I’ll buy it from you. Oh wait, there’s probably thousands here who will buy it...and your shares.I have some horrendous news, it looks like I'm allergic to my Tesla wool blanket. Selling all shares.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I have some horrendous news, it looks like I'm allergic to my Tesla wool blanket. Selling all shares.

When are you selling your shares? We need more details.

TheTalkingMule

Distributed Energy Enthusiast

Like new! Never been washed!I’ll buy it from you. Oh wait, there’s probably thousands here who will buy it...and your shares.

Edit: I actually think I'm going to give it to my mom. She recently converted from skeptic to shareholder to fanatic. She'll have the only Tesla blanket in the senior living center no doubt.

adiggs

Well-Known Member

The only thing I understand is STONKS only go up!!This pullback was due...might even dip more, but we all know the outcome...it's just a matter of time.

I went with Like, but taken seriously, this is a dangerous point of view for an investor. In our lifetime, we barely need a decade to find a time where stocks didn't just go up.

In fact they went down so much I was able to find a 10% nearly guaranteed dividend because an excellent company was on such a fire sale. The dynamic here (why should a good company like TSLA go down even if the stock market overall is tanking?), or at least 1 component, is that anybody on margin in a general downturn will find some combination of leveraged downside on their position. As the margin calls start rolling in, something / anything needs to be sold to meet the margin call. As the account gets closer and closer to 0 value, the need to sell everything grows. When those margin calls arise, one way of satisfying those calls is to sell something that isn't falling off the cliff - such as TSLA.

I agree that it's a matter of time. But what if that time window is a decade? Think 1930s - I at least need to go into the history books, so I only know about it second hand; my mom and dad (they didn't particularly talk about it), my father-in-law (needed some prompting). It's happened before, and will happen again. But when?

For those in an open ended growth situation, with an investment hypothesis that extends to 2030 or beyond, then just hold and wait is a great approach (MHO) - it's what has worked so well for me. Oh - and no margin - margin provides leverage going up; it also provides leverage going down. A big 'down' (50%? depends on how much margin you're using) and you can find that it's all gone.

Ok. How did you guys know the 804 bottom? Was it one of those situations where that was just above the uptick rule amount? I set a buy order earlier in the day at 804. I was out teaching my kid to ski and my phone was blowing up. Eventually I checked it and I saw I purchased a bunch and the market price was ten points higher. Great success! Thank you!

I forgot to put my disclaimer: My posts are not financial adviceI went with Like, but taken seriously, this is a dangerous point of view for an investor. In our lifetime, we barely need a decade to find a time where stocks didn't just go up.

In fact they went down so much I was able to find a 10% nearly guaranteed dividend because an excellent company was on such a fire sale. The dynamic here (why should a good company like TSLA go down even if the stock market overall is tanking?), or at least 1 component, is that anybody on margin in a general downturn will find some combination of leveraged downside on their position. As the margin calls start rolling in, something / anything needs to be sold to meet the margin call. As the account gets closer and closer to 0 value, the need to sell everything grows. When those margin calls arise, one way of satisfying those calls is to sell something that isn't falling off the cliff - such as TSLA.

I agree that it's a matter of time. But what if that time window is a decade? Think 1930s - I at least need to go into the history books, so I only know about it second hand; my mom and dad (they didn't particularly talk about it), my father-in-law (needed some prompting). It's happened before, and will happen again. But when?

For those in an open ended growth situation, with an investment hypothesis that extends to 2030 or beyond, then just hold and wait is a great approach (MHO) - it's what has worked so well for me. Oh - and no margin - margin provides leverage going up; it also provides leverage going down. A big 'down' (50%? depends on how much margin you're using) and you can find that it's all gone.

TSLA $811.19 -$68.83 -7.8%

Third highest closing price.

Streak ends for 11 consecutive up days that gained 37.4%.

Wall Street needed a dip, so funds could buy more cheaply.

If TSLA had closed where it finished in evening after-hours trading, that would have been the second highest closing price, topped only by that of Friday.

