this year.

This is from a few years ago - but they have done it before.

Canada Revenue Agency says it's still auditing high-balance TFSAs | Financial Post

"The tax agency contends that some Canadians are operating their TFSAs like a business and has set up eight criteria that can lead to an audit including frequency of trading, period of ownership, knowledge of securities markets, trading experience and time spent on an account. Some of those criteria tend to penalize people in the securities industry, say critics."

Im not an accountant, so perhaps some accountants like @st_lopes can chime in on this ?

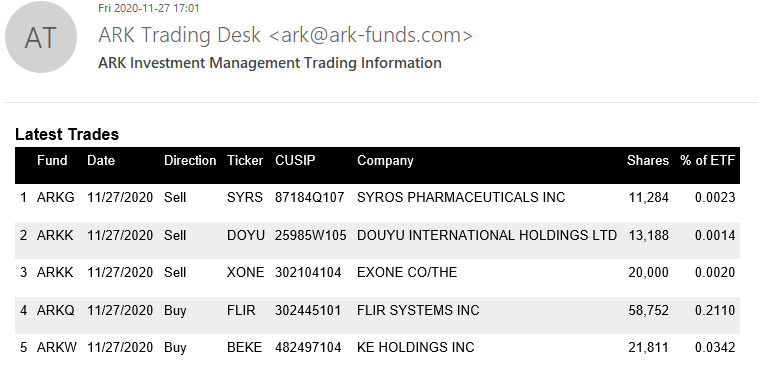

ARK has not trimmed any of its quite large TSLA holdings, since it did so on November 19, despite TSLA now on a string of 4 consecutive record highs.

EDIT to Add: TSLA is now 12.89% of ARKQ.

EDIT to Add: TSLA is now 12.89% of ARKQ.

Last edited:

Mostly agree, but there's one class of people that will resist robotaxi, and that's parents. Hauling the child seat in an out of a robotaxi is a real pain--and what do you do with it while your shopping? Robotaxi will only be a success if it's also more convenient. If it's not more convenient (say you have to wait fifteen minutes for the robotaxi to arrive--five minutes is about the maximum) just lower cost alone won't drive the numbers you are suggesting.Yes you can -- with electric robotaxis. As shown by your example of the NYC subway, over 50% of car owners could switch to a much cheaper and convenient alternative when it becomes available to them.

But regardless of whether you believe that, please note that ICE new car sales will drop below 50% well before ICE car usage. As people realize EVs are the future and ICE resale values collapse, people will stop buying new ICE cars even if they don't buy EVs right away. They will delay buying any new car, especially if robotaxis are available. This is the tsunami coming for the automajors, which will hit sooner than they expect.

To really make this work Tesla owners have to be convinced to use their car as a robotaxi. That would put enough cars in the area to get within the five minute time. Certainly robotaxi will eat normal taxis and Uber type services, and people where the cost sells them (of course, these are pretty large numbers, but nowhere near 50% as the taxi and Uber are often people who don't own a car to start with).

We had to cut down on the champagne each ATH, as the new ATH frequency was not compatible with the travel requirements to replenish my stock due to covid travel restrictions. So my liver is still ok. We did drink a millesime from 2013, the year I bought my first TSLA, to celebrate todays ATH though.Probably why we haven't heard from @NicoV for some time = liver failure...

Edit: Can’t wait to test out the new V3 supercharger in Reims. Very strategically positioned for us.

Mostly agree, but there's one class of people that will resist robotaxi, and that's parents. Hauling the child seat in an out of a robotaxi is a real pain--and what do you do with it while your shopping? Robotaxi will only be a success if it's also more convenient. If it's not more convenient (say you have to wait fifteen minutes for the robotaxi to arrive--five minutes is about the maximum) just lower cost alone won't drive the numbers you are suggesting.

To really make this work Tesla owners have to be convinced to use their car as a robotaxi. That would put enough cars in the area to get within the five minute time. Certainly robotaxi will eat normal taxis and Uber type services, and people where the cost sells them (of course, these are pretty large numbers, but nowhere near 50% as the taxi and Uber are often people who don't own a car to start with).

