In the 4th Q of 2019 I wrote a lot about how share prices have momentum and that it works in both directions. There is considerable downward momentum right now but it's pretty much impossible to say how far that could take it. But, my entire life spent watching stock prices tells me that even good stocks with bright futures can go lower than they have any business going before they turn around. Much of it will probably depend on the overall mood of the market. If that doesn't co-operate, look out below!

Since it's probably apparent even to casual observers that Tesla has a very high likelihood of a bright future, there is a good chance Tesla will be a leading indicator of market strength returning. Unfortunately, that doesn't tell us when this turnaround will happen and my intuition says this will not be as clean of a turnaround as it was in early 2020. Head fakes could confuse the issue unless this is nothing more than another "blip" which is certainly possible.

While I am not a big fan of technical chart analysis, I am a believer in "pretty charts". This just means that charts tend to look "right" and I can't define what "right" is, it's more of a feeling. This is what technical analysis tries to turn into a science (but, IMO, mostly fails). IMO, the chart is telling us there must be more downside to make the chart look "right" and that it will probably take more than a couple of weeks. I tend not to try to play these moves because they are just noise in the bigger picture and impactful news can blow everything I just said out of the water. If it were not for market moving news, I believe all charts would look "pretty" and "right". The "pretty" and "right" charts takes us downward and rightward. Then it breaks to the upside, either unexpectedly (by news) or at the proper "pretty" place because sentiment finally has a change that sticks.

A few months ago I said I don't mind if we hang out somewhere in the $500's to the $800's for the rest of the year and that's still where I stand. I still think we have a decent chance of breaking out into the four digits before the year is out (better than 50/50) but if I have to wait until next year, I won't lose any sleep over it.

Some thoughts to consider in terms of the environment:

The May 2021 outlook favors warmth for the southern half of the country and a wet East-dry West split.

climate.gov

IMO, I think September (the height of wildfire season in CA) is going to be telling to see how much money goes into clean tech companies (IMO

again)...especially via Silicon Valley. My opinion, as it has changed over this year, is that I'm still bullish and there is going to be a 1-2 levels up trigger IMO. That is a little under 4 months away. What makes this all complicated is the ramification of COVID on the world (especially India) and it stress testing the resiliency of the supply chains in the world.

A terrifying and record-breaking wave of Covid-19 in India threatens to stall the country's economic recovery and send shockwaves through several important global industries.

www.cnn.com

Personally, I think we're all going to get waayyyy more reactionary as the year progresses based on the changes to the outer environment.

A couple more thoughts to consider:

Last year had the "Orange Day" and the

remarkable 2020 wildfire season in CA and I really do think it had an effect on the stock price in the run-up on the latter part of the year (would enjoy hearing other theories if anyone wants to share on TSLA as it blew past $2k pre-split) -

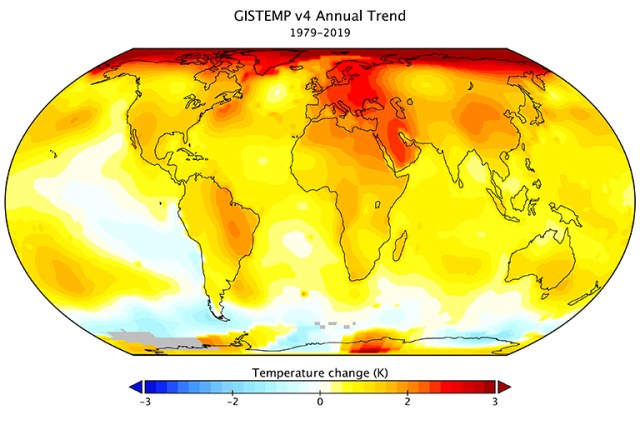

Since it is the weekend, some fodder in regards to this increase in carbon emissions projection over the next few years:

New Study Narrows the Range of Uncertainty in Future Climate Projections Recently, an international research team published a comprehensive review in the journal Reviews of Geophysics on our state of understanding of Earth’s “climate sensitivity,” a key measure of how much our climate will...

climate.nasa.gov

IMO: The likelier for increase variance in climate sensitivity, the likelier need for policy towards renewables. I think that'll entail higher multiples for the company in order to fuel growth to reach its goals from investors. I do wonder what happens when we start seeing more scenarios, worldwide, like the CA Wildfires "Red Day" on 9/9/2020 where extrinsic turns into intrinsic. Since that day:

Day: $366.28

7-day (after): $441.76 on 9/16/2020

1-month (after): $425.30 on 10/7/2020

3-month (after): $568.82 on 12/2/2020

Latest: $654.87

Edit: Link to California "Orange Day"

People took to social media Wednesday morning in the Bay Area to post about the glowing...

www.sfchronicle.com

View attachment 646589

Further, hurricane season was pretty exceptional too in 2020 as it was the most active on record.

en.wikipedia.org

Though, this year is forecasted to be just as bad if not worse and that season is just beginning on the East Coast:

After last year's record-breaking hurricane season, forecasters are expecting another overactive season.

www.cnn.com

Even if you ignore climate change history and forecasting, that last year, 2020, could be considered an aberration and one-off. Two years weightens consistency and a trend even if its not a normative sample of 5 years...even though we're getting there if you really pull back from 2017-2018. With the exceptional drought occurring, again, in the Western United States...well, I think people will make decisions off the trend of climate change really changing things up in civilization...

Anyways, some food for thought.