Artful Dodger

"Neko no me"

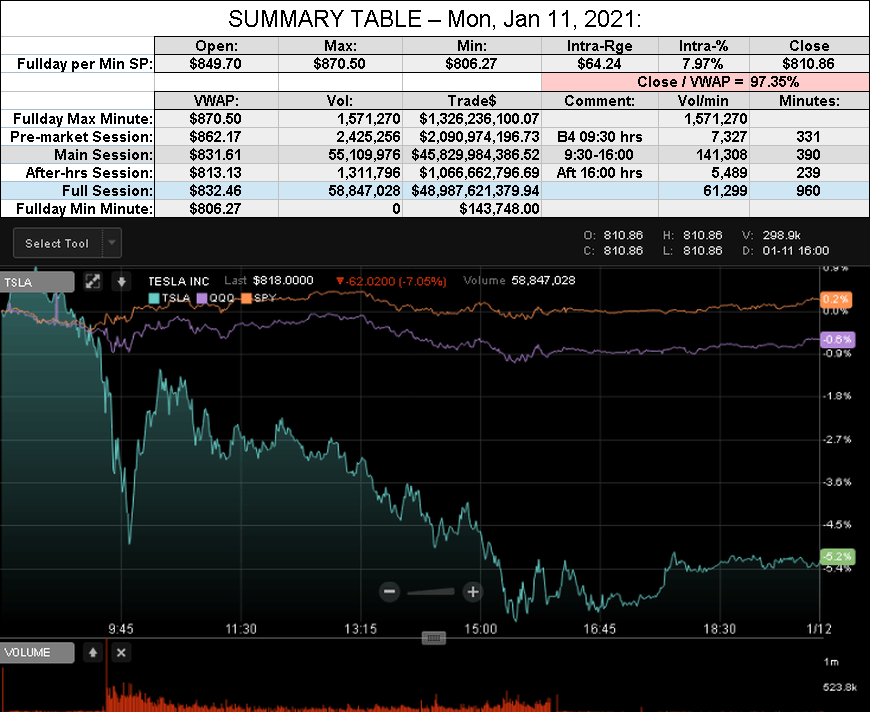

After-action Report: Mon, Jan 11, 2021: (Full Day's Trading)

Headline: "TSLA Fades amidst Market Uncertainty"

QOTD: @Mo City "an exercise in frustration sometimes leads to bad decisions."

Comment: "It's hard to beat a dead investor in the long run..."

View all Lodger's After-Action Reports

Cheers!

Headline: "TSLA Fades amidst Market Uncertainty"

Traded: $48,987,621,379.94 ($48.99B)

Volume: 58,847,028

VWAP: $832.46

Close: $811.19 / VWAP: 97.35%

TSLA closed BELOW today's Avg SP

TSLA MaxPain (7:00 A.M.): $440 (+$40 from Fri)

TSLA S&P 500 Weight: 2.068898% (Jan 08)

Mkt Cap: TSLA / FB $768.928B / $731.555B = 105.11%

Note: Yahoo Finance yet to update TSLA Mkt Cap re shares issued Dec 11th (SEC Filing)

CEO Comp. Status: (est'd Mkt Cap including Dec 11th shares)Volume: 58,847,028

VWAP: $832.46

Close: $811.19 / VWAP: 97.35%

TSLA closed BELOW today's Avg SP

TSLA MaxPain (7:00 A.M.): $440 (+$40 from Fri)

TSLA S&P 500 Weight: 2.068898% (Jan 08)

Mkt Cap: TSLA / FB $768.928B / $731.555B = 105.11%

Note: Yahoo Finance yet to update TSLA Mkt Cap re shares issued Dec 11th (SEC Filing)

TSLA 30-day Closing Avg Market Cap: $669.25B

TSLA 6-mth Closing Avg Market Cap: $434.13B

Mkt Cap req'd for 7th tranche ($400B) likely achieved on Tue, Dec 29, 2020

Nota Bene: Operational milestones are req'd for this tranche.

'Short' Report:TSLA 6-mth Closing Avg Market Cap: $434.13B

Mkt Cap req'd for 7th tranche ($400B) likely achieved on Tue, Dec 29, 2020

Nota Bene: Operational milestones are req'd for this tranche.