Why can't a robotaxi have its own child seat... if not installed then in the frunk for you to take out and use? Or your Tesla Network phone app could let you specify that you need a ride with a child seat installed.

I have some faith in the imagination and ingenuity of Tesla's engineers.

I always considered myself a super bull on Tesla, but the stock has gone up considerably faster than myself and pretty much everyone else imagined. I have several thoughts around this topic, but my general idea is that we have a massive conservative bias with our Tesla predictions.

Take a look back at some of the old super-bull predictions, which now seem like bear predictions: Super Bulls Only

Or take a look at ARKs 7000EV (1400) by 2024 target... starting to look kind of low, especially with FSD looking much closer now than people thought.

I think the reason for having a conservative bias is:

* Unconscious absorption of FUD

* Expecting the past flat period from 200-300SP to repeat, instead of realising we are on an S curve of ramping

* Struggling to imagine the scale of Tesla/EVs/renewables

* Struggling to imagine the new tech, and the changes they bring

* Underestimating FSD and more specifically the effectiveness of computation scale on AI (May 2020 news & 'On GPT-3' · Gwern.net)

* Not wanting to sound crazy

I think the most accurate predictions of Tesla will be top down based on total addressable market, across all the markets they are touching, with massive margins, growth and market share. From EVs, to AWS for AI and all 15-20 or so industries in between. In this regard you can think of Tesla as 15-20 companies, all which can end up leading their fields. 550B might seem like a lot now, but really it's just 20 companies undervalued at 30B each. Some of those startups perhaps could be valued at 550B alone... most notably FSD.

It has been on my todo list to attempt sizing up these markets and assigning a large percentage of them to Tesla. For now though, I can say the potential upside is so much higher than I see anyone putting numbers to.

I would like to see an analysis where:

* Tesla gets to FSD in next 2 years with high probability and has 5 years with no competition in FSD

* Tesla batteries/energy/EVs grows 20% faster than predicted at battery day

* Solar scales at similarly rapid rates

* Tesla's DoJo supercomputer and NN training farm has a bigger value than Amazon's AWS

* Decade long predictions take into account acceleration change: Accelerating change - Wikipedia

* And comprehensive valuation of all the other startup components like insurance, chip design, seats, etc.

Taking all this into account, I can see a case for a current SP of 2000-3000. I may sound crazy now, but check back in 5-10 years and see whether I was crazy, or perhaps even bearish in my outlook. Perhaps even 1-2 years will prove me right. I should say I am not 100% confident on any of these super-bull predictions, they are complete guesses and I haven't done the top down analysis which I think is needed to most accurately predict the 10 year stock price. It's not really necessary for a buy and hold investor like me.

However, I did want to point out a historical collective bearish shortcoming in predicting Tesla and TSLA.

Take a look back at some of the old super-bull predictions, which now seem like bear predictions: Super Bulls Only

Or take a look at ARKs 7000EV (1400) by 2024 target... starting to look kind of low, especially with FSD looking much closer now than people thought.

I think the reason for having a conservative bias is:

* Unconscious absorption of FUD

* Expecting the past flat period from 200-300SP to repeat, instead of realising we are on an S curve of ramping

* Struggling to imagine the scale of Tesla/EVs/renewables

* Struggling to imagine the new tech, and the changes they bring

* Underestimating FSD and more specifically the effectiveness of computation scale on AI (May 2020 news & 'On GPT-3' · Gwern.net)

* Not wanting to sound crazy

I think the most accurate predictions of Tesla will be top down based on total addressable market, across all the markets they are touching, with massive margins, growth and market share. From EVs, to AWS for AI and all 15-20 or so industries in between. In this regard you can think of Tesla as 15-20 companies, all which can end up leading their fields. 550B might seem like a lot now, but really it's just 20 companies undervalued at 30B each. Some of those startups perhaps could be valued at 550B alone... most notably FSD.

It has been on my todo list to attempt sizing up these markets and assigning a large percentage of them to Tesla. For now though, I can say the potential upside is so much higher than I see anyone putting numbers to.

