mickificki

Member

Very light volume in the premarket and light volume in this thread...Calm before the storm?

waves are rolling back quietly as the tsunami begins its arrival...

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Very light volume in the premarket and light volume in this thread...Calm before the storm?

That's a tough one. This is pretty much a guess, but I feel like the percentage that will try is going to be very high, as in the majority.

However, I'd also guess that front-runners will buy up a lot of shares this week to sell to indexers during the cross, which should drive up the stock price. If that's not going to be enough to satisfy demand from indexers during the cross, I'd guess some buying will spill over to next week.

Not super confident in this, but you asked for a guess

That was my thought as well - why wouldn't they buy then? Just seems like the most straight-up way to add TSLA. I thought that it could result in an interesting dynamic wherein we see a lot of volatility within a tight range - maybe $600-$650 - as speculators alternate between buying in at attractive levels and getting antsy waiting for the indexers to show up.

I personally still believe there's almost no way demand from indexers can be fulfilled at this level.

Gotcha - thought being, just the buying from frontrunners looking to sell on Friday's closing cross alone will be more than enough to drive up the price between now and Friday.

Here comes TMC...

“...shall we dance?!”

So excited to see this part play out!

Robs' analysis is second to none!

- at least 15% of available shares are disappearing permanently into index funds

- up to 22% of available shares are disappearing likely permanently into benchmarked funds

The first number (give or take a % or two) is pretty well known as fact.

That second # continues to make no sense to me.

Benchmark funds have 0 requirement to buy TSLA ever.

Those that thought it would outperform the overall index would've already bought (ARKs funds for example)

Those that think it won't outperform the index won't magically do so now if they still think it won't....and even if they did- doing so during what everyone expects to be a temporary spike in prices would be the dumbest possible time to do so.

Then again remember buffets bet? Most active funds don't beat the index, so I guess they're mostly run by idiots and expecting them to not do the dumbest thing possible is a fools errand?

If you log out and log back in, i think that will clear up the issue. Of course that works after $TSLA is up $25 from when i initially wanted to buy itExactly same happening here in NYC - trying to put a test sell order from the call options I hold. Phone line 800 ... rings and then goes busy signal - Chat message is not working at this time - WTF ?

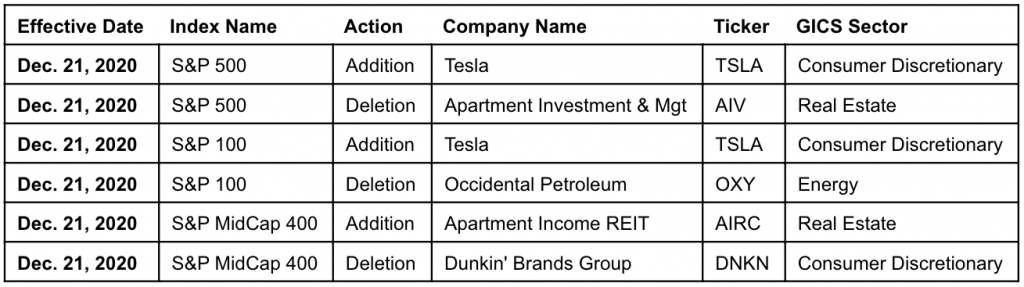

View attachment 617608

Well, Nordnet.se also went down a few mins ago.Rrrggh...Schwab is down. Anyone know the RSI for TSLA at the moment?

Nobody is right all the time. In the stock market you make money if you are right more than you are wrong. Because of the overpriced MACROS and the 11 year straight bull run coupled with the fact that Tesla at 600 Billion market cap is fairly priced. I would take a lot of the table.

waves are rolling back quietly as the tsunami begins its arrival...

If anything, it looks like capping on the downside to me. Seems to me like somebody is very carefully buying up every time it drops below $xxx, and ups this limit by a few $s every so often.

Random observation that could be totally wrong, but that's the feeling I get from observing the stock movement..