in 2020 we took nine ~1500 mile trips. When you subtract the home charging and destination charging. That works out to around 2500 kW of SC charging or $250 based on home charging rates (don't know about SC rates as our Teslas have always had unlimited charging).Yeah, I estimate that this offer is valued at ~$750. While the one year of free Supercharging that people have been getting up to this point is more like ~$300 for most people. (Way more for some people and $0 for others.)

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Artful Dodger

"Neko no me"

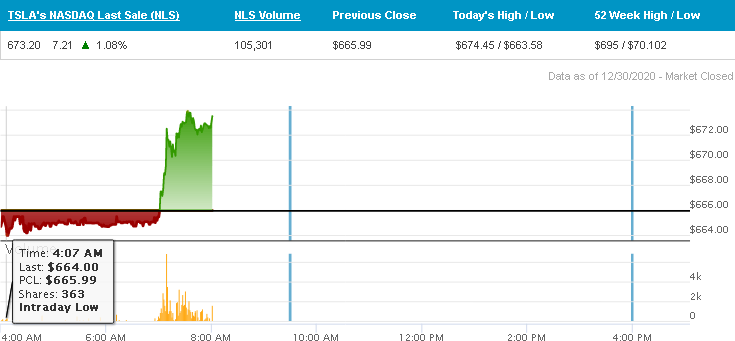

08:00 a.m. Whistle: Wed, Dec 30, 2020

TSLA share price: $672.58 +$6.59 +0.99%

Volume: 356,808 shares (Moderate)

Max Pain (07:00 ET): $640 (+$5 from Tuesday)

Comment: "Those 7:00 am Cowboys are riding high today"

Cheers!

TSLA share price: $672.58 +$6.59 +0.99%

Volume: 356,808 shares (Moderate)

Max Pain (07:00 ET): $640 (+$5 from Tuesday)

Comment: "Those 7:00 am Cowboys are riding high today"

Cheers!

Last edited:

Words of HABIT

Active Member

Hedge funds had their best month since 2009. They’re still not keeping up with the stock marketGreat OP!

Also lots of observant comments on this.

However, I find the most striking point in OP was the broader perspective, namely this: "...vying for dominance of the american pie".

This forum has often discussed that technology is taking over, the famous "Software is eating the world" and so on.

Maybe the finance people are waking up to the fact that there is a new world where science and technology is dominant - and their field is being existentially threatened. Few things upset people more than being in a position of power and wealth - and then also seeing that there might soon be a swift end to that position.

The information imbalance has shifted from people in the know, doing difficult to evaluate financial analysis, "legacy, closed source", towards people in the youtube and TMC and twitter community doing deep technological dives - and sharing those openly: Open source investing.

"Open source"-fund managers like ARK will have a place together with DYI investors. The key differentiating factor will be the level of science and tech understanding they employ or otherwise bring to the table.

Traditional closed source fund managers are becoming obsolete.

Summary: Hedge funds returns suck. It used to be the wealthy invested in Hedge funds that had inside information and knowledge and made outside gains in the stockmarket. Now....not so much. When Hedge funds can't even keep up with the Index funds you know they are a dying breed. With knowledge comes power. The trend of money flowing out of managed funds and into direct stocks by retail investors will continue for many years to come.

There's also cell manufacturing in Raleigh NC. I can't wait to hear more about Tesla's CapEx plans - hopefully in the Q4 call. They're clearly working on more facilities in the US for cells and Semi.

Link to tweet:

https://twitter.com/Ryan_Alvarez116/status/1344166377741926400

Link to Job:

Careers | Tesla

Tslynk67

Well-Known Member

Hm, second analyst this week to change his Q4 deliveries estimate to exactly what Troy Teslike is predicting - 183k. Coincidence I'm sure..