FINRA Volume / Total NASDAQ Vol = 50.4% (49th Percentile rank FINRA Reporting)

FINRA Short / Total Volume = 56.7% (54th Percentile rank Shorting)

FINRA Short Exempt ratio was 0.46% of Short Volume (46th Percentile Rank Exempt)

FINRA Short / Total Volume = 56.7% (54th Percentile rank Shorting)

FINRA Short Exempt ratio was 0.46% of Short Volume (46th Percentile Rank Exempt)

QOTD: @Mo City "an exercise in frustration sometimes leads to bad decisions."

Comment: "It's hard to beat a dead investor in the long run..."

View all Lodger's After-Action Reports

Cheers!

G

goinfraftw

Guest

Q - I have no idea what I'm doing, but I'm interested in using my TSLA shares to fund the creation of a solar farm. Does anyone have any good info on what it'd cost to start one, how much space is needed, and how much passive income can be generated from a solar farm?

Little info: Solar Farm Land Requirements: How Much Land Do You Need?

Little info: Solar Farm Land Requirements: How Much Land Do You Need?

Last edited by a moderator:

Artful Dodger

"Neko no me"

This article had already appeared on Teslarati.com (do you subscribe to their RSS feed?)Nothing yet. I've been refreshing all the usual sources. Maybe it'll be a CES unveiling after all?

Tesla Model S and Model X lines to resume production in Fremont factory today

LN1_Casey

Draco dormiens nunquam titillandus

Q - I have no idea what I'm doing, but I'm interested in using my TSLA shares to fund the creation of a solar farm. Does anyone have any good info on what it'd cost to start one, how much space is needed, and how much passive income can be generated from a solar farm?

Little info: Solar Farm Land Requirements: How Much Land Do You Need?

I don't think this is an appropriate topic for this chat. Try the Solar energy subforum.

Nuclear Fusion

Banned

You’ve missed the pointare you seriously drawing similarities between TSLA and real estates / Elon and Burry?

Nuclear Fusion

Banned

Additionally, it wouldn’t be where it is or possibly exist, without government loans eitherPretty sure the company would not exist without him.

TheTalkingMule

Distributed Energy Enthusiast

It wasn’t a government loan, it was a private loan guaranteed by the government and paid back ahead of schedule with interest. You’re welcome(taxpayer who made money off the loan guarantee).Additionally, it wouldn’t be where it is or possibly exist, without government loans either

Is this guy just trolling? I recognize the name, but don’t recall any posting recently.

Artful Dodger

"Neko no me"

Vincent had that twitter post.......but honestly I'm not a fan of doing that. To just put a vague statement of soon without stating a timeframe or if it's his own speculation or from a inside source, just rubs me the wrong way with getting people's expectations up.

the source I know that works at Tesla mentioned he was going to be ordering a S or X in the next week or two. My response to him was "Exactly what version of the S/X are you getting???His response was “....”.

LN1_Casey

Draco dormiens nunquam titillandus

Is this guy just trolling? I recognize the name, but don’t recall any posting recently.

He regularly bashes Musk in the Elon Musk topic thread, and similar posts in other forums I occasionally brows through enough that I think it's a reasonable chance he's Martin Eberhard under a pseudo-name.

MC3OZ

Active Member

This article had already appeared on Teslarati.com (do you subscribe to their RSS feed?)

Tesla Model S and Model X lines to resume production in Fremont factory today

This quote doesn't inspire much confidence in the article author:-

The Model S and Model X are getting a bit long in the tooth, after all, with both EVs still using 18650 battery cells, the same form factor that the company used in its original Roadster back in 2008.

To be clear I think the refresh is happening, but there is 50/50 chance or higher that the refreshed version uses 18650 cells.

Last edited:

Artful Dodger

"Neko no me"

You don't need to work at Tesla to know that aluminum castings will never be used for doors. Just the auto industry, or frankly any manufacturing industry.They'd do it for different reasons. Could be Energy, Time to Market, TPT, or Floorspace... I'm just guessing which is my point, we all are unless we work at Tesla.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M