I would like to see an analysis where:

* Tesla gets to FSD in next 2 years with high probability and has 5 years with no competition in FSD

* Tesla batteries/energy/EVs grows 20% faster than predicted at battery day

* Solar scales at similarly rapid rates

* Tesla's DoJo supercomputer and NN training farm has a bigger value than Amazon's AWS

* Decade long predictions take into account acceleration change: Accelerating change - Wikipedia

* And comprehensive valuation of all the other startup components like insurance, chip design, seats, etc.

Taking all this into account, I can see a case for a current SP of 2000-3000. I may sound crazy now, but check back in 5-10 years and see whether I was crazy, or perhaps even bearish in my outlook. Perhaps even 1-2 years will prove me right. I should say I am not 100% confident on any of these super-bull predictions, they are complete guesses and I haven't done the top down analysis which I think is needed to most accurately predict the 10 year stock price. It's not really necessary for a buy and hold investor like me.

However, I did want to point out a historical collective bearish shortcoming in predicting Tesla and TSLA.

Causalien

Prime 8 ball Oracle

This is from a few years ago - but they have done it before.

Canada Revenue Agency says it's still auditing high-balance TFSAs | Financial Post

"The tax agency contends that some Canadians are operating their TFSAs like a business and has set up eight criteria that can lead to an audit including frequency of trading, period of ownership, knowledge of securities markets, trading experience and time spent on an account. Some of those criteria tend to penalize people in the securities industry, say critics."

Im not an accountant, so perhaps some accountants like @st_lopes can chime in on this ?

You left out the most frustrating term and the catch all that they use to catch ppl they don't like :" Engage in speculation"

I will admit I have trouble with exponential growth and your examples relies such skills. I have yet digested my exponential account growth. Noodle cup for dinner it is. I’m with you in just couple of years we’ll look back and think your predictions are bearish.I always considered myself a super bull on Tesla, but the stock has gone up considerably faster than myself and pretty much everyone else imagined. I have several thoughts around this topic, but my general idea is that we have a massive conservative bias with our Tesla predictions.

Take a look back at some of the old super-bull predictions, which now seem like bear predictions: Super Bulls Only

Or take a look at ARKs 7000EV (1400) by 2024 target... starting to look kind of low, especially with FSD looking much closer now than people thought.

I think the reason for having a conservative bias is:

* Unconscious absorption of FUD

* Expecting the past flat period from 200-300SP to repeat, instead of realising we are on an S curve of ramping

* Struggling to imagine the scale of Tesla/EVs/renewables

* Struggling to imagine the new tech, and the changes they bring

* Underestimating FSD and more specifically the effectiveness of computation scale on AI (May 2020 news & 'On GPT-3' · Gwern.net)

* Not wanting to sound crazy

I think the most accurate predictions of Tesla will be top down based on total addressable market, across all the markets they are touching, with massive margins, growth and market share. From EVs, to AWS for AI and all 15-20 or so industries in between. In this regard you can think of Tesla as 15-20 companies, all which can end up leading their fields. 550B might seem like a lot now, but really it's just 20 companies undervalued at 30B each. Some of those startups perhaps could be valued at 550B alone... most notably FSD.

It has been on my todo list to attempt sizing up these markets and assigning a large percentage of them to Tesla. For now though, I can say the potential upside is so much higher than I see anyone putting numbers to.

I would like to see an analysis where:

* Tesla gets to FSD in next 2 years with high probability and has 5 years with no competition in FSD

* Tesla batteries/energy/EVs grows 20% faster than predicted at battery day

* Solar scales at similarly rapid rates

* Tesla's DoJo supercomputer and NN training farm has a bigger value than Amazon's AWS

* Decade long predictions take into account acceleration change: Accelerating change - Wikipedia

* And comprehensive valuation of all the other startup components like insurance, chip design, seats, etc.

Taking all this into account, I can see a case for a current SP of 2000-3000. I may sound crazy now, but check back in 5-10 years and see whether I was crazy, or perhaps even bearish in my outlook. Perhaps even 1-2 years will prove me right. I should say I am not 100% confident on any of these super-bull predictions, they are complete guesses and I haven't done the top down analysis which I think is needed to most accurately predict the 10 year stock price. It's not really necessary for a buy and hold investor like me.

However, I did want to point out a historical collective bearish shortcoming in predicting Tesla and TSLA.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M