'Credit Suisse sees Tesla clearing 2020 target of 500,000 deliveries 07:02 TSLA Credit Suisse analyst Dan Levy predicts Tesla will deliver about 183,000 vehicles in Q4, which he notes is above the sell-side consensus of 163,000 deliveries and the likely buy-side consensus of about 175,000 to 180,000 deliveries. Such a figure would put Tesla at 502,000 for 2020 and allow the company to achieve its target of 500,000 deliveries in 2020, noted Levy. While his expectation would require a record month of December for Tesla, Levy believes this is feasible given Tesla's "typical quarter-end wave," he added. Levy keeps a Neutral rating and $400 price target on Tesla shares.'

Read more at:

Credit Suisse sees Tesla clearing 2020 target of 500,000 deliveries TSLA - The Fly

Pretty bullish for someone with a 40% down-side price-target

Driver Dave

Member

the VW agency Dealership Model right now makes every ID sold a lost business for Dealers.

It is no secret that dealers are going out of business.

In a world where market forces drive things to become more efficient and tech enables it and consumers expect it, direct auto sales is the only path forward.

And dealers totally deserve to die. They just exist to skim money off every deal while writing laws to hold their monopoly through generations.

VW will eventually have to kill its dealer network as it will cease to be a viable business.

and they will be a better brand and company in the end, not having to have these fairly awful con men represent their product to consumers.

Tesla is already in the future. Not sure these old guys will ever catch up.

For those interested, I wrote an article that gives insights in relation to a German Greenpeace study why the VW agency Dealership Model right now makes every ID sold a lost business for Dealers. The disadvantage of the Dealership network of incumbents gets more and more obvious.

I received VW internal leaked and confidential documents from VW France that allow me to support the Greenpeace study with prove that showed why only 1 out of 25 dealers recommended the ID.3

Volkswagen Dealers Making 4.5% Margin Selling ID.4 vs. 14%+ For Fossil Fuel Vehicles — CleanTechnica Exclusive

Of course as usual a ton of haters and trolls try to go after me

My next article will include a confidential competitive strenghtweakness VW analysis that compares the ID.4 with the Model Y, Kona, iX3 a.o.

Feels strange to publish these confidential documents as VW may put me on their 'person of interest' list now or even decides to try to sue me.

Time will tell

Really enjoy your insight Alex, so please keep it coming.

You have a lot of support on this forum, so if VW do sue you don't worry..... you're on your own

Buckminster

Well-Known Member

Factchecking estimates:

Q4 deliveries: 187k, 507k for 2020

Q4 production: 182k, 502k for 2020

https://twitter.com/truth_tesla/status/1344255910508695554

Q4 deliveries: 187k, 507k for 2020

Q4 production: 182k, 502k for 2020

https://twitter.com/truth_tesla/status/1344255910508695554

Artful Dodger

"Neko no me"

More evidence pointing to an imminent Model “S/X P2.” It relates to a selfie camera found in the cars’ cabins similar to those found on the Model 3 and Model Y:

Tesla Model S and Model X 'refresh' cabin camera teased in code | Teslarati.com

Cheers!

Tesla Model S and Model X 'refresh' cabin camera teased in code | Teslarati.com

Cheers!

JayNT

Member

I just took delivery of my new Model S two days ago and not bummed at all about the possible refresh because if the refresh changes the Model S to 1 screen like the 3 and Y I would consider myself lucky.

You mean 2500 kwh?in 2020 we took nine ~1500 mile trips. When you subtract the home charging and destination charging. That works out to around 2500 kW of SC charging or $250 based on home charging rates (don't know about SC rates as our Teslas have always had unlimited charging).

And future models will use even less for the same trip after starting you out with more of the original home charge. Also with longer range = fewer stops. Looking forward to upgrading to a newer X this year or next... just because... I can! Thanks to TSLA and you guys.

Last edited:

JayNT

Member

StealthP3D

Well-Known Member

One thing to keep in mind. There will ALWAYS be conditions where vehicles should not be on the road, with a driver or without. People seem to think that FSD means the vehicle will handle ANY condition. This is simply not true and not safe. You can't fight physics. Two tons of moving vehicle, even at a slow speed, on ice covered roads is a recipe for disaster, no matter who or what is in control.

Sometimes you just have to admit that it's better to just stay home by the fire and enjoy your favorite beverage in front of the fire.

Exactly! And with FSD in Beta that decision is currently made by the human behind the wheel (or the nut behind the wheel as the case may be). When FSD no longer requires a human, that decision will need to be made by FSD. I have no doubt it will be able to make that decision and show greater judgement than many humans.

Any service or role that depends on asymmetric information is dying. Investment professionals, real estate agents, car salesmen, travel agents etc.Hedge funds had their best month since 2009. They’re still not keeping up with the stock market

Summary: Hedge funds returns suck. It used to be the wealthy invested in Hedge funds that had inside information and knowledge and made outside gains in the stockmarket. Now....not so much. When Hedge funds can't even keep up with the Index funds you know they are a dying breed. With knowledge comes power. The trend of money flowing out of managed funds and into direct stocks by retail investors will continue for many years to come.

Artful Dodger

"Neko no me"

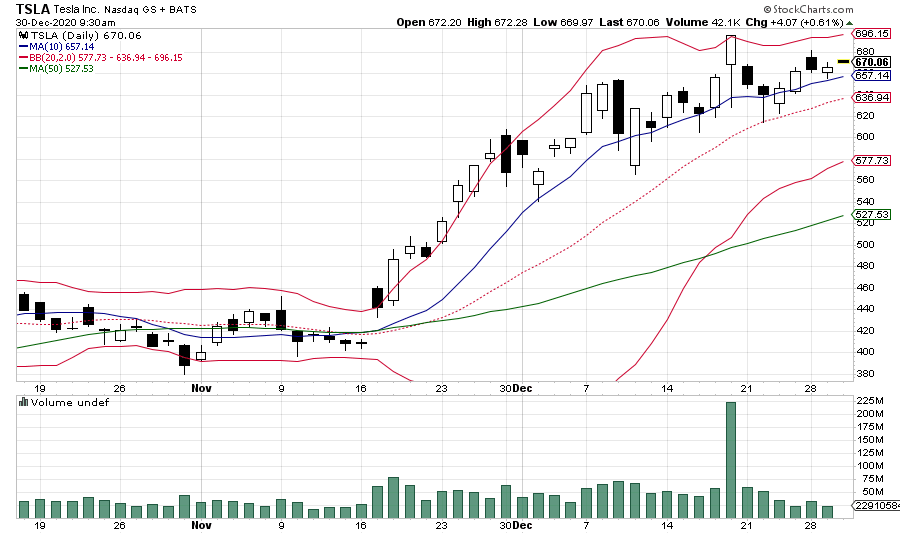

Here is today's TSLA Tech chart as of 09:30 EST: (Note: Upper-BB at Market Opening was $696.15)

Cheers!

Cheers!

I just wish I knew what all this gibberish meant.

Seems to be a recommendation to strangle some short-sellers. Fun, but still illegal.

Pezpunk

Active Member

The FSD trial has nothing to do with motivating sales -- there are practically zero sales that could possibly occur today that would result in delivery before the end of the quarter! This is merely a motivator to improve FSD uptake. Has absolutely zero relevance to delivery numbers.

Hmm, could Tesla claim 100% take rate on their financials and assume that FSD will be public by the time the free trial ends?The FSD trial has nothing to do with motivating sales -- there are practically zero sales that could possibly occur today that would result in delivery before the end of the quarter! This is merely a motivator to improve FSD uptake. Has absolutely zero relevance to delivery numbers.

Dodger, how would someone use the Upper BB value in a trade decision? Thanks in advance.(Note: Upper-BB at Market Opening was $696.15)

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K